Table of Content

Paper Trading for Beginners - How to Start and the Best Simulators

By Vincent NguyenUpdated 270 days ago

Exploring the Best Platforms for Paper Trading

Paper Trading is the practice of trading stocks, currencies, or other assets without using real money. It allows beginners to explore trading strategies in a simulated environment that carries zero financial risk. You can think of it like training wheels for new traders. Using fake money (often referred to as virtual money or virtual funds) in a paper trading environment helps you focus on learning, rather than fretting about capital at risk. Many first-time traders use this technique to build trading skills before transitioning to real-world trading and dealing with real-time market conditions.

In this article, we will explore what Paper Trading is, why it’s an excellent place to start, and how you can develop a trading workflow without risking actual capital. We’ll also discuss a wide range of tips to refine your trading strategies. Finally, we’ll review four of the best Paper Trading platforms and simulators for getting started. Whether you’re into Day Trading, swing trading, or advanced trading strategies, paper trading accounts are a powerful way to test your investment ideas. You’ll learn how to transition from fake money to real trading with confidence and skill. Let’s dive right in and see how simulated trading can help you level up in the stock market.

What Is Paper Trading?

Paper Trading is a method that lets traders buy and sell assets on a virtual trading platform, often referred to as a demo trading app, without placing real money at risk. This concept originated from the past, when aspiring investors used a piece of paper to note down hypothetical trades, track them over time, and evaluate their profits or losses. Today, paper trading accounts come with real-time data, interactive chart trading, and advanced features that mimic actual market scenarios. This approach to paper trading empowers beginners to practice the basics of day trading and more advanced hedge trading strategies.

Traders across various experience levels often rely on simulated trading to deepen their understanding of financial markets. Because there’s no money on the line, Paper traders can test new ideas, experiment with technical indicators, and practice dealing with emotional reactions—an aspect of trading that is often underestimated. By focusing on trading decisions that would typically require real capital, Paper traders can refine each step in their trading workflow. Ultimately, Paper Trading platforms provide a risk-free environment to study investment strategies, monitor real-time quotes, and explore potential trading opportunities.

Why Paper Trading Matters for Beginners

Paper Trading matters for beginners because it offers a safe space to experiment. Real trading can be intimidating for first-time traders due to financial risk, real-time market conditions, and the possibility of money loss. By using virtual money in Paper Trading, you eliminate that financial stress. This process lays the groundwork for building strong trading skills and helps you avoid the steep learning curve that accompanies real trading too soon.

Another crucial benefit of Paper Trading is that it gives new investors the chance to explore a wide range of trading styles. Whether you’re into Day Trading, swing trading, or more complex trades, simulated trading allows you to get a feel for each. Beginners can practice analyzing real-time data, deploying technical indicators, and executing trades using a simple interface. Paper Trading also improves your comfort level with investment strategies and advanced trading strategies. By the time you move to an actual trading platform, you’ll be more prepared to put real funds on the line.

Building Your Paper Trading Workflow

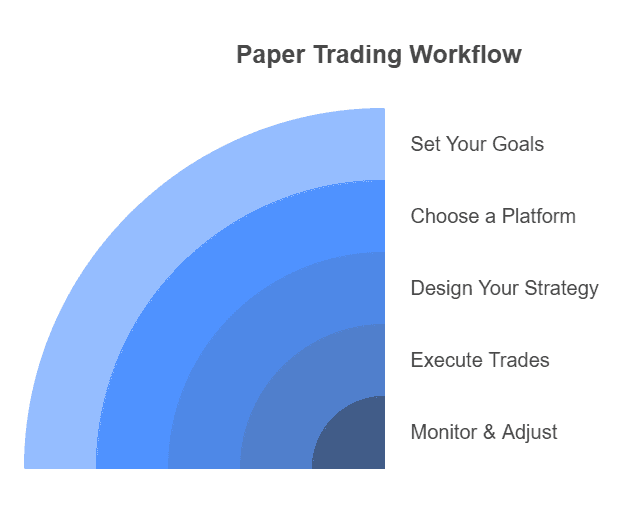

A structured approach to Paper Trading can significantly boost your success. Here’s a basic workflow to guide you:

- Set Your Goals: Identify whether you want to practice Day Trading, swing trading, or test long-term investment strategies. A clear goal provides direction.

- Choose a Paper Trading Platform: Select from various online trading platforms that offer paper trading accounts or built-in access to a simulated environment. Ensure they have features like real-time quotes, a virtual balance, and analytical tools.

- Design Your Strategy: Test basic strategies first. Then, step up to advanced trading strategies if you feel comfortable. Use technical indicators to refine your entries and exits.

- Execute Trades: Use virtual funds or fake money to buy and sell on the virtual trading platform. Record each transaction as if it were a real trade.

- Monitor & Adjust: Track performance metrics over time. Look for any weaknesses in your approach and fine-tune your strategies. This is where thorough loss analysis helps.

This workflow cements confidence among beginners. It highlights how to respond to market changes without the pressure that actual trading entails. Over time, Paper Trading transforms novices into experienced traders who can handle real markets.

Paper Trading for Different Types of Traders

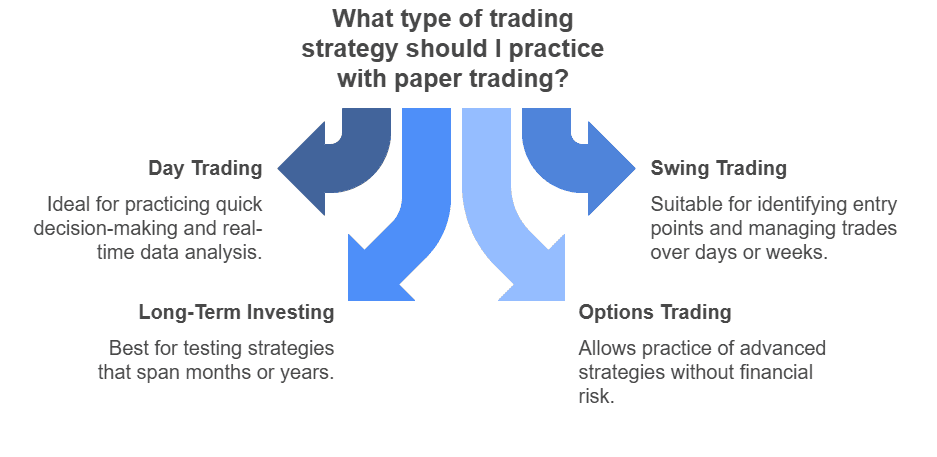

1. Day Traders

Day Trading involves buying and selling stocks within the same day. In a paper trading environment, Day Traders can test how real-time data influences quick decisions. They can practice reading charts, applying technical indicators, and perfecting their timing. Because day trading is fast-paced, practicing in a risk-free environment is invaluable.

2. Swing Traders

Swing trading is a slower-paced approach than Day Trading. It focuses on price swings that can last several days or weeks. Paper Trading helps you figure out the best ways to spot ideal entry points and manage trades over slightly longer periods.

3. Long-Term Investors

Long-term investors use Paper Trading to try out investment strategies spanning months or years. While many platforms cater to active traders, plenty of them still support simulated accounts for more patient strategies. Tracking how your portfolio grows or shrinks in a simulated environment can guide your real-world decisions later.

4. Options Traders

Options traders often need more advanced tools. They might track real-time quotes, implied volatility, and complexities such as spreads. Paper Trading allows them to practice advanced hedge trading strategies without taking on substantial financial risk.

4 Best Paper Trading Simulators

Below are four popular Paper Trading platforms that cater to a wide range of traders. Each offers unique features to help you test advanced trading strategies, refine your investment ideas, and manage financial risk. They vary in complexity, so pick one that best matches your level of comfort.

1. Webull Paper Trading

Webull Paper Trading is popular among novice investors and advanced traders alike. This virtual trading platform provides a risk-free environment for testing a wide range of trading strategies. You start with a virtual balance and can trade stocks, ETFs, and other assets. Webull’s simple interface offers essential analytical tools without overwhelming new users. Moreover, you can get real-time quotes and track your performance through detailed analytics. Many experienced investors enjoy Webull because it mimics real-world trading conditions, enabling a smoother transition to real trading.

2. Interactive Brokers’ Trader Workstation

We touched on Interactive Brokers earlier, but their Trader Workstation deserves a special mention among paper trading simulators. It’s a robust trading platform with advanced features like advanced hedge trading strategies testing, real-time data, and a wide range of asset classes. Though it may have a steeper learning curve, Trader Workstation is a powerful solution for advanced stock investors. It also accommodates various trading styles, from Day Trading to complex trades, making it ideal for passionate traders seeking a serious paper trading environment.

3. TD Ameritrade’s thinkorswim

thinkorswim by TD Ameritrade is known for its comprehensive analysis capabilities and intuitive interface. It offers a PaperMoney feature, essentially a paper trading demo account, giving you real-time market data and advanced charting options. PaperMoney is suited for both newbies and advanced traders. You can test out technical indicators, try advanced trading strategies, and see how your trades perform under real market conditions. thinkorswim also boasts an extensive library of educational content, making it a go-to platform if you crave a range of education curated for all levels of traders.

4. eToro

eToro shines as a social trading platform that also offers paper trading features. You can open a virtual trade account, experiment with investing in a wide range of assets, and even copy other traders’ strategies if you’d like. eToro’s user-friendly, slick interface caters to multiple experience levels. You get access to stocks, crypto, and more, all while using fake money to practice. This is an excellent place to build confidence and refine your trading style before committing real funds.

How to Get the Most Out of Paper Trading Platforms

To maximize your Paper Trading experience, treat it as though it’s real trading. Here are some ways to do that:

1. Set a Realistic Virtual Balance: Don’t inflate your paper trading account with unlimited paper cash. Use an amount that mirrors what you’d invest in real trading. This keeps your trading decisions realistic.

2. Stick to Your Rules: Approach every trade with guidelines that mimic your real strategy. Focus on risk management, position sizing, and stop-loss orders.

3. Record Every Trade: Maintain a trading journal. Include the date, time, entry price, exit price, and the rationale behind each trade. This record-keeping will pay off when it’s time to analyze successes and failures.

4. Analyze and Evolve: Use the platform’s analytical tools to study your performance. Look for patterns or mistakes, and tweak your approach accordingly.

5. Stay Updated: Keep an eye on real markets, even if you’re only trading with virtual funds. Familiarize yourself with real-world events that affect the stock market and real-time quotes.

Selecting the Right Paper Trading Platform

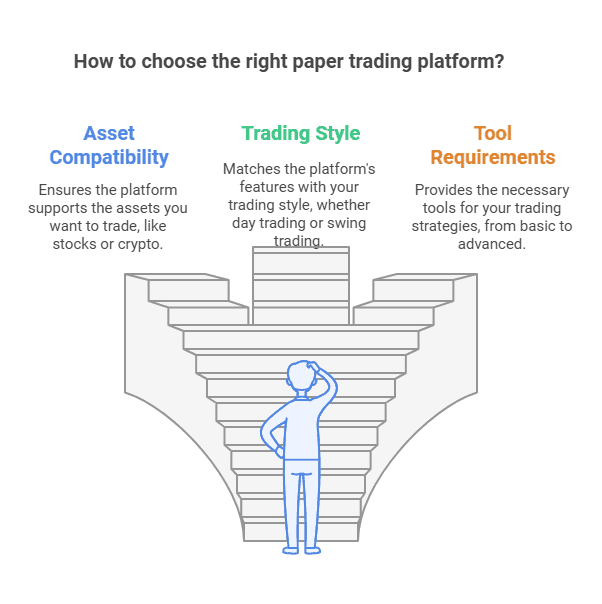

Choosing the correct Paper Trading platform is a pivotal step. Some platforms specialize in advanced features that cater to advanced traders and experienced investors. Others prioritize a simple interface for first-time traders. Ask yourself the following:

1. Which Assets Do You Want to Trade?

If you’re exploring the stock market, look for a platform with real-time quotes, chart analysis, and easy order placement. If you also want to trade crypto, make sure the simulator accommodates it.

2. What Is Your Trading Style?

Day Trading requires instant updates and swift order execution. Swing trading focuses on advanced charting tools and multi-day analysis.

3. What Tools Do You Need?

Are you into advanced trading strategies that require complex trades and deep technical indicators? Or do you prefer more basic features for now?

4. Community and Education

Some paper trading simulators offer a community of traders, social features, or additional paper trading resources. If these help you grow, it might be wise to pick such a platform. Look for a platform that offers real-time data, real-time market conditions, and simulates spread and slippage accurately.

Monitoring Financial Risk with Paper Trading

Monitoring financial risk in Paper Trading is simpler than in real trading because you’re protected from actual money loss. However, you should treat your simulated trades as if you’re risking real capital. Apply standard risk management principles, like never risking more than a small percentage of your balance on a single trade. This habit will help you avoid catastrophic losses when you eventually switch to real-world trading.

Use the simulator’s analytical features to track your drawdowns and volatility. This step is crucial for advanced traders testing complex trades. By noting your maximum drawdown, you’ll gauge how well your strategy handles rough patches in the market. Even if you’re only using fake money, building risk management discipline is essential for long-term viability in real trading.

Final Thoughts and Conclusion

Paper Trading is your training ground for entering the world of finance and speculation without risking real money. From your first paper trade to advanced trading strategies, this simulated approach equips you with essential trading skills. It introduces you to basic strategies, advanced tools, emotional control, and more. By the time you transition to a powerful trading platform for real trading, you’ll have the discipline and knowledge to make informed trading decisions. Remember to keep analyzing your trades, adopt good record-keeping, and maintain emotional discipline.

Paper Trading can transform a raw beginner into a confident trader ready for real-world trading. Make the most of the wide range of paper trading simulators available, including Interactive Brokers, Webull Paper Trading, and more. By leveraging virtual money in a risk-free environment, you’ll gain the experience and poise needed to succeed once you move on to real capital. In the end, Paper Trading remains a vital tool for building a strong foundation in the exciting and challenging realm of financial markets.

Ready to take your trading skills to the next level?

Start your journey risk-free with TradeSearcher—the ultimate platform for mastering Paper Trading. Analyze strategies, refine your techniques, and connect with a vibrant community of traders.

Sign up for TradeSearcher today and turn your trading potential into results! 🚀