Table of Content

The Ultimate Guide to Backtesting

By Vincent NguyenUpdated 443 days ago

Introduction: What Is Backtesting?

Backtesting is the process of evaluating how well a trading strategy might have performed in the past. By applying a set of trading rules to historical market data, you can simulate how your strategy would have fared under real market conditions. The idea is that a strategy which worked well in the past has a higher probability of working well in the future, while a poor historical performance suggests that the strategy may not be worth pursuing.

The benefits of backtesting go beyond mere curiosity. Before risking real money, backtesting can help you:

- Validate a Strategy’s Potential: Ensure that a given approach to trading (entering and exiting trades based on certain criteria) makes sense and has merit.

- Refine Your Rules: Identify flaws and areas for improvement before you start risking capital.

- Build Confidence and Discipline: By seeing how your strategy could have performed, you gain the confidence to execute trades more systematically in live markets.

Why Backtest?

- Risk Management: Before you deploy capital, you want to know if your system can withstand different market conditions. Backtesting helps you see if it at least survived historically.

- Strategy Validation: Without backtesting, you’re guessing. A trading strategy can sound logical but fail in practice. Historical data acts as a reality check.

- Confidence Building: When you’ve seen your strategy perform over various historical periods—bull markets, bear markets, sideways markets—it becomes easier to trust it during tough times in the future.

What You Need to Get Started

To start backtesting, you need:

- A Strategy: Before you begin, you need a clear, rules-based trading strategy. This might be as simple as “Buy when price closes above its 50-day moving average and sell when it falls below.” The rules should be unambiguous so that there is no confusion when applying them to historical data.

- Historical Data: You need access to reliable, high-quality historical price data for the instrument(s) you intend to trade. This data should be representative of various market conditions. Ensure that the data includes not only active companies or instruments but also those that may have gone bankrupt, changed ticker symbols, or been delisted. This avoids survivorship bias.

- Tools and Software: Although you can backtest manually using charts and a spreadsheet, it’s often more efficient to use charting platforms (e.g., TradingView), specialized software, or programming languages (e.g., Python with libraries like pandas). Manual backtesting, however, offers a more intimate understanding of the price action and can help beginners stay disciplined.

- Time and Patience: Backtesting is not a quick process if done properly. You need to be meticulous and methodical, especially at the beginning.

No idea what strategy to choose ? Check our Find Your Strategy Quiz

Setting Up Your Backtest

Step 1: Define Your Strategy Clearly

A clearly defined strategy is the foundation of a good backtest. Your rules must be so clear that they require no interpretation. For example:

Criteria for Setup (Example):

- A. A strong bullish impulse wave (a rapid price increase).

- B. A subsequent, shallow pullback to a key moving average (e.g., the 20-period EMA).

- C. A confirming candle pattern (e.g., bullish engulfing) at the EMA.

- D. Higher time frame (e.g., daily chart) trend alignment (i.e., trend is also up).

Entry and Exit Rules (Example):

- Entry: Enter long at the close of the confirming candle.

- Stop Loss (SL): Place SL below the swing low or a volatility-based measure, such as 1.5 times the Average True Range (ATR).

- Take Profit (TP): Set TP at a fixed 2:1 reward-to-risk ratio.

The more precise and mechanical your criteria, the easier it is to avoid subjective decision-making. Vague rules like “buy when it feels right” aren’t testable.

Step 2: Determine Your Sample Period

You don’t need decades of data. In fact, too much data can be counterproductive, especially for beginners. Here are general guidelines:

- Longer-Term Strategies (e.g., daily charts): 1-2 years of data is usually sufficient to start. These 1-2 years should ideally include different market conditions—rising prices, falling prices, and sideways movement.

- Short-Term Strategies (e.g., scalping on 1-min or 5-min charts): Test 1-6 months of data. Shorter timeframes produce more trade signals, so you get enough sample trades in less calendar time.

Testing beyond these periods can be time-consuming and often doesn’t substantially improve your understanding of the strategy’s viability. Once you have a good feel from a manageable period, you can always broaden your testing later for additional confirmation.

Step 3: Pick Your Instruments

Don’t try to backtest every stock, currency pair, or cryptocurrency available. Start with 1-2 key markets. Common choices:

- Forex Traders: Start with a major currency pair like EUR/USD.

- Stock Traders: Pick a stock index or a few large, stable companies.

- Crypto Traders: Focus on a major pair like BTC/USD.

By narrowing your focus, you’ll refine your strategy more effectively before expanding to other instruments.

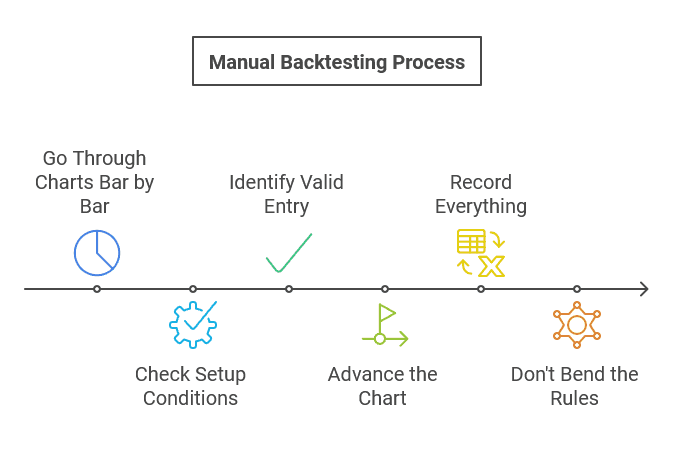

The Manual Backtesting Process

Step 1: Go Through the Charts Bar by Bar

It’s tempting to skim through the charts, spotting perfect trades and ignoring failed setups. Don’t do this. Move through the historical chart as if time is passing in reality. For each candle or bar:

- Check Your Setup Conditions: Is there a strong impulse move? Has price pulled back to the moving average? Are we in line with the higher-time-frame trend?

- Identify a Valid Entry: If the conditions are met, mark a hypothetical trade entry. Record the entry price, stop loss, and take profit levels. It helps to take a snapshot or screenshot at the time of entry so you can review it later.

- Advance the Chart: Move forward bar by bar until the trade hits either your TP or SL. Record the outcome.

This disciplined approach prevents hindsight bias. You’re not allowed to skip ahead to see if your trade would have worked. You must follow the rules as if you’re trading in real time.

Step 2: Record Everything

Documentation is paramount. Use a spreadsheet, a note-taking application like Notion, or a Google Sheet to log each trade:

- Date and time of entry

- Entry price

- Stop loss price

- Take profit price

- Initial position size (for simulation)

- Outcome (win, loss, break-even)

- Comments about market conditions

This record becomes your database for analysis. Over time, you can see how the strategy performed across different periods, how often it hits the SL before TP, and what the average win/loss ratio is.

Step 3: Don't Bend the Rules During the Test

One of the biggest mistakes beginners make is to tweak the strategy mid-backtest. They see a losing trade and think, “If I just remove that one rule, it would have been a win.” This leads to a biased and untrustworthy backtest. Your job during backtesting is to follow the rules strictly, no matter what. Make a note of what you would like to change, but do not implement changes until the testing period is complete.

If you encounter a situation where your rules are unclear (“Is this a ‘strong impulse move’ or not?”), clarify how you’ll interpret it going forward and stick to that interpretation consistently.

After the Backtest: Analyzing Results

Step 1: Summarize Your Performance

After you’ve tested a sufficient number of trades (it could be 20 trades, or 50 trades, depending on your timeframe and strategy), it’s time to review the data. Look at metrics such as:

- Win Rate: Percentage of trades that ended in profit.

- Risk-Reward Ratio: On average, how much do you gain when you win compared to how much you lose when you lose?

- Net Profit/Loss: If you started with a certain capital, what would your ending balance be?

For beginners, a win rate above 40% with a 2:1 reward-to-risk ratio is often a good starting point. Even a 30% win rate can be profitable if your winners are significantly larger than your losers. The key is consistency and risk management, not a high win rate alone.

Step 2: Look for Patterns in Wins and Losses

Now that you have data, print out snapshots of your trades—both winners and losers. Look for common characteristics:

- Winning Trades: Did they tend to form after a certain chart pattern or time of day? Did the candle that confirmed your entry share specific traits (like a strong bullish engulfing in an uptrend)?

- Losing Trades: Did they occur in choppy, sideways markets? Were your stops too tight, causing you to get stopped out frequently before the move happened?

By studying real examples, you’ll identify elements that contribute to success or failure. Maybe you’ll discover that a slight tweak in stop-loss placement—either wider to accommodate volatility or tighter to reduce unnecessary risk—improves the outcome. Or perhaps you’ll notice that trades taken against the higher-time-frame trend rarely worked, reinforcing the importance of aligning with bigger market forces.

Step 3: Adjusting the Strategy

Armed with insights from your backtest, consider minor refinements:

- Stop-Loss Adjustments: If trades seldom come close to your SL, consider tightening it to improve your risk-reward ratio. Conversely, if trades often stop out too early, give them more breathing room.

- Take-Profit Adjustments: If you notice that price frequently moves 1.5 times your risk but rarely hits 2 times, you might adjust your TP to 1.5R, provided that the overall profitability improves.

- Filter Out Low-Quality Trades: If you find certain conditions (like a doji candle pattern at your entry point) lead to consistent losses, consider adding a rule to avoid those trades.

Always remember: make these changes after completing a full backtest run, not during. After applying these refinements, backtest again or move into a forward-testing phase (paper trading) to see if the changes help.

Some profitable backtests examples

Backtests examples from the library of TradeSearcher.

MomGulfing

UnitedHealth Group Incorporated (UNH)

@ 15 min

1.34

Risk Reward4.05 %

Total ROI84

Total TradesTTP Intelligent Accumulator

TOTALENERGIES (TTE)

@ 5 min

2.18

Risk Reward557.52 %

Total ROI3794

Total TradesTry Premium to view this strategy and 100K+ others.

Premium users can access all backtests with a Risk/Reward Ratio > 3

@ 4 h

9.13

Risk Reward151.44 %

Total ROI59

Total TradesForward Performance Testing (Paper Trading)

Even if your backtesting shows promising results, it’s wise to test your strategy in real-time without risking real money. This is known as forward performance testing or paper trading.

- How It Works: You follow your strategy in a live market environment, logging hypothetical trades as if you were really executing them. No real money changes hands.

- Why It’s Valuable: Markets are dynamic. A strategy that looks good historically may stumble in a live environment. Paper trading helps confirm whether your backtest results hold up under current conditions.

- Be Honest: The key is to trade exactly as your rules dictate. Don’t cherry-pick trades. If your setup occurs, “take” the trade on paper. Log the result. This honesty ensures your forward test data is reliable.

By comparing backtested results with forward testing results, you gain further confidence in the strategy. If both sets of results are similar, that’s a good sign.

Scenario Analysis vs. Backtesting

While backtesting relies on actual historical data to assess performance, scenario analysis involves imagining hypothetical events. For example, you might wonder, “What if interest rates suddenly jumped by 2%?” Scenario analysis can help you prepare for rare events, but it’s inherently less precise than backtesting, since you’re not anchored to actual historical patterns. Beginners should prioritize backtesting to build a foundation of understanding. Scenario analysis can come later, once you’re comfortable with the basics.

Common Backtesting Pitfalls and How to Avoid Them

Pitfall 1: Overfitting

What It Is: Overfitting means you’ve tailored your strategy so precisely to past data that it only works for that exact dataset. It fails miserably on new data.

How to Avoid It:

- Keep your strategy rules simple.

- After creating the strategy from in-sample data, test it on out-of-sample data (a different historical period not used for strategy development).

- Avoid endless tinkering to achieve “perfect” backtest results.

Pitfall 2: Survivorship Bias

What It Is: Testing only on instruments that survived up to the present day. For example, testing a stock strategy only on companies still listed. This can artificially inflate results.

How to Avoid It:

- Use datasets that include delisted stocks or instruments.

- Include a broad, representative sample of the market.

Pitfall 3: Ignoring Transaction Costs

What It Is: Forgetting to factor in brokerage commissions, spreads, and slippage. Even a seemingly profitable strategy can become unprofitable when real costs are included.

How to Avoid It:

Incorporate realistic assumptions for spreads, commissions, and slippage in your backtest results.

Be conservative. It’s better to assume slightly higher costs than too low.

Pitfall 4: Cherry-Picking Trades

What It Is: Only counting the “good” setups you spot and ignoring the losing ones you don’t like.

How to Avoid It:

Follow the rules consistently.

Document every single setup that meets your criteria, whether you like it or not.

How Much Backtesting Is Enough?

For beginners, it’s easy to fall into the trap of thinking more is always better. Testing 10 years of data might seem thorough, but if you’re trading a short-term strategy, market conditions from a decade ago may be less relevant.

Guidelines:

- For short-term strategies (scalping or day trading), a few months of historical data is often enough to generate a sufficient number of trades to evaluate the strategy.

- For swing or position trading strategies on daily charts, 1-2 years of diverse market conditions can provide a solid baseline.

- Once you’re confident in your initial backtest results, move on to paper trading. You can always revisit and test more data later if needed.

From Backtesting to Profitability: A Roadmap

- Initial Strategy Idea: Start with a simple approach. Don’t worry about complexity at first.

- Initial Backtest (Short Period): Test a small subset of data. If results are terrible, revise or abandon the strategy. If they’re promising, continue.

- Full Backtest (1-2 Years or a Few Months for Scalpers): Implement your full backtest. Keep detailed records.

- Review and Refine: Make small adjustments based on observed weaknesses.

- Forward Testing (Paper Trading): Test your refined strategy in real-time without risking money.

- Assess Real-Time Results: If paper trading aligns with backtest performance, consider slowly introducing small amounts of real capital.

- Ongoing Improvement: Even after going live, continue to document trades, assess performance, and make gradual refinements as needed. Trading is an ongoing learning process.

The Importance of Discipline and Consistency

Many traders have used strategies that could have been profitable, yet they failed to execute them consistently. Emotions, impatience, and lack of discipline often derail good systems. The backtesting process teaches you consistency:

- By strictly following your rules during backtesting, you train yourself to rely on those rules in real-time trading.

- If your strategy is truly robust, it can handle periods of drawdown. Having seen it in the backtest gives you the confidence to stay disciplined in the future.

Practical Tips for Beginners

- Start Small: Begin with one simple strategy. It’s better to master a single, well-defined approach than to juggle multiple complicated ideas.

- Start from what's best: Use backtests library like TradeSearcher to start from a well-proven strategy and improve from there with price action and additional analysis.

- Keep Emotions Out: Treat the backtest as a job. Your job is to follow the rules and record what happens. You’re not there to “prove” you’re a great trader yet. You’re there to learn.

- Focus on Quality Over Quantity: A small dataset of clean, consistent results is more valuable than a gigantic dataset of sloppy, cherry-picked results.

- Refine Gradually: Don’t overhaul your entire strategy after a few losing trades. Instead, identify patterns over multiple trades before making any adjustments.

When to Walk Away from a Strategy

Not every idea can be rescued. If your backtesting results are persistently poor (e.g., you consistently lose money after testing dozens of trades across different market conditions), it might be time to abandon that strategy and try a new idea. Remember, the goal is to find an edge. If you can’t find one, move on rather than forcing a failing approach.

Conclusion: The Value of Backtesting

Backtesting is a powerful tool that gives structure to your trading education. It’s your first filter for weeding out ideas that don’t work and refining those that show promise. Proper backtesting demands honesty, consistency, and patience. By starting small, being disciplined, and resisting the urge to constantly “improve” your system mid-test, you set yourself on a path toward developing a strategy you can trust.

Once you’ve completed a careful backtest and a period of paper trading, you’ll know if it’s time to put a strategy into action with real capital. Even then, your education doesn’t end. Markets evolve, and so should you. But with the foundational skills learned through backtesting, you’ll be better prepared to adapt, refine, and stay profitable over time.

In Summary

- Backtesting uses historical data to test a strategy’s viability.

- Clarity and discipline are crucial. Clearly define your rules and follow them strictly.

- Small data samples can be enough, especially when starting out.

- Record-keeping is essential. Log each trade and analyze the results meticulously.

- Refinement should come after the test, not during.

- Forward testing (paper trading) confirms if backtest results are realistic.

- Avoid pitfalls like overfitting, survivorship bias, ignoring costs, and cherry-picking trades.

- Stay patient and consistent. Success in trading is built gradually through careful testing and disciplined execution.

By approaching backtesting with the right mindset and methodology, beginners can significantly increase their odds of eventually becoming consistently profitable traders.