Table of Content

Best Books About Algo Trading: Your Comprehensive Guide

By Vincent NguyenUpdated 417 days ago

Why the Best Books About Algo Trading Are Essential for Your GrowthAlgo Trading

Best books about algo trading are an excellent gateway for beginners to understand the fundamental concepts of quantitative trading and automated trading strategies. By diving into these carefully curated resources, aspiring traders can discover how trading algorithms work, learn basic programming concepts, and explore various market structures. Moreover, each book offers a systematic approach that helps retail traders and experienced traders alike develop effective trading strategies with reduced human intervention. In other words, books can serve as invaluable resources, guiding readers through complex trading strategies in the ever-evolving world of financial markets.

In this article, we will explore why these best books about algo trading matter, which titles can set you on the right path, and how to pick the most suitable algorithmic trading books for your level of expertise. We will also discuss key factors to consider when building an algorithmic trading business. Finally, we will uncover how artificial intelligence and machine learning can shape modern trading ideas, providing real-world examples of how readers can implement these advanced techniques.

Why Choose the Best Books About Algo Trading?

Developing a strong foundation in algorithmic trading is vital for any algorithmic trader, whether you are a seasoned trader at a large firm like Goldman Sachs or a newcomer exploring crypto trading. Often, the best books about algo trading offer comprehensive insights that help you navigate the complexities of financial analysis and risk management. They simplify intricate topics such as statistical analysis, mathematical models, and high-frequency trading into concepts accessible enough for novices.

Advantages for All Levels of Expertise

- Beginner-Friendly Guidance: Many of the best books about algo trading start with a comprehensive introduction to algorithmic trading fundamentals. They explain key concepts like direct market access, the intricacies of market microstructure, and how market participants influence market conditions.

- Structured Learning Path: Books create a step-by-step roadmap, which is especially helpful for learners who find complex topic breakdowns challenging. This structured approach also helps Professional traders refine existing strategies.

- Depth of Content: From fundamental concepts of algorithmic trading to advanced machine learning techniques, good authors delve into crucial aspects of portfolio management and how to handle a systematic approach for consistent trading performance.

- Practical Application: The best resources do more than share theories. They provide practical examples using popular programming language frameworks like Python, R, or C++ for implementing automated trading strategies. This real-life connection fosters better retention of complex concepts.

Role of Acclaimed Authors

Writers such as Ernie Chan (often spelled Ernest Chan), Marcos Lopez de Prado, and Kevin Davey have contributed invaluable insights to algorithmic trading books. Their works cover everything from risk management techniques and systematic trading strategies to applying machine learning techniques for trading algorithms. By reading these authors, one can glean valuable insights into real-life examples and advanced techniques that drive successful trading operations.

Best Books About Algo Trading for Beginners

Diving into algorithmic trading strategies can feel overwhelming at first. Fortunately, several beginner-friendly books simplify the approach to trading. These titles offer a comprehensive overview of fundamental theories, practical implementation steps, and even the impact of trading on various asset classes. Whether you plan to day trade equities or forex trading, these books are a fantastic resource for understanding the basics.

1.“Algorithmic Trading: Winning Strategies and Their Rationale” by Ernest P. Chan

- Why Read It? This book offers a practical guide to designing and evaluating systematic trading tactics. It explains basic programming concepts, introduces statistical models, and provides practical insights into building your own approach to machine learning in trading.

- Key Topics: Statistical analysis of market conditions, risk management, and thorough backtesting methods.

- Ideal For: Beginner to intermediate readers who want a guide to understanding how to incorporate real-life examples and test them in the actual market.

2. “Building Winning Algorithmic Trading Systems” by Kevin J Davey

- Why Read It? Davey shares detailed guidance on creating, testing, and deploying trading algorithms. He covers everything from drafting your initial trading ideas to establishing successful trading operations in line with different market structures.

- Key Topics: Steps to develop a systematic day trading program, pitfalls to avoid, and effective risk management strategies.

- Ideal For: Retail traders needing a structured, comprehensive resource.

3. “Advances in Financial Machine Learning” by Marcos Lopez de Prado

- Why Read It? This book explores how machine learning transforms algorithmic trading systems, including feature engineering, entropy estimators, and robust risk management. It also covers innovative methods like hierarchical risk parity.

- Key Topics: High-frequency trading, statistical arbitrage, and advanced application of machine learning in the financial markets.

- Ideal For: Readers eager to explore advanced trading strategies underpinned by mathematical models and machine learning techniques.

Key Factors to Look For in the Best Books About Algo Trading

Selecting the best books about algo trading requires more than a simple look at the table of contents. Different authors and publishing houses cater to various levels of expertise, from novices to seasoned trader professionals working at Morgan Stanley or Credit Suisse. To get the most out of your reading list, evaluate the following criteria:

1. Author’s Background and Expertise

- Reputation: Writers such as Ernie Chan and Kevin Davey have extensive experience in hedge funds, proprietary trading, or as investment analyst professionals. Their insider perspective on systematic trading can offer a treasure trove of practical application and an in-depth look at real-market challenges.

- Affiliations: Authors linked to reputable academic institutions like Cornell University or major firms like Goldman Sachs might bring advanced financial applications or in-depth overviews of market participants and market structures.

2. Depth of Content and Structure

- Comprehensive Coverage: Books should address fundamental concepts, such as technical analysis and statistical analysis, before moving on to more advanced techniques like high-frequency data analytics or Kalman Filter models.

- Real-World Examples: Look for sections that break down algorithmic strategies with concrete rules and detailed examples of how those rules perform in different market conditions. This ensures you gain not just theoretical but also practical insights.

- Practical Exercises: Some authors encourage coding a sample system in a popular programming language or simulating systematic trading strategies. This interactive element cements learning and reveals how to adapt your approach to trading as conditions shift.

3. Relevance to Current Market Environments

- Updated Editions: The financial industry evolves quickly. Seek out the latest editions to ensure the content remains accurate concerning market structures, machine learning developments, and evolving automated trading platforms.

- Breadth of Markets: The best books about algo trading often address multiple types of assets—from stocks, bonds, and crypto market instruments to forex trading. This variety helps you build a more holistic approach to trading.

- Case Studies: Real-life examples often spotlight institutions traders or professional traders who overcame hurdles in volatile market conditions. Analyzing their journeys can provide invaluable insights into how to adapt your systems to unforeseen events.

4. Emphasis on Risk Management

- Risk Control Measures: Look for authors who devote entire chapters to risk management techniques, including margin requirements, maximum drawdown settings, and systematic stop-loss triggers.

- Advanced Approaches: Some books delve deeper into statistical analysis for portfolio-level decisions, exploring portfolio management concepts such as diversification, correlation, and risk parity.

- Scalability: If you plan to grow your operation or eventually attract institutional traders, robust risk frameworks are non-negotiable. They ensure your algorithmic trading venture can adapt to higher capital inflows while maintaining steady trading performance.

By applying these selection factors, you will identify the best books about algo trading that align with your needs, skill level, and desired approach to machine learning or advanced trading strategies. This diligence also prevents spending time on outdated or overly simplistic materials.

Section 4: Making the Most of the Best Books About Algo Trading

Even the best books about algo trading can only guide you if you apply what you learn. Too many retail traders skim chapters without attempting to build trading algorithms or test algorithmic trading strategies. By taking a proactive approach, you transform theoretical knowledge into valuable real-world results. Here are several methods for bridging this gap between reading and practice.

1. Develop Your Own Trading Ideas

- Start Small: Focus on simple concepts like moving average crossovers or basic technical analysis. Test these ideas on a small account or a demo platform before scaling up.

- Iterate Regularly: Document your results, adjust parameters, and explore new variables. Over time, this process refines your systematic approach, guiding you to more effective trading strategies in diverse market conditions.

2. Utilize Demo Environments and Backtesting Tools

- Practice with Virtual Funds: Many brokerage platforms, like those used by institutional traders, let you simulate trades under actual market constraints. This scenario helps you see the impact of trading decisions without risking real money.

- Analyze Performance: Employ advanced backtesting software or spreadsheets to measure trading performance. Look for metrics such as drawdowns, Sharpe ratios, or profit factors to evaluate if your algorithmic trading approach is profitable and scalable.

3. Embrace Collaboration and Feedback

- Online Communities: Join forums, Slack channels, or social media groups where algorithmic trader enthusiasts share successes and failures. You can ask questions, seek debugging help for your algorithmic trading systems, or glean practical insights from more experienced members.

- Mentorship: Team up with a seasoned trader or a professional trader who already applies advanced strategies. Their first-hand knowledge can shortcut your learning curve and clarify complex areas like financial market microstructure, machine learning techniques, or mathematical models.

4. Stay Adaptable and Open to Innovation

- Machine Learning Integration: Go beyond static algorithmic strategies by applying artificial intelligence. Techniques like logistic regression, Natural Language Processing, or advanced machine learning techniques for analyzing text-based data can spark new trading ideas.

- Direct Market Access: Some algorithmic trading books detail how direct market access can shorten latency times and enable high-frequency trading. Incorporating these elements broadens your skill set and may improve your trading performance.

- Risk Control: Markets evolve, so regularly assess whether your risk management techniques and trade size settings still match prevailing market structures. Adaptive strategies maintain relevance and hedge against sudden market participants-driven volatility.

Section 5: Intermediate to Advanced Titles for Best Books About Algo Trading

Beginners can learn a lot from entry-level books, but eventually, many retail traders and mid-level algorithmic trader enthusiasts crave deeper, more specialized knowledge. The following intermediate and advanced titles stand out for their coverage of complex topics such as high-frequency trading, quantitative trading, and machine learning applications. These books also provide a more comprehensive guide to automated trading systems, offering practical application tips for institutional and experienced trader audiences.

1. “High-Frequency Trading: A Practical Guide to Algorithmic Strategies and Trading Systems” by Irene Aldridge

- Why Read It? This book explores how to harness high-frequency data and reduce latency in your trades. It demonstrates practical examples of coding custom algorithmic strategies that minimize lag.

- Key Highlights: In-depth analysis of financial markets in micro timeframes, featuring a systematic approach to building effective trading strategies. It also discusses how financial models can be optimized for speed and precision.

- Ideal For: Readers intrigued by automated trading systems at millisecond intervals. The text suits those looking for in-depth coverage of order execution, liquidity, and the intricacies of market microstructure.

2. “Systematic Trading: A Unique New Method for Designing Trading and Investing Systems” by Robert Carver

- Why Read It? Carver’s perspective stems from experience at Morgan Stanley, giving readers an inside look at real-world market conditions and systematic trading strategies. He prioritizes robust design over chasing short-term gains, ensuring your systems endure volatility.

- Key Highlights: Detailed chapters on building resilient algorithmic trading setups using straightforward rules and statistical analysis. He also emphasizes risk management and explains how to keep your strategies relevant under varied market structures.

- Ideal For: Traders seeking to refine existing designs or expand beyond simpler algorithmic trading fundamentals. The book offers a balance between theoretical depth and practical guidance.

. “Algorithmic Trading & DMA: An Introduction to Direct Access Trading Strategies” by Barry Johnson

- Why Read It? Johnson provides a comprehensive introduction to direct market access, helping readers understand how to minimize delays and secure better fills. He shares invaluable insights into how institutional traders leverage advanced market participants data.

- Key Highlights: Insights into market structures like order books, routing systems, and how to tailor your trading algorithms for different liquidity pools. The focus on direct market access can give you a significant edge.

- Ideal For: Algorithmic trader professionals upgrading from basic to advanced DMA knowledge, plus those who want to design complex trading strategies sensitive to microsecond-level data.

Intermediate and advanced titles delve into specific subfields like quantitative trading, exploring everything from machine learning techniques to refined mathematical models. This deeper dive also sheds light on the human expertise needed for systematic approach refinement. By consistently upgrading your reading list with these best books about algo trading, you ensure a continuous flow of fresh trading ideas and maintain your edge in financial markets.

Section 6: Expanding Beyond the Best Books About Algo Trading

While the best books about algo trading are foundational, you can accelerate learning with additional methods and resources. Books serve as an indispensable resource, but combining them with hands-on experimentation and networking can take you to the next level of algorithmic trading.

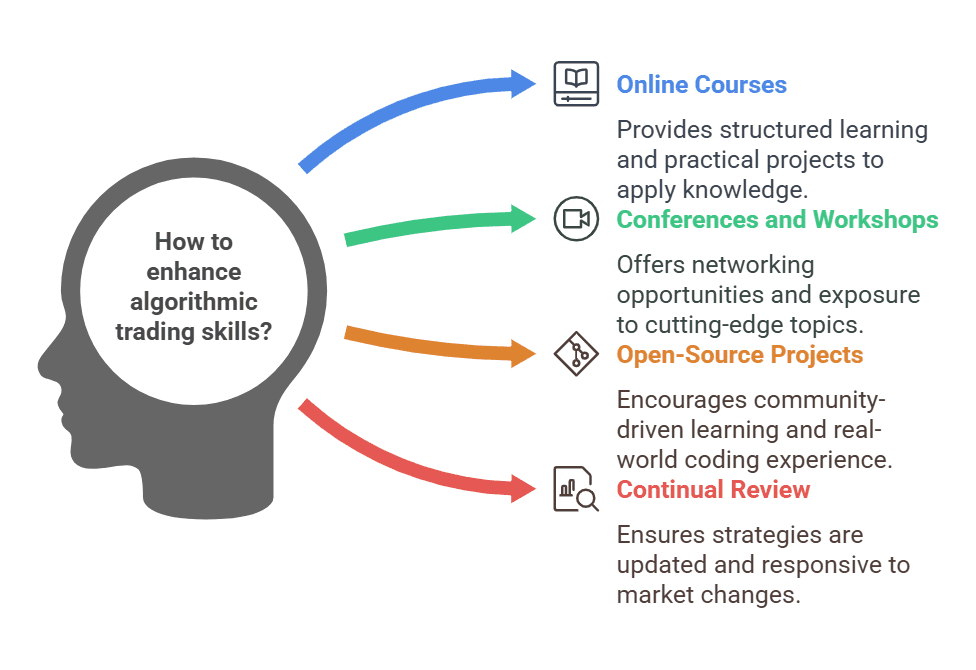

1. Explore Online Courses and Tutorials

- Supplemental Learning: Several platforms provide courses on machine learning for financial analysis, helping you translate your new reading knowledge into code. Specialized classes on advanced trading strategies, portfolio management, or systematic trading can fill critical knowledge gaps.

- Interactive Projects: Some courses go beyond lectures and require you to build working algorithmic strategies. This project-based format ensures you convert theory into practical application in actual market simulations.

2. Attend Conferences and Workshops

- Networking Opportunities: Events dedicated to algorithmic trading or quantitative trading bring together market participants from global banks, hedge funds, and top-tier investment analyst firms. You can swap insights, discover new frameworks, or even find collaboration partners.

- Cutting-Edge Topics: Conferences often introduce advanced machine learning techniques, such as feature engineering and application of machine learning to alternative data sets. Staying current helps you maintain a leading edge when constructing systematic trading strategies.

3. Engage in Open-Source Projects

- Community-Driven Learning: Platforms like GitHub host open-source libraries for building trading algorithms, analyzing financial data, and applying machine learning techniques. Contributing code or offering feedback to others hones your skills.

- Practical Insights: By collaborating on real coding projects, you uncover real-world examples of debugging, data cleaning, and model optimization. These experiences mirror the daily challenges faced by a seasoned trader or an algorithmic trader at a major institution.

4. Continual Review and Adaptation

- Monitor Market Changes: Keep an eye on shifts in liquidity, new regulations, or emergent financial applications like decentralized finance. Stay responsive to these changes in your trading code.

- Revise Strategies: Even proven systems require updates. Periodically test new trading ideas and incorporate them into existing pipelines. This iterative approach fosters deeper mastery over complex concepts.

Broadening your knowledge base through structured courses, industry events, open-source collaborations, and periodic strategy updates ensures you don’t rely solely on the best books about algo trading. This layered method can turn your ambitions into a sustainable algorithmic trading business or even pave the way for you to become an algorithmic trader at leading firms.

Conclusion

Best books about algo trading are a vital stepping stone for anyone venturing into the evolving realms of quantitative trading and automated trading systems. Each recommended title, whether beginner-friendly or advanced, equips you with invaluable insights into designing robust algorithmic trading strategies, navigating financial markets, and honing your systematic approach. These books capture everything from statistical analysis of market data to advanced machine learning techniques, ensuring you gain a comprehensive guide to building effective trading strategies. They also emphasize risk management and practical application, helping you foster algorithmic trading solutions that adapt to complex concepts in actual market scenarios.

As you immerse yourself in these resources, remain open to the broad spectrum of learning opportunities that lie beyond the page. Put theory into practice by testing customized trading algorithms in a demo environment or collaborating with peers on open-source projects. Keep refining your trading ideas and updating them for current market conditions, whether you’re exploring crypto trading, equities trading strategies, or forging a true algorithmic trading business. Above all, allow the best books about algo trading to guide you toward continuous learning, innovation, and the implementation of trading strategies that can shape your path in modern finance.

Take your quantitative trading to the next level

Explore TradeSearcher’s advanced tools and data-driven insights—start your free trial today.