Table of Content

ThinkOrSwim Backtesting: A Beginner’s Tutorial for Smarter Trading

By Vincent NguyenUpdated 410 days ago

Beginner Tutorial to ThinkOrSwim Backtesting

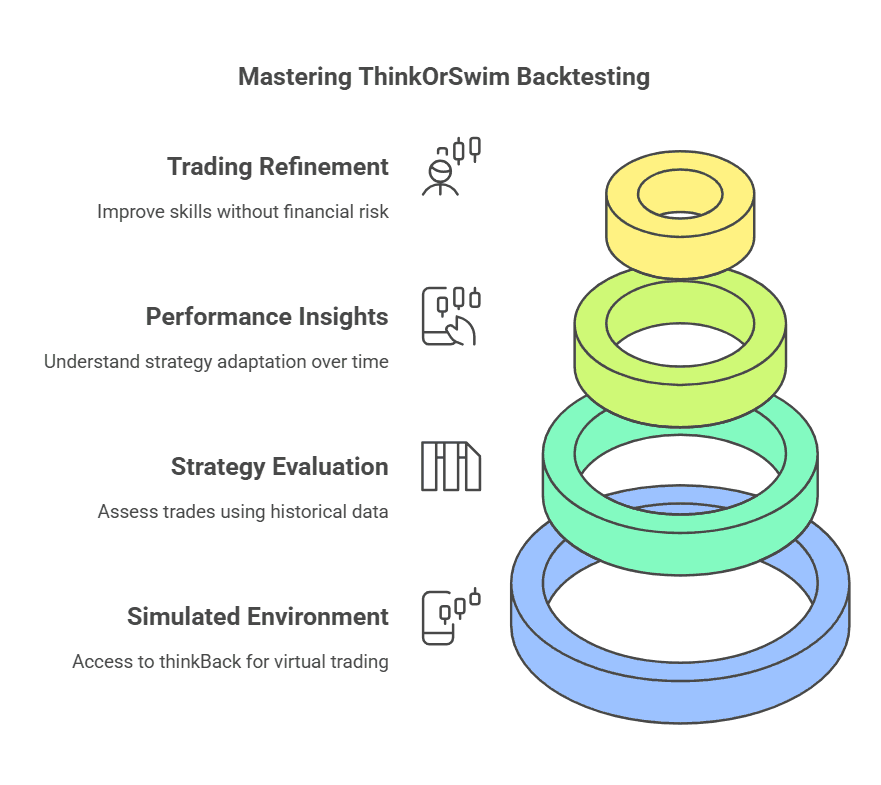

Thinkorswim backtesting is a powerful tool that allows you to evaluate a trading strategy using historical market data. It gives you the freedom to experiment with different market conditions before risking real money. Moreover, it helps you refine your trading style as you learn from both winning and losing scenarios. ThinkOrSwim, often called TOS, is a robust trading platform provided by TD Ameritrade. It offers advanced features and a user-friendly interface that makes backtesting less intimidating for new traders.

When you backtest, you run simulated trades based on specific rules. This approach shows how a strategy might have performed in the past. As a result, you get a clearer view of your trading performance. Many experienced traders consider backtesting an essential step because it gives insight into how well a strategy adapts to time frames and various market hours. Additionally, the process can alert you to flaws in your plan, saving you from actual trading losses later.

Thinkorswim backtesting provides a simulated trading environment called thinkBack. You can access daily charts, custom strategies, and technical indicators to evaluate your trade setup. These tools, along with the community of stock market enthusiasts who share their experiences, create a rich environment for learning. From forex market tests to simple stock market investors’ approaches, TOS accommodates a broad range of trading needs.

This beginner-friendly tutorial will guide you through the backtesting process step by step. You will learn how to set up your trade entry and exit conditions, analyze historical performance, and even compare theoretical trades against real-time market moves. By the end, you will feel more confident in your trading journey. You will also understand why thinkorswim backtesting is such a valuable tool for stock traders who want to improve their trading skills without risking actual capital.

Why Backtesting Matters

Backtesting Capabilities are crucial to anyone who wants to refine an investment strategy. Essentially, you replay past price action to see how your rules hold up in different market conditions. This replay can involve specific time frames, like daily charts or even shorter intervals. As you watch the outcome of each trade setup, you discover whether your theoretical trades generate consistent gains or worrying losses.

Spotting Strengths and Weaknesses

One major benefit of using a robust backtesting feature is that it reveals your strategy’s strengths and weaknesses. A plan that works well in a bull market may falter in a bear market. Similarly, a strategy might look good on daily charts but perform poorly on intraday charts. By comparing multiple time frames, you gain a more accurate view of your trading strategy’s adaptability.

- Strengths: Identify conditions under which your rules excel (e.g., strong trending markets).

- Weaknesses: Uncover moments when the strategy fails (e.g., choppy, range-bound markets).

Backtesting also helps you stay realistic about future performance. Even if your historical performance looks fantastic, there is no guarantee of similar outcomes going forward. However, testing under varied market conditions does improve your odds of creating a more resilient trading style.

Reducing Emotional Bias

Many traders struggle with emotions, especially when real money is on the line. By running simulated trades through thinkorswim backtesting, you remove that anxiety. You rely on data rather than guesswork. Paper trading through this powerful tool simulates real-time decisions using virtual money. This process allows you to refine your rules until you are ready to risk actual capital in the market. Over time, less emotional trading leads to better discipline and more consistent trading performance.

Getting Started with ThinkOrSwim Backtesting

Accessing the thinkBack Feature

To begin the backtesting process on ThinkOrSwim, you first need to locate the thinkBack feature. Launch your TOS platform and log in. Navigate to the “Analyze” tab, then select “thinkBack.” This built-in module allows you to place theoretical trades and see how they would have played out historically. ThinkOrSwim’s advanced trading functionalities, such as custom studies and Exclusive indicators, integrate seamlessly here.

You can choose a date in the past to simulate trades. The platform fetches the historical price from that specific day. Then, it updates your positions as if you were trading during those market hours. This approach is beneficial if you want to test a trade setup or an investment strategy on daily charts or shorter intervals.

Defining Your Entry and Exit Conditions

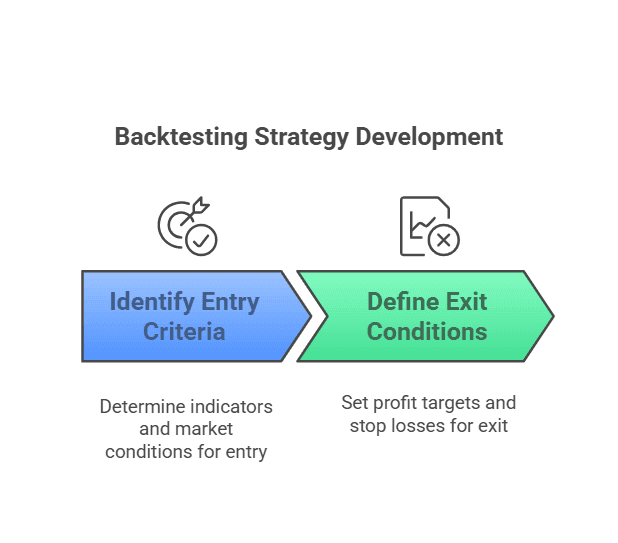

A critical part of backtesting is clarity in your trading rules. In other words, you must decide on entry criteria and exit conditions:

- Entry Criteria:

- Indicators involved (e.g., moving averages, RSI, or other technical indicators).

- Price action triggers (e.g., a specific candlestick pattern on daily charts).

- Market conditions that need to be met (e.g., above a certain moving average).

- Exit Conditions:

- Profit targets based on percentage gains.

- Stop losses to minimize potential damage if the market turns.

- Time-based exits (e.g., exit after a predetermined number of days).

Checking Your Strategy Report

After running your theoretical trades, ThinkOrSwim generates a basic summary of your trading performance. This report might include metrics such as net profit, win rate, average gain, and more. Take the time to review these numbers carefully. Look for patterns in winning trades and losing trades. For instance, you might discover that certain market conditions (like low volatility) work against your plan.

Though the default strategy report offers valuable insights, you can also use custom indicators or advanced features to expand your analysis. The more you understand the data, the easier it becomes to adjust your rules for improved performance.

Step-by-Step Backtesting Process

Step 1 – Select a Market and Time Frame

Choose the market that interests you, such as the stock market or the forex market. Then, pick a time frame for your analysis. Daily charts are popular for swing traders who want a broader trade plan. Meanwhile, shorter intervals might suit more active traders seeking faster feedback. ThinkOrSwim backtesting supports different chart types so you can tailor the analysis to your trading style.

Step 2 – Apply Technical Indicators and Custom Strategies

Next, add relevant tools to help you test your trading strategy thoroughly. You can use the platform’s built-in technical indicators or create custom strategies through ThinkScript. If you are new, start with simple elements like moving averages or basic oscillators. More advanced traders often incorporate custom studies or advanced features to refine signals. In any case, keep an eye on the market conditions that might affect these indicators.

Step 3 – Place Simulated Trades

Once your layout is set, place simulated trades via thinkBack. This action is similar to paper trading, except you focus on a previous date rather than real-time data. Enter your intended share size, trading volume, and any protective stops or targets. Each position gets tracked as the simulation moves forward day by day, mirroring historical performance.

- Important Tip: Record each trade setup in a journal or spreadsheet. That way, you can revisit your decisions and outcomes for deeper analysis later.

Step 4 – Analyze Results and Adjust

Finally, review the outcomes of your hypothetical trades in detail. Check whether your exit conditions triggered at the right time. Evaluate net gains or losses across multiple trades. If you spot a consistent pattern of failure under specific market conditions, consider refining your rules. This iterative approach ensures your strategy evolves as you gain more insight. You can pinpoint the best formula for your strategy report by comparing multiple sets of simulated trades.

Common Pitfalls and Mistakes in ThinkOrSwim Backtesting

Backtesting on ThinkOrSwim is undoubtedly a powerful tool. Yet, many novice traders and even experienced traders fall into certain traps when they use the thinkBack feature. These pitfalls can lead to misleading results, poor trading decisions, and frustration.

Overfitting Your Strategy

One major error is overfitting your investment strategy to historical price data. Overfitting happens when your rules match past data too perfectly, capturing random market noise rather than genuine patterns. As a result, your trading performance might look stellar in the backtest. However, once you move to real money trades, the strategy may fail due to ever-changing market conditions.

- How to Avoid:

- Use multiple time frames and varied market periods—bull market, bear market, and sideways market to see if your rules remain consistent.

- Avoid using too many technical indicators with no clear purpose. Each indicator should serve a specific function in your trade setup.

Ignoring Slippage and Commissions

Thinkorswim backtesting often simulates trades without factoring in additional costs like broker commissions (though TD Ameritrade has specific approaches to trading commissions) and slippage. Slippage refers to the difference between your expected fill price and the actual price you get in a live trade, especially in fast-moving market hours. If you ignore these real-world factors, your backtesting results might be too optimistic.

- How to Avoid:

- Add a small buffer to your theoretical trades to account for slippage.

- If your trading platform allows, adjust your backtest settings to factor in estimated commissions.

Using Unrealistic Position Sizes

Sometimes traders set extremely large position sizes or ignore margin requirements during their backtest. This approach can inflate results artificially, especially in a short time frame. For instance, a $100,000 paper trading account can quickly grow to unrealistic levels if you are not mindful of position sizing rules.

- How to Avoid:

- Use position sizes that mirror what you might genuinely trade in real time.

- If you plan to trade with $10,000 of actual capital, do the same in your simulated trading environment.

Failing to Test Multiple Market Conditions

Market conditions are rarely static. A simple strategy might work well in a bullish environment but fail in volatile or choppy scenarios. Some stock market investors only test their plan on daily charts during a strong uptrend, missing out on how it might behave when the market turns. This oversight can lead to actual trading losses when real-world conditions vary.

- How to Avoid:

- Test your approach across different historical market cycles (e.g., bullish, bearish, and sideways).

- Evaluate performance over a longer backtest period to capture enough variety in price behavior.

Expanding Your ThinkOrSwim Backtesting Approach

After you have mastered the basics, you may want to push your thinkorswim backtesting further. ThinkOrSwim offers advanced trading strategies, custom indicators, and additional resources that can transform a basic plan into a more sophisticated system. These expansions can help you adapt to new market conditions and broaden your overall trading style.

Using Custom Studies and Exclusive Indicators

Thinkorswim features a scripting language called ThinkScript. This language allows you to develop custom studies and exclusive indicators for your charts. You can implement unique signals that might not exist in the default library. For instance, you can code a tool to generate signal alerts when certain candlestick patterns appear. You can also create an exit bar condition based on volume spikes or momentum thresholds.

- Why It Helps:

- You tailor your analysis to match your personal trading goals.

- You can combine multiple technical indicators into one study, reducing chart clutter and making it easier to interpret signals.

Testing More Complex Strategies

Once you feel comfortable with a simple strategy, you can integrate advanced trading functionalities. For example, you could use ThinkScript to develop algorithmic trading capabilities by automating portions of your trade setup. Automated trading strategies can adapt quickly to intraday movements, although they come with their own challenges such as the need for robust backtesting to ensure accurate signals.

Additionally, you can explore advanced options trading tools within ThinkOrSwim. These include multi-leg options strategies that require precise timing and risk management. By applying the thinkBack feature, you can see how an options-based approach might perform across various market conditions, from sudden spikes to slow grinds.

Combining Thinkorswim with External Analysis

Although ThinkOrSwim is a feature-rich backtesting software platform, you might benefit from combining it with external resources. Some traders prefer to run initial scans or market analysis in different tools, then refine or confirm ideas in TOS. You could also compare your TOS backtesting experience with data from other backtesting Vendors like NinjaTrader 8 or even Real-Time NinjaTrader solutions.

- How It Helps:

- You gain a second opinion on your strategy’s viability.

- You see whether any discrepancies exist in how each platform retrieves historical data or calculates performance metrics.

Exploring Paper Trading for Real-Time Practice

Thinkorswim offers a paper trading feature that goes beyond pure backtesting. In paperMoney mode, you can place virtual trades in live markets without risking actual capital. This experience sits between theoretical trades and real money. It is an excellent way to check if your system rules still hold when you must react in real time to price charts and trading volume.

- Key Advantage:

- You can test how well you handle emotional pressures without incurring actual trading losses.

- You can refine your broader trade plan before transitioning to a live account.

Comparing ThinkOrSwim Backtesting with Other Platforms

No single platform is perfect for all traders. While ThinkOrSwim backtesting is undeniably powerful, it’s helpful to compare its features to other options. That way, you can decide if TOS stands as your base for stock traders, or if you might benefit from additional tools.

NinjaTrader 8 and Other Alternatives

NinjaTrader 8 is a well-known platform that also offers backtesting features. It caters to active traders who want algorithmic trading capabilities and direct market access. Like TOS, it provides Real-Time Market Data and advanced charting. However, NinjaTrader might have a steeper learning curve for novice traders who are just beginning their journey.

- Pros of NinjaTrader 8:

- Highly customizable with a wide array of standalone trading indicators.

- Potential for advanced automation and strategy development.

- Cons:

- Some advanced features require a paid license.

- Not as beginner-friendly as ThinkOrSwim.

Strengths of ThinkOrSwim Backtesting

User-Friendly Interface: TOS is known for its intuitive design. Novice traders can quickly adapt to charting tools and the thinkBack feature.

- Integration with TD Ameritrade: You can manage real accounts, analyze simulated trades, and transition between them seamlessly.

- Vibrant Community: ThinkOrSwim has an active trader community, which offers a deep knowledge base, video tutorials, and code from post samples.

- Robust Backtesting Feature: The synergy of custom strategies, advanced trading tools, and a large user community fosters a strong environment for learning.

Despite these positives, TOS may not offer every advanced version of technical interface user features found in specialized software. Yet for many traders especially those who value a comprehensive approach ThinkOrSwim remains a valuable tool.

Deciding What’s Best for Your Trading Style

Each trader has unique needs. If you aim to become a frequent trader who relies on complex, automated trading systems, you might prefer a platform that focuses heavily on algorithmic trading capabilities. If you want an all-in-one trading platform with user-friendly paper trading, charting, and backtesting, ThinkOrSwim is a solid choice.

- Questions to Ask:

- Do you require advanced analysis tools for economic news events and time-based events?

- Is your focus primarily on stocks, forex market, or a mix of assets?

- How important is real-time data for your trading goals?

Answering these questions will lead you to the platform that aligns best with your personal preferences and approach to trading.

Additional Tips and Resources

Thinkorswim backtesting becomes even more effective when you combine it with good habits and quality education. These suggestions will help you make more informed trading decisions, improve your trading skills, and avoid common pitfalls.

Maintain a Trading Journal

A trading journal is an essential part of any backtesting guide. Document each trade setup, market conditions, and final outcomes. Track both the winning and losing trades. Over time, you will gather valuable insights about your strengths and weaknesses. This record also provides data you can revisit if your trading performance changes as market conditions shift.

- Tips for Success:

- Include screenshots of price charts for each trade (candle by candle if needed).

- Note any emotional responses you felt. This step can help you identify psychological barriers.

Seek a Private Discord Community or Other Groups

Consider joining a Private Discord community or a user community dedicated to ThinkOrSwim. In these groups, active traders and novice traders alike exchange ideas, share custom indicators, and discuss new ways to refine the backtesting process. You might find code snippets or instructions for advanced trading strategies that you can adapt to your own plan.

- Benefit:

- Access to a wide network of traders with varied backgrounds and strategies.

- Real-time feedback on your script or approach, speeding up your learning curve.

Educate Yourself Continuously

While TOS is user-friendly, there is still a lot to learn about advanced trading tools, custom strategies, and even the approach to real time market data. TD Ameritrade offers plenty of educational resources like webinars and tutorials. You can also explore external channels for in-depth instructions:

- Video Tutorials: Visual step-by-step guides that show you how to navigate TOS and create advanced scripts.

- Online Courses: Paid or free courses that detail ThinkScript essentials and advanced concepts.

- Forums: Public and private forums where you can read about the experiences of advanced traders who have built complex backtesting tools.

Conclusion

Thinkorswim backtesting provides a structured way to evaluate how a trading strategy might perform under various market conditions. By placing simulated trades in the thinkBack feature, you gain a preview of your trading performance without risking actual capital. This combination of theoretical trades, robust backtesting feature options, and advanced analysis tools makes TOS a strong base for stock traders and a solid choice for refining your trading style.

As you move forward, remember to avoid common pitfalls such as overfitting or ignoring slippage. Instead, test multiple time frames and keep a well-documented trading journal. Use custom studies, advanced features, and even external platforms like NinjaTrader 8 to cross-check your results. By building on your backtesting experience step by step, you can better handle real money trades. Most importantly, you will develop the confidence needed to adapt to shifting market hours and conditions.

Thinkorswim backtesting is only one part of a broader trade plan, but it serves as a significant milestone on your trading journey. Whether you are a novice trader or someone with moderate experience, the insights gleaned from accurate backtesting can guide you toward more consistent success. Stay curious, keep learning, and refine your approach continuously. Over time, you will discover that backtesting on ThinkOrSwim combined with good risk management and emotional discipline can open the door to steady growth in both your knowledge and your trading account.

Trade Smarter with TradeSearcher!

Discover better trading strategies using TradeSearcher’s easy-to-use backtesting tools. Learn from past data, refine your plans, and make smarter decisions. Start today and trade with confidence!