Table of Content

Beginner’s Guide to Scalping Trading Strategy: Tips, Tools, and Examples

By Vincent NguyenUpdated 409 days ago

How to Learn Scalping in Trading

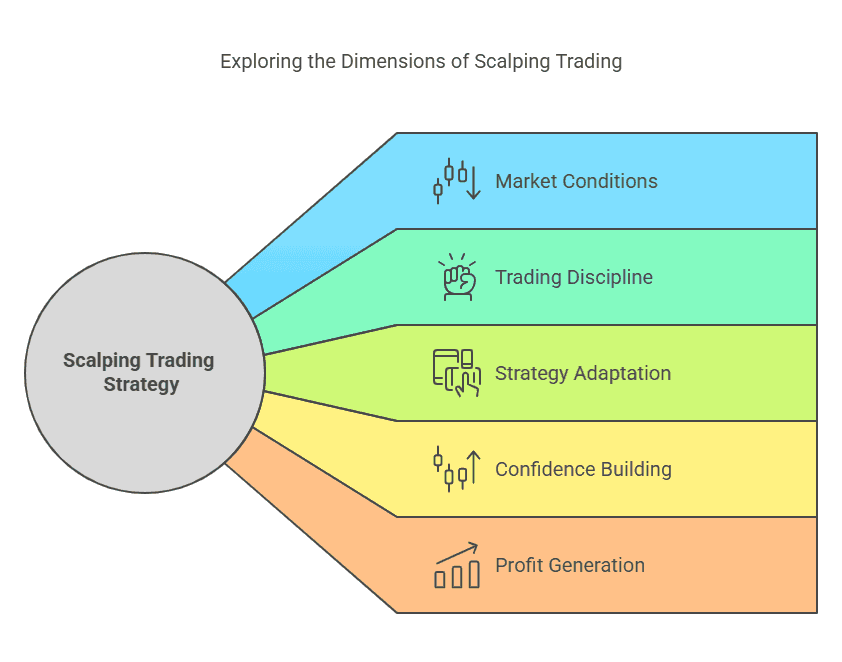

Scalping trading strategy is a fast-paced method that aims to capture small and frequent gains during short-term market movements. Many traders find this trading style appealing because it offers multiple entry and exit positions within a single trading session. Scalping focuses on rapid price movements, tight bid-ask spreads, and quick decision-making.

Newcomers often choose scalping because it builds confidence through numerous trades. This approach can help beginners learn how price action behaves in real time. In addition, the goal of scalping is not to secure enormous profit on one single trade. Instead, the plan is to generate consistent gains by stacking smaller profits over an extended period.

Scalp traders often adapt their trading strategies to market volatility and liquidity. They might perform hundreds of trades in a day if conditions remain favorable. However, scalping requires a disciplined approach and the ability to read price bars on shorter time frames. It also demands constant monitoring of markets for sudden changes in current price dynamics.

In this guide, you will learn how to start practicing a scalping trading strategy. You will also discover essential tools, market conditions to watch, and three scalping strategies for beginners. Let’s dive in!

What Is Scalping and Why Does It Matter?

Scalping is one of several trading strategies designed for traders who prefer quick interactions with the financial market. Unlike swing traders, who hold positions for days, or long-term investors, who hold stocks for months, scalp traders typically hold trades for seconds or minutes.

Key Characteristics of Scalping:

- Frequent Trades: The pace of intraday trading in scalping is swift. Traders may execute numerous trades each hour.

- Short Holding Periods: This style aims to capitalize on small price swings. Scalp traders usually do not hold onto positions for an extended period.

- Tight Targets: Most scalpers set tight stop-loss and take-profit levels. This strict exit strategy helps limit market risks while seeking rapid gains.

Why Scalping Matters for Beginners

- Quick Feedback Loop: Scalping offers constant monitoring of entries and exits. This helps new traders learn fast by evaluating live price movements.

- Lower Market Exposure: Because individual trades are short, the potential for large adverse event impacts is often reduced.

- Skill Development: Over time, beginners can refine trade execution, develop discipline, and learn to manage emotional challenges.

Why Scalping Matters for Beginners

- Quick Feedback Loop: Scalping offers constant monitoring of entries and exits. This helps new traders learn fast by evaluating live price movements.

- Lower Market Exposure: Because individual trades are short, the potential for large adverse event impacts is often reduced.

- Skill Development: Over time, beginners can refine trade execution, develop discipline, and learn to manage emotional challenges.

Potential Drawbacks

- High Stress: Scalp trading can be mentally taxing. The trading session may require continuous attention to real-time market data.

- Trading Fees: Frequent trades increase trading costs, especially if your broker charges commissions or wide spreads.

- Risk Management: Small movements can turn quickly. Without a disciplined approach, losses may pile up.

Despite these challenges, scalping remains a popular trading style. It provides an introduction to analyzing price action, managing position sizes, and making informed trading decisions in various market conditions.

Core Principles of a Scalping Trading Strategy

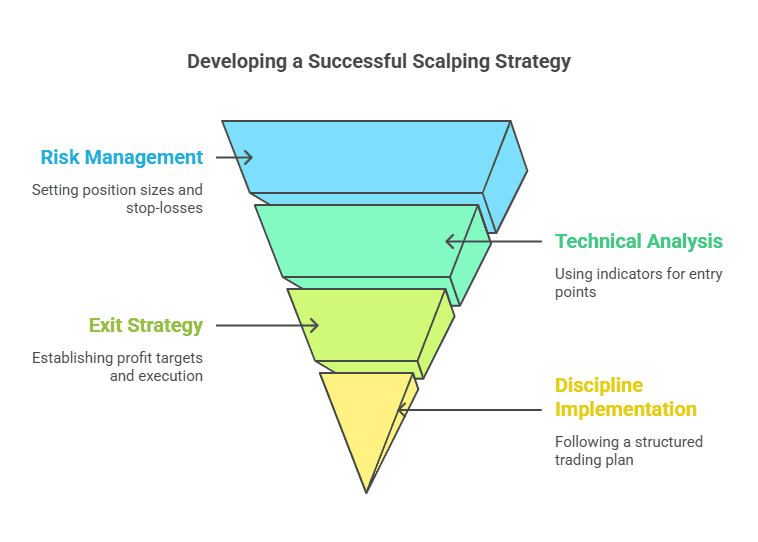

A robust scalping strategy combines speed, precision, and risk control. These principles guide traders as they open and close positions in rapid trading strategies.

1. Focus on Liquid and Volatile Markets

- Liquidity: Hot stocks, major forex pairs, and popular cryptocurrencies often have narrower spreads. This factor in scalping can be crucial for maximizing Profit Margins.

- Volatility: Volatile markets allow price swings within shorter time frames. Rapid fluctuations mean more potential price movements to profit from.

2. Manage Risk and Position Sizing

- Position Sizes: Many scalpers risk only a fraction of their trading equity on each trade. This approach helps maintain a favorable reward ratio.

- Stop-Loss Orders: Place tight stop-loss levels just below or above resistance levels or support zones. This helps limit losses on individual trades.

3. Utilize Technical Indicators for Timely Entries

- Momentum Indicator: Tools like the stochastic oscillator or the RSI can spot overbought or oversold conditions.

- Volatility Indicators: Bollinger Bands and standard deviation bands display where price fluctuations might expand or contract.

- Moving Averages: A 20-period MA is a common indicator for identifying short-term opportunities. Combining it with a long-term MA can help spot shifts in market trends.

4. Prioritize a Strict Exit Strategy

- Profit Targets: Realistic profit targets are essential for each single trade. Traders should exit positions quickly if the market reverses.

- Trade Execution: Scalpers rely on direct market access and a reliable trading platform to avoid slippage. Quick entries and exits are important to lock in small gains.

5. Embrace a Disciplined Approach

- Trading Plan: Predetermined trading strategies reduce emotional decision-making and excessive trading. Write down your target entries, stop-loss levels, and exit criteria.

- Daily Goals: Set maximum loss limits and daily goals that keep you on track. If you reach your loss limit, consider pausing for the day.

- Consistent Scalping Routine: Follow a structured trading routine that includes market analysis, trade reviews, and Performance Analysis for continuous improvement.

By focusing on these principles, traders can establish a successful scalping strategy. The key is to stay flexible and refine your approach as you learn more about market movements.

Essential Tools and Preparations for Scalping

Setting up the right environment for your scalping trading strategy is vital. You will rely on speed and precision when you enter or exit trades. The tools you choose can make or break your intraday performance.

1. Reliable Trading Platform

Setting up the right environment for your scalping trading strategy is vital. You will rely on speed and precision when you enter or exit trades. The tools you choose can make or break your intraday performance.

2. Broker Selection

- Tight Spreads and Low Fees: Look for low-cost brokers or commission-free trading if possible. High trading fees can erode profit margins in a scalping strategy.

- Direct Access Trading: A direct-access broker can speed up order execution because it bypasses intermediaries. This advantage matters when price movements are sudden.

- Market Liquidity: Aim for major markets during major trading sessions, as these often provide beneficial trading conditions for scalpers.

3. Technical Analysis Indicators

a) Stochastic Oscillator

This momentum indicator helps identify potential price reversals. In scalping, it can signal quick entry or exit opportunities.

b) Bollinger Bands

They measure standard deviations around a moving average. Bollinger Bands help scalpers see when price swings could intensify or when the market might tighten into a narrow spread.

c) Multiple Time Frames

Switching between a 15-minute chart for context and a shorter time frame for entry can refine your analysis of market conditions. It also confirms whether a sudden move aligns with the broader trend.

5. Risk Management Preparations

- Short-Term Opportunities: Scalpers look for micro-movements in chart patterns. They watch for breakouts, pullbacks, or quick rebounds near support and resistance levels.

- Reading Candlestick Patterns: Pin bars, engulfing candles, and doji patterns can indicate an immediate shift in market sentiment.

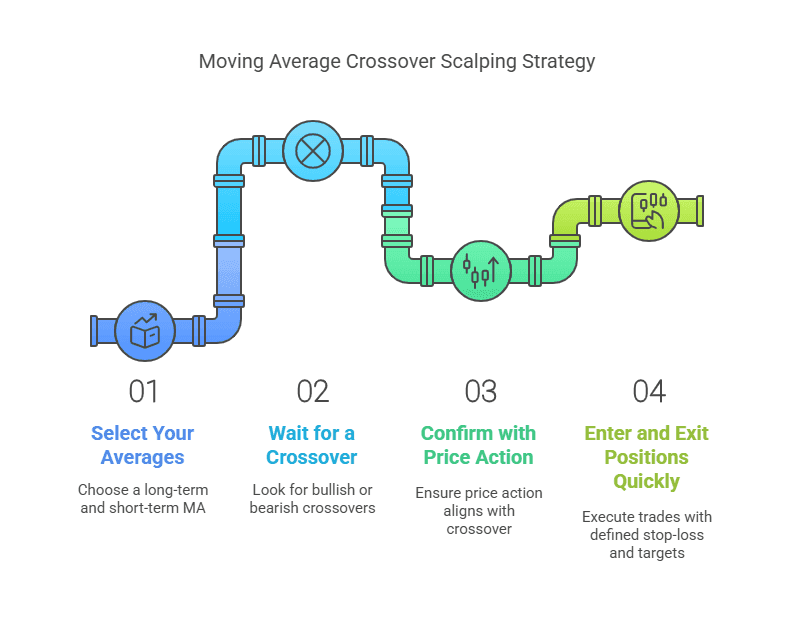

Scalping Trading Strategy #1 – Moving Average Crossovers

Moving average crossovers are often considered one of the simplest scalping strategies for beginners. This approach involves plotting two or more moving averages on a chart and waiting for them to cross. While many traders use this system for day trading technique or swing trading, it can also work well on shorter time frames when combined with tight stops and disciplined execution.

How It Works

1. Select Your Averages

Pick a long-term MA (such as the 50-period) and a shorter-term average (like the 20-period MA). These technical indicators help identify market trends and potential entry points.

2. Wait for a Crossover

A bullish crossover occurs when the short-term MA moves above the long-term MA. Conversely, a bearish crossover happens when the short-term line crosses below. Scalpers often look for rapid market movements that can generate small yet consistent gains.

3. Confirm with Price Action

Before you take the trade, check if price action aligns with the crossover signal. For instance, observe whether price bars are forming higher highs and higher lows for a bullish trade. If the current price remains stagnant or moves sideways, you might want to wait for a clearer signal.

4. Enter and Exit Positions Quickly

The goal of scalping is to capture quick profits. Once you see a valid crossover and price bars confirm upward or downward momentum, you enter rapidly. Set your stop-loss a few pips or ticks below the most recent swing low (for a bullish trade) or above the most recent swing high (for a bearish trade). Then, define a modest profit target, such as a 1:1 or 1:1.5 Risk-Reward Ratio.

Key Benefits

- Simplicity: It’s easy to follow. New traders can understand moving averages without extensive prior knowledge.

- Clear Signals: Crossovers provide frequent trading signals that are straightforward to interpret.

- Adaptable to Different Markets: You can apply this method to forex markets, stocks, or crypto, as long as there is sufficient volume and liquidity.

Potential Drawbacks

- False Signals in Low Volatility: During low-volume trading periods, crossovers can occur frequently but yield choppy moves.

- Late Entries: Because moving averages are lagging indicators, you might enter after much of the price swing has already happened.

- Wide Spreads: Some hot stocks or less liquid assets may have wide spreads. That can lower your potential profit factor in a single trade.

Practical Example

Imagine you’re watching a 5-minute chart on a popular forex pair. The 20-period MA crosses above the 50-period MA, and price bars start forming new highs. You observe that the bid price is inching upward, reflecting bullish market sentiment. You enter a small position quickly, place a tight stop-loss, and exit your trade as soon as you see signs of a pause in price movements.

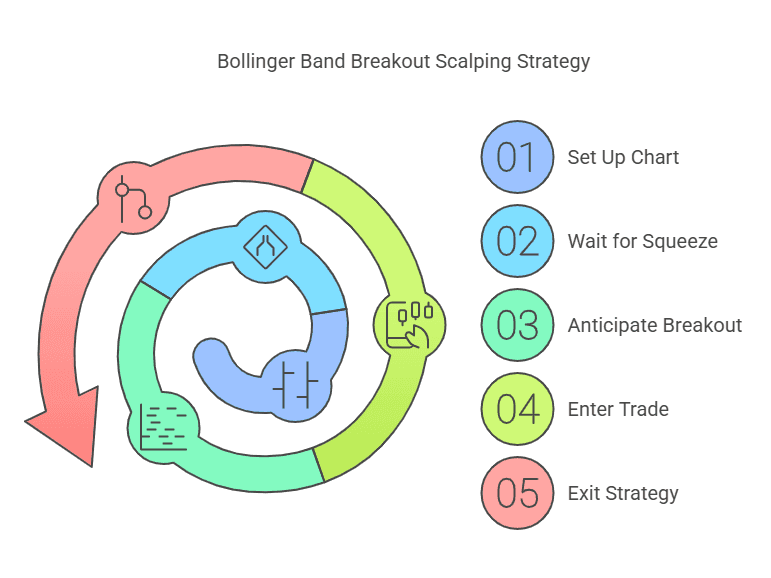

Scalping Trading Strategy #2 – Bollinger Band Breakouts

Bollinger Bands are classic volatility indicators that measure standard deviations around a moving average. They can be highly effective for scalping, especially when sudden price swings occur. This method seeks quick, small gains as price pops above or below the band structure, signaling a potential short-term breakout or reversal.

Why Bollinger Bands?

1. Volatility Measurement

The upper and lower bands expand or contract based on current volatility levels. Scalpers thrive on intraday performance, so understanding volatility is crucial.

2. Identifying Narrow Spread Phases

When Bollinger Bands squeeze together, it suggests the market is consolidating. Scalpers often wait for breakouts from these tight ranges to capture short-term opportunities.

3. Quick Entries on Extreme Moves

If price action suddenly touches or pierces the upper band, it may indicate overbought conditions. When price hits the lower band, the market might be oversold. In both cases, scalp traders can look for rapid reversals or breakouts.

Steps to Implement

1. Set Up Your Chart

Plot a 20-period MA with Bollinger Bands (often default settings are two standard deviation bands). You can adjust the period based on your preference for shorter time frames.

2. Wait for a Squeeze

Identify a phase where the bands come closer, revealing a narrowing range. This suggests reduced market movements but also builds pressure for a possible breakout.

3. Anticipate the Breakout

Watch for price to break above the upper band or below the lower band. Confirm direction by checking momentum indicators like the stochastic oscillator or RSI for additional confidence.

4. Enter Rapidly, Exit Strategically

Scalpers who prefer more aggressive trades may enter right at the band breach. Others wait for a slight retrace to confirm momentum. Always set a strict exit strategy with a small stop-loss. If the move stalls, exit quickly. Scalping is about capturing short bursts of momentum, not holding for an extended period.

Advantages

- Clarity of Volatility: Bollinger Bands visually showcase volatility, helping you gauge when the market might surge.

- Fast Signals: Once price punctures a band, it often triggers a flurry of trading activity, creating ideal conditions for numerous trades.

- Versatility: You can adapt Bollinger Band breakouts to different trading style preferences, including forex scalping, crypto, or equities.

Risks to Consider

- False Breakouts: Not every band breach leads to a sustained move.

- Rapid Price Reversals: If market sentiment suddenly shifts, you could be caught on the wrong side of a trade.

- Trading Fees: Remember that making multiple trades per day can elevate costs of trading. Watch your spreads and commissions to protect your profit margins.

Example Scenario

A stock’s Bollinger Bands squeeze tightly during the first hour of trading. Suddenly, the stock shoots above the upper band. The momentum indicator and your price action analysis confirm bullish strength. You jump in with a small position size, using a limit order close to the breakout level. As soon as the move begins to slow or volume starts to drop, you lock in profits.

Tracking your scalping session in a trading journal is vital. Look at your average profit per trade, track the times you entered and exited, and note any market risks you encountered. Over time, you can refine your system to reduce false entries and enhance consistency.

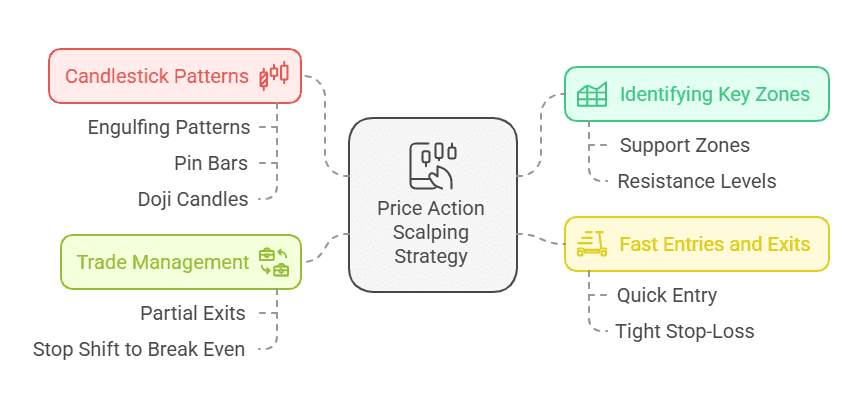

Scalping Trading Strategy #3 – Price Action & Support/Resistance

For traders who dislike too many technical indicators, a price action approach may be the perfect choice. This method emphasizes reading raw price bars and candle formations near key support and resistance levels. By focusing on market structure, scalpers try to capture short-term opportunities without relying heavily on complex signals.

Core Elements of a Price Action Scalping Strategy

1. Identifying Key Zones

Spot major support zones where price bounces or major resistance levels where price stalls. Scalpers often look at higher time frames, like a 15-minute chart, to find these zones and then switch to a shorter time frame for precise entries.

2. Candlestick Patterns

Price action traders pay attention to engulfing patterns, pin bars, or doji candles forming around these zones. They look for quick price movements typical of scalping scenarios.

3. Fast Entries and Exits

Once a pattern emerges near a support or resistance level, the trader enters swiftly. Stop-loss orders remain tight, just behind the key zone. This approach to trading ensures you cut losses quickly if the setup fails.

4. Trade Management

If the market moves in your favor, you can exit positions partially to lock in partial gains or shift your stop to break even. That way, you protect your profits if there is an adverse event in the market.

Why This Strategy Works

- Simplicity: Fewer indicators reduce potential confusion or conflicting signals.

- Immediate Feedback: You see how actual prices respond to critical levels almost instantly.

- High Probability Setups: Price action around well-established support and resistance often yields successful trades, given the concentrated demand or supply there.

Drawbacks to Watch Out For

- Subjective Analysis: Determining support and resistance requires some discretion, which can lead to errors for new scalpers.

- Market Liquidity: If the market is illiquid, your trade might slip below or above your ideal entry.

- Constant Monitoring: You need real-time vigilance to capture short-term price fluctuations.

Practical Walk-Through

Imagine you’re watching a 1-minute chart for a liquid stock during the morning market hours. You’ve identified a clear support level from the 15-minute chart at a round number (for example, $100). As the price drifts lower, you see a pin bar forming off this support zone. You enter a quick scalp with a stop-loss a few cents below support. Price surges for a few seconds, so you exit your position at a small profit. That single trade might only net a fraction of a percent, but repeating profitable trades like this is the essence of scalping.

Over hundreds of trades, this style can build a consistent return on trading capital, as long as you maintain a disciplined approach to risk and do not overtrade. Regularly reviewing your approach in trading journals can help refine your entries, identify times when the market is too choppy, and pinpoint the best hours of trading for your strategy.

Conclusion

Scalping trading strategy remains a popular choice for those who thrive on speed, quick decisions, and short-term market exposure. When you adopt this rapid trading style, you can learn a great deal about price movements, risk management, and trading psychology in a short period of time.

The three scalping strategies you’ve explored—Moving Average Crossovers, Bollinger Band Breakouts, and Price Action at Support/Resistance—offer varied pathways to capture small gains from the market. Each method involves different technical indicators or focuses on raw price action. Whichever approach you choose, remember that disciplined position sizing, strict stop-loss placements, and frequent reviews of your trading plan are essential for achieving successful trades.

Start by testing these ideas in a demo account or with minimal capital. Gather data on your trades, analyze what works, and refine your scalping trading strategy over time. With patience, consistent practice, and the right mindset, you can create a successful scalping routine that aligns with your investment objectives and personal trading goals.

Ready to take your scalping trading strategy to the next level?

Sign up for TradeSearcher and instantly backtest your strategies across any market. Discover what works, refine your approach, and trade smarter with our powerful tools today!