Table of Content

Best Backtesting Tools for Python Algo Trading | Complete Guide to Backtesting py

By Vincent NguyenUpdated 379 days ago

Best Backtesting Tools for Python Algo Trading

Backtesting py is one of the most straightforward and powerful Python libraries for validating algorithmic trading strategies without risking real money upfront. Whether you’re just starting your journey in algo trading or looking to refine your existing strategies, a robust backtesting tool can help you identify the strengths and weaknesses of a trading idea.

In this guide, you’ll discover why Python is a go-to language for traders, how backtesting works in principle, and why tools like Backtesting py can make the difference between a well-informed strategy and an expensive trial-and-error approach.

Backtesting plays a critical role in modern trading. Instead of guessing if a strategy might work, you use historical market data to simulate real trades, gauge performance, and adjust parameters before going live. This process helps eliminate the emotional component of trading decisions because you rely on hard data. By the end of this article, you’ll not only grasp the key concepts behind backtesting, but you’ll also have a roadmap to start using Backtesting py effectively.

Understanding the Basics of Backtesting

Before diving into any specific library, it’s crucial to understand what backtesting actually entails. In the simplest terms, backtesting is the process of taking a trading strategy and evaluating how it would have performed on historical price data. If you were to sum up backtesting in a few steps, they would be:

- Formulate a Strategy: Decide on your entry and exit conditions, risk management rules, and position sizing.

- Gather Historical Data: Collect relevant market data such as open, high, low, close (OHLC) prices, volume, and possibly other indicators or fundamental data over a suitable time frame.

- Apply the Strategy: Use your defined rules to “trade” on the historical data, simulating each buy, sell, short, and cover action.

- Record Results: Track metrics such as net profit, number of trades, win/loss ratio, drawdown, volatility, and risk-adjusted returns like the Sharpe ratio.

- Analyze and Refine: Evaluate whether the strategy’s performance is robust. Look at how consistent or volatile it is, and see if there are periods when it performs poorly. Adjust parameters or approach based on insights.

Why Does Backtesting Matter for Algo Traders?

- Risk Management: It allows you to manage risk by identifying strategies with unfavorable profit-to-loss ratios.

- Efficiency: Instead of forward-testing every new idea in live markets (which can be costly), you quickly zero in on what’s worth pursuing.

- Validation of Concepts: If a strategy never worked in the past, there’s less reason to believe it will magically start working in the future.

It’s important to note that successful backtesting does not guarantee future profits markets can change, and a profitable historical pattern might disappear. However, skipping this step altogether is a high-risk move. It leaves you with little data-driven evidence that your approach holds any water.

Why Backtesting py Is Essential for Python Algo Trading

Python has become a favorite language among traders for good reason: it’s relatively easy to learn, boasts an enormous ecosystem of libraries (NumPy, Pandas, Matplotlib, scikit-learn, etc.), and has a large, helpful community. Within this Python ecosystem, several libraries are designed to tackle backtesting. Among them, Backtesting py stands out for its simplicity, efficiency, and adaptability.

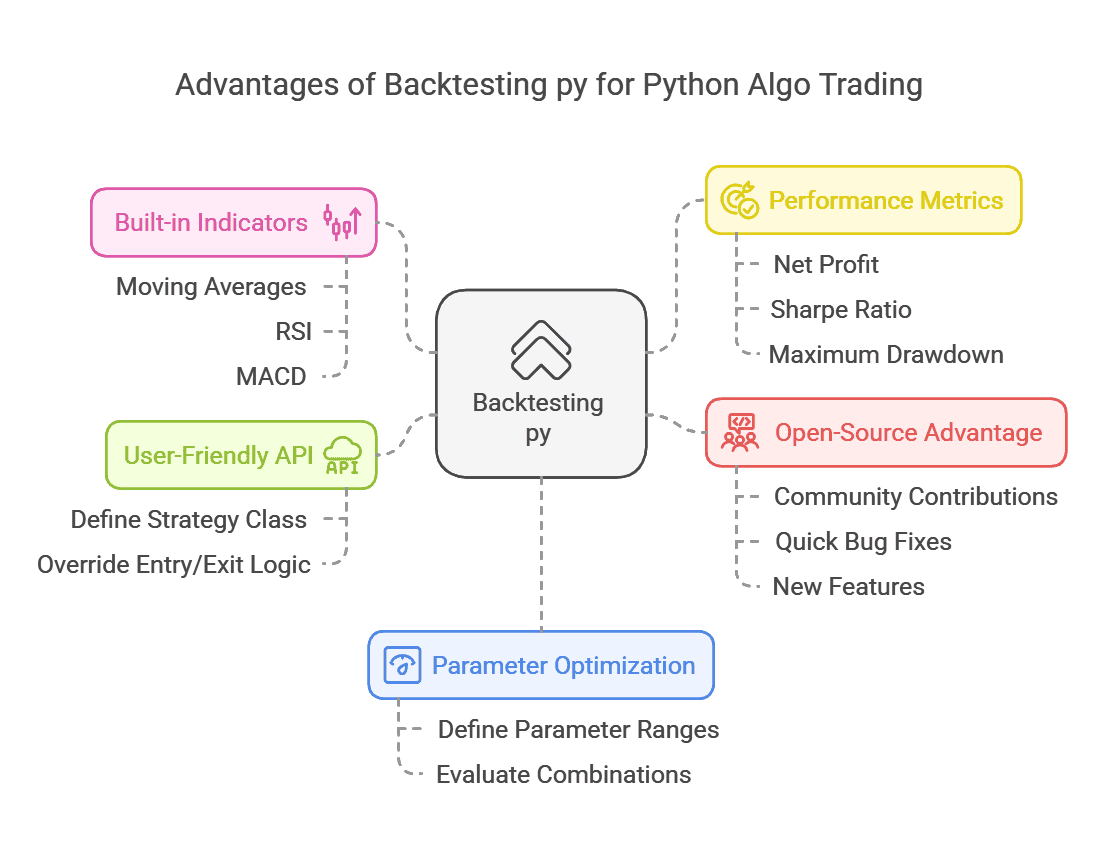

Here’s why many algo traders choose Backtesting py:

- User-Friendly API: The library has an intuitive, object-oriented structure. You can define your own strategy class, override entry and exit logic, and let the library handle the rest.

- Built-in Indicators: Backtesting py comes pre-packaged with common indicators like Moving Averages, RSI, and MACD. This saves you the hassle of coding indicators from scratch.

- Performance Metrics: You get instant feedback on your strategy performance, including net profit, Sharpe ratio, and maximum drawdown.

- Parameter Optimization: With Backtesting py, you can easily optimize multiple parameters. You simply define parameter ranges, and the library evaluates each possible combination.

- Open-Source Advantage: Being open source, it’s constantly evolving with contributions from a growing community. This fosters quick bug fixes and new feature rollouts.

For Python algo traders both novice and experienced Backtesting py provides a solid foundation that allows you to focus on the creative aspects of strategy development rather than the nitty-gritty mechanics of building a backtesting engine from the ground up.

Setting Up Your Python Environment for Algo Trading

A well-structured Python environment can save you countless headaches down the road. Whether you plan on using Backtesting py or exploring other libraries, a stable environment ensures that code runs consistently across multiple machines or team members.

1. Choose Your Python Version

- Most developers today use Python 3.8 or higher. Check your version by running python --version in your terminal or command prompt.

- Certain libraries might have specific version requirements, so always keep an eye on documentation.

2. Select an IDE

- Jupyter Notebook: Great for exploratory analysis and quick testing of ideas.

- Visual Studio Code: A robust editor that integrates well with Python. You can install Python-specific extensions for debugging and linting.

- PyCharm: A feature-rich IDE with advanced code refactoring tools, though it has a steeper learning curve.

3. Create a Virtual Environment

- Virtual environments isolate project dependencies, preventing version conflicts.

- For instance, using venv or conda can help maintain separate environments for different projects.

4. Install Core Dependencies

NumPy: For numerical computations. Pandas: For data manipulation and analysis. Matplotlib or Plotly: For data visualization. requests or yfinance: For fetching financial data from APIs or Yahoo Finance. With a proper setup, you can seamlessly integrate additional libraries (like Backtesting py) and ensure that your environment remains stable as you iterate through different trading strategies.

Installing and Using Backtesting py

The real power of Backtesting py comes from how easy it is to install and implement. Let’s take a look at setting up the library and coding a basic strategy from scratch.

Step-by-Step Installation of Backtesting py

Check Your Environment

- Make sure you have Python 3.8 or later (though it may work on some earlier versions).

- Activate your virtual environment if you have created one.

Install the Library

- pip install backtesting

- If you’re using Anaconda, you can also run:

- conda install -c conda-forge backtesting

Verify Installation

- Open a Python shell or a Jupyter Notebook and try:

- from backtesting import Backtest, Strategy

- print("Backtesting py is installed successfully!")

- If you see the print message without errors, you’re good to go.

Setting Up Your First Strategy

Let’s walk through a minimal example of a two-line moving average crossover strategy.

from backtesting import Backtest, Strategy

from backtesting.lib import crossover

from backtesting.test import SMA, GOOG # Sample data, GOOG is a pandas DataFrame

class SmaCross(Strategy):

n1 = 10

n2 = 20

def init(self):

# Initialize moving averages

self.sma1 = self.I(SMA, self.data.Close, self.n1)

self.sma2 = self.I(SMA, self.data.Close, self.n2)

def next(self):

# If short SMA crosses above long SMA, go long

if crossover(self.sma1, self.sma2):

self.buy()

# If short SMA crosses below long SMA, close any open positions

elif crossover(self.sma2, self.sma1):

self.sell()

# Run the backtest on Google's historical data included in the library

bt = Backtest(GOOG, SmaCross, cash=10_000, commission=.002)

stats = bt.run()

bt.plot()

print(stats)

How This Works

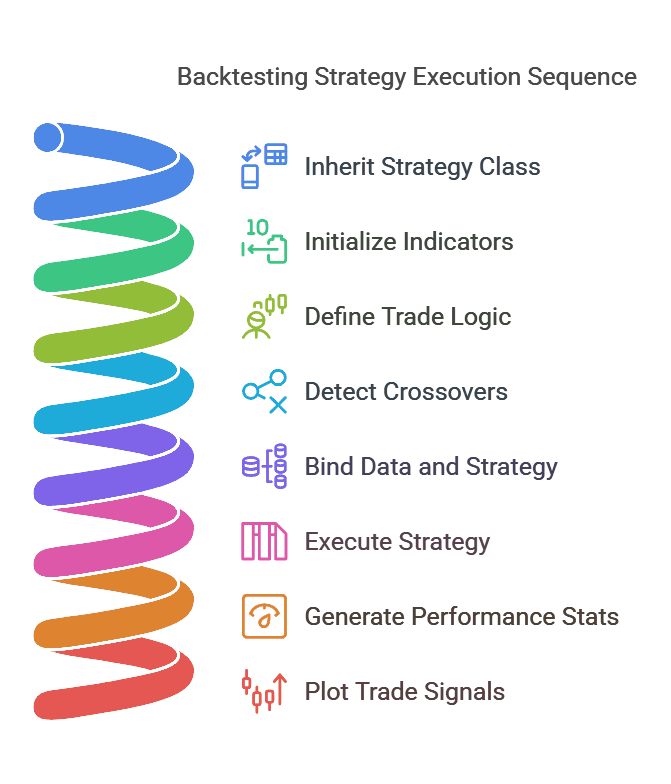

- SmaCross(Strategy): Inherits from Backtesting py’s Strategy class.

- init() method: Sets up the indicators you plan to use.

- next() method: Defines the logic for entering and exiting trades.

- crossover(): A helper function to detect when one series crosses another.

- Backtest(...): The core function that binds your data and strategy together.

- bt.run(): Executes the strategy on the data, returning performance stats.

- bt.plot(): Generates a visual chart of the strategy’s trade signals on the price data.

Once you run this script, you’ll see performance metrics—like final portfolio value, trades, maximum drawdown, and Sharpe ratio—printed out. A chart will open in a separate window or inline (if using Jupyter), showing entries and exits.

Alternatives to Backtesting py

While Backtesting py is a fantastic option, especially for beginners, it’s not the only backtesting library in the Python ecosystem. Each alternative has its own strengths and is worth exploring, depending on your specific needs.

1. Zipline

- Developed by Quantopian (now closed), Zipline is still available as open source.

- Features advanced event-driven architecture.

- Comes with a steep learning curve; the community has shrunk somewhat after Quantopian’s closure.

2. backtrader

- Another popular choice with robust features.

- Large community and plenty of documentation.

- Slightly more complex API compared to Backtesting py.

3. PyAlgoTrade

- Provides strategy building blocks, technical indicators, and a paper-trading module.

- Active but smaller community compared to some other libraries.

4, Custom Scripts

- Some traders develop their own backtesting frameworks in raw Python.

- Offers maximum control but requires significantly more time and effort.

In comparing these, you’ll notice that Backtesting py stands out for its balanced approach to user-friendliness, performance, and built-in features. Its simplicity is a big win for those who don’t want to get bogged down in architecture but still need a reliable engine for quick experimentation.

Best Practices and Common Pitfalls with Backtesting py

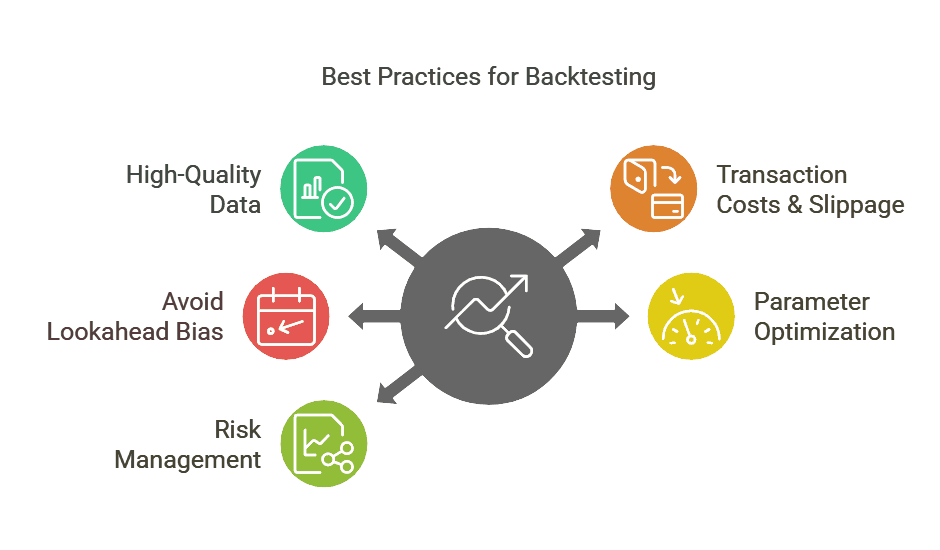

It’s easy to get excited about the results of a new strategy, but always remember: backtesting is merely a simulation. Markets are unpredictable, and no amount of historical testing guarantees future success. However, certain best practices can help you get more meaningful results from Backtesting py.

1. High-Quality Data

- Ensure your historical data is accurate and representative.

- Beware of survivorship bias (where defunct securities are excluded) if testing on equities.

- Clean your data to handle missing values, unexpected price spikes, or data gaps.

2. Transaction Costs & Slippage

- Real trading isn’t free: you’ll pay commissions, and the actual fill price may differ from your historical data’s last trade.

- Backtesting py lets you set commissions and can incorporate slippage assumptions, so use these features for realistic simulations.

3. Avoid Lookahead Bias

- Make sure your indicators only use data that would have been available at the time.

- Many new traders inadvertently access future data in their calculations.

4. Parameter Optimization

- Over-optimizing your strategy leads to curve-fitting: a strategy that performs phenomenally on historical data but fails in real markets.

- Use out-of-sample testing or walk-forward analysis to see if your strategy can adapt to changing conditions.

5. Risk Management

- Focus on drawdowns and volatility, not just net profit.

- A strategy with smaller, steadier gains may outperform a highly volatile strategy in the long run.

Overfitting and Data Snooping

One of the most common pitfalls in backtesting is overfitting. This happens when you fine-tune parameters to achieve near-perfect performance on historical data, only for the strategy to fail in live trading. Data snooping is a related hazard if you tweak your rules based on every nuance of historical data, your strategy’s success is more coincidence than skill.

Handling Transaction Costs in Backtesting py

Backtesting py makes it relatively straightforward to include transaction costs. Within your Backtest call, you can specify a commission argument:

bt = Backtest(GOOG, SmaCross, cash=10_000, commission=0.001, slippage=0.001)

Experiment with different rates to simulate various broker structures or liquidity conditions. This helps ensure your backtest results better reflect real-world outcomes.

Case Study: Moving Average Strategy with Backtesting py

To illustrate how you might refine strategies using Backtesting py, let’s take a deeper look at a Moving Average Crossover approach. We’ll walk through the initial code, discuss optimization, and highlight potential improvements like adding a stop-loss or adjusting position sizing.

Defining the Strategy

Below is a more involved version of the moving average crossover example, featuring separate short and long time periods and a built-in stop-loss:

from backtesting import Backtest, Strategy

from backtesting.lib import crossover

from backtesting.test import SMA, GOOG

import numpy as np

class SmaCrossAdvanced(Strategy):

short_window = 10

long_window = 30

stop_loss_pct = 0.02 # 2% stop-loss

take_profit_pct = 0.05 # 5% take-profit

def init(self):

close = self.data.Close

self.sma_short = self.I(SMA, close, self.short_window)

self.sma_long = self.I(SMA, close, self.long_window)

# Track the highest and lowest price since entry for trailing stops if needed

self.high_since_entry = None

self.low_since_entry = None

def next(self):

price = self.data.Close[-1]

# On each bar, update high/low since entry

if self.position:

if self.high_since_entry is None or price > self.high_since_entry:

self.high_since_entry = price

if self.low_since_entry is None or price < self.low_since_entry:

self.low_since_entry = price

# 1. Check moving average crossover signals

if crossover(self.sma_short, self.sma_long):

self.buy()

# Reset tracking after opening a new position

self.high_since_entry = price

self.low_since_entry = price

elif crossover(self.sma_long, self.sma_short):

self.position.close()

self.high_since_entry = None

self.low_since_entry = None

# 2. Implement a basic stop-loss

if self.position.is_long:

if price <= self.entry_price * (1 - self.stop_loss_pct):

self.position.close()

# 3. Implement a basic take-profit

if price >= self.entry_price * (1 + self.take_profit_pct):

self.position.close()

# Run the backtest

bt = Backtest(GOOG, SmaCrossAdvanced, cash=10_000, commission=.002)

stats = bt.run()

bt.plot()

print(stats)

Performance Analysis

After running this code, Backtesting py provides a summary of key performance metrics:

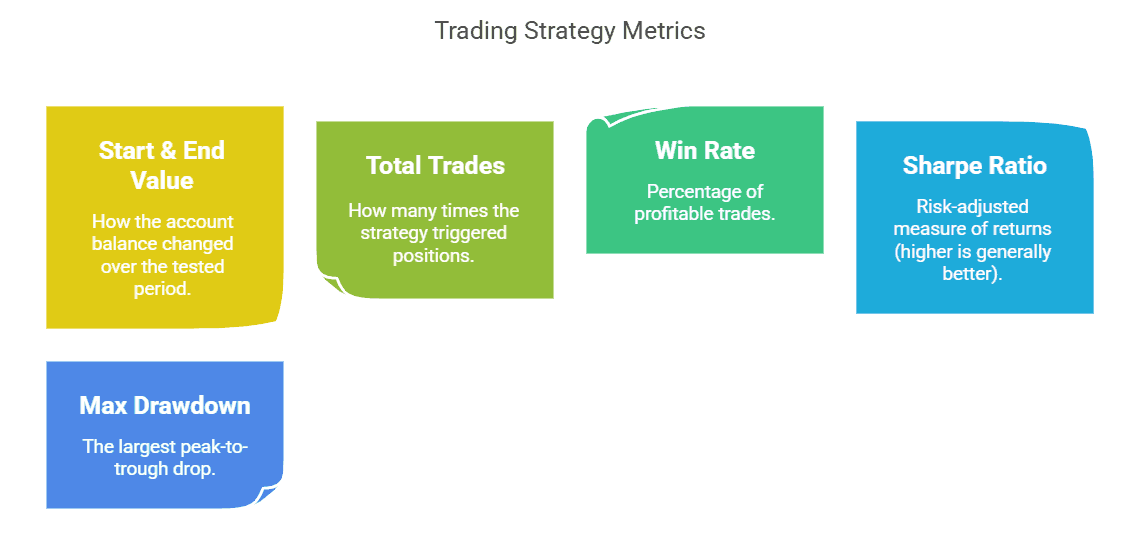

- Start Value & End Value: How the account balance changed over the tested period.

- Total Trades: How many times the strategy triggered positions.

- Win Rate: Percentage of profitable trades.

- Sharpe Ratio: Risk-adjusted measure of returns (higher is generally better).

- Max Drawdown: The largest peak-to-trough drop.

Interpreting these metrics is crucial. For instance, if you see a high Sharpe ratio but also a high maximum drawdown, you might need to refine your risk controls. Perhaps you’ll want to test a different stop_loss_pct or take_profit_pct.

Parameter Optimization

Backtesting py can automatically optimize your parameters. Here’s a basic example:

def optimize_strategy():

bt = Backtest(GOOG, SmaCrossAdvanced, cash=10_000, commission=.002)

stats = bt.optimize(

short_window=range(5, 20, 5),

long_window=range(20, 50, 5),

stop_loss_pct=[0.01, 0.02, 0.03],

take_profit_pct=[0.03, 0.05, 0.07],

maximize='Sharpe Ratio'

)

return stats

optimized_stats = optimize_strategy()

print(optimized_stats)

Here, we vary moving average windows, stop-loss, and take-profit levels. The library runs all possible parameter combinations and returns the set that yields the best Sharpe Ratio. This is an excellent way to find a reasonably good starting point for your strategy parameters. However, always remain mindful of overfitting: the best parameters in historical data aren’t guaranteed to work in the future.

Further Refinements

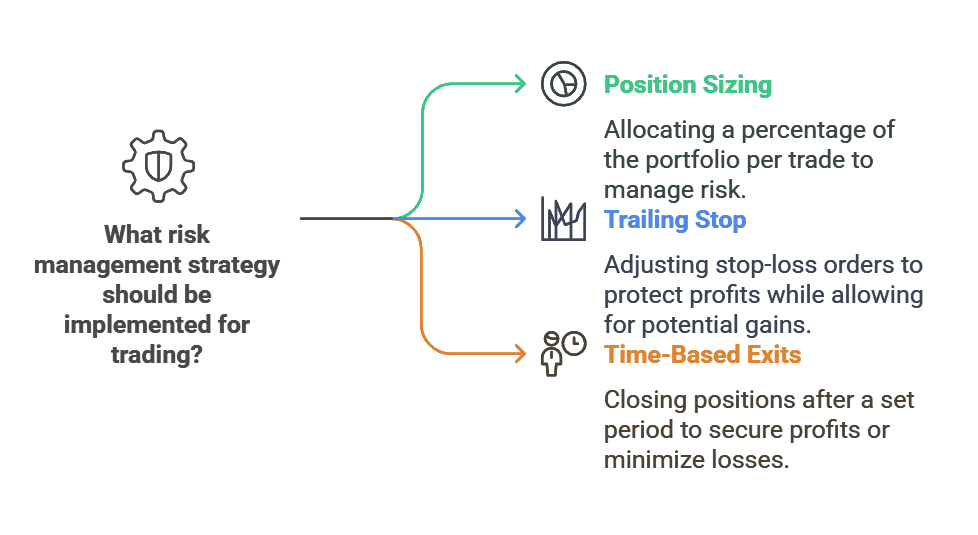

- Position Sizing: You could allocate a certain percentage of your portfolio per trade instead of going all-in on every signal.

- Trailing Stop: Instead of a fixed stop-loss percentage, trail the stop behind recent high/low values.

- Time-Based Exits: Close positions after a certain period to lock in profits or cut losses.

With each iteration, Backtesting py enables you to gather performance data quickly and pivot your strategy accordingly.

Conclusion

Backtesting py remains one of the most reliable and beginner-friendly libraries for those seeking to build and refine algorithmic trading systems in Python. By taking advantage of its straightforward API, built-in indicators, and optimization tools, you can streamline the entire backtesting process from coding your first strategy to performing advanced parameter sweeps.

No matter which strategy you pursue, always remember that successful backtesting hinges on accurate data, realistic assumptions, and robust risk management. Even the best historical performance won’t guarantee future profits, but ignoring the backtesting phase can leave you blind to potential pitfalls. Start with simple ideas, refine continuously, and let Backtesting py power to your quest for consistent, data-driven gains in the ever-evolving world of algorithmic trading.