Table of Content

Nadaraya Watson Envelope Trading Strategy | Complete Beginner’s Guide

By Vincent NguyenUpdated 405 days ago

What Is the Nadaraya Watson Envelope Strategy?

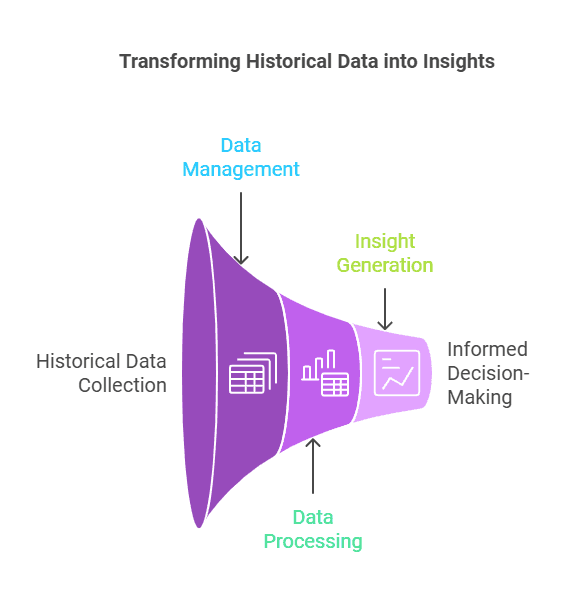

The Nadaraya Watson Envelope Strategy is a powerful yet beginner-friendly trading approach. It focuses on evaluating the price trend through a smooth kernel regression technique. Many traders struggle with identifying trend direction and knowing when to execute trades. This method aims to reduce that confusion. It also helps detect signals of trend more accurately than many classical band indicators, thanks to its dynamic envelope bands.

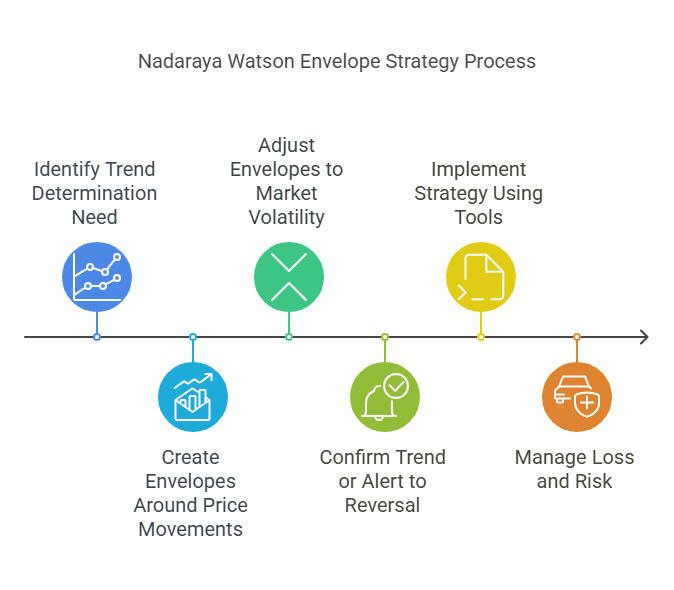

Beginners often seek effective trend determination indicators that can offer stability of trend identification. The Nadaraya Watson Envelope Strategy steps in here. It works by creating upper and lower envelopes around price movements. These envelopes adjust to market volatility and offer a clear sense of potential trend shifts. They can help you confirm a price trend or alert you to a possible trend reversal.

To get started, you need to understand a few basic concepts, such as how smoothing with trend indicators works. You may also explore the LuxAlgo - NadarayaWatsonEstimator.zip if you use TradingView or another charting platform that supports custom scripts. You simply import files or a usable zip file to load the source files. If you prefer coding your own approach, you can try a pine script or any other script finance trading tool.

In the sections that follow, you will learn how the strategy works and how to handle loss management, especially during volatile phases. You’ll also discover how to keep an eye on the risk of loss, which is crucial in trading. Finally, we’ll discuss how to avoid wrong trades through proper risk controls. Let’s begin by breaking down the fundamental concept behind the Nadaraya Watson Envelope Strategy.

Understanding the Nadaraya Watson Envelope Strategy

This section explains what the Nadaraya Watson Envelope Strategy is and why traders rely on it. You will learn its basics, as well as the role of trend lines and trend momentum in shaping a clearer perspective of market movement.

1. Core Concept

The Nadaraya Watson Envelope Strategy uses a kernel regression formula. It generates a smooth curve that follows the market trend more closely than simple moving averages. This curve adjusts for error correction, so it reacts in near-real time to changes in price.

2. Envelopes vs. Classical Band Indicators

Classical band indicators often use fixed calculations, such as standard deviations. By contrast, the Nadaraya Watson Envelope Strategy creates adaptive envelope bands that shift based on price behavior. This flexibility helps you spot potential trend reversals before they cause severe losses.

Why the Envelope Approach Matters

Envelopes serve as visual markers of likely support and resistance. By tracking the position of band changes, traders can gauge the underlying trend and anticipate where price might bounce or break. This insight can be vital for capturing profit for trend following or minimizing losses during trend reversal.

Key Benefits

- Adaptive Smoothing: The strategy adjusts to volatility, yielding a more stable signal.

- Reduced Noise: Price fluctuations get smoothed, making trends clearer for beginners.

- Early Warnings: Envelope lines can offer early alerts when the direction for trend following shifts.

At this point, you should have a foundational grasp of what the Nadaraya Watson Envelope Strategy brings to your trading. Next, we’ll explore how it performs in diverse market conditions.

Applying the Nadaraya Watson Envelope Strategy in Various Market Environments

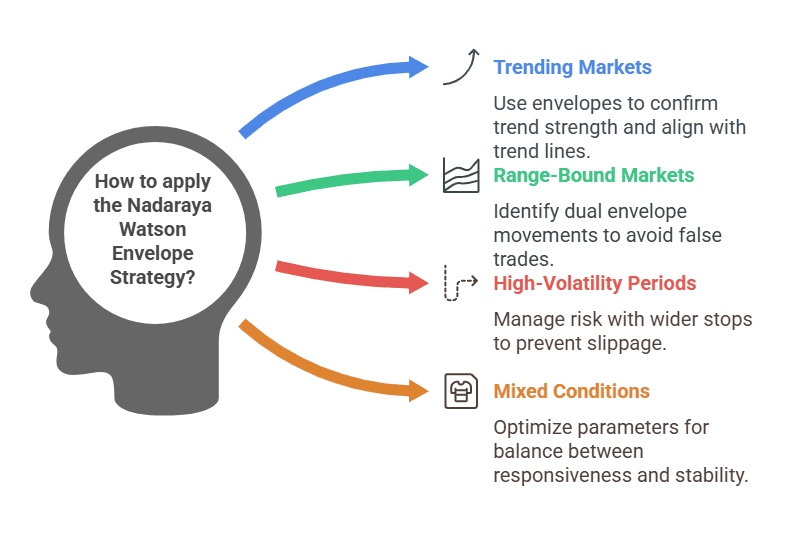

Different market environments require different tactics. Here, we’ll discuss how the Nadaraya Watson Envelope Strategy handles different phases of the price trend, including sideways movement and high-volatility scenarios.

1. Trending Markets

When markets are on a steady climb or decline, you can rely on these adaptive envelopes to confirm trend strength. The smoothing parameter in the kernel regression helps filter out random noise, giving you a clearer look at whether a trend in price using the envelopes remains valid. You might also integrate trend lines to confirm that both envelope direction and linear price channels align.

Range-Bound Markets

Some markets lack a clear trend direction and instead fluctuate within a specific price band. In these conditions, you want to look for signals of dual envelope trend movements, where the upper and lower envelopes flatten. This often indicates limited trend momentum and suggests you should remain cautious to avoid wrong trades in the choppy zone.

3. High-Volatility Periods

When markets swing wildly, the envelopes widen. This reaction time allows the Nadaraya Watson Envelope Strategy to contain larger price spikes. However, high volatility also raises the risk of loss price slippage. Use prudent loss management here. Consider setting stops a bit further away from the envelope lines to avoid unnecessary exits during sudden spikes.

4. Mixed Conditions

Markets sometimes show a mix of trends and sideways periods, especially over a longer period of time. The strategy parameters, particularly the kernel’s smoothing parameter, can be tuned to adapt. You can even apply Parameter optimization to find the best balance between responsiveness and stability.

Strategy Parameters and Basic Risk Disclosure

Let's dive deeper into how to configure your Nadaraya Watson Envelope Strategy and manage the risk of loss. Proper parameter choices can improve your outcomes while also reducing the chances of severe losses.

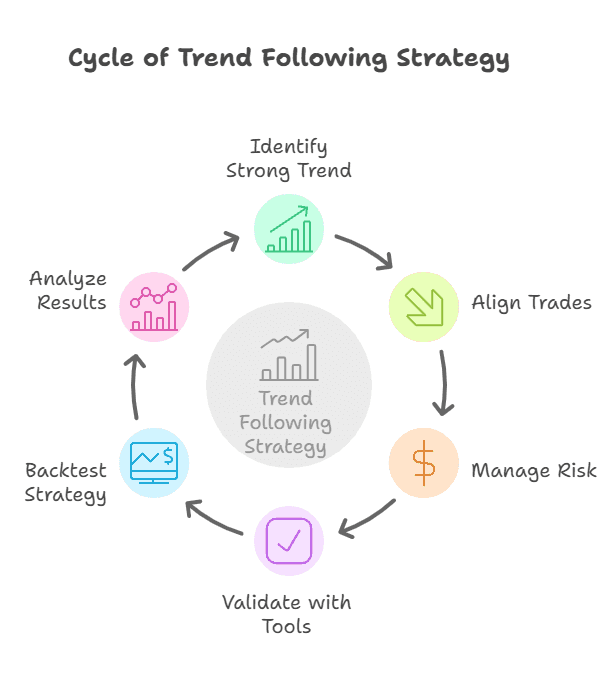

1. Choosing the Right Strategy Parameters

- Kernel Bandwidth: This is your smoothing parameter. Too high, and you lose detail. Too low, and you get noise. The sweet spot depends on your market trend and the parameter combinations you want to test.

- Period Selection: The period of time you use for calculations can alter the envelope’s responsiveness. Shorter periods respond quicker to changes, which can be ideal for scalping. Longer periods provide more context, useful for swing trading.

- Error Correction: Some variations of this strategy allow for adjusting how strongly the envelope reacts to sudden price shocks. This function aims to reduce loss failure probabilities when markets move against your positions.

2. Parameter Optimization

- Backtesting: Always backtest your chosen Strategy parameters on historical data. This process will highlight how the envelope performs under different volatility regimes.

- Forward Testing: After backtesting, try a demo account or small position sizes to see if the real-world results match. Doing so lets you identify and fix any loss strategy improvement opportunities.

- Avoid Overfitting: Resist the urge to fine-tune parameters excessively. Overfitting can lead to wrong trades once actual market conditions shift.

3. Risk Disclosure and Loss Management

Trading involves a substantial risk of loss. Even the best strategy might fail if the market trend changes abruptly. Here’s how to mitigate potential damage:

- Position Sizing: Decide how many shares or contracts you will trade based on your risk tolerance.

- Stop-Loss Placement: Place your stop-loss just below the upper band if you’re short, or just above the lower band if you’re long. This tactic can prevent huge drawdowns.

- Loss Management: Track each trade’s loss calculation method to evaluate how often you hit your stop. Proper management can help avoid repeated loss pips that accumulate quickly.

- Profit Controls Risks: Scaling out of winning trades or trailing your stop can lock in profits. This approach counters losses during trend reversal and fosters profit for trend following.

Trading Examples with the Nadaraya Watson Envelope Strategy

Practical examples can cement your understanding of the Nadaraya Watson Envelope Strategy. In this section, we’ll explore how it works in live scenarios and point out key elements to watch. By looking at detailed case studies, you’ll see how this strategy reacts to changes in trend direction and how you can execute trades with more confidence.

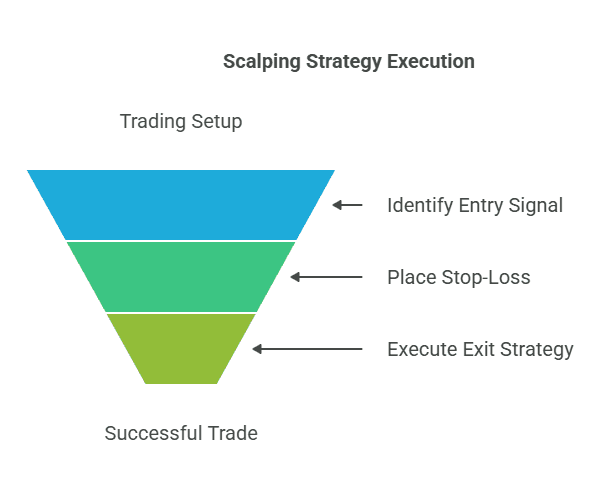

1. Short-Term Scalping Example

- Setup: Assume you’re trading on a five-minute chart. You load the LuxAlgo indicator("Nadaraya-Watson Envelope") to generate a real-time envelope around price. You’ve also imported any info file or used zip files containing the script’s parameters.

- Entry Signal: When the price closes above the upper envelope band, it can signal a bullish breakout. If trend lines confirm an upward angle, you enter a quick long position.

- Stop-Loss Placement: Place the stop-loss slightly below the lower envelope band. Doing this can protect you from severe losses if the move is a fakeout.

- Exit Strategy: As soon as the upper envelope flattens or slopes downward, lock in profits or set a trailing stop. This step aims to control risk if the underlying trend weakens.

2. Swing Trading in a Stable Trend

- Setup: Switch to a daily chart for more extended moves. Deploy your Nadaraya Watson Envelope Strategy with a moderate smoothing parameter.

- Trend Confirmation: Wait for the envelopes and price bars to consistently move higher, indicating a stable bullish price trend. Checking for strong trend momentum helps confirm your approach.

- Risk Control: Since swings last longer, place stops further away. This avoids whipsaw exits triggered by minor corrections.

- Profit Target: Watch for signs of a potential trend slowdown, like flattening envelope bands. If you notice trend reversal signals, consider closing part of your position.

3. Error Correction in Action

- Setup: You might be in a trade when the market suddenly spikes against you. The kernel-based method adjusts quickly to reflect new conditions.

- Envelope Reaction: The Nadaraya Watson Envelope Strategy recalculates swiftly, shifting its bands closer or further away. This is where error correction helps. It reduces false signals when the spike subsides.

Nadaraya-Watson Envelope Strategy (Non-Repainting) Log Scale

The Nadaraya-Watson Envelope Strategy leverages kernel regression to form volatility bands around the price, using a log scale for wider price moves. Buy signals are generated when prices breach the lower band, and sell signals when they surpass the upper threshold. Flexibility is provided through adjustable parameters in Pine Script v5. It excels on larger timeframes and requires solid backtesting and understanding of its mathematical foundation.

Execution Tactics and Tools for the Nadaraya Watson Envelope Strategy

The Nadaraya Watson Envelope Strategy doesn’t demand advanced coding skills, but using the right tools and approaches can make a difference. In this section, we’ll explore practical ways to execute trades, manage risk, and refine your methods with user-friendly platforms.

1. Selecting a Trading Platform

- TradingView or MetaTrader: Both offer the ability to import files and run custom indicators, including the LuxAlgo - NadarayaWatsonEstimator.zip. This file contains the script that applies kernel-based smoothing to your charts.

- Platform-Specific Scripts: If you’re comfortable with pine script or any other script finance trading language, you can tweak the strategy’s code to your liking. A simple tweak may improve the stability of trend identification or reduce the risk of wrong trades.

2. Setting Orders and Stops

- Market Orders: These get you in or out immediately. They’re useful when your envelope indicates a strong breakout or breakdown.

- Limit Orders: Place these at the price you prefer. They allow for a more controlled entry, especially if you expect a mild correction before the price continues in its trend in price using the envelope.

- Stop-Loss and Loss Management: Always have a plan for loss calculation method. You might align your stop with the envelope lines. If the bands turn against you, cut your losses right away.

3. Leveraging Additional Indicators

- Volume: High volume during a crossover of the upper band can confirm a robust move.

- Momentum Oscillators: Tools like RSI or Stochastics can add context for trend momentum. If momentum aligns with the envelope’s direction, it suggests higher conviction.

- Trend Lines: Drawing lines that mirror the envelope can reinforce your confidence in a dual envelope trend or show you where the position of band changes might indicate a looming reversal.

4. Error Correction and Reaction Time

- Parameter Tuning: Set your smoothing parameter to handle frequent or rare adjustments, depending on whether you’re a day trader or swing trader.

- Fast vs. Slow Response: A fast reaction time might be perfect for short-term trades but can lead to more fake signals. A slower response might miss early breakouts but could protect you from quick market rips.

Advanced Considerations and Additional Techniques

Once you grasp the basics, you can explore advanced adjustments. These fine-tune your Nadaraya Watson Envelope Strategy for specific goals, such as minimizing loss failure probabilities or maximizing gains in rapidly changing markets.

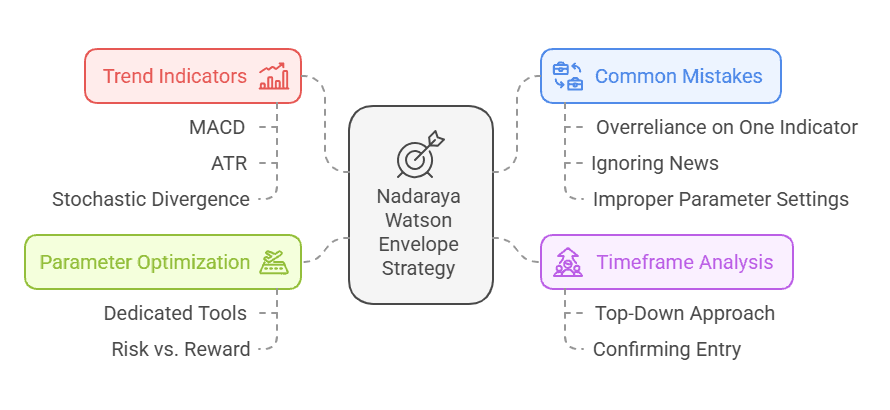

1. Combining with Other Trend Indicators

- MACD: Use the moving average convergence divergence to double-check your primary trend strength signals.

- ATR (Average True Range): This can help manage stop losses. If ATR is high, consider placing stops wider than usual to avoid being shaken out by normal volatility.

- Stochastic Divergence: When the oscillator diverges from the envelope’s slope, it might warn of a pending reversal. This heads-up can reduce severe losses.

2. Multiple Timeframe Analysis

- Top-Down Approach: Start from a higher timeframe—like daily or weekly charts—to identify the underlying trend. Then, zoom in to a lower timeframe for entries.

- Confirming Entry: If both long-term and short-term envelopes point upward, you can trust the signals of trend continuation. This synergy might increase your profit for trend following.

3. Parameter Optimization Software

- Dedicated Tools: Some platforms allow you to automate parameter optimization for your strategy. They test dozens of parameter combinations to find the most profitable set.

- Risk vs. Reward: Even if a certain configuration promises high returns, make sure it doesn’t expose you to unacceptable risk of loss. Keep an eye on loss strategy improvement to balance the equation.

Common Mistakes

- Overreliance on One Indicator: While the Nadaraya Watson Envelope Strategy is robust, combining it with other methods leads to more reliable results.

- Ignoring News: Sudden announcements can wreck even the best setups. Always stay aware of economic data releases and major market events.

- Improper Parameter Settings: Tweaking the smoothing parameter without understanding its effect can lead to random signals or missed opportunities.

Real-World Pitfalls and Best Practices for the Nadaraya Watson Envelope Strategy

Even though the Nadaraya Watson Envelope Strategy offers adaptive smoothing and a clear view of trend lines, traders still face challenges. Recognizing these pitfalls and applying proven best practices can help you stay profitable and minimize severe losses.

1. Over-Optimization Risks

- Parameter Overfitting: Tweaking your Strategy parameters too much can produce impressive historical performance but fail in real time. Real markets change constantly, so chase robust settings rather than a perfect backtest.

- Improper Parameter Settings: If your smoothing parameter is too small, the envelope might jump around, creating wrong trades. If it’s too large, you might overlook key signals of trend changes.

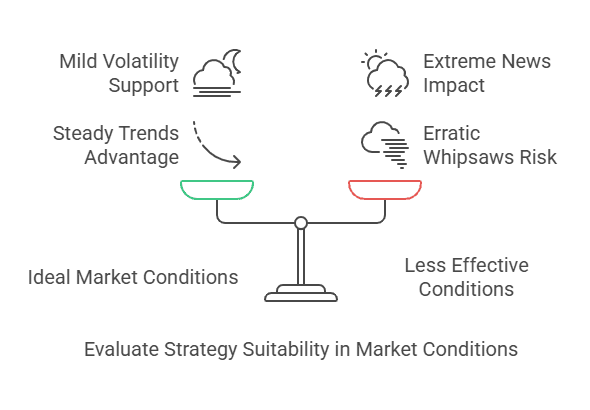

2. Market Regime Shifts

- From Trend to Range: The market trend can shift from a strong directional move into a sideways chop. If you don’t adjust your strategy, you risk multiple losses during trend reversal or consolidation phases.

- High Volatility Events: Sudden news can alter trend direction instantly. A reliable stop-loss and loss calculation method are crucial to limit drawdowns.

3. Ignoring Risk Disclosure

- Risk of Loss: Traders often forget that no technique is foolproof. Even the Nadaraya Watson Envelope Strategy can lead to losses if the underlying trend reverses abruptly.

- Profit Controls Risks: Locking in gains early keeps you protected. Let some of your position run for profit for trend following, but scale out gradually if price nears your upper band target.

4. Best Practices for Strong Execution

- Combine Indicators: Use momentum or volume tools alongside your envelope to confirm the direction for trend following. You get fewer false signals and a clearer read on trend momentum.

- Stay Updated: Keep an eye on economic calendars and major events. News can invalidate your signals in seconds.

- Parameter Optimization: Perform regular checks to confirm your parameter combinations still fit current market conditions. A semi-annual or quarterly review is enough for many traders.

When to Use (and Not Use) the Nadaraya Watson Envelope Strategy

The Nadaraya Watson Envelope Strategy excels in revealing the position of band changes and aiding in smoothing with trend indicators. Still, it’s not ideal for every period of time or market condition. Let’s see when it shines brightest, and when you might consider alternatives.

1. Ideal Market Scenarios

- Steady Trends: A clear price trend, with consistent higher highs or lower lows, suits an envelope-based system. You’ll enjoy a smooth, visual guide to trend strength.

- Mild Volatility: Moderate fluctuations give the kernel regression time to adjust without creating too many false signals. This balance supports the stability of trend identification.

2. Combining with Fundamentals

- Company Earnings or Economic Data: If you trade stocks or forex, fundamental metrics might support or contradict the signals from your envelope bands.

- Confirmation of Potential Trend: A strong fundamental backdrop might confirm that you’re safe to follow a bullish or bearish envelope signal over a longer timeframe.

3. Adjusting Strategy Parameters for Special Circumstances

- Short-Term Intraday Volatility: Consider a faster reaction time by lowering your smoothing parameter. That approach tracks rapid swings more closely.

- Longer-Term Positions: Widen the envelope by increasing the bandwidth. This method reduces over-reaction to day-to-day price noise.

- Dual Envelope Trend: Some traders apply two sets of envelopes with different smoothing to measure both short-term and long-term signals of trend.

Choose your usage scenario carefully. If conditions don’t favor the Nadaraya Watson Envelope Strategy, you might do better sitting on the sidelines or switching to a different method. No single technique dominates all the time, so be ready to adapt.

Conclusion

The Nadaraya Watson Envelope Strategy provides a flexible, kernel regression-based framework for tracking a market’s evolving direction. It excels at highlighting trend reversal signals before they cause severe losses. By aligning the envelopes with trend lines, volume indicators, or other tools, you can boost your odds of catching the right moves. This dynamic approach also helps you navigate a trend in price using adaptive boundaries that respond to shifts in volatility and trend strength.

Keep in mind that every trade carries a risk of loss. To handle unexpected twists, practice consistent loss management, set sensible stop-losses, and remain vigilant about market news. Experiment with the smoothing parameter and other Strategy parameters to find the balance that suits your style. Over time, you’ll refine your envelope-based entries and exits, preserving capital and maximizing opportunities. Remember to stay curious, backtest often, and never bet more than you can afford to lose.

Ready to take your trading to the next level?

Use TradeSearcher to backtest the Nadaraya Watson Envelope Strategy instantly and find the best setups for any market condition. Start your free trial today and discover profitable opportunities!