Table of Content

Range Filter Buy & Sell Strategy [5min] | Learn ROI Boosting Techniques + Backtests

By Vincent NguyenUpdated 339 days ago

Introduction: Understanding the Range Filter Buy & Sell Strategy [5min]

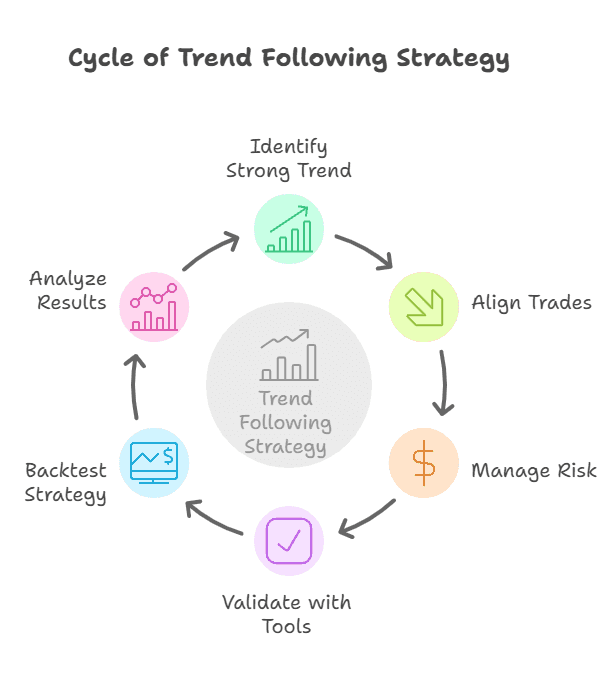

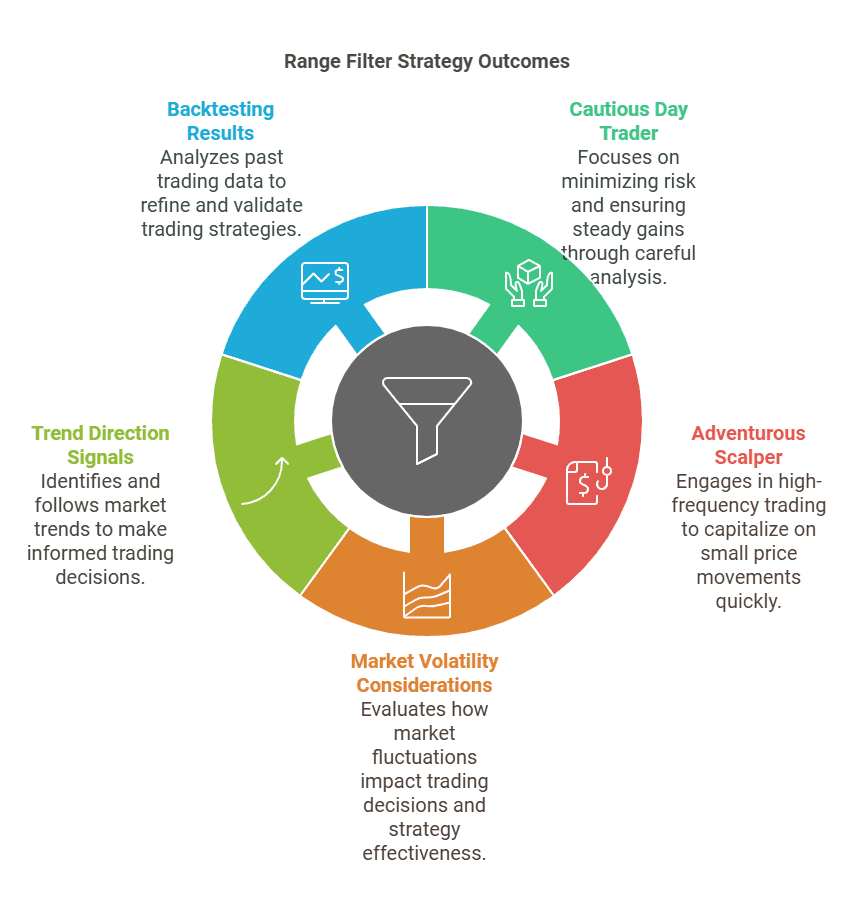

Range Filter Buy & Sell Strategy [5min] is a simple yet powerful tool for day traders and short-term investors who want to capture quick price movements without getting caught in unnecessary market noise. In this guide, we will explore the basics of how the Range Filter indicator works, why it’s considered an effective indicator in filtering out minor price action, and how to apply it on the 5min chart for maximum ROI. You will learn why many successful traders rely on range-based filters, what you need to get started, and how to adapt this approach to different financial markets and trading sessions. Moreover, we’ll delve into market volatility considerations, trend direction signals, and potential profits generated from proper backtesting.

We’ll also discuss how to fine-tune this strategy to match your preferred style, whether you’re a cautious day trader or a more adventurous short-term scalper. By the end of this article, you’ll understand the importance of a well-defined price range, the significance of false signals, and how to interpret range breakout techniques as part of an effective range breakout strategy. We will share three backtests that illustrate how varying risk levels influence results. Let’s begin by breaking down the concept of the Range Filter and why it’s essential for capturing profitable trades in the 5-minute timeframe.

Understanding the Range Filter Buy & Sell Strategy [5min]

The Range Filter Buy & Sell Strategy [5min] is designed to help traders filter price movement in a fast-paced environment while reducing false signals. On a 5min chart, this approach looks at an average price range and targets key levels where buy or sell signal opportunities emerge. When the market trades within a specific price range, many traders struggle to distinguish trend direction from temporary pullbacks. The Range Filter attempts to solve this issue by smoothing out minor price action and emphasizing true breakouts.

Why a 5-Minute Range Filter Matters

A 5-minute range offers a balanced perspective between the choppy 1-minute windows and the slower 15-minute or hourly chart windows. This time frame allows day traders to quickly capture profitable trades without exposing themselves to excessive market volatility. For instance, if you wait too long on a higher time frame, you might miss out on potential profits from small bursts in trend direction. Conversely, a 1-minute chart can show too many minor price fluctuations, leading to whipsaws and reduced clarity.

How the Range Filter Works

The Range Filter typically calculates the distance between recent price highs and lows, forming a filter price movement band. This indicator helps identify moments when price action ventures beyond its average range, potentially signaling a breakout. When price exceeds the upper filter band, a buy signal is triggered. Likewise, if price dips below the lower filter band, a sell signal occurs. These clear visual cues often reduce overthinking and help traders act decisively.

Additionally, some traders add other technical tools like moving averages or volume-based indicators to confirm signals. These additional indicators serve as extra layers of validation, especially if the current chart window displays significant market volatility or you are looking at absolute price movements with a higher risk tolerance.

Advantages and Limitations

Advantages:

Noise Reduction: The filter movement removes many of the tiny fluctuations that lead to false signals.

- Trend Confirmation: The strategy allows clearer identification of when a bullish market or bearish trend may be starting.

- Scalping-Friendly: Because it’s on a 5min chart, it’s particularly suitable for scalpers looking to capitalize on quick trade entry and exit points.

Limitations:

Lag in Reversal Entries: Any filter-based system may lag slightly, meaning you might enter or exit a trade a bit later than someone using pure price action.

- Market Volatility Sensitivity: Extremely volatile assets can trigger frequent breakouts, leading to more trades and potentially higher transaction costs.

Setting Up the Range Filter Buy & Sell Strategy [5min]

Implementing the Range Filter Buy & Sell Strategy [5min] requires a clear understanding of your charting software, your target ranges, and your preferred risk tolerance. By focusing on a 5-minute time frame, you’ll be better equipped to manage quick trades without losing sight of trend direction. Below is a straightforward approach to get started.

Choosing the Right Chart Platform

First, select a platform that supports custom scripts and technical tools like TradingView or similar software. This allows you to integrate the // Range Filter indicator or any range breakout systems easily. Most charting platforms have a built-in library of indicators, including versions of the Range Filter, so explore topics related to “Range Filter,” “range breakout trading strategies,” or “range breakout trading system” in the platform’s public library or store.

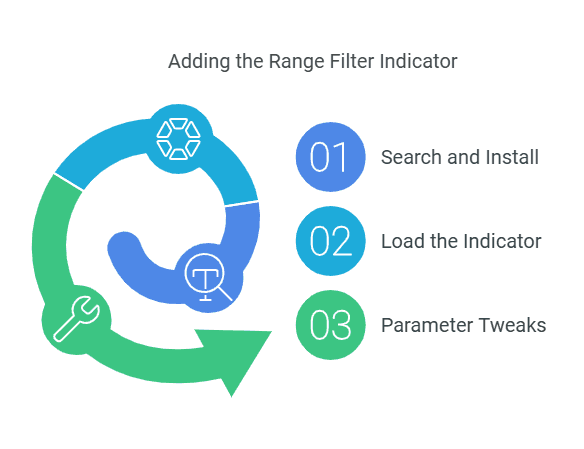

Adding the Range Filter Indicator

1. Search and Install: From your platform’s indicator library, type “Range Filter” or “5-Minute Range Filter” to locate a reliable script. Ensure it’s from a reputable creator or has positive user feedback.

2. Load the Indicator: Once installed, open the indicator settings. Different versions might have unique names like “5min - guikroth” or “guikroth version,” but they generally serve the same purpose.

3. Parameter Tweaks:

Look for Range or Threshold settings. Adjust these according to the average price range you observe on your market of choice.

- If the filter is too tight, you might see many signals triggered by minor price action. If it’s too wide, you might miss timely breakouts.

Defining Your Entry and Exit Criteria

- Buy Signal: Occurs when price closes above the upper range filter line. This implies a range breakout strategy, suggesting a bullish market sentiment.

- Sell Signal: Triggers when price closes below the lower filter line, indicating a potential reversal or bearish trend.

- Stop-Loss Placement: Place stops slightly below the lower filter line for a buy signal, or slightly above the upper filter line for a sell signal. This helps you exit quickly if the signal turns out to be false.

- Profit Target: You can aim for a 1:1 or 1:2 risk-to-reward ratio. Alternatively, you could use a trailing stop to lock in gains if the trend extends further.

Combining Additional Indicators

While the Range Filter alone can be enough for many traders, adding indicators such as moving averages, RSI, or volume filters may boost accuracy. These extra confirmations act as a second layer of “volatility filter,” minimizing your likelihood of jumping into a trade prematurely. If your current time zone or trading session tends to be more volatile (e.g., the start of a New York trading day), confirm that the breakout is valid before entering your position.

Practical Tips for a Seamless Setup

- Keep It Simple: Don’t clutter your screen with too many technical tools. Focus on the essential signals.

- Alert Settings: Some scripts allow code for alerts on your trading platform. Use them to avoid staring at your chart for hours.

- Test Thoroughly: Before committing real capital, run an experimental study or paper trades to check how often your filter triggers profitable trades.

Key Backtesting Methods for the Range Filter Buy & Sell Strategy [5min]

Backtesting is an integral part of applying the Range Filter Buy & Sell Strategy [5min] in real-world financial markets. It lets you see how the strategy might behave with different degrees of market volatility, price levels, and time frames. Moreover, backtesting helps prevent over-optimizing your trading strategies by showing how the filter performs under a variety of trading strategies, including range breakout techniques and simpler scalping methods.

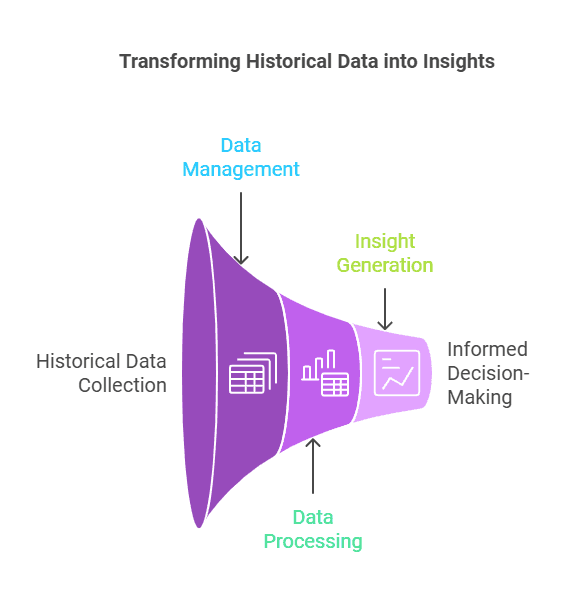

Overview of Backtesting

Backtesting involves analyzing historical data to see if your set rules—such as a buy signal when price crosses above the filter—would have produced profitable trades. This method helps you measure performance metrics like win rate, net profit, maximum drawdown, and false signals frequency. By comparing these statistics across different market conditions and time frames, you learn which settings yield the best results.

Preparing Your Data

- Historical Charts: Gather data for the 5-minute timeframe, spanning enough trading days or weeks to capture multiple phases of the market (bullish, bearish, and sideways).

- Clean Price Data: Ensure you have high-quality price movements data without gaps or irregularities.

- Consistent Parameters: If your filter threshold is set to 2.0 and your stop-loss is 1.0, keep them consistent during a single backtest to gather accurate results.

Method #1 – Conservative Setup

A conservative approach aims to minimize risk by using narrower target ranges and more sensitive filters:

- Tighter Threshold: If the filter triggers more frequently, you can spot smaller breakouts. However, watch for false signals in a choppy market.

- Quick Exits: Once a small profit target is reached, exit promptly to avoid sudden reversals.

- Best For: Traders who prefer fewer risks and want to preserve capital during uncertain periods.

Method #2 – Moderate Risk-Reward Balance

The second approach balances the sensitivity of the Range Filter with a slightly looser threshold:

- Medium Threshold: Filter is neither too tight nor too wide, capturing moderate price moves while ignoring minor price action.

- Risk-Reward Ratio: Often around 1:2, meaning you aim for double the profit compared to what you’re risking.

- Best For: Traders seeking a blend of consistency and higher reward potential in range breakout trading system setups.

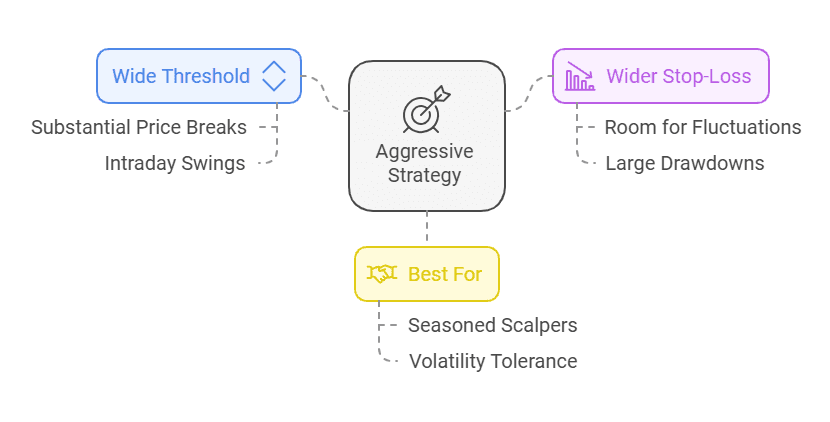

Method #3 – Aggressive Strategy

For those who thrive on market volatility:

- Wide Threshold: This approach waits for substantial breaks in the price range, focusing on bigger intraday swings.

- Wider Stop-Loss: Give your positions room to breathe, but keep an eye on possible large drawdowns.

- Best For: Seasoned scalpers who can handle the emotional pressure of large swings and want to maximize profit potential.

Range Filter Buy and Sell 5min [Strategy]

This strategy involves executing backtests on a 5-minute timeframe to identify buy and sell signals within a specified range. It includes setting test periods and predetermined take-profit and stop-loss orders for disciplined trade exits.

Interpreting Your Backtest Results

Evaluating the performance of any trading approach is crucial. When you run backtests on the Range Filter Buy & Sell Strategy [5min], you’ll see metrics that reflect your potential profits and risks. These metrics help you decide whether to adjust certain parameters or scrap the strategy entirely. Focus on the following points to get the most from your analysis:

1. Win Rate vs. Risk-Reward

A high win rate means the Range Filter Buy & Sell Strategy [5min] is producing more winners than losers.

- If you set a tighter stop-loss and a modest profit target, you might see more frequent small wins.

- If you aim for a bigger profit target, the win rate could drop, but each successful trade may yield a larger gain.

2. Drawdown and Recovery

Drawdown measures the largest peak-to-trough loss your account might face during a series of trades.

- A big drawdown indicates high risk. Consider adjusting your threshold or using a more conservative stop-loss if you see this consistently.

- Always examine how quickly your strategy can recover from a losing streak. A quick bounce-back suggests stronger long-term viability.

3. Profit Factor

Profit Factor is your total gross profit divided by your total gross loss.

- A profit factor above 1.5 often signals that your Range Filter Buy & Sell Strategy [5min] is reasonably profitable.

- When your profit factor dips below 1.0, the strategy is losing money overall. You might need a better balance of entry triggers and exit rules.

4. False Signals Count

Even the best range breakout strategy can generate misleading signals.

- When your backtest shows a flurry of losing trades within tight price movements, that might be due to false signals.

- You could increase the filter threshold or add complementary indicators to filter out these minor fluctuations.

5. Sample Size

One month of data might not be enough to confirm that a setup works in all financial markets.

- Aim for several months or even a year of 5-minute timeframe data if possible. This ensures you see how the strategy handles both low and high market volatility.

Twin Range Filter Algo

The Twin Range Filter Algo combines volatility and range conditions to trigger trades. Incorporating ATR with 32 and 64 periods, a trade is signaled when the shorter-term ATR is less than the longer-term ATR. This method is augmented by manually set target and stop-loss levels in ticks, along with a candle-based time stop-loss to exit positions. Originally effective for 15m and 1h BTCUSD time frames, it requires individual market assessment to optimize for other instruments.

Twin Range Filter Algo

PYTH / TetherUS (PYTHUSDT)

@ 2 h

1.13

Risk Reward53.70 %

Total ROI228

Total TradesFine-Tuning Your Range Filter Buy & Sell Strategy [5min]

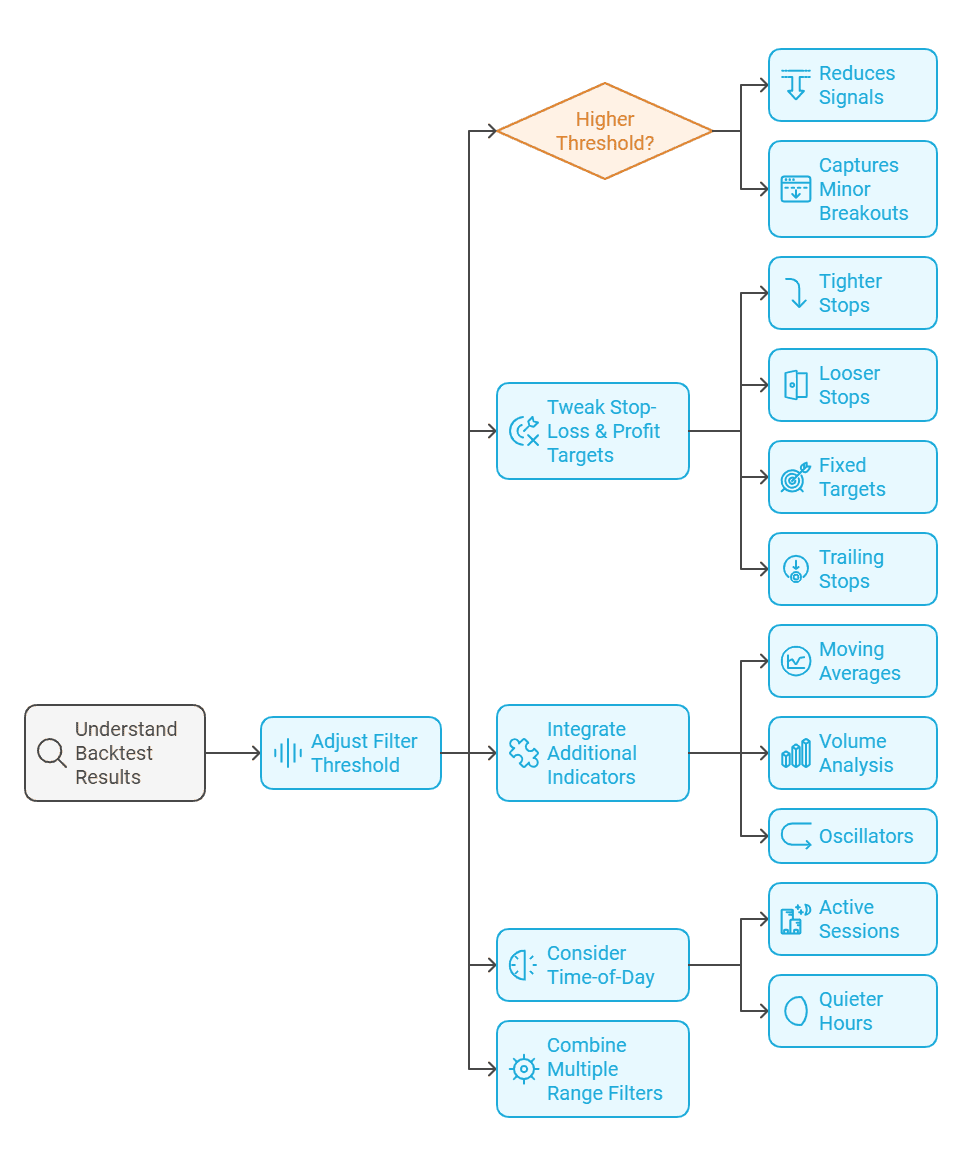

Once you understand your backtest results, you can tweak your Range Filter Buy & Sell Strategy [5min] for optimal performance. Fine-tuning involves balancing responsiveness against stability, especially when faced with unpredictable price movements. Here are some methods to refine your strategy:

Powertrend - Volume Range Filter Strategy [wbburgin]

The Powertrend - Volume Range Filter Strategy leverages volume data to identify trends, offering potentially greater accuracy than traditional price-based filters. It's a long-only breakout strategy, optimal for trending markets with high volume. Key entry and exit points are dictated by the crossing of price over range bands, with adjustable settings like Length, ADX Filter, and Range Supertrend to refine signals. The strategy requires customization for take profits/stop losses and may benefit from higher timeframe application to account for fees and slippage.

Adjusting the Filter Threshold

Higher Threshold

Reduces the number of signals by waiting for a more pronounced price breakout.

- Helps you avoid whipsaws in markets where minor price action triggers frequent breakouts.

- Potential downside: You might miss short-lived trends.

Lower Threshold

Captures even minor breakouts, which can be useful in a bullish market with steady momentum.

- Increases the risk of false signals and might lead to more whipsaws.

Tweaking Stop-Loss and Profit Targets

Stop-Loss Options

Tighter Stops: Protect your capital by exiting quickly if the breakout fails. This might result in multiple small losses during erratic markets.

- Looser Stops: Give each trade more breathing room, yet risk bigger drawdowns if the signal is wrong.

Profit Target Choices

Fixed Targets: Set predefined levels, such as 1:1 or 1:2 risk-reward. Helps with simpler decision-making.

- Trailing Stops: Lock in gains if price continues in your favor. This approach can capture bigger wins but sometimes leads to premature exit.

Integrating Additional Indicators

Moving Averages

They help confirm the broader trend direction.

- If a breakout occurs above a rising moving average, you might have a stronger bullish confirmation.

Volume Analysis

High volume during a range breakout often signals greater conviction behind the move.

- Combining volume and a Range Filter can give you a volatility filter to dodge low-conviction signals.

Oscillators (RSI, Stochastics)

Detect overbought or oversold conditions.

- They may help you decide if it’s too late to enter after a big breakout candle.

Time-of-Day Considerations

Active Sessions

Certain trading sessions, like the New York or London open, can produce sharper price movements.

- A faster filter setting might work well during these hours, capturing profitable trades from sudden range breakouts.

Quieter Hours

Overly tight filters during low-volume periods could lead to multiple whipsaws.

- Adjusting your threshold or skip-trading altogether during quiet periods might improve overall performance.

Combining Multiple Range Filters

A creative approach is to use two separate Range Filter Buy & Sell Strategy [5min] indicators with different thresholds. One can function as a primary filter for major breakouts, while the second captures smaller moves. This layered setup might suit aggressive scalpers with the flexibility to handle multiple signals.

Risk Management and Trading Psychology

Approaching any strategy, including the Range Filter Buy & Sell Strategy [5min], requires a robust mindset and disciplined risk management. Even the most accurate indicators can’t shield you from unexpected price movements or emotional reactions to market fluctuations. Below are essential considerations to keep your trading on track.

Defining Risk Parameters

Many day traders risk only 1–2% of their account balance per position. This ensures a series of losing trades won’t wipe out their capital. For scalpers using the 5-minute timeframe, small position sizing keeps large drawdowns at bay.

If your Range Filter Buy & Sell Strategy [5min] suggests a breakout, adjust position size according to your chosen stop-loss. If your filter threshold is wider, you might need a smaller position to accommodate a bigger stop.

Emotional Control

Once your Range Filter triggers a buy or sell signal, follow through with your preset stop-loss and profit target. Avoid second-guessing based on short-term noise or your gut feeling.

Losses are inevitable in any variety of trading strategies. Instead of chasing them, accept them as part of the bigger picture. Practicing mindfulness or journaling your trades can help you identify patterns in your emotional reactions.

Trading Psychology Best Practices

Wait for the filter price movement to unfold fully. Jumping in prematurely often leads to false signals and frustration

When your rules say there’s no valid entry, do nothing. Preservation of capital is a valuable skill in day trading.

The 5-minute chart can produce frequent signals, especially if your threshold is set low. Overtrading can rack up commissions and amplify stress, so only act on well-confirmed breakout

Maintain a trading journal. Log every trade, including your emotional state, the reason for entry, and whether the Range Filter Buy & Sell Strategy [5min] gave a reliable signal. Regular reviews help you refine your approach, spot recurring mistakes, and continuously learn.

Conclusion – Final Thoughts on the Range Filter Buy & Sell Strategy [5min]

Range Filter Buy & Sell Strategy [5min] remains one of the most accessible methods for filtering out noise and capitalizing on potential profits. By focusing on a 5-minute timeframe, you can capture short bursts of momentum without becoming overwhelmed by minor price fluctuations. We’ve covered how to install and configure the indicator, interpret backtest data, fine-tune settings, and implement strong risk management.

Through our exploration of multiple backtesting approaches, you can see how varying the filter threshold or combining additional indicators influences success. While aggressive strategies may capture large moves, they come with higher drawdowns. Meanwhile, conservative traders often enjoy smaller but more consistent gains. Regardless of where you stand on the risk spectrum, keep refining your approach with thorough practice and data analysis.

Remember that no strategy is ever foolproof. The key lies in balancing practicality, discipline, and ongoing adaptation to shifting market conditions. If you remain patient, methodical, and open to continuous learning, the Range Filter Buy & Sell Strategy [5min] can be a powerful tool in your trading toolbox.

Backtest Smarter with TradeSearcher!

Optimize your Range Filter Buy & Sell Strategy [5min] with TradeSearcher’s AI-powered backtesting tools. Explore over 1,000 strategies daily and find the perfect fit for your trading style.