Table of Content

The Ultimate Guide to AI Algo Trading: Strategies, Setup & Best Tools

By Vincent NguyenUpdated 384 days ago

How to Start AI Algo Trading

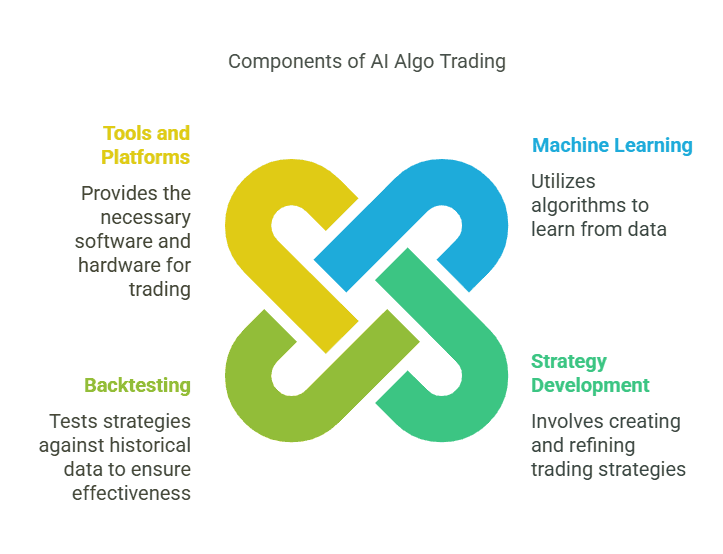

AI algo trading is an innovative approach to automated financial transactions that uses artificial intelligence (AI) and machine learning to make faster, more efficient, and more data-driven trading decisions. In contrast to traditional algorithmic trading, which typically follows predefined sets of rules, AI algo trading continuously adapts and learns from market patterns, historical data, and real-time price movements. This dynamic ability to learn from new information allows traders and investors to refine their strategies, reduce emotional bias, and execute trades at speeds impossible for human operators.

In this comprehensive guide, we will cover everything you need to know to get started with AI algo trading. We will begin by explaining why AI algo trading is becoming increasingly popular in both retail and institutional circles, then walk through each step involved in setting up an AI-driven trading environment. You will learn the essential prerequisites, from understanding machine learning basics to sourcing reliable market data. We'll also discuss how to develop and refine strategies, emphasize the importance of rigorous backtesting, and highlight the must-have tools and platforms. By the end of this guide, you will be equipped with a solid foundational roadmap for venturing into the exciting world of AI-powered algorithmic trading.

Why AI Algo Trading Is Gaining Popularity

Technology and finance have always been intertwined, and the emergence of AI algo trading represents the latest step in this evolution. Algorithms have been used on trading floors for decades, particularly among high-frequency traders seeking to exploit microsecond-level market inefficiencies. However, the addition of AI takes algorithmic trading to a new level of sophistication.

- Adaptive Learning: Classic algorithmic strategies are often rule-based and static. They struggle when market conditions shift dramatically. AI-driven systems, on the other hand, can “learn” from changing trends and adapt their models accordingly. This adaptability is especially valuable during volatile market conditions or black swan events.

- Superior Pattern Recognition: Machine learning algorithms excel at discovering hidden correlations in large datasets. They can detect subtle patterns in price action, volatility, volume, and even social media sentiment. Human traders might miss such signals, but AI algo trading tools can sift through mountains of data in seconds.

- Speed and Efficiency: Executing trades at sub-millisecond speeds requires robust computing infrastructure. AI systems, once trained and integrated, can scan multiple markets simultaneously and react to opportunities faster than any human. This efficiency can be crucial for high-frequency or intraday strategies.

- Risk Management: AI models can incorporate sophisticated risk metrics, constantly recalibrating positions based on new market data. While no system is infallible, AI-driven risk protocols help limit drawdowns by dynamically adjusting stop-loss thresholds or position sizes.

- Accessibility: In the past, complex algorithmic setups were limited to large financial institutions with massive budgets. Today, thanks to open-source libraries, cloud computing, and user-friendly platforms, AI algo trading is increasingly within reach for small retail traders.

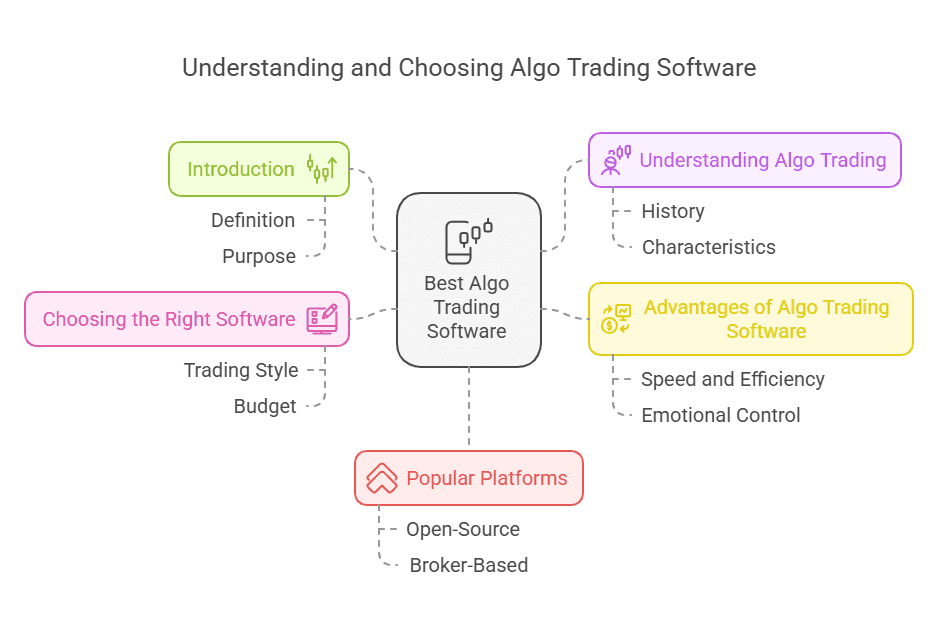

Step 1 – Understand the Basics of AI Algo Trading

Before diving headfirst into AI algo trading, it is crucial to grasp a few foundational concepts. Having a strong baseline of knowledge in both finance and technology can help you navigate the more advanced aspects of building and deploying AI-driven trading strategies.

Key Concepts in AI

1. Machine Learning: Encompasses various techniques by which computers learn from data without explicit rule-based programming.

- Supervised Learning: Models learn from labeled datasets (e.g., historical stock prices with known outcomes).

- Unsupervised Learning: Models find patterns in unlabeled data (e.g., clustering similar market regimes).

- Reinforcement Learning: Models learn optimal actions through reward-based systems, valuable in dynamic trading scenarios.

2. Neural Networks: Inspired by the human brain, these networks can approximate complex, non-linear functions. Deep neural networks, in particular, have transformed fields like image recognition and natural language processing—and now, trading.

3. Feature Engineering: The process of turning raw data (price, volume, or sentiment) into meaningful input features that your AI models can interpret effectively.

Financial Market Fundamentals

- Asset Classes: Stocks, forex, commodities, cryptocurrencies, and bonds each have different volatility levels, liquidity, and trading hours.

- Market Microstructure: Understanding order types (market, limit), spreads, and slippage is essential for effective automated execution.

- Technical vs. Fundamental Analysis: AI algo trading often employs technical indicators (moving averages, RSI), but may also incorporate fundamental metrics (earnings, debt ratios) or even alternative data (social media sentiment).

Basic Coding and Tools

- Programming Languages: Python is widely considered the go-to language for AI research and development. R is popular among statisticians, while C++ is used for high-frequency trading due to its speed.

- AI Libraries: TensorFlow, PyTorch, and scikit-learn are among the most common machine learning frameworks, each offering extensive community support.

- APIs: Many online brokers provide APIs that let traders programmatically execute trades. Examples include Interactive Brokers, TD Ameritrade, and various crypto exchanges.

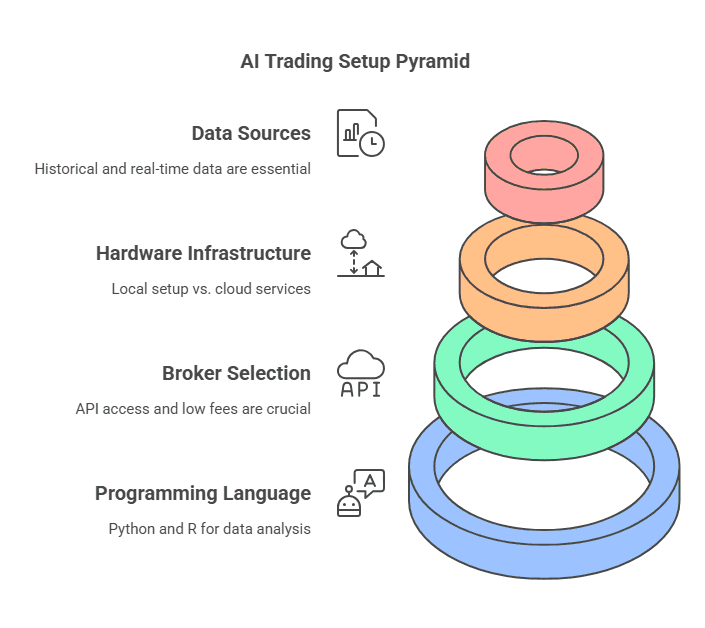

Step 2 – Setting Up Your AI Algo Trading Environment

Once you have a handle on the core principles, the next step is establishing the infrastructure needed to support AI algo trading. This includes selecting a reliable broker, deciding on a technology stack, and ensuring you have adequate hardware or cloud resources.

Choosing a Programming Language and Platform

- Python: Favored for AI research and rapid prototyping. Its rich ecosystem of libraries (NumPy, pandas, scikit-learn) simplifies data manipulation and model building.

- R: Ideal for statistical analysis but less common for large-scale trading bots.

- C++: Offers speed advantages, often used in high-frequency trading but more complex to integrate with AI frameworks.

Broker Selection

- API Access: Choose a broker that offers stable, well-documented APIs. Look for comprehensive libraries or Software Development Kits (SDKs) that facilitate seamless integration with your algorithms.

- Fees and Commissions: High commissions can eat into profits, particularly if your system executes frequent trades.

- Regulatory Compliance: Ensure the broker is regulated in your jurisdiction for added security and protections.

Hardware and Infrastructure

1. Local vs. Cloud:

- Local Setup: May suffice for smaller data sets or less frequent trades. However, scaling can become expensive and time-consuming.

- Cloud Services: Providers like Amazon Web Services (AWS), Google Cloud, and Microsoft Azure offer scalable, on-demand compute resources. This can be crucial for running computationally intensive machine learning models.

2. Low Latency Requirements: If your AI algo trading strategy involves high-frequency or arbitrage, you might need servers co-located near exchange data centers.

Data Sources and Market Feeds

- Historical Data: Obtain from reputable vendors like Quandl, Bloomberg, or exchange-specific data providers. Proper historical data is essential for training and backtesting AI models.

- Real-Time Data: For live trading, you need real-time or near real-time price updates. Your broker’s data feed or specialized market data providers (e.g., Polygon.io, Alpha Vantage) can supply this.

- Alternative Data: Social media sentiment, news analytics, and web scraping can provide additional signals beyond traditional price-volume feeds.

Step 3 – Developing Your AI Algo Trading Strategy

With your environment set up, the next focus is designing a trading strategy that leverages AI capabilities. Traditional algorithmic systems often rely on fixed rules or well-known technical indicators, but AI-based approaches allow for far more flexibility and adaptability.

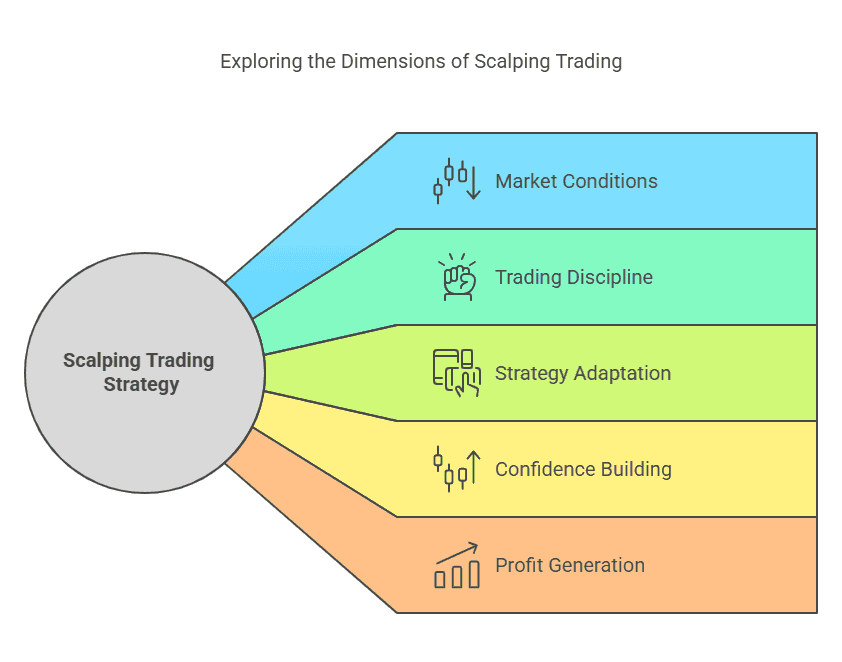

Defining Trading Objectives

- Time Horizon: Are you focusing on scalping or day trading, where you close all positions by market close? Or are you interested in swing or position trading, holding positions for days or weeks?

- Asset Preference: Stocks, forex, crypto, futures—each market presents unique challenges and opportunities.

- Risk Tolerance: Higher-risk strategies can yield higher rewards but also larger drawdowns. Outline your acceptable level of volatility and potential losses from the outset.

Data Collection and Cleaning

- Data Quality: AI models are only as good as the data they learn from. Missing or inaccurate data can lead to erroneous predictions.

- Data Cleansing: Remove outliers or corrupted entries. If you trade across multiple markets, align timestamps and fill missing data appropriately.

Feature Engineering

- Technical Indicators: Examples include moving averages, Bollinger Bands, RSI, and MACD. These can serve as input features that help the AI model gauge market momentum or overbought/oversold conditions.

- Fundamental Metrics: For stocks, incorporate P/E ratios, revenue growth, or balance sheet metrics if your horizon is longer term.

- Sentiment Analysis: NLP (Natural Language Processing) techniques can extract sentiment from news articles, social media, or financial tweets, transforming raw text into quantifiable features.

Model Selection

- Linear Models: Simple, fast to train, and less prone to overfitting, but may fail to capture complex market dynamics.

- Tree-Based Methods: Algorithms like random forests or gradient boosting often perform well on tabular data.

- Neural Networks: Good for capturing non-linear relationships and highly complex patterns, especially if you have large datasets.

- Reinforcement Learning: Can be particularly useful for dynamic decision-making, as it learns optimal policies through trial and error.

Risk Management

- Position Sizing: Tools like the Kelly criterion, volatility-based position sizing, or fixed fractional methods help you avoid overexposure.

- Stop-Loss Orders: Even AI systems can make mistakes. Automatic stops help limit catastrophic losses.

- Diversification: Spread trades across multiple asset classes or strategies to mitigate unsystematic risk.

Once you’ve pieced together these components—objectives, data, features, model, and risk controls—you have the blueprint for an AI algo trading strategy. However, the real test comes when you move from research to rigorous validation.

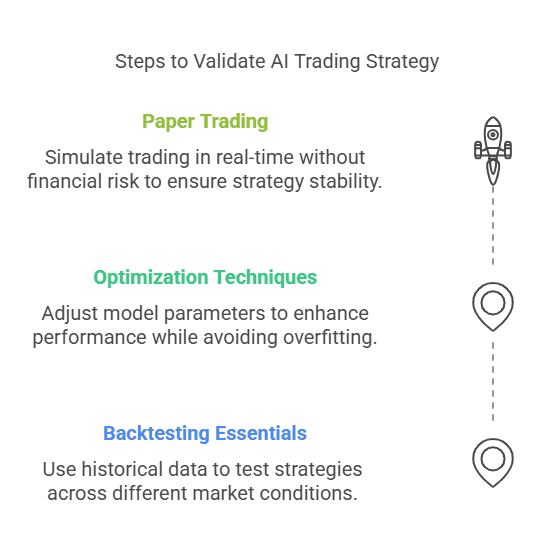

Step 4 – Backtesting and Optimization in AI Algo Trading

No matter how sophisticated your model or how promising your strategy appears on paper, it is vital to confirm its effectiveness through backtesting and optimization before risking real capital. Thorough testing helps ensure you’re not chasing illusions of profitability caused by overfitting or data quirks.

Backtesting Essentials

- Historical Data: Use sufficiently long time periods to capture various market conditions—bullish, bearish, sideways, and volatile.

- In-Sample vs. Out-of-Sample: Train your model on a segment of data (in-sample), then test it on previously unseen data (out-of-sample). This reduces the risk of overfitting.

- Walk-Forward Analysis: Iteratively shift your training and testing windows to simulate real-world conditions. This approach emulates how a model will perform when continuously retrained on the latest data.

Optimization Techniques

- Hyperparameter Tuning: AI models often come with parameters like learning rates, hidden layer sizes, or regularization coefficients. Use algorithms such as grid search or Bayesian optimization to find optimal settings.

- Avoiding Curve-Fitting: Excessive tuning can lead to a strategy that performs well on historical data but fails in live markets. Regularize your models and keep an eye on validation metrics.

- Performance Metrics: Track not just returns but also Sharpe ratio, maximum drawdown, and sortino ratio. This multidimensional view helps assess risk-adjusted performance.

Paper Trading

Even after passing backtests, you should practice paper trading—running your AI algo strategy in a simulated environment with live market data but without risking real money. This transitional step helps you evaluate real-time execution quality, data feed reliability, and overall strategy stability.

- Integration Testing: Ensure your broker API handles order submissions correctly.

- Latency Checks: In fast-moving markets, even slight delays can affect fill prices.

- Performance Monitoring: Keep track of daily or weekly performance, verifying alignment with backtest expectations.

Once your AI algo trading strategy shows consistent results in paper trading, you can gradually transition to live trading, starting with a small allocation of your capital. This staged approach minimizes initial exposure while you validate performance in real market conditions.

8 Best Tools for AI Algo Trading

With the fundamentals in place, it’s time to explore some of the most popular and effective tools that can help you kickstart or scale your AI algo trading journey. Each tool offers unique features, cost structures, and levels of complexity to suit different trading styles.

Tool #1: PowerTrade AI Algo Trading Platform

PowerTrade is renowned for its user-friendly interface and robust AI-driven functionalities. It provides a variety of pre-built machine learning models for pattern recognition and offers a drag-and-drop environment for strategy development.

Key Features

- Drag-and-Drop Strategy Builder: Allows non-programmers to create sophisticated trading rules.

- Real-Time Market Data Integration: Seamlessly pulls data for immediate AI model inference.

- Automated Risk Management Modules: Includes built-in stop-loss settings and portfolio diversification tools.

Recommended For

Beginners or intermediate traders looking for a ready-to-use AI algo trading solution with minimal coding.

Tool #2: Tradetech

Tradetech is a modular platform that offers basic algorithmic trading capabilities, with optional AI modules that users can integrate into their existing workflows. Its flexible design allows you to add only the features you need.

Key Features

- Basic Machine Learning Integration: Use Python or R to incorporate your own ML libraries.

- Compatibility with Multiple Broker APIs: Connect to multiple exchanges simultaneously.

- Performance Metrics Dashboard: Monitor daily trades, monthly returns, and drawdowns in real time.

Recommended For

Developers or traders who prefer to keep their system lean and add custom AI components as needed.

Tool #3: DeepSignal AI Algo Trading Software

DeepSignal specializes in deep learning algorithms for financial market forecasting. Its main strength is a suite of pre-trained neural network models tailored to time-series data, ideal for spotting complex patterns.

Key Features

- Pre-Trained Neural Networks: Quickly deploy advanced models without building from scratch.

- Automated Feature Selection: The platform analyzes your dataset for relevant indicators.

- Advanced Analytics Reports: In-depth performance breakdown, confusion matrices, and correlation heatmaps.

Recommended For

Intermediate to advanced traders or data scientists who want to leverage deep learning in AI algo trading strategies.

Tool #4: Quantedge

Quantedge is primarily a quantitative research platform that has optional AI plugins and Python notebook integrations. It supports sophisticated charting and multi-asset class strategy testing.

Key Features

- Powerful Charting and Visualization: Ideal for quick identification of patterns and anomalies.

- Strategy Testing Across Multiple Assets: Equities, forex, commodities, and crypto.

- Integrated Python Notebooks: Code directly in the platform using popular AI libraries.

Recommended For

Quantitative analysts who want a versatile platform for research and are comfortable adding customized AI capabilities.

Tool #5: BotMaker AI Algo Trading Suite

BotMaker aims to be an all-in-one platform for data ingestion, AI model training, backtesting, and live trading execution. Its automated pipeline approach minimizes the need to switch between different applications.

Key Features

- Customizable Bots with Built-In ML Modules: Start with templates and tweak them to suit your preferences.

- Scalability for High-Frequency Trades: Offers low-latency connections and quick order execution.

- Automated Alerts and Performance Tracking: Real-time notifications for anomalies or trade signals.

Recommended For

Those ready to invest in a complete AI algo trading ecosystem with minimal external dependencies.

Tool #6: AlgoWizard AI Algo Trading Solution

AlgoWizard targets traders who want to harness AI algo trading strategies without extensive coding knowledge. Its code-free environment enables you to build, test, and deploy AI-driven signals rapidly.

Key Features

- Code-Free Development: Drag-and-drop interface for building logic flows.

- Real-Time Data Feed Integration: Supports major stock and crypto exchanges.

- Built-In Risk Assessment Tools: Monitor potential drawdowns and adjust stop-loss parameters automatically.

Recommended For

Beginners or semi-technical traders looking to incorporate AI signals without delving deep into software engineering.

Tool #7: Brainwave AI Algo Trading Bot

Brainwave is designed around self-learning capabilities and adaptive rule layers, making it a compelling choice for traders who want their bots to evolve alongside market conditions.

Key Features

- Reinforcement Learning Modules: Bots can learn optimal trading policies through trial and error.

- Smart Order Routing: Ensures trades are executed at the best available price across multiple venues.

- Intelligent Risk Controls: Automatically reduces position sizes in volatile markets.

Recommended For

Traders seeking a cutting-edge, adaptive AI algo trading solution that requires minimal manual parameter updates.

Tool #8: TechQuant

TechQuant is an analytics platform with a strong emphasis on quantitative methods, which also integrates seamlessly with machine learning libraries for those wanting to build advanced AI algo trading models.

Key Features

- Statistical Modeling Suite: Offers advanced regressions, cointegration tests, and factor analysis.

- Flexible Framework: Integrate external AI frameworks like TensorFlow or PyTorch with minimal hassle.

- In-Depth Portfolio Optimization Tools: Craft diversified portfolios using Markowitz optimization or advanced risk-parity algorithms.

Recommended For

Seasoned quantitative researchers looking to merge classic quant techniques with AI algo trading.

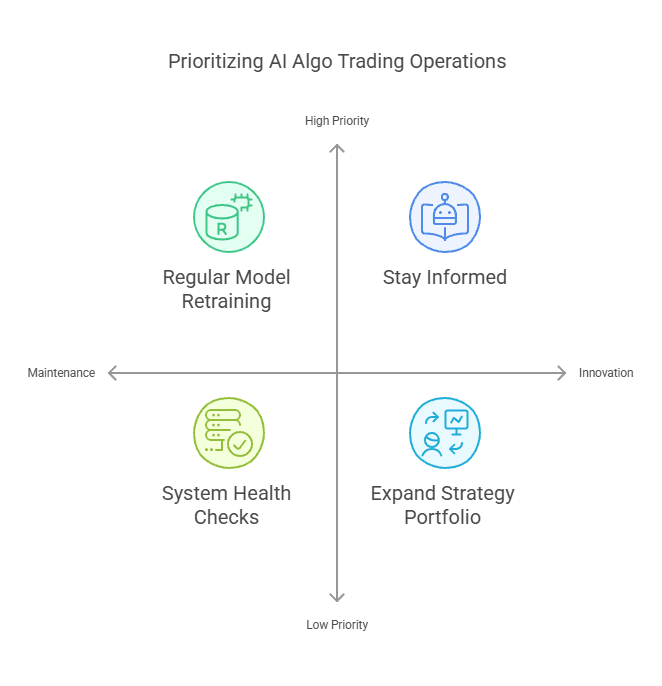

Tips for Scaling and Maintaining Your AI Algo Trading Operations

Building a profitable AI algo trading system is an accomplishment, but maintaining it and scaling up can be even more challenging. Markets evolve, and so must your trading strategies.

Monitoring and Maintenance

- Regular Model Retraining: Financial markets change over time. By retraining your models at set intervals or when performance declines, you ensure they remain relevant.

- System Health Checks: Monitor latency, data feed uptime, and broker connection stability.

- Automated Alerts: Configure notifications for unusual drawdowns, missed trades, or data discrepancies.

Security and Compliance

- Regulatory Requirements: Depending on your jurisdiction, you may need to register as an advisor or comply with specific reporting rules if managing client funds.

- Data Protection: Safeguard API keys, personal data, and proprietary models with encryption and secure access protocols.

- Incident Response Plan: Outline what to do in case of system failures, hacking attempts, or significant market disruptions.

Continuous Learning and Innovation

- Stay Informed: Keep up-to-date with new AI techniques (transformer architectures, advanced reinforcement learning) and emerging market trends.

- Community Involvement: Participate in forums, attend webinars, or join professional groups dedicated to AI and quantitative finance.

- Expand Your Strategy Portfolio: Once your first system is running smoothly, consider creating additional strategies (momentum, mean reversion, pairs trading) for broader diversification.

Conclusion and Next Steps

When it comes to modern finance, AI algo trading is more than a buzzword—it represents a paradigm shift that allows traders to harness machine learning for faster and more informed decision-making. By understanding the fundamentals of AI, setting up the right infrastructure, and diligently developing and testing strategies, even beginners can tap into the potential of AI-powered algorithms.

Remember to start small, backtest thoroughly, and gradually scale your system as your confidence grows.

With dedication, the right tools, and a commitment to ongoing optimization, AI algo trading can transform the way you engage with the financial markets and open up exciting possibilities for your investment journey.

Optimize your trading with TradeSearcher!

🚀 Access 100,000+ TradingView strategies and backtests, uncover high-performance AI-driven insights, and trade smarter. Join 3,200+ traders leveraging data-driven decision-making. Start exploring today! 🔍📈