Table of Content

What Is Quantitative Trading? Beginner's Guide to Get Started in 2025

By Vincent NguyenUpdated 386 days ago

What Is Quantitative Trading?

Quantitative trading is a sophisticated, data-driven approach to trading financial markets that leverages mathematical models and algorithms to identify and execute trading opportunities.

Unlike traditional trading methods that rely heavily on human intuition and discretionary decision-making, quantitative trading utilizes statistical and computational techniques to analyze vast amounts of market data, ensuring objective and systematic trading strategies.

This method has gained significant traction in recent years due to its ability to process large datasets efficiently, minimize emotional biases, and execute trades at speeds unattainable by humans.

In this beginner-friendly guide, we will explore the fundamentals of quantitative trading, how it differs from traditional trading, the essential tools and components involved, strategies for developing your own quantitative trading system, the associated risks, and the steps you need to take to get started in this exciting field.

Understanding the Basics of Quantitative Trading

To grasp the essence of quantitative trading, it's essential to understand its foundational components and how they interrelate to form a cohesive trading strategy.

Data and Statistics

At the heart of quantitative trading lies data. Quantitative traders rely on historical market data, including price movements, trading volumes, and economic indicators, to identify patterns and trends that can be exploited for profit. Statistical analysis plays a crucial role in this process, enabling traders to develop hypotheses about market behavior and validate these hypotheses through rigorous testing.

Mathematical Models

Quantitative trading employs various mathematical models to forecast price movements and detect inefficiencies in the market. These models can range from simple linear regressions to complex machine learning algorithms. The choice of model depends on the specific trading strategy and the nature of the data being analyzed.

Automation

One of the key advantages of quantitative trading is automation. By developing algorithms that can execute trades automatically based on predefined criteria, quantitative traders can capitalize on opportunities in real-time without the need for constant manual intervention. This not only increases efficiency but also reduces the likelihood of human error.

Objective Approach

Quantitative trading emphasizes an objective approach to decision-making. By relying on data and mathematical models, quantitative traders aim to eliminate emotional and cognitive biases that often plague discretionary traders. This objectivity leads to more consistent and disciplined trading practices.

Quantitative vs. Discretionary Trading

Quantitative traders differ significantly from discretionary traders in both mindset and execution. While discretionary traders rely on intuition and subjective judgment to make trading decisions, quantitative traders depend on data-driven insights and systematic processes. This fundamental difference often results in contrasting trading styles and risk management practices.

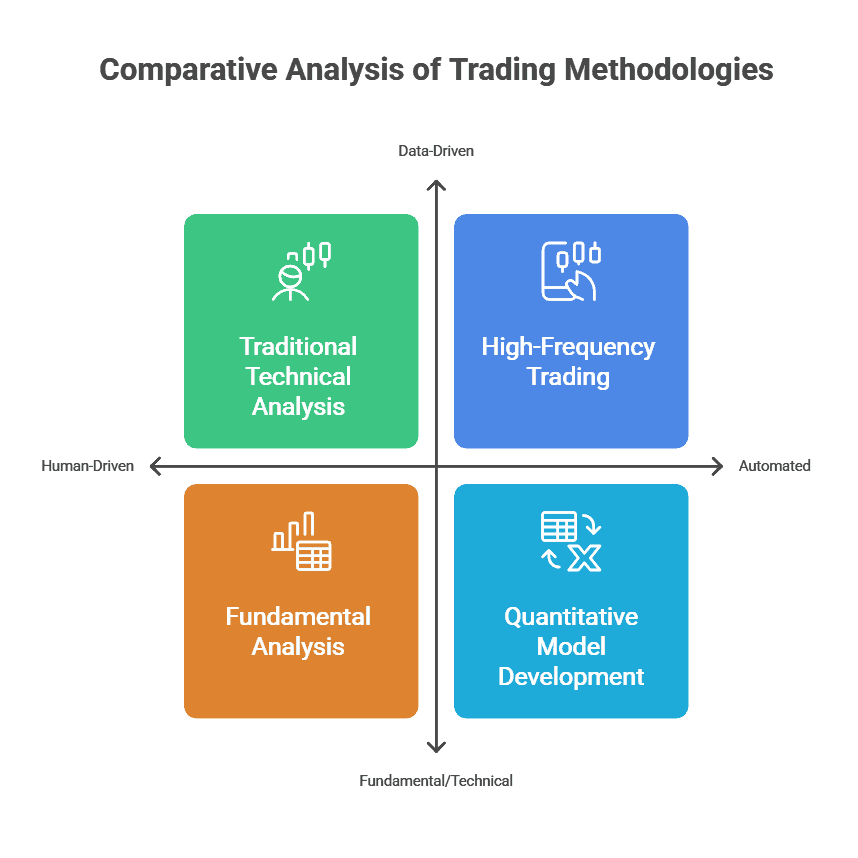

How Quantitative Trading Differs from Traditional Trading

Quantitative trading stands apart from traditional trading methodologies through its reliance on data and automation. Understanding these differences can help aspiring traders appreciate the unique advantages and challenges associated with quantitative trading.

Fundamental Analysis vs. Quantitative Trading

Traditional fundamental analysis involves evaluating a company's financial statements, management, and competitive position to determine its intrinsic value. In contrast, quantitative trading focuses on statistical signals derived from large datasets, often ignoring fundamental factors unless they can be quantified and incorporated into a model.

Technical Analysis vs. Quantitative Trading

While technical analysis also utilizes historical price data, it primarily relies on chart patterns and indicators crafted by human analysts. Quantitative trading, on the other hand, uses algorithmic detection of market inefficiencies and relies on rigorous statistical validation to develop trading signals.

Speed and Automation

Speed and Automation

Quantitative trading leverages automation to execute trades at speeds and frequencies that are impossible for human traders. This high-speed execution is particularly beneficial in strategies like high-frequency trading (HFT), where milliseconds can make a significant difference in profitability.

Integration of Multiple Data Sources

Quantitative traders often incorporate a wide array of data sources, including alternative data like social media sentiment, news feeds, and economic indicators. This data-heavy perspective allows for more comprehensive models that can adapt to various market conditions.

Key Components and Tools of Quantitative Trading

Successful quantitative trading requires a robust infrastructure composed of several key components and tools. Understanding these elements is crucial for building and maintaining effective trading strategies.

Data

Data is the cornerstone of quantitative trading. Traders need access to high-quality historical and real-time market data, which can be sourced from financial data vendors, exchanges, or APIs. Ensuring data integrity through cleaning and preprocessing is essential to avoid misleading results.

Software and Platforms

Quantitative traders typically use programming languages like Python, R, and C++ to develop their models and algorithms. Specialized trading software and quantitative libraries, such as Pandas, NumPy, and TensorFlow, provide the necessary tools for data analysis, modeling, and backtesting.

Computational Resources

Handling large datasets and running complex models requires significant computational power. Traders must decide between local computing setups and cloud-based solutions, considering factors like cost, scalability, and reliability.

APIs and Broker Integrations

To execute trades automatically, quantitative traders integrate their algorithms with broker APIs. This seamless connection allows strategies to send orders directly to the market, facilitating real-time execution and monitoring.

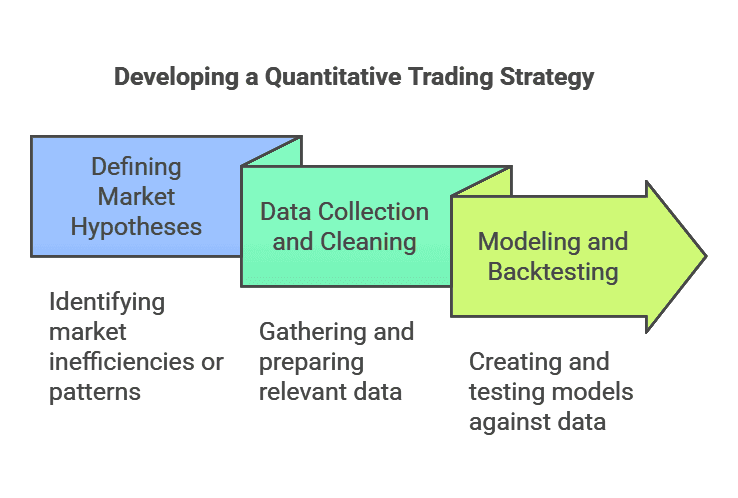

Developing a Quantitative Trading Strategy

Creating a successful quantitative trading strategy involves a systematic approach, from formulating hypotheses to deploying models in live markets. Here's a step-by-step overview of the process.

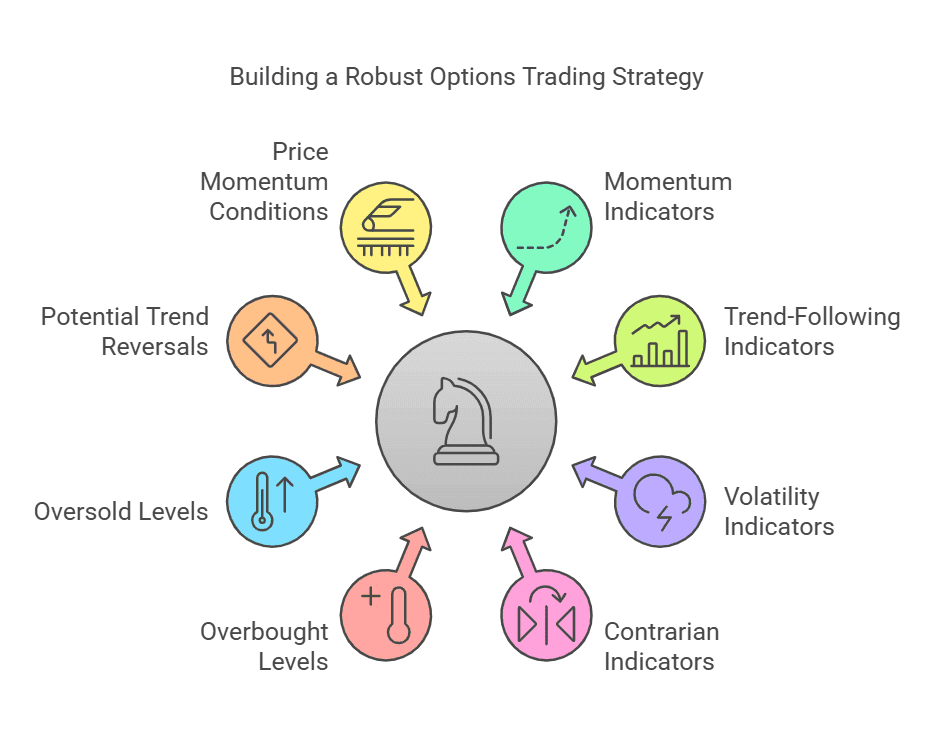

Defining Market Hypotheses for Quantitative Trading

The first step in developing a quantitative trading strategy is identifying market inefficiencies or patterns that can be exploited for profit. Common hypotheses include mean reversion, momentum, and arbitrage opportunities. Each hypothesis should be framed as a testable statement with clear parameters to ensure it can be rigorously evaluated.

Data Collection and Cleaning in Quantitative Trading

High-quality data is crucial for developing reliable trading models. Quantitative traders must collect relevant data types, such as price and volume data, economic indicators, and alternative data sources. Data cleaning involves handling missing values, outliers, and ensuring consistent formatting to maintain data integrity.

Modeling and Backtesting for Quantitative Trading

Once a hypothesis is defined and data is prepared, the next step is to create statistical or machine learning models to validate the hypothesis. Backtesting these models against historical data helps assess their performance and robustness. Best practices in backtesting include using in-sample and out-of-sample testing, as well as walk-forward analysis to prevent overfitting and ensure the model's generalizability.

Popular Techniques and Algorithms in Quantitative Trading

Quantitative trading encompasses a wide range of techniques and algorithms, each suited to different market conditions and trading objectives. Here are some of the most popular methods used by quantitative traders.

Statistical Arbitrage in Quantitative Trading

Statistical arbitrage involves identifying mispriced securities or mean-reverting pairs that can be exploited for profit. Traders use cointegration tests and correlation analysis to find pairs of assets whose prices move together over time, allowing them to capitalize on temporary deviations from their historical relationship. An example of this is pairs trading, where one asset is bought while the other is sold short to profit from their convergence.

Machine Learning Models in Quantitative Trading

Machine learning models, including regression, classification, and reinforcement learning, are increasingly used in quantitative trading for predictive analytics. These models can identify complex patterns and relationships within data that traditional statistical methods might miss. However, they also pose challenges such as interpretability and the risk of overfitting. Continuous model retraining is essential to adapt to changing market conditions and maintain predictive accuracy.

High-Frequency Trading (HFT) in Quantitative Trading

High-frequency trading is a subset of quantitative trading that relies on ultra-fast execution speeds and co-location services to gain a competitive edge. HFT strategies involve placing a large number of orders at extremely high speeds, capitalizing on minute price discrepancies before they disappear. Due to the high costs and technological demands, HFT is typically inaccessible to individual beginners. Additionally, HFT raises ethical and regulatory concerns, making it a controversial area within quantitative trading.

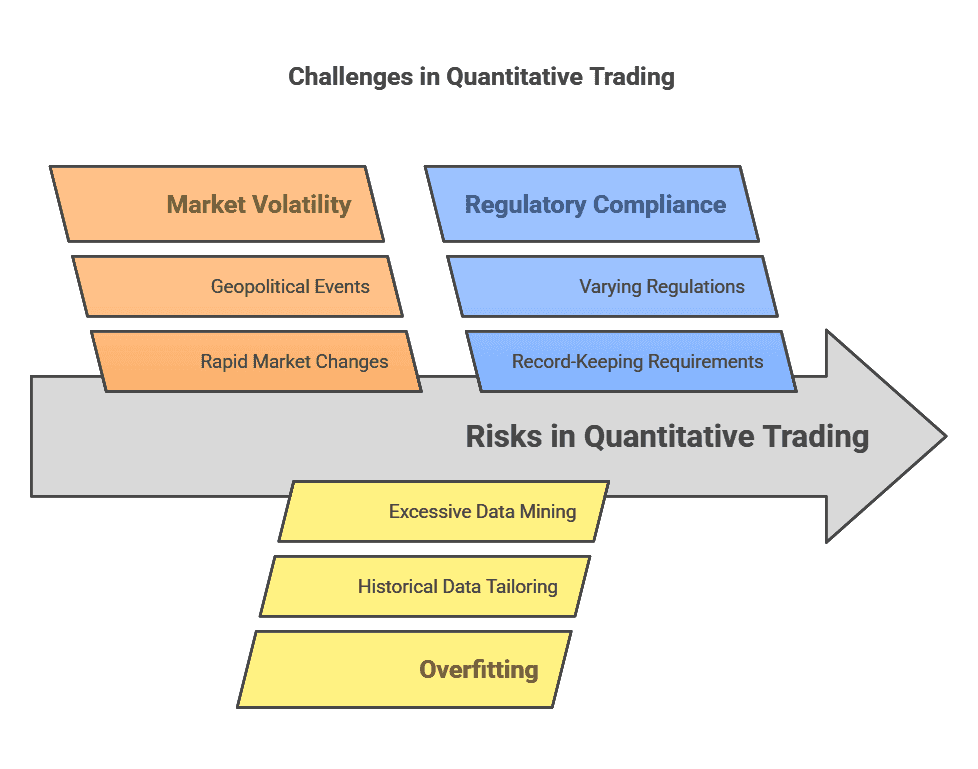

Risks and Challenges of Quantitative Trading

While quantitative trading offers numerous advantages, it also comes with inherent risks and challenges that traders must navigate carefully.

Market Volatility and Correlation

Market conditions can change rapidly, causing shifts in correlations and relationships that models rely on. Black swan events or significant geopolitical news can invalidate existing models, leading to unexpected losses. Quantitative traders must develop strategies to adapt to such volatility and incorporate mechanisms to detect and respond to abrupt market changes.

Overfitting and Data Mining Bias

One of the primary dangers in quantitative trading is overfitting, where a model is too closely tailored to historical data and fails to generalize to new, unseen data. This often results from excessive data mining and testing numerous hypotheses without proper validation. To mitigate this risk, traders should employ rigorous out-of-sample testing and avoid overly complex models that capture noise rather than true signal.

Regulatory and Compliance Issues

Quantitative traders must adhere to various market regulations, which can differ significantly across different asset classes and jurisdictions. For instance, trading in stocks is regulated by the Securities and Exchange Commission (SEC) in the United States, while cryptocurrency trading may be subject to different rules. Compliance involves maintaining accurate records, reporting trades appropriately, and ensuring that trading strategies do not violate any regulatory standards. Failure to comply can result in hefty fines and legal consequences.

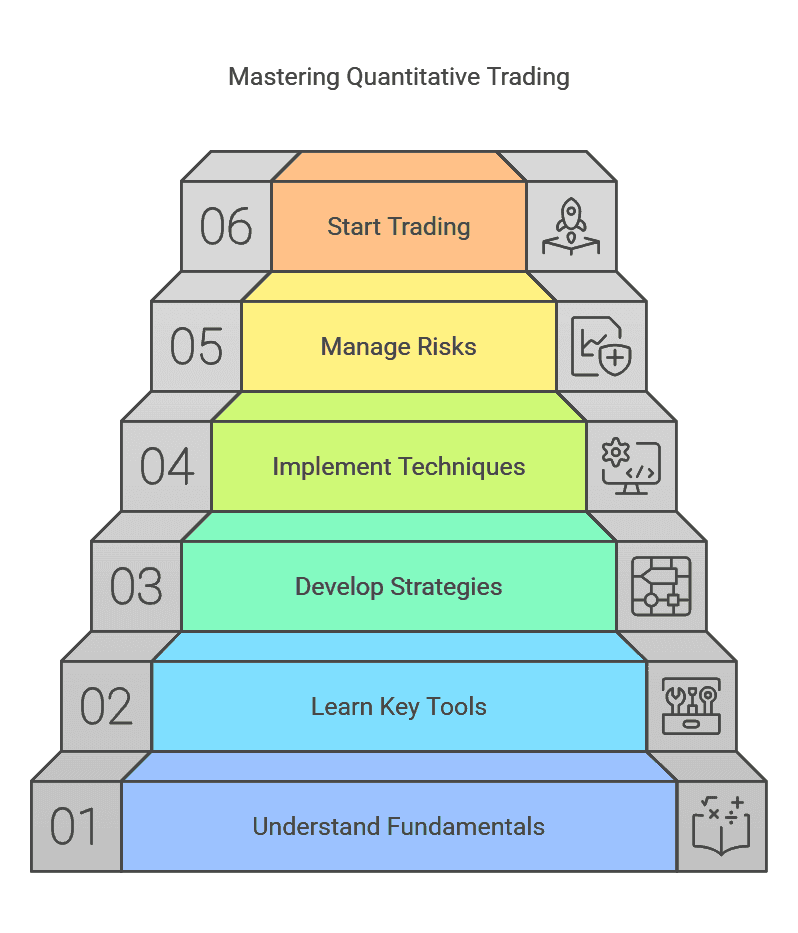

Steps to Get Started in Quantitative Trading

Starting a quantitative trading journey requires a strategic approach that includes education, tool selection, and infrastructure setup. Here is a practical roadmap for beginners aiming to enter the field.

Learning Resources and Skills Required

To succeed in quantitative trading, you need a strong foundation in programming, statistics, and financial markets. Learning programming languages like Python and R is essential, as they are widely used for data analysis and model development. Additionally, understanding quantitative methods such as statistics, econometrics, and machine learning will enable you to create robust trading models. Recommended resources include:

- Books: "Quantitative Trading" by Ernie Chan, "Algorithmic Trading" by Andreas F. Clenow

- Online Courses: Coursera's "Machine Learning" by Andrew Ng, Udemy's "Python for Finance"

- Forums and Communities: QuantConnect, Elite Trader, Stack Overflow

- Open-Source Projects: Explore repositories on GitHub related to quantitative trading strategies

Choosing the Right Broker or Platform

Selecting a broker that supports algorithmic trading is a crucial step. Key factors to consider include:

- API Support: Ensure the broker provides robust APIs for seamless integration with your trading algorithms.

- Transaction Costs: Lower transaction fees can significantly impact your overall profitability.

- Market Access: Choose a broker that offers access to the markets and instruments you intend to trade.

- Data Fees: Consider the cost of data subscriptions and whether they fit within your budget.

Popular brokers for quantitative trading include Interactive Brokers, Alpaca, and QuantConnect.

Setting Up a Quantitative Trading Infrastructure

A reliable technical setup is essential for quantitative trading. This includes:

- Hardware: A powerful computer with sufficient processing power and memory to handle large datasets and complex computations.

- Internet Connection: A fast and stable internet connection is crucial for real-time data processing and trade execution.

- Coding Environment: Set up a development environment with tools like Jupyter Notebooks, Visual Studio Code, or PyCharm.

- Version Control: Use Git for version control to manage changes in your codebase efficiently.

- Cloud Computing or VPS: Consider using cloud services or virtual private servers for scalability and to ensure your trading algorithms run continuously without interruption.

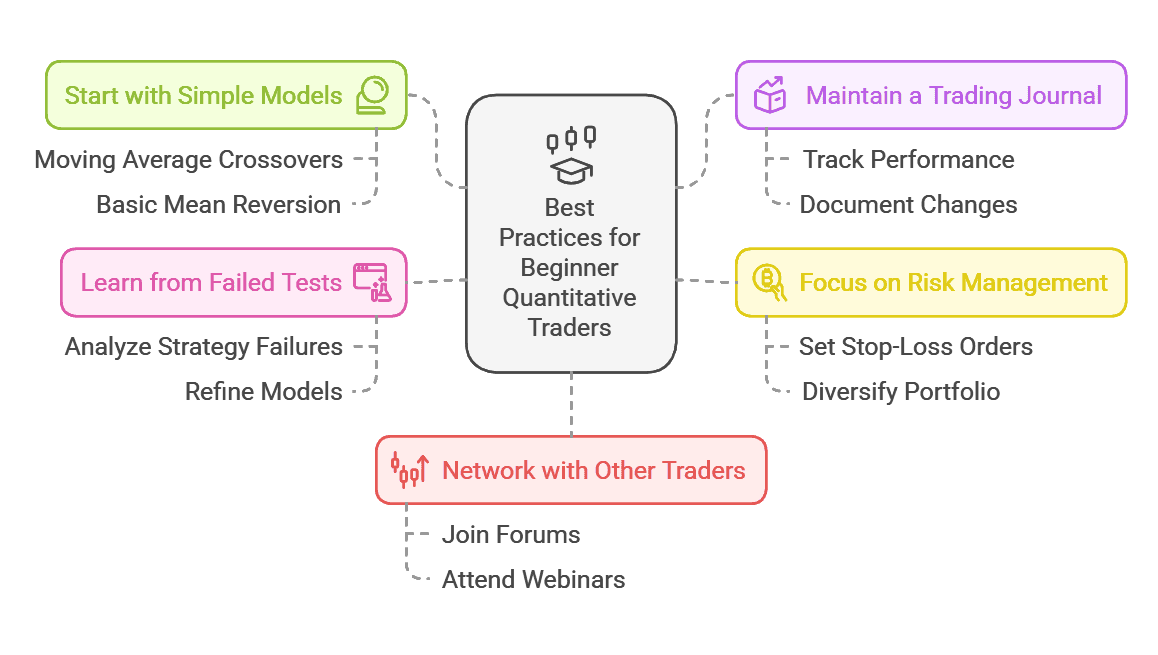

Best Practices and Tips for Beginner Quantitative Traders

Embarking on quantitative trading can be daunting, but adhering to best practices can help you navigate the complexities and increase your chances of success.

Start with Simple Models

Begin with straightforward models to build a solid foundation. Simple strategies like moving average crossovers or basic mean reversion can help you understand the mechanics of quantitative trading before moving on to more complex algorithms.

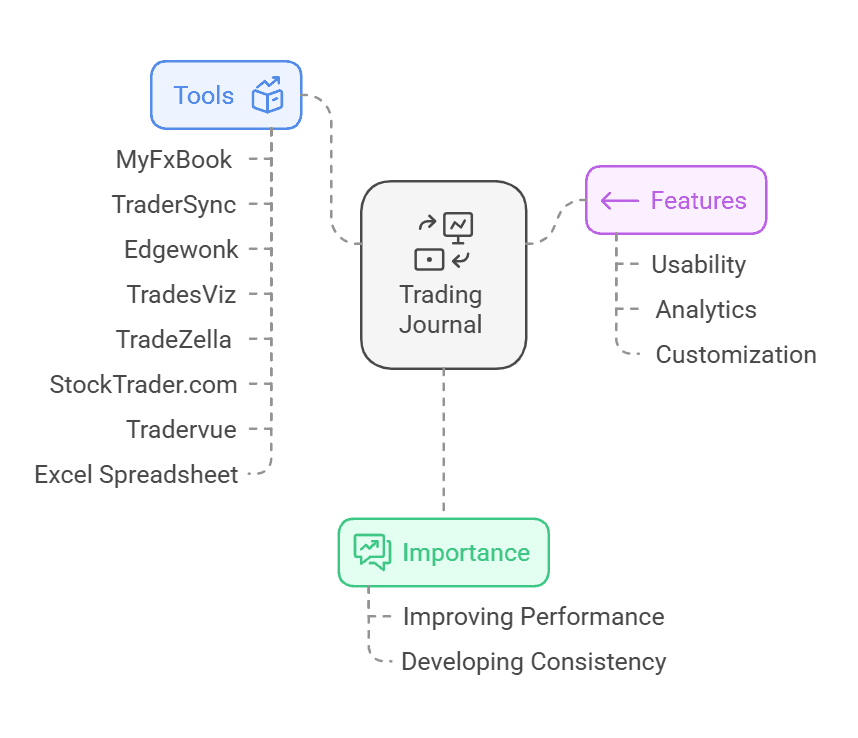

Maintain a Trading Journal

Keeping a detailed trading journal helps you track the performance of your strategies, document changes, and analyze the reasons behind successes and failures. This practice promotes continuous learning and improvement.

Focus on Risk Management

Effective risk management is paramount in quantitative trading. Implement strategies to limit potential losses, such as setting stop-loss orders, diversifying your portfolio, and controlling the size of individual trades. Never risk more than a small percentage of your capital on a single trade to protect your overall investment.

Learn from Failed Tests

Negative results and failed tests are valuable learning opportunities. Analyze why a strategy didn’t work as expected, adjust your models accordingly, and use these insights to refine your approach.

Network with Other Traders

Engaging with the quantitative trading community can provide support, insights, and collaboration opportunities. Join forums, attend webinars, participate in local meetups, and connect with other traders to share knowledge and stay updated on industry trends.

Conclusion: Why Quantitative Trading Matters

Quantitative trading is revolutionizing the financial markets by introducing a systematic, data-driven approach to trading that emphasizes objectivity, scalability, and robust risk management. By leveraging mathematical models, statistical analysis, and automation, quantitative traders can efficiently process vast amounts of data to identify and exploit trading opportunities that traditional methods might overlook.

This beginner-friendly guide has outlined the foundational concepts, key differences from traditional trading, essential tools, strategy development, associated risks, and practical steps to embark on a quantitative trading journey.

As the financial markets continue to evolve, quantitative trading remains a dynamic and promising field for those who are curious, disciplined, and committed to continuous learning. Whether you aim to develop sophisticated algorithms or start with simple models, the principles of quantitative trading can provide a strong framework for achieving success in the competitive world of financial markets.

Ready to turn your quantitative trading ideas into actionable strategies?

With TradeSearcher, you can backtest and optimize your algorithms instantly, finding the best opportunities for any ticker. Start your free trial today and elevate your trading game!