Table of Content

Master UT Bot Alerts: Strategy Guide with 3 Proven Backtest Examples

By Vincent NguyenUpdated 408 days ago

Introduction: What Are UT Bot Alerts?

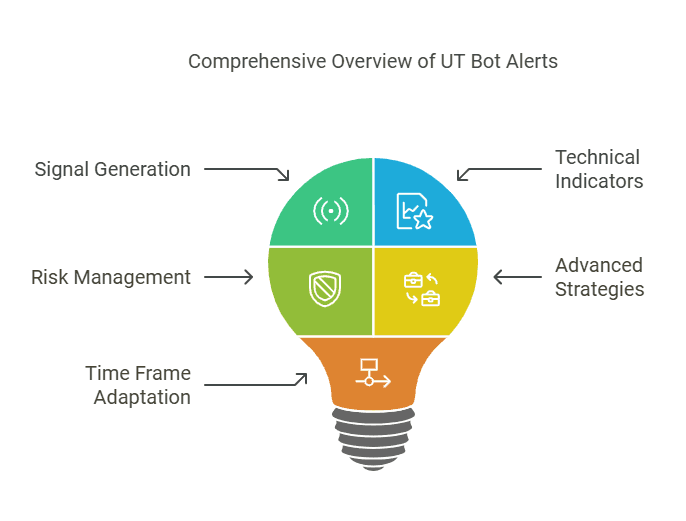

UT Bot Alerts have gained traction among traders looking for a straightforward and effective trading strategy. These alerts generate buy and sell signals based on price action and trend analysis, often displayed as a green arrow for potential entries and corresponding markers for exits. Their simplicity makes them particularly appealing to beginners seeking guidance without delving into complex calculations. However, no strategy works alone. Pairing UT Bot Alerts with other technical indicators, market insights, and careful risk management is essential. This article will guide you through setting up UT Bot Alerts, adapting them across time frames, and fine-tuning Indicator configuration. You'll also see three detailed backtests and learn how to combine UT Bot Alerts with other strategies to enhance performance—all while considering the inherent risk of loss in trading.

Understanding the Basics of UT Bot Alerts

Many traders want a straightforward system that provides clear signals. UT Bot Alerts aim to fulfill that exact need. They combine algorithmic logic with visual prompts on your chart. This method helps you identify potential shifts in price movements without decoding multiple overlapping lines or unfamiliar formulas.

What Are UT Bot Alerts?

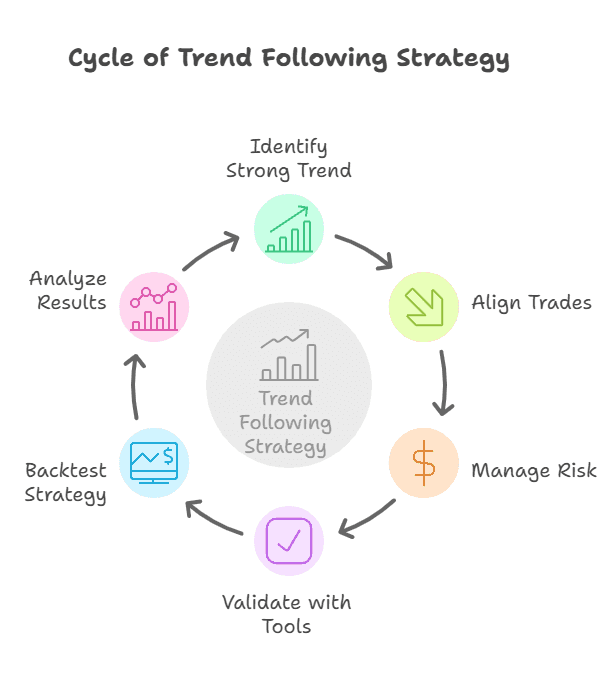

These alerts are a Custom Trading Indicator designed to send notifications when market conditions meet specific criteria. Generally, they rely on trend indicators and technical indicators like moving averages or volatility measures. Once the algorithm detects a potential shift, the system draws a green arrow pointing upwards. This arrow often represents an alert buy signal. Conversely, a downward arrow could mean a bot alert sell signal is triggered. The system can work on multiple time frames. It suits day traders who watch 1-Minute Stock Prices and swing traders examining a 4-hour chart.

Why Consider UT Bot Alerts Over Conventional Signals?

Many traders appreciate UT Bot Alerts for their simplicity. While traditional methods require mastering candlestick formations or Drawing Arrows manually, UT Bot Alerts do the heavy lifting. Because this is a custom indicator, you can adjust its settings to align with your strategy. You can also combine it with other approaches like a trend reversal strategy or a momentum-based filter. The tool shines by alerting you in real time. You can use push notifications on TradingView or your broker’s platform. These notifications help you focus on price action rather than staring at charts all day.

Configuring UT Bot Alerts for Different Time Frames

UT Bot Alerts are highly versatile. You can apply them to various intervals, including a TradingView Time Frame 30 minutes or even a 4-hour chart. Your choice depends on your trading style. Day traders often watch short intervals like five-minute or 1-Minute Stock Prices. Swing traders might look at the daily signal or multi-day signals. Position traders might opt for weekly charts. No matter your preference, you can still incorporate UT Bot Alerts effectively.

Basic Settings and Indicator Configuration

Once you add UT Bot Alerts to your chart, you will see an Indicator configuration panel. Here, you can set parameters like sensitivity or signal confirmation. A higher sensitivity might produce more frequent signals. However, it can also increase the chance of false positives. A lower sensitivity setting might filter out minor market noise. This lower setting can help if you only want signals for strong trends. If you need more confirmation, you can combine UT Bot Alerts with other tools such as Regression Candles or Heikin Ashi Candles. These candles smooth out volatile price action, making it easier to spot a trend reversal strategy.

Matching Settings to a Suitable Indicator Approach

Different traders have different needs. Day traders might prefer UT Bot Alerts set to higher sensitivity. This setting aims to capture swift moves in the current price. Swing traders might reduce the sensitivity to avoid overtrading. If you also use forex trading signals, you might set UT Bot Alerts to align with your typical hold times. A multi time frame trend analysis approach can be particularly powerful. By reviewing signals on a TradingView Time Frame 30 minutes and then cross-referencing with a 4-hour chart, you can verify if a shorter-term signal aligns with the broader trend. This synergy can reduce whipsaws and strengthen decision-making.

Key Components of UT Bot Alerts Signals

UT Bot Alerts stand out due to their simplicity, but understanding each part of the signal can further boost effectiveness.

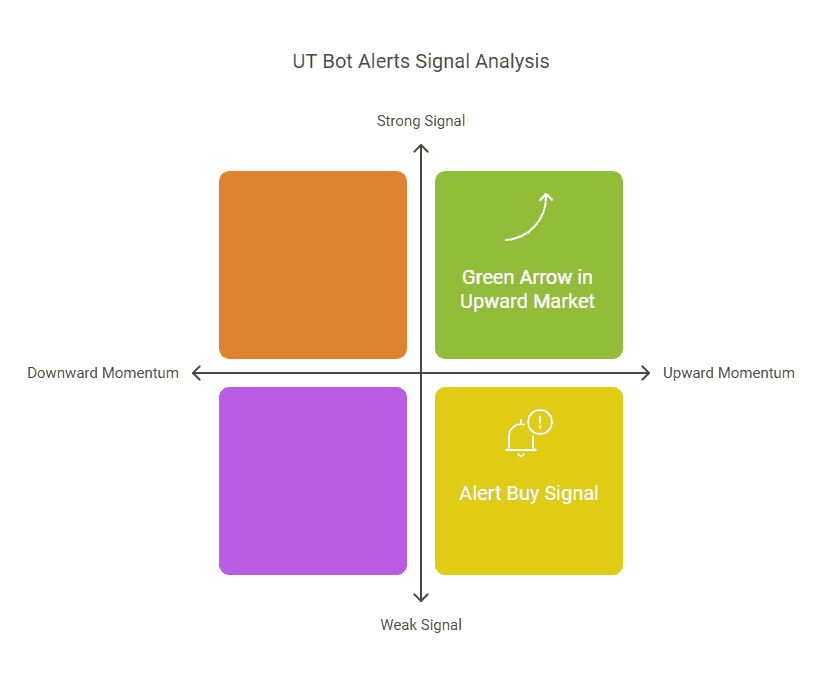

Price Position and Trend Strength

One crucial aspect is your price position relative to key levels. The indicator might show a green arrow when the price crosses above a moving average. It might issue a bot alert sell signal when the price crosses back below that same level. The strength of the signal often correlates with how strongly price diverges from its previous time reference or average. If you see a green arrow during a generally upward market, it could signify a robust signal.

Alert Buy Signal and Bot Alert Sell Signal

An alert buy signal occurs when UT Bot Alerts detects upward momentum. This condition might involve a crossover or a shift in volatility. The system can send you a notification so you can act promptly. A bot alert sell signal works similarly for downward moves. Both signals aim to streamline your decision process. They remove guesswork when you watch multiple markets or financial instruments.

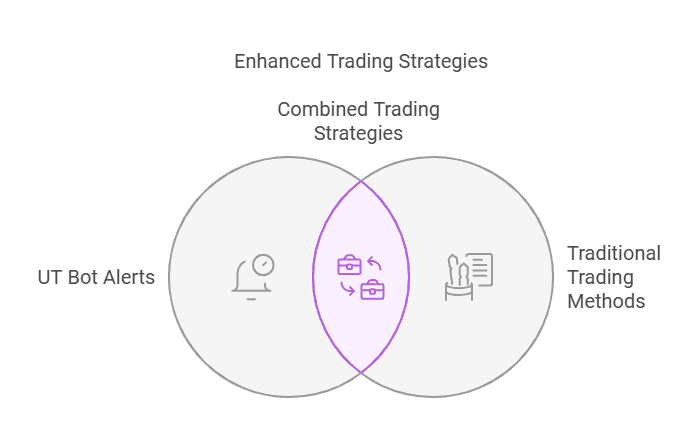

How to Use UT Bot Alerts Alongside Other Technical Indicators

It pays to diversify your approach. While UT Bot Alerts can function alone, blending them with other technical indicators can lead to better decisions. Mixing signals prevents overreliance on one data point. This integration also meets the needs of experienced investors who want robust frameworks.

Combining UT Bot Alerts with Bollinger Bands Strategy for Cryptocurrencies

Many traders look at a Bollinger Bands Strategy for Cryptocurrencies to gauge volatility. Bollinger Bands measure standard deviations around a moving average. When price touches the upper band, it may indicate overbought conditions. When price dips to the lower band, it could suggest oversold levels. By adding UT Bot Alerts, you get clearer entry and exit signals. You might see an alert buy signal near the lower band if UT Bot Alerts also triggers a green arrow. This two-pronged confirmation can increase confidence in your trade.

Using UT Bot Alerts with Larry Williams RSI 2-Scalping Strategy

Another noteworthy strategy is the Larry Williams RSI 2-Scalping Strategy. This method focuses on short-term momentum. It uses the RSI (Relative Strength Index) with a period of two. Traders often look for oversold readings below a certain threshold. They then buy when RSI moves back up. If UT Bot Alerts also signals a bullish turnaround, that confluence can be powerful. On the flip side, if RSI indicates overbought conditions and you see a bot alert sell signal, you can exit or short confidently.

Three UT Bot Alerts Backtest Examples

Now, let’s dive into the heart of this article: the backtests. We will present three distinct scenarios. Each scenario will showcase how UT Bot Alerts can perform under different market conditions and time frames. These examples should help you decide if UT Bot Alerts work for your style.

Backtest #1 – Short-Term Equity Trades Using 1-Minute Stock Prices Context

We start with a highly active environment: 1-Minute Stock Prices. Our sample ticker is a mid-cap tech stock known for rapid intraday swings. We set UT Bot Alerts to a relatively high sensitivity. This means the system triggers more green arrow signals, but also includes more potential noise.

Setup

- Trading Time Frame: 1 minute

- Indicator Configuration: Higher sensitivity for quick signals

- Additional Filters: A short moving average to confirm the current price direction

Results

Over 100 trades in one month, the strategy produced a moderate win rate. Gains mostly occurred when the price crosses the short moving average in sync with a green arrow. Losses happened when false breakouts triggered quick reversals. However, the tight stop-loss strategy reduced the risk of loss. Overall, the profit factor was acceptable, though commissions could eat into returns. This scenario illustrates that UT Bot Alerts can suit scalpers. But you must remain vigilant due to the fast pace of 1-minute intervals.

Backtest #2 – Swing Trading a 4-Hour Chart on Major Forex Pair Context

Next, we shift to a 4-hour chart of a major currency pair. We chose EUR/USD for stable liquidity and consistent forex trading signals. Swing traders often prefer this time frame because it requires fewer trades while still capturing substantial moves.

Setup

- Trading Time Frame: 4 hours

- Indicator Configuration: Medium sensitivity for balanced signals

- Additional Tools: A momentum indicator for confirmation

Results

Over a three-month period, UT Bot Alerts generated around 25 signals. Roughly 60% resulted in profitable trades. The bot alert sell signal often coincided with fundamental news, which triggered strong downward price moves. Combining UT Bot Alerts with a momentum gauge helped filter out false signals. The net gains were steady, and drawdowns were moderate. This backtest demonstrates how UT Bot Alerts can assist swing traders. They provide structured entries and exits without excessive screen time.

Backtest #3 – Daily Signal on a High-Volatility Cryptocurrency Context

Finally, let’s analyze a popular altcoin with wild price swings. We conduct a daily chart analysis to reduce noise and test broader trends. Cryptocurrencies often see sharper fluctuations. This environment can be rewarding but carries added risk of loss.

Setup

- Trading Time Frame: Daily

- Indicator Configuration: Lower sensitivity to avoid whipsaws

- Additional Confirmation: We used Heikin Ashi Candles to smooth out choppy price movements

Results

Over six months, UT Bot Alerts triggered around 10 trades. Most signals aligned with major bullish or bearish runs. The alert buy signal appeared when the price position stabilized above a certain moving average. The bot alert sell signal helped exit when momentum faded. The strategy captured several multi-day swings. Overall, the returns were significant. However, there were two notable losses when the market reversed abruptly. This outcome underscores the need for proper risk management. Still, the daily UT Bot Alerts offered a structured framework to ride big moves.

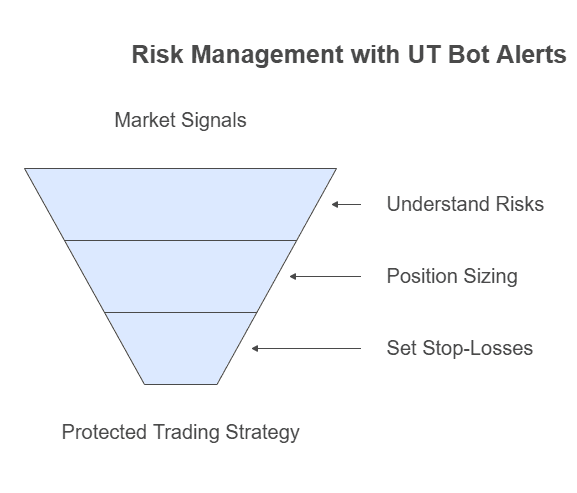

Incorporating UT Bot Alerts into Your Risk Management Plan

Every strategy, no matter how accurate, comes with inherent uncertainty. Markets can turn volatile due to macro events, sudden news, or liquidity shifts. UT Bot Alerts don’t eliminate these risks. They only aim to guide your decision process.

The Importance of Proper Risk Disclosure

Before relying on UT Bot Alerts, read the Risk disclosure for any platform you use. Understand that no system guarantees profits. Each financial instrument carries potential rewards but also a real risk of loss. Make sure you grasp position sizing, stop-loss placement, and the emotional discipline required. If you are relatively new, start small. Gradually increase your exposure only when you feel confident.

Position Sizing and Protective Stops

A successful trader knows how to protect capital. Even if a green arrow or an alert buy signal appears, confirm the setup. Then, place a stop-loss to limit downside if the market unexpectedly turns. Depending on your style, you can use the previous time high or low as a logical stop level. Alternatively, you might rely on volatility-based stops. Tools like ATR (Average True Range) can help you determine an optimal safety cushion.

How UT Bot Alerts Compare to Other Custom Trading Indicators

The trading world is filled with custom indicator packages promising easy gains. UT Bot Alerts stand out by offering a clear approach. Yet, you might wonder how they stack up against other solutions.

Alerts Indicator vs. Regression Candles

Alerts indicator packages usually focus on notifying you about major market pivots. Regression Candles help identify the trend path by smoothing out short-term fluctuations. UT Bot Alerts combine the best of both worlds by offering immediate signals that also account for trend movement. If you crave a deeper view of the market’s path, you can overlay Regression Candles and compare how UT Bot Alerts align with them.

Finding a Suitable Indicator Mix

No single tool is perfect. Combining UT Bot Alerts with a few carefully chosen methods can yield comprehensive insights. Keep the chart readable. Cluttered charts often lead to confusion. If your UT Bot Alerts conflict with other signals, look for reasons. Is the market sideways? Is volatility abnormally high? Such questions can guide you toward a balanced approach. Moreover, keep an eye on your Indicator configuration. It should reflect your risk profile and asset class.

Using UT Bot Alerts to Access Exclusive Content and Advanced Strategies

Various platforms now integrate UT Bot Alerts. Some offer exclusive content like detailed tutorials, premium templates, and user forums. These resources can jumpstart your learning curve.

Subscription Services and Communities

Some UT Bot Alerts creators offer monthly or yearly subscriptions. These often include exclusive content such as advanced tutorials, webinars, or direct chat support. Participating in a community can broaden your perspective. You may learn from others who tested UT Bot Alerts on different assets. Always read the Risk disclosure provided by these communities. Understand that even with shared insights, no community or tool can remove the risk of loss entirely.

Combining UT Bot Alerts with Advanced Strategies

As you grow in skill, you might merge UT Bot Alerts with advanced strategies. For instance, combining UT Bot Alerts with a trend reversal strategy can capitalize on early signals of momentum change. You can also employ custom filters for high-impact news events. Another approach is to integrate UT Bot Alerts with automated bots. This synergy can help remove emotion from trading. However, be mindful of over-automation. The human element still plays a crucial role in navigating unexpected market conditions.

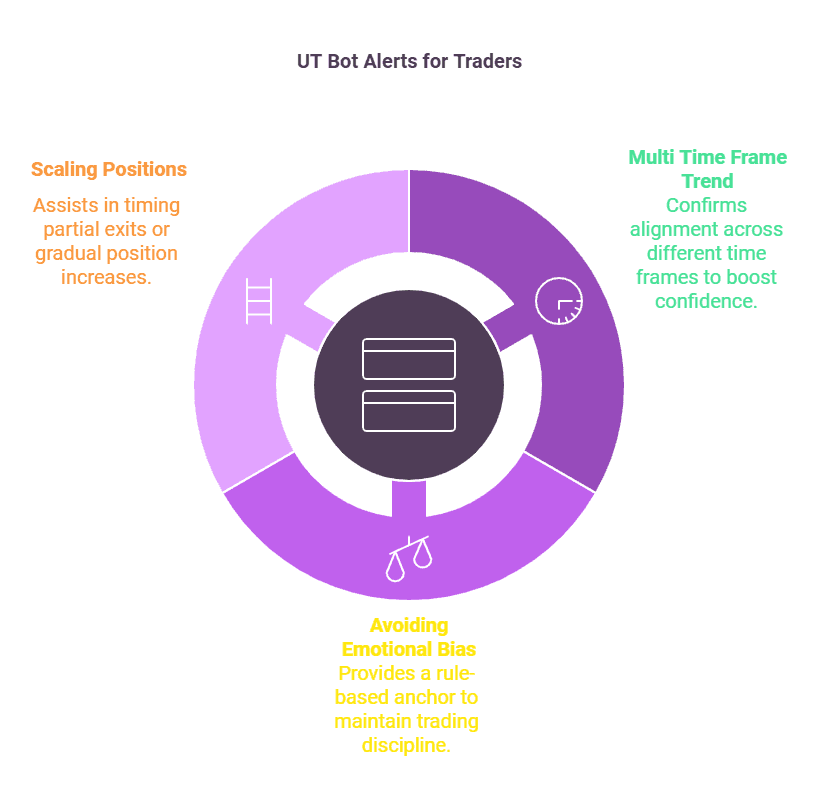

UT Bot Alerts for Experienced Investors: More Than Just Entry Signals

Even experienced investors can find value in UT Bot Alerts. They provide a second opinion on trades you plan to take. They also help in timing partial exits or scaling into positions.

Multi Time Frame Trend and Confluence

Many seasoned traders rely on confluence. They check multiple signals or time frames for alignment before entering a position. UT Bot Alerts can serve as one of these signals. By confirming a multi time frame trend, you reduce the likelihood of jumping into a false move. For instance, if the daily chart is bullish and the TradingView Time Frame 30 minutes triggers an alert buy signal, that synergy can boost your confidence.

Avoiding Emotional Bias

Veteran traders know how easy it is to become overconfident after a series of wins. UT Bot Alerts provide a consistent, rule-based signal. This consistency can act as a psychological anchor. It reminds you to follow your plan rather than chasing impulses. At the same time, you remain free to override signals if you spot fundamental data or macro trends that disagree with a mechanical alert. The key is balance.

Practical Tips for Optimizing UT Bot Alerts

Simple is often better, especially if you’re just starting out. Yet, a few tweaks can refine your UT Bot Alerts usage. These practical tips can guide your setup and help you avoid common pitfalls.

Backtest Regularly

Markets change, and so does the effectiveness of any custom indicator. Regular backtests are essential. Use your platform’s data to verify whether UT Bot Alerts still align with current market conditions. If you switch to a new asset class, like commodities or cryptocurrencies, run fresh tests.

Learn to Read Chart Fig and Other Visual Aids

While UT Bot Alerts supply alert buy signal and bot alert sell signal, deeper context helps. Check the chart fig or any available annotated chart. Tools like Drawing Arrows allow you to mark potential support and resistance zones. If your platform supports Heikin Ashi Candles or Regression Candles, consider using them to smooth out the noise. This clarity can help you spot times when UT Bot Alerts might generate conflicting or premature signals.

Monitor News and Fundamentals

No technical system is immune to the impact of economic data releases or breaking news. Keep track of events that could cause sudden shifts. If you see a green arrow but a major news release is imminent, you might delay entry or size down your position. Conversely, if the bot alert sell signal triggers just before a significant announcement, consider how that news might amplify price volatility.

Common Mistakes to Avoid with UT Bot Alerts

Traders sometimes assume that a new tool solves all problems. However, trading remains a skill-based endeavor. Here are some errors to avoid when using UT Bot Alerts.

Overtrading

A reliable tool can tempt you to take every signal you see. This habit often leads to excessive commission costs. It can also inflate losses when markets fluctuate unpredictably. Exercise restraint. Wait for clear confluence with other signals or overall market structure.

Neglecting Stop-Losses

Even if UT Bot Alerts provides a perfect entry, price can reverse without warning. Always use a stop-loss. Failing to set a protective stop can jeopardize your account. Remember, no system is flawless. The risk of loss is ever-present in every financial instrument.

Mistaking Signals for Guaranteed Investment Advice

UT Bot Alerts is not investment advice. It is a mechanism for generating potential signals. You must apply your own judgment and risk management to each trade. If uncertain, consult licensed financial professionals. Their insights can complement mechanical signals.

Final Thoughts and UT Bot Alerts Conclusion

UT Bot Alerts provide a user-friendly way to structure trading signals, making them ideal for beginners and valuable for experienced investors alike. Throughout this guide, we emphasized their versatility, from helping you trade 1-Minute Stock Prices to longer intervals like the 4-hour chart. By pairing them with other technical indicators, such as the Bollinger Bands Strategy for Cryptocurrencies or the Larry Williams RSI 2-Scalping Strategy, you can build advanced strategies tailored to your goals.

Remember, no tool guarantees profits or eliminates the risk of loss. A balanced perspective and disciplined risk management are essential for success.

Ready to refine your trading strategies?

Use TradeSearcher to find the best backtests and trading insights for any ticker. Visit TradeSearcher today to empower your trading journey!