Table of Content

How to Achieve Consistency in Day Trading: Proven Tips for Profitable Trading

By Vincent NguyenUpdated 99 days ago

How to achieve consistency in day trading

How to achieve consistency in day trading is a common challenge for both beginner traders and seasoned traders alike. Day trading, by its nature, involves short-term moves in the financial markets, where active traders seek to capitalize on trading opportunities within a single trading day. Consistency in trading refers to maintaining stable returns and effectively managing risk over time, rather than chasing quick profits or falling victim to impulsive trades.

Many retail traders and even some Professional traders can struggle to become a consistent trader when they first start their trading journey. The pull of market conditions, fear of consecutive losing trades, and the temptation of revenge trading can derail a trading plan. This guide aims to provide a step-by-step framework on how to develop a consistent approach to trading that includes proper risk management, a solid trading plan, disciplined actions in trading, and effective trading psychology.

Throughout this article, we will break down crucial elements such as defining a consistent trading strategy, building a solid foundation with technical analysis and fundamental analysis, structuring a systematic approach to your trading day, and refining your approach to trading decisions through continuous learning. By the end of this guide, you should have a roadmap of how to achieve consistency in day trading and set yourself up for long-term success in the competitive trading industry.

How to achieve consistency in day trading: Laying the Foundations

Let's help you define what consistency in trading really means, why it matters, and how beginner traders can start from a solid foundation to become a successful trader.

1. Defining Consistency in Trading

- Consistency in trading refers to the ability to maintain a steady performance (consistent profit) over a series of trades, rather than merely experiencing one-off profitable trade outcomes.

- Becoming a consistent trader requires an effective blend of skills, including risk manager capabilities, strong analytical skills, and a clear perspective on market dynamics.

- Consistency in trading acts as a cornerstone to achieving long-term success, because stable returns can compound over time and help you avoid substantial drawdowns.

2. Why Consistency Matters

- A consistent trading approach builds trader confidence, helps traders avoid huge losses, and fosters continuous learning.

- Both amateur traders and more advanced active traders benefit from a system that delivers an above-average return over a large sample of trades, rather than putting all hopes on a single trade.

- Consistency over time is often a key aspect to trading success, because it demonstrates resilience in different market conditions.

3. Starting with a Solid Foundation

- A solid foundation includes understanding basic Trading concepts, technical analysis, and fundamental analysis.

- Beginner traders should avoid random trades and develop a systematic approach, focusing on consistency in trade execution and proper risk management.

- This groundwork will set the tone for achieving stable returns and building a profitable trader mindset.

Building a Solid Trading Plan for Consistency

A well-defined trading plan is a critical element in learning how to achieve consistency in day trading. This section explores the must-have components of a solid trading plan.

1. Key Elements of a Solid Trading Plan

- Clear Objectives: Define whether you aim for consistent profitability, steady growth, or learning new trading practices.

- Risk Management Strategy: Incorporate position sizing, stop losses, and a risk manager approach to minimize substantial drawdowns.

- Trading Strategy and Style: Determine if you’ll use common day trading strategies (like Breakout trading, Range trading, or a trend-following day trading strategy), or if you’ll adopt a consistent forex trading strategy for currency pairs.

- Market Selection: Decide if you will concentrate on 1-3 markets (e.g., stock market, forex, crypto) or diversify across multiple financial instruments.

2. Why You Need a Trading Plan

- A solid trading plan eliminates guesswork and impulsive trades by laying out structured trading rules.

- It helps you adapt to changing market conditions and remain a consistent trader.

- Professional traders and retail traders alike rely on well-defined plans to become successful traders over time.

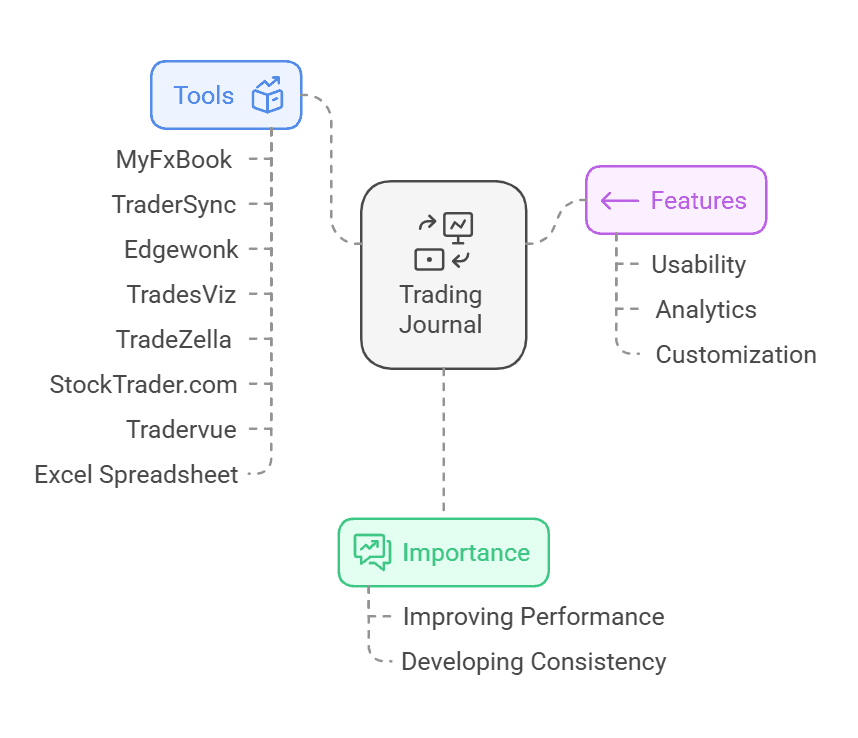

3. Combining a Trading Plan with a Trading Journal

- Maintaining a trade journal provides valuable insight into your performance, documents trade execution details, and helps identify patterns in successful trades or consecutive losses.

- Pairing your trading plan with a thorough journal ensures that each trading day is approached with clarity, discipline, and a consistent approach.

How to achieve consistency in day trading Through Risk Management

Proper risk management is pivotal for those looking to master how to achieve consistency in day trading. This section introduces specific risk management strategies and best practices.

1. Consistency in Risk Management

- Consistency in risk management ensures that each trade has a controlled and predefined amount of risk, helping to avoid huge losses that can wipe out your trading capital.

- A key rule to remember: never risk more than a small percentage of your total trading balance on a single trade.

- This practice allows you to withstand a series of losses without suffering catastrophic damage to your account.

2. Position Size and Position Sizing

- Position size plays a large role in controlling risk, so adjusting your trades according to the volatility of the asset and your total trading capital is crucial.

- Consistent Position Sizing Parameters can help keep your approach to risk uniform over time, preventing emotional or revenge trading decisions.

- Evaluate your position sizing in relation to your stop-loss levels and risk tolerance, ensuring that you maintain a consistent risk per trade.

3. Stop-Losses and Protective Orders

- Properly placed stop-losses can protect you from significant drawdowns in the event the market moves against your position.

- Consistent time frames in analyzing market movements can also aid in setting your stop-loss levels with better precision.

- Being a thorough risk manager includes understanding when to exit, especially during bad times or choppy markets.

Mastering Trading Psychology to Achieve Consistency in Day Trading

Trading psychology is an essential aspect to trading success. This section shows how addressing emotional pitfalls can pave the way for consistent trading performance.

1. The Importance of Trading Psychology

- Trading psychology deals with emotional control, discipline, and mental resilience—traits that differentiate a profitable trader from someone who struggles with consistency.

- Loss aversion and fear of missing out (FOMO) can lead to impulsive trades that disrupt a consistent trading approach.

2.Common Psychological Pitfalls

- Revenge Trading: Attempting to recover previous losses immediately by placing larger positions can lead to more substantial losses.

- Greed for Quick Profits: Over-leveraging or ignoring risk management to hit a “home run” trade often ends in consecutive losing trades.

- Overconfidence: After a successful trading streak, traders may deviate from their trading plan, risking too much of their trading capital.

3. Strategies to Manage Emotions

- Mindfulness and Self-Awareness: Recognize emotional triggers and pause before taking actions in trading, ensuring your decisions align with your solid trading strategy.

- Consistent Routine: Create a daily routine that includes a pre-market prep, reviewing potential trading opportunities, and post-market reflections in your trading journal.

- Patience and Discipline: Wait for bullish trading opportunities or bearish signals that match your consistent trading strategy analysis instead of forcing random trades.

Developing a Consistent Trading Strategy

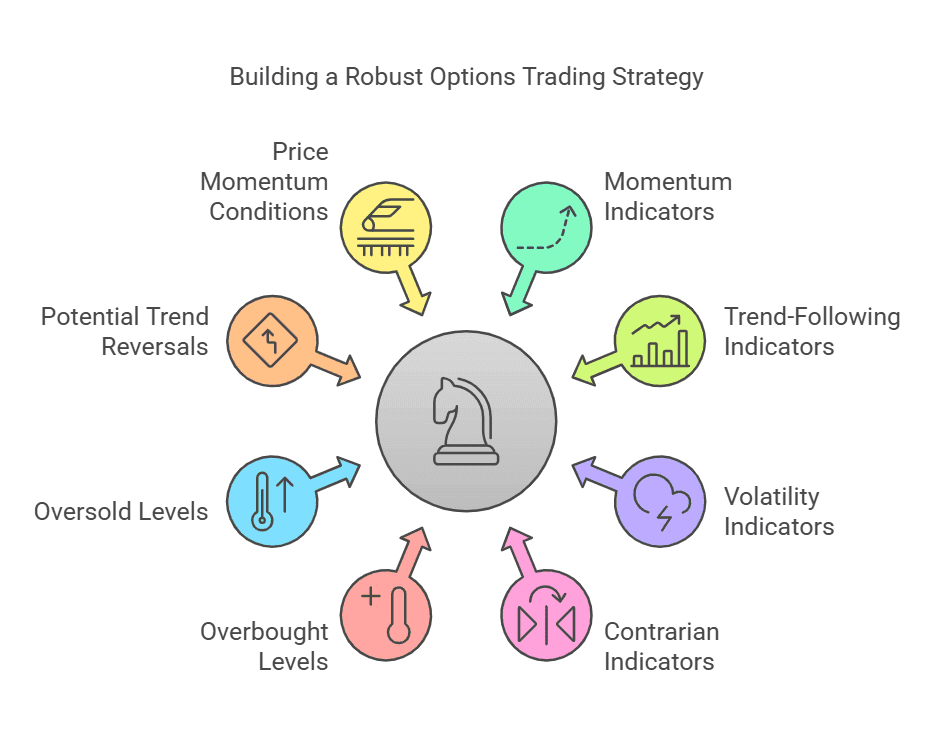

We examine how to craft a consistent trading strategy that aligns with your trading journey, the market conditions you face, and your broader approach to trading decisions.

1. Consistency in Strategy Selection

- The trading industry offers countless day trading strategies. Some are tailored for short-term scalping, while others are suitable for Swing traders or active traders.

- A consistent trading strategy focuses on repeatable setups across similar market conditions, rather than jumping between untested method after method.

- Consistency in trading begins with picking an approach like Range trading, Breakout trading, or trend-following day trading strategy and refining it over time.

2. Backtesting and Forward Testing

- Backtest your single strategy to gather evidence of stable returns, success rate, and correlation with profitability.

- Demo trading is an excellent way to test your strategy during regular trading hours without risking real trading capital.

- If your backtest and demo trades show consistent trading profits, consider gradually applying the method to your live account.

3. Adapting to Different Financial Instruments

- Keep in mind that a consistent Forex trader might apply a consistent forex trading strategy differently from a stock market or crypto market participant.

- Tailor your approach to the unique price movements of each asset. Pay attention to the broad market knowledge that underpins each instrument.

- This adaptability helps ensure you remain a consistent trader, even as you venture into new markets.

Price Action and Technical Analysis for Consistent Trading

Using price action and technical analysis can help you anticipate active price behavior and refine your entries and exits for consistent trading performance.

- Support and Resistance Levels: Identifying these areas helps you spot bullish market or bearish confluence signal setups.

- Chart Patterns and Indicators: Tools like moving averages, RSI, or MACD can provide additional confluence factor to confirm your trades.

- Trend Confirmation: A bullish trend-following signal or a bearish signal can be used to time entries, while a bullish fadeout signal might indicate caution or a reversal in price action.

Fundamental Analysis for a Balanced Approach

While many day traders focus on technical analysis, adding fundamental analysis can offer valuable insight into longer-term shifts in market dynamics.

- News Events and Earnings: Keeping track of relevant corporate announcements, macroeconomic news, or policy changes can help you avoid sudden volatility.

- Company and Sector Health: For equities, do your due diligence on the financial stability, competitive borrowing rates, and annual growth rate of the company.

- Balancing Both Approaches: Combining technical and fundamental analysis offers a more stable platform for consistent approach in trading, as it merges short-term price action with long-term investor considerations.

How to achieve consistency in day trading By Tracking Performance

Tracking performance and refining trading practices over time to achieve consistency in day trading through self-evaluation and continuous improvement.

1. The Role of a Trading Journal

- A comprehensive trading journal details your entries, exits, position size, and the rationale behind every trade.

- Studying patterns in your successful trades and unsuccessful trades helps refine your approach to trading decisions.

- Logging each trade also supports consistency of trades, as you can replicate what works and discard what doesn’t.

2. Reviewing Trading Performance

- Perform weekly or monthly reviews of your trades to identify trends, success rate, and areas for improvement.

- Look for big mistakes such as ignoring risk management, inconsistent position sizing, or trading without a plan.

- Utilize data to adjust your consistent trading strategy, focusing on addressing common mistake patterns.

3. Refining Your Strategy

- If you discover a particular aspect of your approach is underperforming, tweak that part of your system.

- Remain flexible: a consistent method doesn’t mean being rigid. It means updating rules in a systematic approach that aligns with evolving market conditions.

- Over time, you build consistency in trading goes hand-in-hand with refining your tactics for stable returns.

Refining Your Approach to Trading Sessions and Market Conditions

Different trading sessions (e.g., London, New York, Asian) and varying market dynamics call for adjustments to your strategy to maintain a consistent trading approach.

1. Choosing the Right Trading Sessions

- Day traders often focus on the most liquid trading sessions for their preferred financial instruments like the New York session for U.S. stocks or the London session for major currency pairs.

- Align your daily routine with these sessions to find better trading opportunities and reduce the chance of random trades.

2.Adapting to Market Volatility

- During volatile sessions or news releases, you might adjust your position size or use tighter stop-losses.

- Avoid forcing trades in choppy markets where price movements are erratic and consistent profitability is more difficult to achieve.

3. Adjusting Your Strategy to Market Conditions

- A consistent trader modifies certain parameters (e.g., how tight stops are set, profit targets, or specific entry triggers) based on overall market volatility and liquidity.

- Keep track of your approach in your trading journal to see if these adjustments improve consistent trading performance or hamper it.

How to achieve consistency in day trading in Various Market Environments

Let's explore diverse market environments ranging from bullish markets to sideways or range-bound markets and how day traders can adjust accordingly to stay profitable.

1. Bullish Market Conditions

- During a bullish market, bullish traders focus on trend-following day trading strategies, bullish trading opportunities, and holding positions until the trend weakens.

- Even in a bullish environment, consistent risk management is essential. A single trade can still go against you if you misread a bullish fakeout signal.

2. Bearish or Downtrending Markets

- Look for bearish signals, such as breakouts below key support levels or a bearish confluence signal from multiple indicators.

- Short-selling or using inverse financial instruments can offer a profitable trade approach in a prolonged downtrend.

- Maintaining consistent time frames for analysis helps you discern real signals from noise.

3. Range-Bound or Sideways Markets

- Range trading within defined support and resistance can be effective when the market lacks a strong trend.

- Stay vigilant for breakouts or false moves that could lead to losses. Follow your consistent trading approach to confirm entries.

- This environment can test your discipline, but a stable approach with proper stop-loss placement keeps you prepared for unexpected market shifts.

How to Achieve Consistency in Day Trading

Becoming a consistent trader depends on your commitment to learning, practicing, and refining your skills. For most traders, it takes 6 months to 2 years of disciplined effort, regular backtesting, and live trading experience.

Yes, but it requires careful planning. Focus on trading sessions that align with your free time, such as the opening or closing hours of major markets. Use automated alerts or a limited number of trading strategies to stay efficient.

The amount depends on your goals, market, and risk tolerance. For day trading stocks, at least $25,000 is often required due to pattern day trading rules in the U.S., while forex and crypto markets typically allow you to start with smaller amounts.

Specializing in one or two instruments initially is highly recommended. It helps you develop a deeper understanding of their price action, volatility patterns, and market behavior, which can improve your consistency.

Burnout is common among day traders. To prevent it, establish a daily routine with breaks, avoid overtrading, and set realistic goals. Incorporate time for hobbies and relaxation to maintain mental and emotional well-being.

Conclusion

How to achieve consistency in day trading ultimately hinges on disciplined execution, a well-structured trading plan, and the mental fortitude to withstand the ups and downs of the financial markets. Whether you’re focusing on a consistent forex trading strategy or diving into the stock market, committing to continuous learning, proper risk management, and a systematic approach will pave the path for consistent profitability and long-term success.

From building a solid foundation in technical and fundamental analysis to perfecting your trading psychology and refining your position sizing, every aspect of your trading journey should converge towards one overarching goal: how to achieve consistency in day trading. Keep a thorough trading journal, remain adaptable to evolving market conditions, and practice patience in the face of volatility. By aligning these elements, you can transform into a more profitable trader, achieve stability in your trading balance, and enjoy the rewards that a consistent method can bring.

Remember, successful day trading is not about quick profits or zero-risk scenarios. Instead, it’s about accumulating consistent gains and developing the confidence, discipline, and expertise required to stay the course—no matter how turbulent the markets become.

Ready to master the art of consistent day trading?

Visit TradeSearcher today for expert insights, proven strategies, and tools designed to help you achieve long-term success in the markets. Take the first step toward transforming your trading journey