Table of Content

Best Algo Trading Software for Beginners: Top Tools & Features (2025 Guide)

By Vincent NguyenUpdated 384 days ago

Best algo trading software

Best algo trading software has become an essential part of modern financial markets, enabling traders to automate their strategies and execute trades at lightning speed. Whether you’re a novice just starting out or an experienced trader looking to streamline your workflow, understanding the capabilities of algorithmic trading tools is the key to staying competitive.

In this beginner-friendly guide, we’ll explore the foundation of algorithmic trading, what features to look for in the best algo trading software, and how to implement and optimize these tools for real-world trading success. We’ll also touch on popular trading strategies and risk management principles that should underpin any automated setup. By the end, you’ll have a detailed roadmap that demystifies algo trading, helping you select the right software solutions and avoid common pitfalls.

From backtesting historical data to real-time market analysis, modern algorithmic trading tools offer a wide range of functionalities that can give you an edge. However, choosing the right platform can be overwhelming—especially if you’re new to the automated trading scene. This guide is structured to provide both the conceptual understanding and practical steps you need to embark on your algorithmic trading journey. So, let’s dive in and uncover what it takes to find and implement the best algo trading software in today’s fast-paced markets.

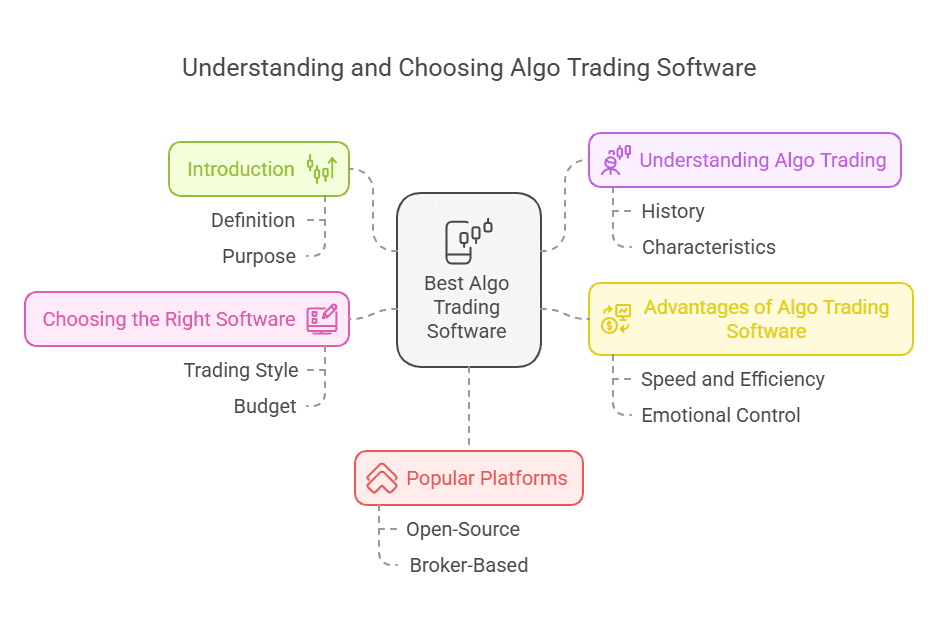

Understanding Algorithmic Trading

Algorithmic trading, often shortened to “algo trading,” is the use of computer programs to execute trades based on pre-defined criteria—such as price movement, volume, or time—and execute them automatically. By leveraging advanced mathematical models and real-time data analytics, these systems can spot market opportunities more efficiently than manual trading methods.

A Brief History

- Institutional Origins: Early algo trading took shape in large financial institutions that used advanced algorithms to automate part of their market-making activities. They leveraged cutting-edge hardware and software to gain a speed advantage, often executing trades in microseconds.

- Rise of Retail Access: As technology became more accessible, retail traders and smaller hedge funds gained entry to the world of automated trading. Now, a laptop, a reliable internet connection, and best algo trading software can help individuals replicate some of what large institutions have been doing for decades.

Key Characteristics

- Speed: Algorithms can scan multiple markets and execute trades at lightning speed.

- Precision: Orders are placed at exact price levels defined by the rules, reducing slippage.

- Emotion-Free: Automated systems eliminate hesitation and fear-based mistakes.

- Scalability: You can run multiple strategies across different asset classes simultaneously.

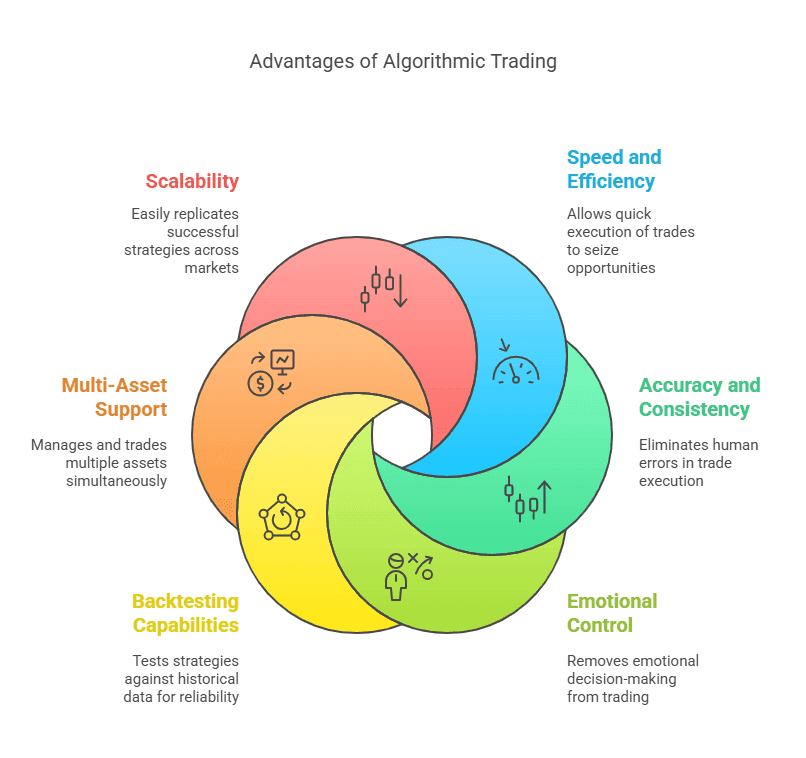

Why Use Best Algo Trading Software? The Key Advantages

Choosing the best algo trading software can revolutionize your trading routine. Instead of spending hours manually tracking market movements, you can automate your strategies. Below are the primary benefits that come with using top-tier automated solutions.

1. Speed and Efficiency

The financial markets move fast—sometimes within seconds. Computers, however, can process thousands of calculations per second and place trades in microseconds. By the time a human analyzes a chart and clicks a button, an algorithm can already have executed multiple trades. This advantage allows you to capture short-lived opportunities and minimize latency-related losses.

2. Accuracy and Consistency

Manual trading is susceptible to errors: miscalculating your position size, typing the wrong ticker symbol, or forgetting to set a stop-loss. Best algo trading software eliminates these mistakes by following a strict rule set with no deviation. Once your strategy is programmed, the software will execute trades with unwavering consistency, ensuring each order adheres to your plan.

3. Emotional Control

Emotional trading often leads to poor decisions. Fear can cause you to exit winning trades too early, while greed might make you hold onto losing positions for too long. By automating your strategy, you remove impulsive reactions. The algorithm doesn’t get scared or euphoric; it just executes the plan.

4. Backtesting Capabilities

Many top algo trading tools offer extensive backtesting features. You can use historical data to test how a particular strategy would have performed under different market conditions. This process helps fine-tune your rules and filters out strategies that look good on paper but fail in real-world conditions.

5. Multi-Asset Support

With manual trading, monitoring many assets (e.g., stocks, forex pairs, cryptocurrencies) is challenging. Automated software can watch multiple markets simultaneously and execute trades whenever conditions are met. This feature lets you diversify across different asset classes, potentially spreading your risk and capitalizing on broader market opportunities.

6. Scalability

Once your system proves successful for one market or strategy, you can often replicate it across multiple assets or slightly modify it for different market conditions. This scalability is significantly easier with algo trading than with manual approaches, where your time and focus become a bottleneck.

In short, best algo trading software frees you from the repetitive tasks of market monitoring and trade placement. By combining speed, precision, and emotional neutrality, you can potentially gain an edge over traders who still rely solely on manual execution.

How to Pick the Right Software for Your Needs

The decision to automate your trades is only the first step; the second—and arguably more critical—step is selecting software that aligns with your goals. Not all platforms are created equal, and some might cater more to beginners, while others suit advanced quants or institutional-level traders.

Identify Your Trading Style

- Scalping: If you execute dozens of trades per day, you’ll need a platform with ultra-fast execution and minimal latency.

- Day Trading: Day traders often benefit from best algo trading software that offers robust technical indicators, real-time market data, and direct market access.

- Swing Trading: For multi-day or multi-week holds, you may focus on chart patterns and fundamental data, so a platform that supports more extended analysis could be ideal.

Define Your Budget and Risk Tolerance

- Free Platforms: Some solutions allow you to build and test algorithms without monthly fees, although they may limit certain features like real-time data feeds.

- Monthly/Annual Subscription: Paid platforms often include advanced features such as AI-driven scanners, robust backtesting modules, and extensive libraries of trading indicators.

- Risk Appetite: Consider how much you’re willing to allocate to software costs versus your trading capital. The best software for advanced high-frequency strategies might be costly, and a simpler, more budget-friendly option might be preferable for smaller portfolios.

Consider Your Preferred Asset Classes

Not all platforms support every market. If you plan to trade crypto, ensure the software integrates with popular crypto exchanges. If forex is your focus, look for specialized broker integrations and advanced features such as custom leverage settings. On the other hand, traders targeting U.S. equities might want direct routing and advanced order types.

Assess User-Friendliness vs. Advanced Features

- New Traders: Simpler interfaces, drag-and-drop strategy builders, and prebuilt algorithms might be your best starting point. These tools require less coding expertise.

- Advanced Coders: If you’re a programmer or come from a quantitative background, you’ll appreciate open APIs, flexible scripting languages (e.g., Python, C++), and the ability to integrate external libraries and data feeds.

At the end of the day, the best algo trading software is the one that meets your specific needs. Start by listing your must-have features, understanding your trading style, and then narrowing down platforms that can deliver those features without unnecessary complexity or cost.

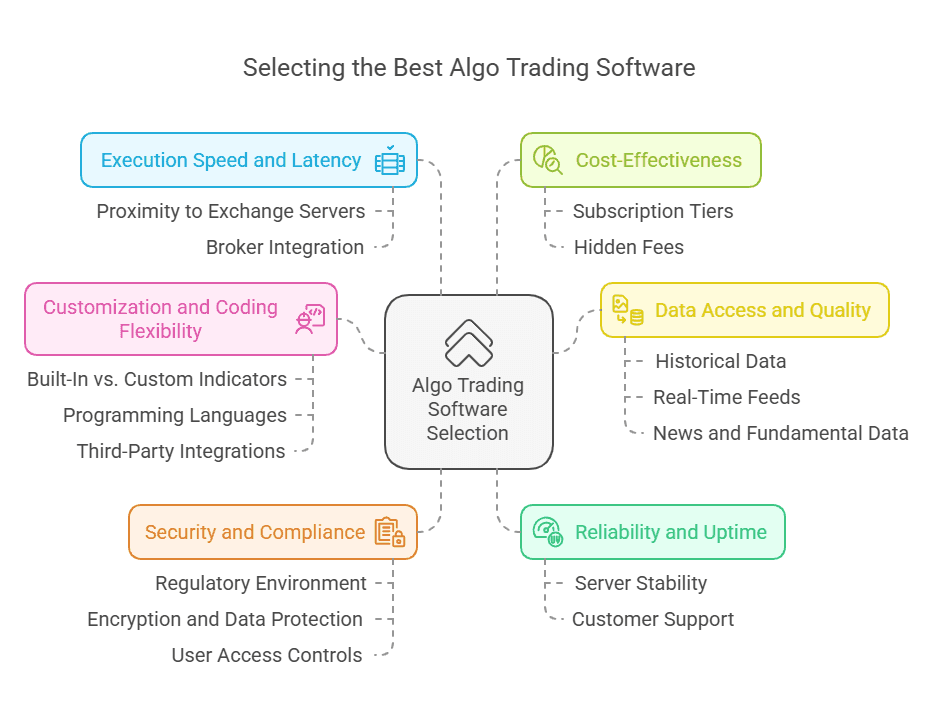

Factors to Consider When Choosing Best Algo Trading Software

While trading style, budget, and asset classes are vital considerations, there are additional technical and practical factors that can make or break your algo trading experience. Below are the major points to keep in mind when you’re evaluating best algo trading software candidates.

Reliability and Uptime

- Server Stability: Look for reviews and track records of server uptime. If the platform goes down when the market is volatile, you might miss critical trades.

- Customer Support: Strong customer service can rescue you when something goes wrong. Check whether the platform offers live chat, email, or phone support.

Customization and Coding Flexibility

- Built-In vs. Custom Indicators: Some platforms come with an array of ready-made indicators, while others let you code your own from scratch.

- Programming Languages: Python, C#, and proprietary languages are common. Verify compatibility with your skill set or hire a developer if needed.

- Third-Party Integrations: Possibly you want to connect with external libraries or custom data feeds. The best algo trading software typically provides an API or plug-in architecture.

Data Access and Quality

- Historical Data: For backtesting, you’ll want comprehensive historical price data. Some platforms limit how far back you can go or restrict the frequency of updates.

- Real-Time Feeds: Ensure the platform provides high-quality real-time data. Delayed data can hamper the effectiveness of high-frequency or day trading algorithms.

- News and Fundamental Data: If your strategy incorporates fundamental analysis—such as earnings releases or economic indicators—you’ll need a platform that provides up-to-date fundamentals and possibly news feeds.

Execution Speed and Latency

- Proximity to Exchange Servers: High-frequency traders often run their algorithms on servers located near major stock exchanges to reduce latency.

- Broker Integration: Some brokers are known for faster execution, while others may have a slower or more complicated order-routing system.

Security and Compliance

- Regulatory Environment: In many regions, you need to ensure your algo trading platform meets regulatory standards. Look for platforms that highlight compliance with bodies like FINRA, the SEC, or the FCA, depending on your jurisdiction.

- Encryption and Data Protection: Financial data is sensitive; verify that the software and broker use secure connections and encryption protocols.

- User Access Controls: For those sharing access with a team, ensure the platform offers multiple permission levels and robust password policies.

Cost-Effectiveness

- Subscription Tiers: Identify what each tier includes—some providers may advertise a low monthly cost, but real-time data or advanced modules can be additional expenses.

- Hidden Fees: Watch out for add-ons such as historical data fees, advanced order types, or specialized indicators that may inflate your total cost.

A systematic approach can help you weigh these factors effectively. Make a list or spreadsheet and note each platform’s pros, cons, and how well it meets your criteria. That way, you can objectively evaluate each candidate until you find one that stands out as the best algo trading software for your situation.

Popular Algo Trading Platforms to Explore

Before we delve into specific best algo trading software recommendations, it’s helpful to understand the broader landscape. Below are some categories of popular algo trading platforms to keep on your radar.

MetaTrader 5: A Popular Platform for Automated Strategies

MetaTrader 5 (MT5) is the successor to MetaTrader 4, one of the world’s most widely used trading platforms. Developed by MetaQuotes, MT5 extends beyond Forex trading to offer equities, futures, and other assets, depending on broker support. While it doesn’t appear in the heading as “best algo trading software,” it remains a staple among retail traders for automated strategy development.

MT5’s proprietary scripting environment, MetaQuotes Language 5 (MQL5), plays a pivotal role in expanding the platform’s capabilities. Through MQL5, you can develop Expert Advisors (EAs) that execute trades based on specific conditions, as well as create custom indicators to analyze price action in a more personalized way. This scripting functionality is also supported by a robust Strategy Tester, which can handle multi-currency backtesting. Traders can optimize their EA parameters by adjusting variables and letting the tester run different permutations to identify the most effective settings.

One of the most appealing aspects of MT5 is its user-friendly interface. Even if you’re a newcomer to algo trading, MT5’s layout is intuitive: from the Market Watch window that displays real-time quotes, to the Navigator that houses your accounts, indicators, scripts, and EAs. You can also access a wide selection of built-in indicators, while the charting tools help you visualize trends, patterns, and potential entry points.

The platform boasts a large community and an official marketplace, where traders can purchase or download free automated solutions. This marketplace integrates seamlessly, allowing you to browse and install trading robots directly within the platform. However, it’s worth noting that if you want to use Python or another language, you’ll need third-party integrations or bridging solutions, since MT5 is primarily coded in MQL5.

NinjaTrader: A Powerful Contender Among the Best Algo Trading Software

NinjaTrader is well-known for its robust charting, analysis tools, and automated trading capabilities. With a focus on futures and Forex but also supporting stocks, it stands out for its customizable interface and extensive library of add-ons. It has earned its place among the best algo trading software platforms, particularly for those willing to invest the time to master its features.

The platform is built around a C# programming environment, which allows traders and developers to craft intricate automated strategies. NinjaTrader’s use of C# opens the door to integrating external libraries and taking advantage of advanced analytics. Beginners may find it challenging to learn a new programming language, but countless community-driven guides and tutorials are available online to ease the process.

One of NinjaTrader’s biggest strengths is its charting. You’ll encounter a broad spectrum of chart types, from standard candlesticks to more specialized views like Renko or Heikin-Ashi. The built-in technical indicators are plentiful, but if you require additional functionality, there’s an ecosystem of user-created scripts and professional add-ons. This marketplace can help you expand your platform’s capabilities, such as adding advanced drawing tools or specialized risk-management features.

Another highlight is broker integration. NinjaTrader has its own brokerage, which can streamline account setup and platform licensing fees. However, you can also connect through other brokers if you prefer. Many advanced order types, like OCO (One-Cancels-Other) and ATM (Advanced Trade Management) strategies, make it easier to manage positions automatically.

Licensing costs can be a downside if you’re not using NinjaTrader Brokerage, and some advanced features are locked behind certain subscription tiers. Despite that, NinjaTrader’s combination of powerful charting, a vibrant community marketplace, and extensive customization options make it a compelling option for traders aiming to automate both short-term and long-term strategies.

TradeStation: Best Algo Trading Software Packed With Robust Features

TradeStation is often hailed as one of the best algo trading software platforms, especially for traders looking to explore stocks, futures, options, and cryptocurrency markets. Known for pioneering innovations in electronic trading, TradeStation offers a professional-grade environment with both a desktop platform and web-based alternatives.

A primary factor behind TradeStation’s popularity is its EasyLanguage scripting framework. This proprietary language was designed to lower the entry barrier for custom strategy development, making it simpler for semi-technical users to automate their trading ideas. By focusing on plain-English syntax, EasyLanguage can be more approachable than C# or Python, although there is still a learning curve if you’re new to coding.

TradeStation also excels in market access. Whether you trade equities, futures, options, or crypto, you can manage them under a single account with unified reporting tools. This consolidation simplifies portfolio monitoring and helps you diversify with minimal hassle. Meanwhile, features like RadarScreen allow you to scan hundreds of symbols in real time, applying custom criteria to spot breakouts, trend changes, or other opportunities instantly.

Stability and execution quality are additional selling points. TradeStation has been a key player in the algorithmic trading space for years, and it’s generally praised for reliability. The platform includes robust order types to manage trades, and it integrates with various third-party tools, giving you flexibility in how you implement your strategies.

That said, costs and data fees are worth investigating. Although newer subscription models can be more competitive, you might run into extra charges for advanced data packages or premium platform features. Also, if you’re coming from a different coding background, adapting to EasyLanguage might require extra effort. Still, for anyone seeking multi-asset functionality, user-friendly scripting, and solid infrastructure under one roof, TradeStation remains a standout choice in the algo trading sphere.

Interactive Brokers: A Global Leader in Best Algo Trading Software

Interactive Brokers (IB) has carved out a reputation for catering to both retail and institutional traders. Often recognized for its low commissions, wide range of tradable securities, and extensive global market access, IB also offers powerful tools for algorithmic trading through its Trader Workstation (TWS) and various APIs. It’s no surprise many consider it a global leader in best algo trading software.

One of the platform’s key advantages is the versatility of its API integration. Traders can connect using Python, C++, Java, and more, granting the freedom to code sophisticated strategies in the language they prefer. This flexibility is especially valuable for quants, systematic traders, or developers who need deep customization or advanced analytics. Another highlight is the TWS interface, which provides real-time quotes, charting, and a range of order types. While it might look complex at first glance, its comprehensive nature ensures you have all the tools necessary to monitor diverse markets and execute trades efficiently.

Interactive Brokers’ pricing model is attractive to those who trade in high volumes. The tiered commission structure can lead to significant cost savings, especially if your algorithm places frequent orders. Over time, lower commissions and narrower spreads can substantially boost profitability for active traders, making IB an appealing choice for cost-conscious individuals and institutions alike.

QuantConnect: Best Algo Trading Software Platform in the Cloud

QuantConnect is a cloud-based platform that allows traders to code, backtest, and deploy algorithmic trading strategies in multiple asset classes. With support for Python and C#, among other languages, it has gained traction among quants and developers who appreciate an open-source ethos and a collaborative community. Many refer to it as one of the best algo trading software solutions due to its flexibility and focus on quant research.

At the heart of QuantConnect is the LEAN Engine, an open-source algorithmic trading engine that underpins the platform. You can write strategies directly in your browser and run backtests on historical data spanning equities, Forex, futures, and even cryptocurrencies, depending on the data packages you subscribe to. One big benefit of this architecture is that your code remains portable. If you ever decide to operate your own servers, you can deploy LEAN independently using the same codebase.

For traders looking to implement complex analytics or machine learning models, QuantConnect’s Research Environment allows in-depth data exploration without the hassle of installing specialized software. This can save substantial time, especially if you prefer the flexibility of coding in Python. Another strong selling point is the supportive, knowledge-sharing community. From code snippets to entire strategy templates, the platform encourages collaboration, which significantly shortens the learning curve for newcomers.

AmiBroker: A Time-Tested Best Algo Trading Software for Technical Analysis

AmiBroker has been a staple in the technical analysis community for many years. It combines a robust charting system with a scripting language (AmiBroker Formula Language, AFL) to design and backtest custom trading strategies. Its flexibility and speed make it a solid candidate for traders specializing in technical strategies, and it frequently appears on shortlists of best algo trading software.

One of AmiBroker’s major strengths is the speed and efficiency of its backtesting engine. Whether you’re testing a single symbol or a multi-symbol portfolio, AmiBroker can parse through historical data rapidly. This performance edge is particularly useful for traders who frequently iterate on their strategies, testing multiple versions before settling on the best approach.

AFL, AmiBroker’s proprietary scripting language, is designed to be relatively easy to learn. Even if you’re new to coding, the language’s structure enables you to build indicators, scans, and trading systems without the complexity you might encounter in more general-purpose languages. Plenty of user-shared AFL scripts exist across forums and community sites, offering a valuable head start for beginners.

Despite its robust technical capabilities, AmiBroker doesn’t integrate with many brokerages by default. You typically need third-party plugins or bridging software to place automated orders. This adds an extra step for those eager to go live with their strategies. Additionally, AmiBroker is primarily built for Windows, meaning Mac or Linux users may have to use virtualization or emulation solutions to run it smoothly.

Conclusion

Choosing the best algo trading software is a key step in automating your trading strategy. Platforms like MetaTrader 5, Interactive Brokers, and QuantConnect offer a range of features to suit different trader needs. By researching, testing, and implementing strong risk management, you can enhance your chances of long-term success. Start exploring free trials and demo accounts today to find your ideal platform!

Ready to take your algo trading to the next level?

With TradeSearcher, you can instantly backtest and optimize strategies for any ticker across stocks, crypto, and forex. Sign up today and discover the best strategies to automate your trading success!