Table of Content

Good Option Trading Stocks: A Beginner’s Guide to Smart Options Strategies

By Vincent NguyenUpdated 33 days ago

Good Option Trading Stocks

Good option trading stocks are among the most accessible entry points for traders looking to explore the world of derivatives. Options contracts that grant you the right (but not the obligation) to buy or sell an underlying asset offer unique flexibility, risk management possibilities, and profit opportunities that differ significantly from traditional stock trading. In this article, we’ll break down the fundamentals of good option trading stocks for beginners, including why they matter, how to identify them, and the strategies most commonly used to trade them. By the end, you’ll have a clear roadmap to get started with confidence.

Why Good Option Trading Stocks Matter for Beginners

Good option trading stocks matter for beginners because they typically exhibit characteristics like liquidity, predictable price movements, and sufficient trading volume that make them easier to learn with and less risky than more obscure or volatile equities. When you’re new to the options market, focusing on specific stocks that fulfill these criteria can significantly improve your trading experience and success rate.

The Basic Concept of Good Option Trading Stocks

At their core, options are contracts tied to an underlying asset often a stock that allow you to purchase or sell it at a predetermined price within a set timeframe.

- Why Certain Stocks Are ‘Good’: Stocks that are considered “good option trading stocks” typically have:

- High Liquidity: Plenty of buyers and sellers, meaning you can open and close positions easily.

- Tight Bid-Ask Spreads: The difference between the purchase and sale price is relatively small, so traders aren’t “overpaying” on one side or leaving money on the table.

- High Open Interest: More contracts are open and being traded, adding to the ease of entry and exit.

When you combine these characteristics, the result is a smoother trading experience, which is exactly what beginners need when they’re still mastering how options work.

How Good Option Trading Stocks Differ from Regular Stock Trading

Buying shares outright grants ownership in a company. Trading options, however, grants the right to buy (a call) or sell (a put) shares of the underlying asset without requiring full ownership upfront.

Risk & Reward Profile:

- With stocks, your risk is tied to the share price—if it drops to zero, you lose your entire investment.

- With options, your risk is typically limited to the premium you pay (when you’re buying calls or puts). The potential reward can be higher percentage-wise if the underlying stock moves in your favor.

Strategic Flexibility: Options give you many choices—like spreads or straddles—that can be structured to profit in bullish, bearish, or even neutral markets.

For beginners, focusing on good option trading stocks is beneficial because the learning curve is less steep when the underlying stock is widely followed, simpler to analyze, and has an active options chain.

Key Factors to Identify Good Option Trading Stocks

Before diving into actual trades, it’s crucial to understand how to evaluate a stock’s suitability for options trading. Not all stocks make good option trading stocks, so you need to know which metrics and attributes to look for.

Liquidity and Open Interest in Good Option Trading Stocks

Liquidity: Options liquidity means there’s a high daily trading volume. The more frequently options on a stock are traded, the tighter (and more favorable) the bid-ask spread.

Why It Matters: Tight spreads reduce the cost of entering and exiting your positions, leaving more profit on the table if your trade goes as planned.

Open Interest: This metric shows how many options contracts are currently “open” in the market (not yet closed or expired). Interpreting Open Interest: High open interest generally signals robust market participation and can be used to gauge market sentiment or potential support/resistance levels. When you’re looking for good option trading stocks, check both the option chain’s trading volume (volume of contracts in a single day) and open interest (outstanding contracts). A stock with high open interest and liquidity is much easier—and often cheaper—to trade.

Fundamental vs. Technical Analysis for Good Option Trading Stocks

- Fundamental Analysis:

- Earnings Reports: Look at revenue growth, earnings per share (EPS), and forward guidance to see if the company is stable or on a growth trajectory.

- Industry Trends: Understand if the company’s sector is thriving or facing headwinds. A stock that aligns with broader economic or industry tailwinds often maintains consistent interest from traders.

- Market Sentiment: Pay attention to news headlines, analyst ratings, and overall investor sentiment.

- Technical Analysis:

- Moving Averages: Identify short-term trends (e.g., 20-day or 50-day) and long-term trends (e.g., 200-day).

- Support & Resistance Levels: Spotting where a stock tends to bounce (support) or get rejected (resistance) can help you time entries and exits.

- Indicators: Tools like the Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD) help you gauge momentum or potential trend reversals.

For a stock to qualify as one of the “good option trading stocks,” it should typically show clear patterns or consistent performance metrics. This clarity allows both fundamental and technical analysis to guide your trading decisions more confidently.

Volatility Considerations for Good Option Trading Stocks

Volatility is a double-edged sword in the realm of options. On one hand, volatility can open the door to substantial gains if the underlying stock moves in your favor. On the other hand, excessive or unpredictable volatility can be disastrous if a trade moves against you. Understanding how volatility influences options pricing is crucial when selecting good option trading stocks.

Implied Volatility’s Role in Good Option Trading Stocks

What Is Implied Volatility (IV)?: IV estimates the expected magnitude of a stock’s future price movements over the life of the option higher IV usually means higher option premiums (cost).

Impact on Premiums: The cost of an option is largely influenced by IV. If implied volatility spikes, options become more expensive.

Volatility Events: Earnings releases, major news announcements, or geopolitical events can drastically change IV. For beginners, high-volatility scenarios can be riskier but also create profit opportunities if you position yourself correctly.

Selecting Strikes for Good Option Trading Stocks

- Strike Price Basics:

- At-the-Money (ATM): Strike price is near the current trading price of the underlying stock. This option will have the highest time value (extrinsic value).

- In-the-Money (ITM): Strike price is already favorable relative to the underlying price (e.g., a call with a strike below the current price). Higher premium, but with intrinsic value.

- Out-of-the-Money (OTM): Strike price is unfavorable relative to the underlying price (e.g., a call with a strike above the current price). Cheaper to buy but riskier to profit.

- Balancing Risk & Reward:

- Deep ITM: Less risk because you have intrinsic value, but they are more expensive.

- Deep OTM: Cheaper but require a significant move in the stock’s price to become profitable.

For new traders focusing on good option trading stocks, starting with near- or at-the-money strikes can help you learn how to manage risk while still benefiting from movement in the underlying asset.

Popular Good Option Trading Stocks to Consider

Although the list can vary over time, certain stocks consistently rank among traders’ favorites due to their robust options activity, reliable liquidity, and strong market capitalization. Below are categories and examples often considered good option trading stocks.

Blue-Chip Companies vs. Growth Stocks

- Blue-Chip Companies:

- Characteristics: Established, stable, and often part of major market indexes. Examples might include large technology firms, consumer staples, or pharmaceutical companies.

- Why They’re Good: They tend to have steady price movements and predictable market interest, making them easier for beginners to track.

- Examples: Some well-known large-cap stocks often cited as good option trading stocks include companies like Apple (AAPL), Microsoft (MSFT), and Coca-Cola (KO).

- Growth Stocks:

- Characteristics: Younger companies or those in expansion mode with high potential for price appreciation.

- Why They’re Good: While they can be more volatile, they often have enthusiastic market attention, leading to active options chains.

- Examples: Tesla (TSLA) or certain biotech companies might fit this profile, but it’s crucial to check liquidity and open interest to ensure they align with your risk tolerance.

Tech Sector vs. Financial Sector for Good Option Trading Stocks

- Tech Sector:

- High Volatility, High Reward: Technology stocks frequently experience notable price swings, which can inflate option premiums and present trading opportunities.

- Examples: Apple (AAPL), Amazon (AMZN), and NVIDIA (NVDA) often see significant daily volumes in their options chains.

- Financial Sector:

- Steady Performer: Financial stocks, like big banks (JPMorgan Chase, Bank of America), can have more stable price action, though they may experience spikes around Federal Reserve announcements or earnings seasons.

- Diverse Macro Sensitivity: Interest rate changes, economic data, and other macro events can heavily impact financial stocks, offering periodic volatility and trading opportunities.

When evaluating good option trading stocks, always cross-reference a stock’s historical volatility and liquidity. Popular names often top the list, but smaller companies might offer niche opportunities if they meet the liquidity requirements.

Analyzing Options Strategies: Calls, Puts, and More

Knowing which strategies to apply is as essential as picking good option trading stocks. Beginners often start with the basics buying calls or puts then gradually explore more complex strategies as they grow comfortable with risk management and market analysis.

Basic Call and Put Strategies for Good Option Trading Stocks

- Buying Calls (Bullish Strategy):

- Scenario: You expect the underlying stock to rise in price before the option’s expiration date.

- Example: You believe a tech stock (one of your good option trading stocks) will surge in the next quarter due to strong product demand. You buy an at-the-money call option with an expiration a few months out.

- Risk/Reward: Limited risk (the premium you paid) but potentially unlimited upside if the stock price skyrockets.

- Buying Puts (Bearish Strategy):

- Scenario: You expect the underlying stock to drop in price.

- Example: You notice a particular company might have weak earnings; you buy a put option anticipating a decline in share value.

- Risk/Reward: Again, risk is limited to the premium, but potential gains can be significant if the stock price falls sharply.

Spreads, Straddles, and Other Complex Strategies

- Spreads (Bull Call Spread, Bear Put Spread):

- Definition: Simultaneously buying and selling options on the same stock with different strike prices (and sometimes different expirations).

- Purpose: Reduces total premium cost and caps risk, though it also limits maximum profit.

- Example: A Bull Call Spread might be used if you’re modestly bullish on a “good option trading stock” and want to hedge against overpaying for volatility.

- Straddles and Strangles:

- Definition: Buying both a call and a put on the same stock (straddle) or with different strikes (strangle).

- Purpose: Best used when you expect a big price move but aren’t sure about the direction.

- Example: An earnings announcement is imminent, so you place a straddle on a stock known for large post-earnings swings. If the stock moves significantly in either direction, you can profit.

- Iron Condors and Butterflies:

- More Advanced: Combination strategies that allow you to profit from low volatility or specific price ranges.

- For Experienced Traders: Ideal for more experienced options traders who have a nuanced understanding of how time decay (theta) and implied volatility can be manipulated.

Beginners should focus on mastering single-leg options (calls and puts) before diving into multi-leg strategies. Nonetheless, keep these advanced setups in mind as you build your options trading skill set.

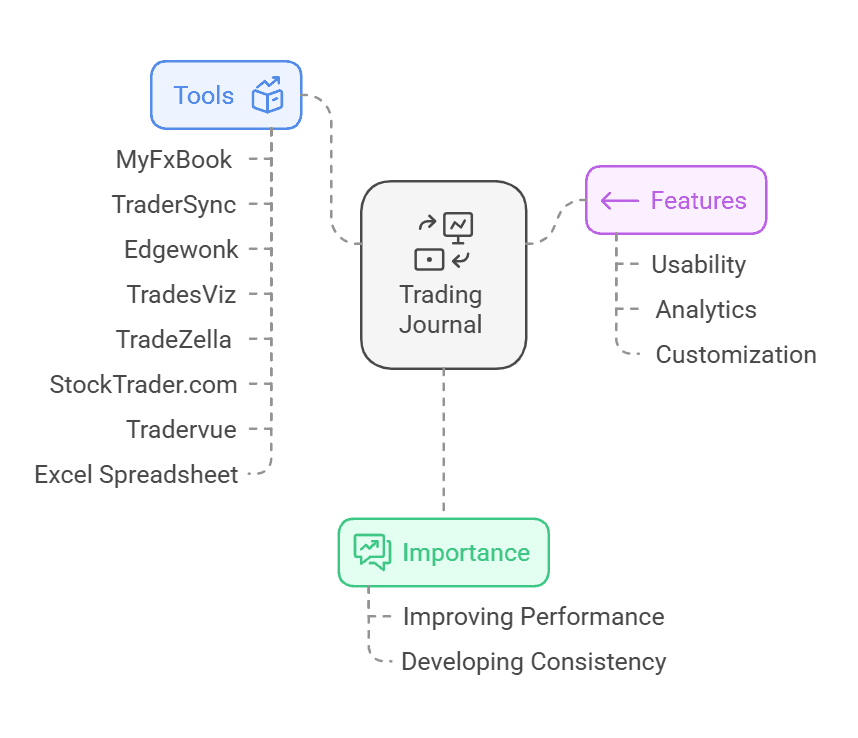

Platform and Tools to Help You Trade Options

Whether you’re zeroing in on good option trading stocks or diversifying across multiple sectors, the right trading platform and tools can make a huge difference. In this section, we’ll cover the essential features to look for in brokers and research platforms.

Research and Charting Tools

- Real-Time Quotes: Ensure your broker or platform updates stock and options prices in real-time to avoid delayed or inaccurate entries.

- Options Analytics: The best platforms offer an options chain layout that clearly displays strikes, premiums, implied volatility, and Greeks (Delta, Gamma, Theta, Vega).

- Screening/Scanning Features: A robust screener lets you filter potential candidates based on liquidity, implied volatility, sector, or market cap crucial for finding good option trading stocks quickly.

- Chart Indicators: MACD, RSI, Bollinger Bands, and other popular indicators should be readily accessible so you can layer fundamental and technical analysis.

Choosing an Options-Friendly Broker

- Commission Structure: Some brokers offer commission-free stock and ETF trading but still charge fees for options contracts. Look for a balance between affordable commissions and platform quality.

- Educational Resources: Beginner-friendly brokers often provide tutorials, webinars, and in-platform guides to ease the learning process.

- Ease of Use: A clutter-free interface helps you find option chains, analyze data, and execute trades without confusion.

- Customer Support: Responsive support is invaluable, especially when you’re learning the ropes. Live chat or phone support can resolve technical issues or clarify order executions.

- Paper Trading: Many brokers provide a simulated environment or “paper trading” where you can practice real-time trades on good option trading stocks without risking actual money.

Spending time evaluating different platforms and brokers can help you avoid frustration down the line. A reliable, feature-rich system sets the stage for more confident options trading—particularly in your early stages.

Conclusion: Start Exploring Good Option Trading Stocks

Good option trading stocks remain one of the most effective ways for beginners to dip their toes into the derivatives market. By focusing on liquidity, open interest, and sound fundamental and technical analysis, you can build a strong foundation for more advanced strategies. Remember to consider volatility carefully both implied and realized when selecting and executing trades, and practice, practice, practice in paper trading accounts before moving to real capital.

Recap of Why Good Option Trading Stocks Are Essential

Accessibility: Broadly followed, high-volume stocks are easier to trade and analyze. Reduced Risk for Beginners: Liquid markets translate to tighter spreads and smoother order executions. Strategic Variety: From simple calls and puts to complex spreads, good option trading stocks offer a wide range of opportunities.

Next Steps for New Traders

- Create a watchlist of potential good option trading stocks and track their daily performance, liquidity, and implied volatility.

- Practice buying and selling options via a paper trading or demo account to hone your skills without risking real money.

- Slowly incorporate more advanced strategies spreads, straddles, etc. as you become comfortable with the basics of buying calls and puts.

- Continuously educate yourself via webinars, trading courses, and reading in-depth analyses.

Ultimately, as you become more proficient in analyzing market conditions and selecting your underlying assets, “Good option trading stocks” can serve as the ideal training ground for bigger, more complex trades. Take the time to research diligently, manage your risk responsibly, and refine your strategies this consistent approach is what truly paves the way to long-term trading success.

Discover Profitable Option Trading Opportunities with TradeSearcher

Find the best option trading stocks with ease using TradeSearcher. Our platform simplifies stock analysis, helping beginners and experienced traders identify high-liquidity stocks and smart options strategies. Start maximizing your trades today—sign up now!