Table of Content

8 Best Trading Journal Tools for Beginners to Track and Improve Trades

By Vincent NguyenUpdated 404 days ago

Mastering Your Trades: An Introduction to Trading Journals

A trading journal is one of the most powerful yet underutilized tools for traders looking to improve performance and develop consistency. Whether you are day trading stocks or dabbling in Forex, logging your trades meticulously can provide invaluable insights into your approach, your strengths and weaknesses, and potential areas for strategy improvement.

Yet, many beginners overlook this practice, either because they assume it’s too time-consuming or they aren’t entirely sure what to record. In reality, keeping a trading journal does not have to be complicated. By systematically documenting trade entries, exits, and the reasons behind those trades, you start to see patterns both good and bad that can shape your journey as a trader.

In this article, we will explore what a trading journal is, why it matters, and which features you should look for when selecting a platform or tool. We will also review eight popular tools to help you find the best fit, ending with tips on how to choose the right journal based on your unique goals. Whether you prefer automated software or a simple spreadsheet, there’s an option that can work for you. Let’s dive in!

What Is a Trading Journal?

A trading journal is a record-keeping system in which traders log the details of every trade. At minimum, it usually contains the date of the trade, the ticker symbol (or currency pair), entry price, exit price, position size, and any profit or loss incurred. However, many traders also include notes on market conditions, chart patterns, economic indicators that influenced their decision, as well as their emotional state at the time of the trade.

The Basic Components

- Trade Details: Instrument traded, entry and exit points, size of the position, and realized profit or loss.

- Date and Time: Helpful for analyzing when you trade best whether it’s certain days of the week or times of the day.

- Market Conditions: The context around the trade (e.g., was the market trending or consolidating?).

- Emotional Notes: Personal reflections, such as whether fear or greed played a role in your decisions.

Why Record Everything?

The real power in a trading journal lies in its ability to reveal patterns. You might notice, for example, that you consistently lose money when trading right after major economic news or that you perform better trading certain types of chart patterns (like breakouts or pullbacks). Without systematically keeping track, you might never realize these underlying trends.

Adaptability for All Levels

Beginners often use a trading journal to build discipline and ensure they follow a clear plan. More advanced traders use it to fine-tune strategies and incorporate detailed analytics. Regardless of your experience level, a trading journal can be as simple or sophisticated as you want—what matters is consistency and accuracy in your entries.

Why a Trading Journal Matters

A trading journal is so much more than a trade log; it’s a mirror that reflects both your trading style and your mindset. When used consistently, it provides clarity on your process and helps you pinpoint the reasons behind each outcome positive or negative.

Boosting Self-Awareness

One of the biggest benefits of maintaining a journal is self-awareness. By writing down your thought process before, during, and after each trade, you can uncover how emotions like fear, anxiety, or overconfidence might affect your decisions. Over time, you become more mindful of your triggers and can take steps to mitigate their impact.

Measuring Performance

Trading is a numbers game. If you don’t know your win rate, average profit, and average loss, you’re effectively flying blind. A trading journal provides you with cold, hard data that can be examined for patterns.

- Win/Loss Ratio: Tells you how often you win compared to how often you lose.

- Risk/Reward Profile: Shows whether your winners are generally bigger than your losers.

- Drawdown Levels: Highlights the worst stretches of losses and how deeply they cut into your capital.

This data helps you measure progress over time. For example, you might spot a trend in which you excel when trading mid-cap stocks but struggle with small-caps, prompting you to refine or abandon certain strategies.

Identifying Strengths and Weaknesses

A thorough review of your trading journal will show which strategies and market conditions yield the best outcomes. Perhaps you excel in range-bound markets but lose consistently in trending markets. With this knowledge, you can shift your focus to the situations where you’ve historically done well and avoid the ones where you struggle.

Cultivating Discipline

Trading can be emotional, especially when real money is on the line. The simple act of writing down your plan before entering a trade can prevent impulsive decisions. Committing your thoughts to paper (or digital notes) encourages you to stick to your predetermined strategy rather than chasing the market.

Accelerating Your Learning Curve

For beginners, a trading journal is like a personal teacher. Each entry is a mini lesson, and when you look back at your notes, you’ll see exactly what went right or wrong. This iterative process helps traders learn faster and avoid repeating the same mistakes.

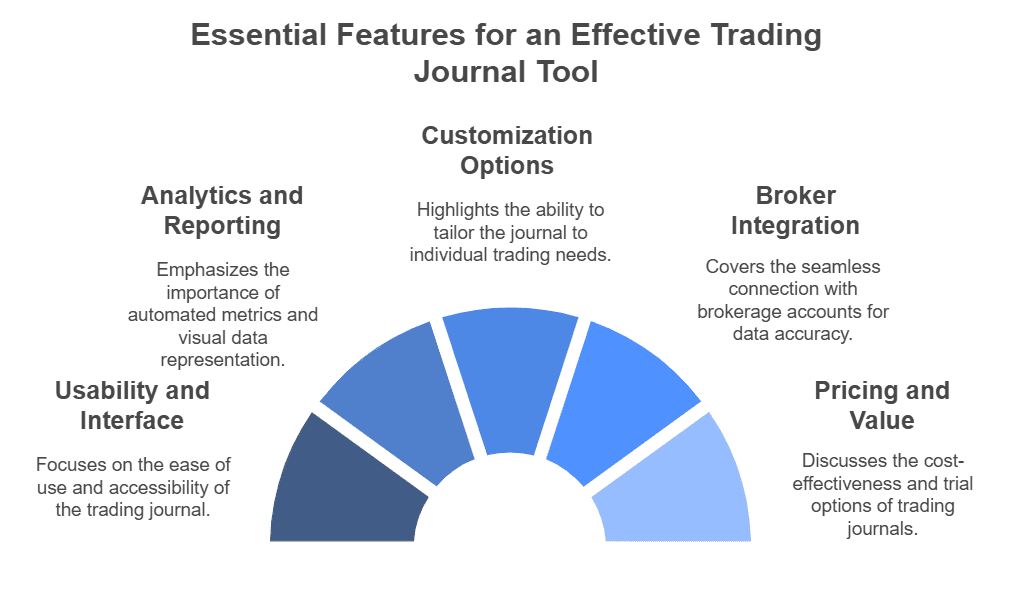

Key Features to Look For in a Trading Journal

With so many platforms and methods available, it’s helpful to know what to look for before committing to a particular trading journal tool. Here are some of the most important considerations:

1. Usability and Interface

- Intuitive Design: A clean, user-friendly dashboard makes it easier to log trades quickly.

- Mobile Accessibility: Some traders use their phones or tablets to update trade entries on the go.

2. Analytics and Reporting

- Automated Metrics: Win-rate, average return, drawdown percentages, etc., should be readily visible.

- Visual Representation: Charts and graphs (like equity curves) can help you quickly spot performance trends.

3. Customization Options

- User-Defined Fields: Add specific tags like “breakout trade” or “swing trade” for easier filtering.

- Export/Import Features: Look for the ability to export data to Excel or import from your broker to save time.

4. Broker Integration

- Automatic Import: Platforms that sync directly with your brokerage can reduce manual errors.

- Multi-Broker Support: If you trade across several brokerages, a journal that centralizes all trades in one place is highly valuable.

5. Pricing and Value

- Free vs. Paid: Some tools are entirely free, while others use monthly or annual subscription models.

- Trial Periods: Many paid journals offer a free trial or a demo mode so you can explore premium features risk-free.

Additional Perks

- Community and Sharing: Some trading journal platforms let you share your results or compare notes with other traders.

- Psychology Tracking: Journals that include prompts about emotional state, confidence level, and adherence to your plan can help tackle the mental side of trading.

Selecting the right features depends on your trading style, budget, and whether you’re more focused on raw analytics or psychological performance.

1. MyFxBook – Specialized Trading Journal for Forex

If you’re primarily a Forex trader, MyFxBook is a go-to choice. Launched over a decade ago, it has become one of the most trusted platforms for automatically tracking Forex trades across numerous brokerages.

Key Features

- Real-Time Statistics: Once linked with your broker, MyFxBook pulls trade data in real-time, updating metrics like total return, drawdown, and risk of ruin.

- Detailed Analytics: Break down performance by currency pairs, session times, or even trade duration.

- Social Community: Compare your stats to other users, join discussions, and participate in contests ideal for those who learn from peer interaction.

Pros and Cons

Pros: Automated account syncing, minimizing manual data entry. Comprehensive set of Forex-specific metrics like currency correlation. Large, active community for insights and feedback. Cons: Primarily geared towards Forex; limited utility for stocks, commodities, or crypto. Some features require an account login to view detailed data.

Ideal For

Forex traders seeking a proven, automated journaling tool and a community-driven environment to benchmark performance.

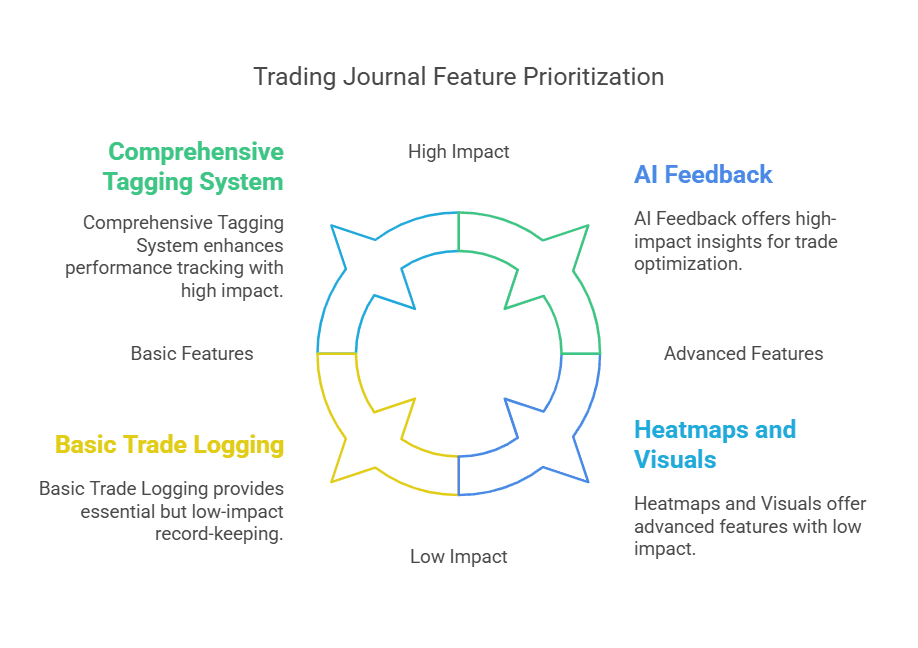

2. TraderSync – AI-Driven Trading Journal Tool

TraderSync distinguishes itself with advanced analytics and AI-powered insights that aim to improve your decision-making. It supports multiple asset classes, including stocks, options, futures, and crypto.

Key Features

- Comprehensive Tagging System: You can tag trades as scalps, swing trades, or breakouts for more granular performance tracking.

- AI Feedback: The platform’s intelligent algorithms highlight potential improvements, such as better entry/exit points.

- Heatmaps and Visuals: Heatmaps let you see which days or times yield the best results, helping you optimize your schedule.

Pros and Cons

Pros: Multi-asset support, covering stocks, Forex, and more. User-friendly dashboard with powerful charts and metrics. Unique AI suggestions that can shorten your learning curve. Cons: Advanced features can get pricey on higher-tier plans. May be overkill for traders who want just a simple record of transactions.

Ideal For

Traders who appreciate cutting-edge technology and want to leverage AI-driven recommendations to refine their trading strategies.

3. Edgewonk – Comprehensive Solution

Unlike many web-based journals, Edgewonk is primarily a desktop software solution that caters to traders who want deep insights into both their performance and psychology. It’s versatile enough for stocks, Forex, commodities, and crypto.

Key Features

- Psychological Tracking: Edgewonk’s “Tilt Meter” measures the emotional state behind each trade, helping you reduce impulsive decisions.

- Customizable Analysis: Filter trades by time of day, market conditions, or even specific chart patterns for robust performance breakdowns.

- Trade Management Tools: Features like “Trade Entry Quality” and “Trade Outcome” metrics give you granular information on how well you’re following your plan.

Pros and Cons

Pros: Extremely detailed analytics that cater to systematic traders. One-time license fee, meaning no recurring monthly payments. Strong emphasis on trader psychology. Cons: Requires some manual data entry (though partial broker import is supported). Desktop-based by default, so cloud access is limited unless you use workarounds.

Ideal For

Methodical traders who value in-depth analyses and psychological metrics, and who don’t mind a slightly steeper learning curve.

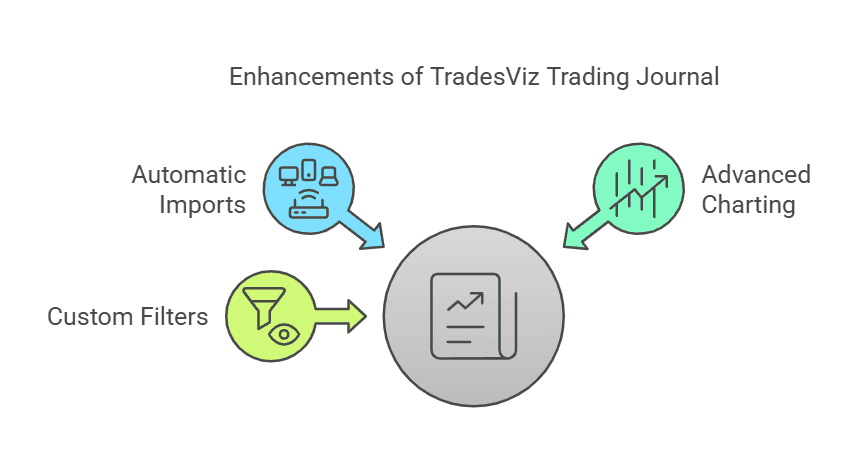

4. TradesViz – Web-Based Trading Journal Platform

If you prefer an entirely online, multi-asset solution, TradesViz is worth considering. It’s designed for traders of stocks, options, futures, Forex, and crypto, offering a broad set of analytics tools accessible from any browser.

Key Features

- Automatic Imports: TradesViz supports direct connections to multiple brokerages and platforms, reducing manual work.

- Advanced Charting: You can track daily, monthly, or even yearly equity curves, overlaying them with key market events for contextual insight.

- Custom Filters: Narrow down trades by tags, time frames, or specific market conditions to see how each factor influences your results.

Pros and Cons

Pros: Comprehensive real-time syncing for quick updates. Highly customizable dashboard with a range of data visualization options. Multi-asset coverage under one unified interface. Cons: Some premium features (like more advanced analytics) require higher-tier subscriptions. The abundance of features can be overwhelming for brand-new traders.

Ideal For

Active traders who use multiple brokers and need a cloud-based solution that offers detailed analytics without requiring desktop installation.

5. TradeZella – Interactive Platform

A relatively new entrant to the market, TradeZella aims to simplify the journaling process while still providing insightful feedback. Its clean interface appeals to traders looking for a modern, user-friendly experience.

Key Features

- Broker Integrations: TradeZella makes it straightforward to import trades from popular platforms, reducing manual entry.

- Replay Function: A unique feature that allows you to revisit market conditions at the time of each trade, helping you learn from specific scenarios.

- Gamification: Unlock performance badges or “achievements,” transforming part of the journaling process into an engaging challenge.

Pros and Cons

Pros: Intuitive layout suitable for both beginners and intermediate traders. Strong focus on post-trade analysis, with a replay tool for deeper learning. Encouraging the environment through gamified elements. Cons: Smaller user community compared to more established journals. May lack some of the advanced analytics found in older platforms.

Ideal For

Anyone who desires an interactive, visually appealing, and easy-to-navigate platform that still covers essential trade analytics and emotional tracking.

6. StockTrader.com – Beginner-Friendly Trading Journal Tool

For complete newcomers to trading, StockTrader.com offers a simple approach to trade logging. While it focuses on stocks, it can be adapted to track other assets in a pinch.

Key Features

- Straightforward Interface: The platform’s design is minimalistic, helping beginners focus on core logging tasks without the distraction of advanced features.

- Educational Resources: Links to articles and videos guide you through fundamental trading concepts and best practices for keeping a journal.

- Progress Reports: The system emphasizes basic metrics like overall win/loss ratio, total profit/loss, and average profit per trade.

Pros and Cons

Pros: Easy to set up and navigate, with minimal technical know-how required. Offers free tools that help novices get started without investing in expensive software. Resource library supports ongoing learning. Cons: Not as robust in analytics or customization compared to specialized journaling solutions. May not support direct integration with multiple brokers.

Ideal For

New traders who want an uncomplicated starting point for logging stock trades and tracking basic performance metrics.

7. Tradervue – Popular Tracking Software

Well-regarded in day trading and swing trading circles, Tradervue has a large user base thanks to its straightforward functionality and community-oriented features.

Key Features

- Quick Import: Tradervue supports direct import from a wide range of broker platforms, saving time and reducing the risk of logging errors.

- Notes and Tags: You can add detailed notes and custom tags to group trades by specific strategies, sectors, or time frames.

- Community Sharing: Users have the option to make parts of their journal public, facilitating feedback and discussions with other traders.

Pros and Cons

Pros: Simple interface, suitable for traders who value minimal friction. Free plan for traders who only need to log a smaller number of trades per month. Flexible enough for various markets, from equities to Forex. Cons: Advanced analytics and reporting require a paid plan. The design is functional but not as visually modern as some newer platforms.

Ideal For

Traders looking for a well-established, user-friendly journaling tool with a strong community element, especially those who want to learn from peers.

8. Excel Spreadsheet – DIY Trading Journal Approach

If you prefer total control or simply don’t want another monthly subscription, a classic Excel spreadsheet might be all you need. While more manual, Excel remains highly flexible and can be adapted to track virtually any performance metric you desire.

Key Features

- Unlimited Customization: You decide which columns to include tickers, entry/exit times, risk/reward ratio, notes, etc.

- Formulas and Functions: Calculate your win-rate, average return, or even advanced statistics like the Sharpe ratio directly in the spreadsheet.

- Graphing Tools: Excel’s built-in chart functions let you create equity curves or bar graphs for each trading strategy.

Pros and Cons

Pros: No recurring costs beyond owning the spreadsheet software. 100% control over the layout, structure, and style of your journal. Portability: can be backed up to cloud services like Google Drive or Dropbox. Cons: Data entry can be time-consuming and prone to human error. Lacks the automation and real-time analytics found in dedicated platforms. Requires intermediate Excel knowledge for more complex formulas and charts.

Ideal For

Traders who enjoy hands-on customization, are comfortable with Excel or Google Sheets, and want to avoid monthly software fees.

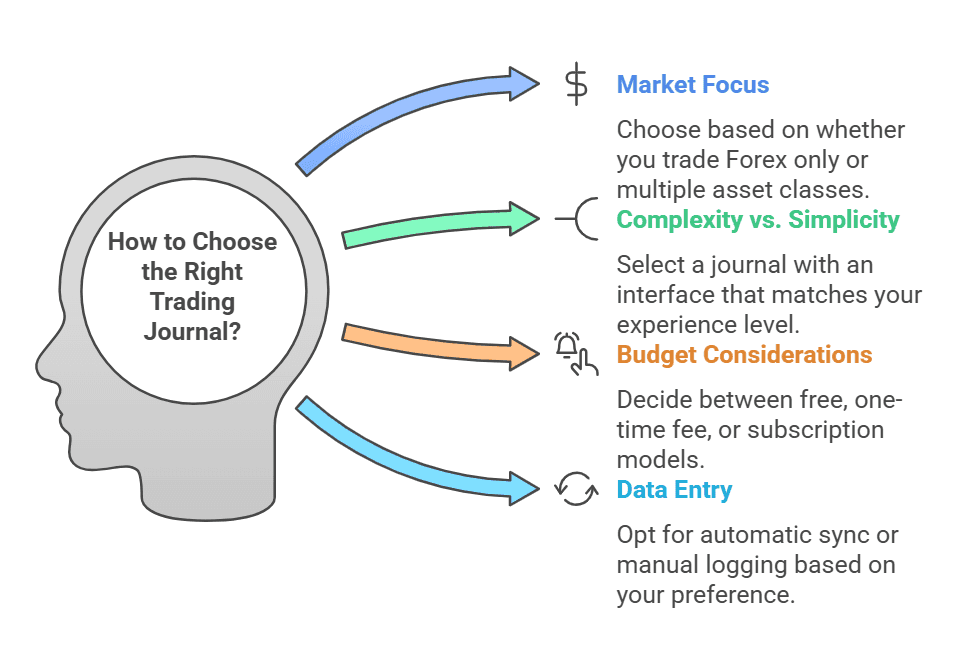

How to Choose the Right Journal for Your Needs

Selecting the best journal ultimately comes down to your trading style, budget, and level of sophistication. You don’t want to be overwhelmed by features you’ll never use, nor do you want to outgrow your journal after just a few months. Consider the following factors before making a decision:

1. Market Focus and Asset Classes

- Forex-Only Traders: Tools like MyFxBook specialize in currency tracking and offer features like currency correlation and real-time trade imports.

- Multi-Asset Traders: If you trade stocks, Forex, and crypto, look for a platform such as TraderSync or TradesViz that can handle multiple asset classes seamlessly.

2. Complexity vs. Simplicity

Beginners: A simple interface (e.g., StockTrader.com or a basic Excel spreadsheet) can help you focus on learning without drowning in complex analytics. Advanced Users: If you’re a quantitative trader or someone who wants deep psychological metrics, Edgewonk or TraderSync’s AI-driven features might be more appropriate.

3. Budget Considerations

- Free Plans and Trials: Tradervue offers a free tier, and many other platforms have trial periods. Start with these to see if they meet your needs without immediate financial commitment.

- One-Time License vs. Subscription: Edgewonk charges a one-time fee, while TraderSync and TradesViz use subscription models. Decide which billing structure works better for you long term.

4. Data Entry and Automation

Automatic Sync: Tools that integrate with your broker can save you hours of manual entry each month and help minimize errors.

Manual Logging: An Excel spreadsheet or a platform that doesn’t fully integrate with your broker demands more diligence but grants you total control.

5. Community and Support

Forums and Peer Interaction: Larger platforms like MyFxBook and Tradervue have active communities where you can learn from others.

Customer Support: Especially important if you’re not tech-savvy. Look for platforms offering responsive support or knowledge bases.

6. Future Growth

- Scalability: If you plan to expand your trading repertoire adding new markets or more complex strategies opt for a journal that can grow with you.

- Regular Updates: Platforms that release new features or improvements show they’re dedicated to adapting to traders’ evolving needs. By weighing these factors, you can narrow down your options to the one or two solutions that align best with your current trading practices and future ambitions.

Conclusion

A trading journal is a powerful ally for anyone serious about improving their trading results and habits. From cutting-edge AI-driven platforms like TraderSync to the ever-reliable Excel spreadsheet, there is no shortage of tools to accommodate different trading styles, budgets, and market focuses.

Each of the eight options highlighted here brings a unique set of features to the table, whether it’s MyFxBook’s Forex specialization or Edgewonk’s deep dive into trader psychology. When choosing a journaling solution, consider factors like automation, analytics, cost, and how well the platform fits your personal workflow. Most importantly, remember that the true value of any trading journal lies in consistent use. Logging your trades, reviewing your performance, and acting on insights are the real keys to refining your trading approach.

By diligently recording every trade, you not only build a historical record of your journey but also set the stage for meaningful improvements. Trading is an ever-evolving skill make sure you have the right journal by your side to track progress and stay on the path to success.

Simplify Your Trading Success with TradeSearcher!

Ready to boost your trading game? TradeSearcher provides powerful, beginner-friendly tools to track and analyze your trades effortlessly. Start your journey toward smarter, more confident trading today—try TradeSearcher and discover how data-driven insights can refine your strategies!