Table of Content

How to Avoid Day Trading Mistakes: Manage Emotions & Trade Smarter

By Vincent NguyenUpdated 7 days ago

How to Avoid Day Trading Mistakes & Manage Emotions

How to avoid day trading mistakes is one of the most crucial skills every aspiring day trader must develop. In the fast-paced environment of stock trading, forex trading, or futures markets, even a single trade can be the difference between a nice daily profit or devastating losses. Traders operate under intense market conditions where quick decisions, often influenced by emotional responses, can either unlock profitable trades or result in significant financial losses.

Novice traders in particular are susceptible to a variety of pitfalls, from lacking a solid trading plan and jumping into the market with unrealistic expectations, to failing to track trades in a trading journal and neglecting proper risk management in day trading. The lure of quick riches can lead to common trading mistake patterns such as skipping initial analysis or ignoring essential technical indicators that sabotage growth. Moreover, the emotional roller coaster of fear, greed, euphoria, and frustration can turn well-intentioned strategies into impulsive bets.

This comprehensive guide is designed to provide real investment advice for day traders eager to strengthen their approach to trading, protect their trading capital, and make more informed decisions. You’ll learn how to devise a solid trading plan, employ technical analysis, and manage your mindset. By the end, you’ll have a practical roadmap to avoid day trading mistakes, adapt to changing market dynamics, and build a foundation of steady profits rather than chasing unsustainable returns.

How to Avoid Day Trading Mistakes with a Solid Trading Plan

A clear, solid trading plan is the cornerstone of successful day trading. By outlining your goals, time frame, and risk level, you mitigate the risk of emotional trades and common blunders.

1. Defining Your Objectives

- Establish clear trading goals: Are you aiming for smaller but consistent steady profits, or are you incrementally building toward larger returns over time?

- Be realistic about your investment time horizon day trading involves short market session timelines, but your skill-building is a long-term endeavor.

2. Identifying Your Financial Instrument and Strategy

- Decide which financial markets you’ll focus on, such as stock price movements, forex markets (with possible high Forex leverage), or futures markets.

- Clarify your trading approach for instance, news trading, range trading, or contrarian trading and make sure it aligns with your strengths.

3. Mapping Entry and Exit Rules

- Use technical indicators like Moving Averages or RSI for your initial analysis.

- Integrate fundamental analysis if relevant checking financial news or news events that can move asset prices.

4. Establishing a Risk Management Protocol

- Allocate an acceptable portion of your trading capital to each position, mindful of the risk-reward ratio.

- Determine a loss level (stop-loss) that closes the trade if the price moves against you, preventing financial losses from ballooning.

5. Setting Clear Benchmarks

- Monitor performance using a trading journal where you log your trades, rationale, outcomes, and emotional states.

- Regularly review whether each day trade aligns with your investment plan and if you are meeting your profit target or daily profit objectives.

Creating a comprehensive trading strategy before placing real money trades drastically reduces impulsive decision-making a common mistake traders make. With structure in place, you’ll be less vulnerable to herd mentality and more capable of informed decisions that protect your bottom line.

Mastering Trading Psychology for Consistent Results

Trading psychology is one of the most overlooked factors in day trading success. Understanding and managing emotional responses is crucial to sidestepping common mistakes traders often make.

1. Acknowledge Emotional Triggers

- Novice traders can feel paralyzed by fear of potential losses or be lured into excessive risk due to greed.

- Recognize how news headlines or previous losses may amplify your stress or push you toward irrational trades.

2. Cultivate Discipline and Patience

- Stick to your solid plan instead of reacting impulsively to a single trade outcome.

- Avoid revenge trading, which occurs when you try to recover a series of bad trades quickly—this often leads to even bigger losses.

3. Leverage Techniques for Emotional Control

- Short meditation sessions or mindfulness exercises during your trading day can help you maintain calm.

- Set rules to step away from the screen after a certain number of losing trades to recalibrate mentally.

4. Process Over Outcome

- Focus on following your strategy precisely, rather than fixating on daily profit or short-term results.

- Document both winning and losing trades in a trading journal to understand your decision-making patterns.

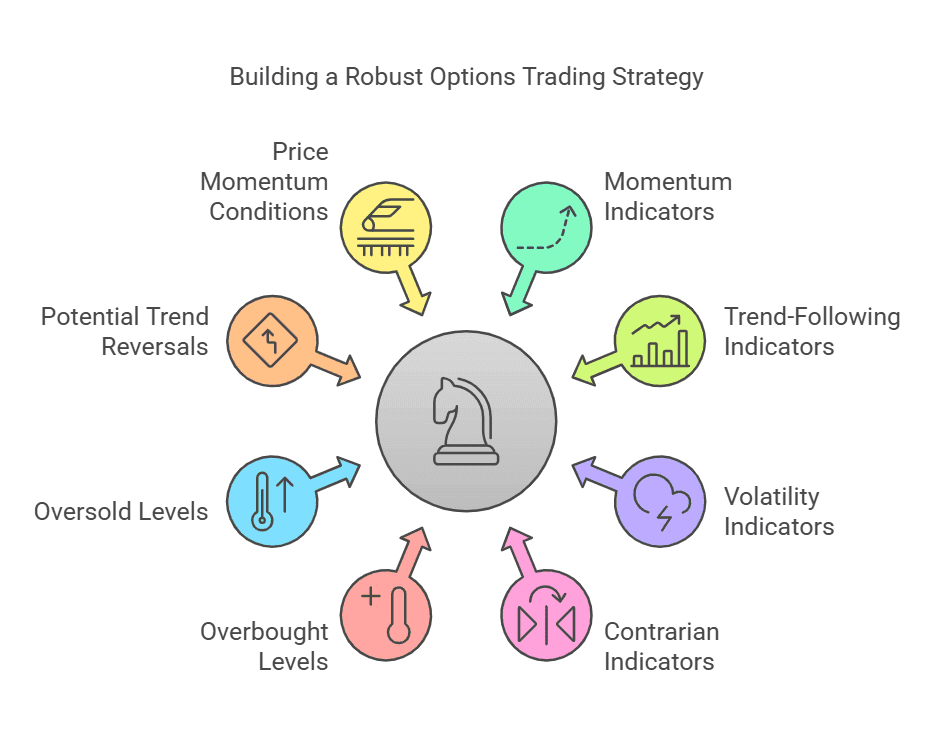

Technical Analysis Basics: How to Avoid Day Trading Mistakes

Leveraging technical analysis can help you make more informed decisions and avoid the pitfalls of guesswork. By interpreting technical indicators, you can refine entries and exits to minimize common mistake patterns.

1. Choosing Effective Indicators

- Moving Averages (MA): Helps identify macro-trends in stock trading or forex trading—is the market bullish or bearish?

- Relative Strength Index (RSI): Pinpoints potential overbought or oversold zones for better entry/exit timing.

- Bollinger Bands: Tracks volatility to gauge whether prices are reaching extreme ends.

2. Multiple Indicator Synergy

- Relying solely on one indicator is a bad idea; combine at least two or three for validation.

- Look for confluence between, say, an RSI divergence and a significant moving average cross.

3. Candlestick Patterns and Support/Resistance

- Learn to read candlestick signals doji, hammer, engulfing for potential market reversals.

- Clearly mark support and resistance levels to define your risk and potential upside.

4. Watching for Fundamental Catalysts

- Even when using technical tools, keep an eye on news events, economic indicators, and financial news that might disrupt price momentum.

- Market sentiment shifts rapidly after a news announcement, so be ready to adapt.

5. Common Pitfalls to Avoid

- Over-analyzing every indicator can cause “analysis paralysis.” Choose a focused set you can consistently apply.

- Ignoring your stops or failing to adapt to intraday market dynamics can quickly lead to financial losses.

Technical analysis is a vital skill set to help you trade more objectively and minimize emotional responses. By grounding your approach in data, you significantly reduce the likelihood of falling into common mistakes traders encounter.

How to Avoid Day Trading Mistakes through Sound Risk Management

Solid risk management in day trading is non-negotiable. This section delves into safeguards like setting a risk-reward ratio, using stop-losses, and considering diversification for more resilient trades.

1. Appropriate Position Sizing

- Decide how much of your trading capital to risk on each position. A typical guideline is 1-2% per trade, but experienced traders might adjust this based on market volatility.

- Over-allocation is a common mistake that can swiftly result in devastating losses when market momentum goes against you.

2. Stop-Loss Orders and Trailing Stops

- A stop-loss is your emergency exit if the market moves the opposite way protecting your position from unlimited downside.

- Trailing stops locking in profits by adjusting the exit point if the market continues in your favor.

3. Diversification of Strategies and Instruments

- Don’t place all your eggs in one basket. Diversify across different stocks, exchange-traded funds, or even digital assets when feasible.

- If you see a bull market in certain financial assets, also keep an eye on hedge positions in case a market reversal occurs.

4. Define Profit Targets and Loss Limits

- Pre-set a profit target for each day's trade knowing when to exit a winning position helps you avoid greed-based errors.

- Be consistent with your loss limits: if you’ve hit your daily maximum loss, walk away to regroup for the next trading session.

5. Monitoring Market Volatility

- Sudden market to market fluctuations can wreak havoc on positions without robust risk controls in place.

- Adjust your approach when you see signs of market conditions shifting drastically.

Day Trading Journal and Paper Trading: Minimizing Beginner Errors

Before jumping into actual money trades, harness the power of paper trading and maintain a thorough trading journal. Doing so helps mitigate common mistakes traders make when real money is at stake.

1. What Is Paper Trading?

- Paper trading, also known as demo trading or simulation trading, involves trading in real-time market scenarios without using actual money.

- It’s an excellent practice ground to test your day trading strategies under real-time quotes while protecting your capital.

2. Importance of a Trading Journal

- Document each single trade entry, exit, rationale, and emotional state creating a database of experiences.

- Over time, you’ll spot patterns in bad trades and successful trades and adjust your approach accordingly.

3. Identifying Common Mistakes Through Journaling

- Whether it’s failing to adjust a stop-loss or ignoring your time frame, recurring issues stand out when you review your documented trades.

- Use these insights to refine your comprehensive trading strategy and avoid mistakes traders tend to repeat.

4. Transitioning to Real-Time Trading

- Move from paper to real money trading slowly. Consider smaller position sizes as you gain confidence.

- Keep journaling. Real-time markets can stir up emotions paper trading never triggers, so consistent documentation remains invaluable.

5. Regular Performance Reviews

- Schedule weekly or monthly reviews of your trading journal. Compare your results, gauge your risk-adjusted returns, and reassess your solid trading plan.

- This process of continuous improvement is what transforms novice traders into skilled traders or even professional traders.

Adopting paper trading and a trading journal early on can save you from financial losses and reduce your learning curve. They are powerful tools for building discipline and a thorough understanding of your own trading psychology.

Adaptive Strategies for Changing Market Conditions

Markets are in constant flux. Rigidly sticking to a single methodology can be a bad idea when volatility spikes or conditions suddenly flip. Adaptability is vital.

1. Recognizing Market Cycles

- Markets can switch between trending and range-bound phases. Certain Day trading strategies, like range trading, thrive in low volatility, while trend-following works best when strong momentum is present.

- Track economic indicators and broader market movements to spot shifts early.

2. Adjusting Time Frames

- If a 1-minute chart appears too choppy, scale to a 5-minute or 15-minute chart for a clearer picture.

- Conversely, if the market is moving fast and you see a potential scalp opportunity, shorten your time frame for tighter control over potential losses.

3. Diversifying Trading Techniques

- Employ a mix of contrarian trading and news-based trades. For instance, if you sense the crowd is reacting irrationally to a news announcement, your contrarian instincts might seize a profitable edge.

- Keep multiple trading ideas in your arsenal so you can rotate strategies as market conditions evolve.

4. Staying Abreast of News Events

- News events can quickly disrupt market momentum, leading to large price swings in seconds.

- Having a fluid plan ensures you can exit or enter trades if new data contradicts your initial analysis.

5. Maintaining Discipline Amid Change

- While flexibility is key, avoid the trap of constantly altering your approach without data-driven reasons.

- Use your trading journal to note each strategic shift and its outcome, so you can measure effectiveness rather than guess.

How to Avoid Day Trading Mistakes by Managing Stress and Anxiety

Day trading can be mentally and emotionally taxing. High pressure, rapid market movements, and the potential for financial losses can stir intense stress or panic. Here’s how to maintain composure.

1. Pre-Market Prep and Routine

- Start your day with a brief analysis of relevant news events and economic calendars.

- Perform a quick mental check-in are you well-rested, calm, and emotionally balanced before engaging in real-time trading?

2. Stress Management Tactics

- Set rules: if you lose a certain percentage of your account in a single trading day, stop trading. Emotional overspill often leads to revenge trading.

- Practice short breathing exercises or mindfulness techniques between trades to stay centered.

3. Limit Screen Time

- Constantly watching every price tick can amplify emotional responses. Use alerts or automated orders for key price levels to ease the burden.

- If you find yourself overly fixated on previous losses or big potential gains, step away for a few minutes to clear your mind.

4. Support Systems

- Connect with a community of day traders or friends who understand the emotional rigors of trading.

- Consider professional coaching or behavioral finance guidance if stress starts affecting your overall well-being.

5. Growth Mindset

- View setbacks as learning experiences rather than personal failures.

- Continue refining your strategy and psychological resilience through each challenge.

By actively implementing stress management, you’ll significantly reduce errors fueled by panic or euphoria leading to a more controlled, steady progression toward profitable trades.

About How to Avoid Day Trading Mistakes

A: One of the most common mistakes novice traders make is trading without a solid trading plan. This leads to impulsive decisions, chasing quick profits, and taking excessive risks. A clear plan with defined entry/exit rules, risk management strategies, and a trading journal helps mitigate this.

A: Managing emotions involves sticking to a pre-defined strategy, using stop-loss orders to limit potential losses, and practicing mindfulness techniques to stay calm. Taking breaks, avoiding overtrading, and reviewing your trading journal regularly also help control emotional responses.

A: Yes, paper trading is a powerful tool for beginners. It allows you to practice day trading strategies in real-time market conditions without risking real money. This helps you refine your approach, test ideas, and build confidence before transitioning to live trading.

A: Risk management is critical to long-term success. It prevents devastating losses by limiting how much of your trading capital is at risk on any single trade. Using position sizing, stop-loss orders, and setting daily loss limits are essential components of effective risk management.

A: A trading journal is invaluable for tracking your trades, analyzing your decision-making patterns, and identifying areas for improvement. It provides insights into what works, what doesn’t, and how to avoid repeating mistakes. It’s a must-have tool for any serious trader.

Final Tips on How to Avoid Day Trading Mistakes and Conclusion

Rounding out the discussion with crucial reminders and concluding thoughts on how to avoid day trading mistakes and manage emotions effectively.

- Keep up with new analytical tools, educational tools, or advanced trading strategy materials.

- Watch how institutional investors or professional investors handle shifting markets there’s often insight to gain from their experience.

- Unrealistic expectations like hoping to double your account daily can spur common mistake behaviors, such as excessive risk.

- Aim for consistent, stable returns rather than large but unsustainable windfalls.

- Automated trading or partial automation (like bracket orders) can help remove emotional decision-making.

- However, don’t blindly trust algorithms perform independent analysis regularly to ensure you understand your positions.

- Market conditions, your personal financial situation, and technology all evolve. Periodically update your solid foundation and trading plan to stay current.

- Record every adjustment in your trading journal and evaluate its long-term effectiveness.

How to avoid day trading mistakes is a continuous journey of discipline, education, and emotional management. Building a solid trading plan, understanding the principles of technical analysis, and practicing consistent risk management in day trading form the backbone of long-term success. Moreover, maintaining a trading journal, experimenting through paper trading, and acknowledging the psychological challenges that come with the territory are crucial steps toward effective self-improvement.

Achieving the status of a successful day trader doesn’t happen overnight. You need to set realistic expectations and cultivate a mindset that values growth over perfection. While market dynamics can turn on a dime, your best defense is a structured, adaptive approach grounded in both rational analysis and emotional stability. Embrace these strategies, keep refining your methods, and you’ll steadily inch closer to your day trading goals. By applying the principles laid out in this guide, you’ll be far better equipped to handle the volatility of the financial markets and truly understand how to avoid day trading mistakes while managing your emotions.

Ready to take your day trading to the next level?

With TradeSearcher, you can backtest strategies, refine your trading plan, and make informed decisions with ease. Sign up today and start optimizing your trades for consistent success!