Table of Content

Good Option Trading Stocks: How to Choose and Trade the Best Picks

By Vincent NguyenUpdated 392 days ago

Good Option Trading Stocks: The Best Stocks for Day Trading

Good option trading stocks are vital for new day traders who aim to maximize short-term gains while keeping risks in check. Day trading relies on capturing rapid price swings within the same trading session, making it a fast-paced approach that demands careful preparation.

By focusing on stocks with high liquidity and robust options activity, traders can quickly buy or sell contracts without facing hefty spreads. Moreover, picking established market movers known for news-driven volatility such as tech giants or popular consumer brands often opens the door to more consistent trading setups. For beginners, understanding these core principles is essential before risking real capital.

This guide offers an easy-to-follow framework for identifying good option trading stocks, so you can build strong strategies rooted in reliable data and disciplined risk management for lasting success.

Day Trading Basics

Before delving deeper into good option trading stocks, it’s critical to grasp the basics of day trading itself. This fundamental knowledge lays the groundwork for assessing both the opportunities and challenges that come with intraday trading in the options market.

1. Definition and Key Characteristics

- Same-Day Trades: Day traders aim to buy and sell within one trading session, avoiding overnight exposure. This eliminates the possibility of “gap risk” where price changes happen between market close and the next day’s open.

- Frequent Transactions: Depending on the strategy, day traders can execute multiple trades in a single day, each targeting small price shifts.

- Short Holding Periods: A typical day trade might last anywhere from a few minutes to several hours, but positions are usually closed before the market closes.

2. Risk Management Essentials

- Stop-Loss Orders: These automated orders close your position if the stock or option moves against you by a specified amount. Stop-losses are crucial in day trading due to the high frequency of trades.

- Position Sizing: Allocating a small percentage of your trading capital to each trade can help mitigate catastrophic losses.

- Margin Requirements: Many brokers require a minimum balance (often $25,000 in the U.S.) for pattern day traders. Exceeding margin capacity can lead to forced liquidations.

3. Psychological Discipline

- Emotional Control: Rapid price changes can trigger panic or greed. Maintaining emotional composure is vital.

- Strategy Over Impulse: A well-defined trading plan that outlines entry, exit, and risk management criteria helps prevent impulsive decisions.

- Consistent Routine: Developing a routine that includes pre-market research, trading journal updates, and end-of-day review fosters methodical progression and learning.

By understanding these core elements, you’ll be better equipped to navigate the often unpredictable intraday environment. Once these foundational blocks are in place, choosing and trading good option trading stocks becomes an exercise in applying these core principles to specific, high-potential assets.

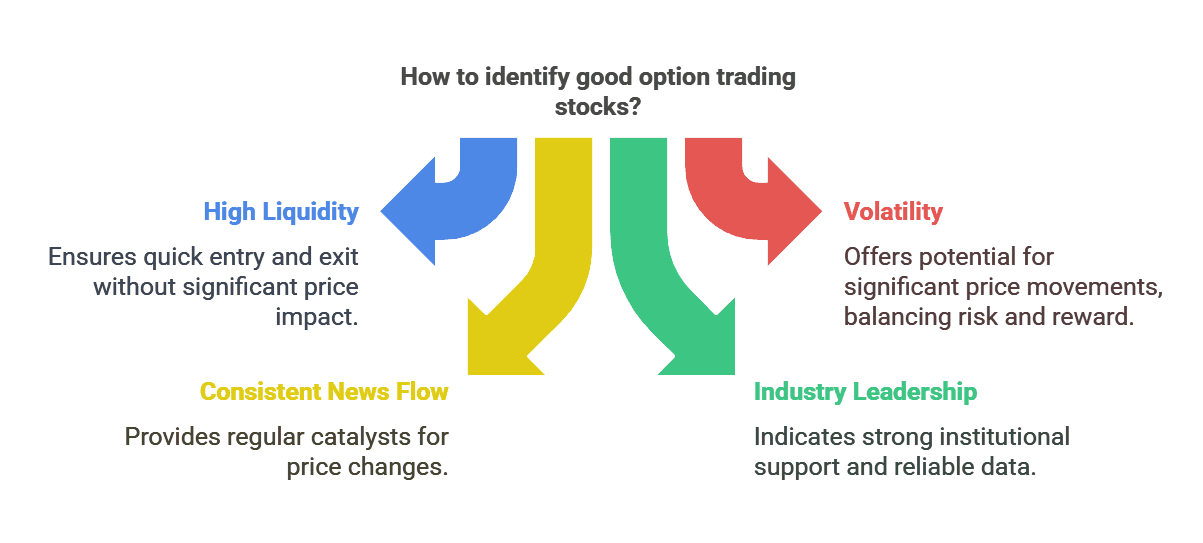

What Makes Good Option Trading Stocks?

Although many stocks list options, not all qualify as good option trading stocks. The distinction primarily comes down to attributes like liquidity, volatility, and consistent news catalysts. Let’s explore these characteristics in detail:

1. High Liquidity

Refers to how easily and quickly a stock or its options can be bought or sold without dramatically affecting its price.

When you’re in a fast-paced environment, you need the ability to enter and exit swiftly. High liquidity translates into narrower bid-ask spreads, reducing the cost of each trade and allowing for more precise execution.

Look for stocks whose option contracts consistently show sizable open interest and trading volume, as this signals a robust market of buyers and sellers.

2. Volatility

Volatility indicates the frequency and magnitude of price movements. While high volatility can magnify gains, it also increases risk.

Implied volatility is derived from option prices and reflects expected future price swings. Historical volatility is based on past price data. Both can help gauge whether a stock’s options are likely to offer suitable day-trading opportunities.

- Balancing Act: Extremely high volatility may cause unpredictable price spikes, but moderate-to-high volatility in good option trading stocks can create predictable patterns that experienced traders can exploit.

3. Consistent News Flow

- Why News Matters: Earnings releases, product announcements, regulatory decisions, and analyst upgrades/downgrades can all move a stock’s price sharply.

- Impact on Options: News events often increase implied volatility as traders speculate on potential outcomes, influencing option premiums and intraday price action.

- Practical Tips: Keep an economic calendar and watch for scheduled announcements, such as earnings calls or major industry conferences. Good option trading stocks generally feature regular news, offering a steady stream of trading catalysts.

4. Industry Leadership

- Market Leaders: Stocks that lead their respective sectors often enjoy large institutional followings, meaning heightened liquidity and consistent price movements.

- Brand Recognition: High-profile companies like Apple, Tesla, and Microsoft attract worldwide attention, driving up trade volume.

- Reliable Data: Well-known companies frequently publish updates, and analysts regularly cover them, ensuring readily available information for traders.

When these attributes converge in a single ticker, it becomes a prime candidate for intraday trading with options. By verifying liquidity, volatility, news presence, and leadership status, you can confidently identify the good option trading stocks most likely to deliver repeated day trading opportunities.

Top Choices for Good Option Trading Stocks

Among the many stocks that fit the liquidity and volatility criteria, a few stand out for day traders who focus on options. While market conditions fluctuate, some names remain perennial favorites due to their prominence, consistent trading volume, and the variety of strategies they enable.

1. Apple (AAPL)

- Liquidity and Volume: Apple is one of the most heavily traded stocks globally, featuring abundant option contracts and tight spreads.

- Volatility Profile: Though sometimes less volatile than startups, Apple still experiences significant intraday moves, particularly around product launches or earnings dates.

- News Flow: Frequent coverage by analysts and tech reviewers ensures a steady stream of potential catalysts. New iPhones, iPads, or software releases can spur short-term trends.

2. Tesla (TSLA)

High Volatility: Tesla is famous (or infamous) for substantial price swings within short time frames, which can be a boon for day traders seeking large intraday moves.

Active Options Market: TSLA options typically have robust open interest, facilitating easier entry and exit.

Catalyst-Driven: CEO tweets, product announcements, and quarterly delivery numbers frequently reshape market sentiment, creating rapid surges in option demand.

3. AMD (Advanced Micro Devices)

- Solid Liquidity: A favorite among tech enthusiasts and traders, AMD options generally remain liquid, keeping spreads manageable.

- Moderate-to-High Volatility: Moves can be significant, especially around earnings, product unveilings, or major semiconductor industry news.

- Correlation with Tech Sector: AMD often moves in tandem with broader tech trends, aiding sector-based strategies or pair trading opportunities (e.g., AMD vs. NVIDIA or Intel).

4. Microsoft (MSFT)

- Steady Performer: Often viewed as a slightly less volatile option than Tesla or some smaller tech names, Microsoft still sees enough movement for day traders, especially during earnings seasons or major acquisitions.

- Global Reach: As a mega-cap, its options market is well-established, offering a range of expirations and strikes.

- Ecosystem Catalysts: Developments in cloud computing (Azure), gaming (Xbox), and productivity software (Office) can spark intraday volume spikes.

5. NVIDIA (NVDA)

- Strong Sector Relevance: Riding the wave of AI, data centers, and gaming, NVIDIA can exhibit rapid price appreciation or decline.

- Frequent News Items: Product launches (like new GPUs) and speculation about AI demand often cause notable price gaps.

- Robust Options Chain: Its status as a technology leader means traders typically see high open interest in both calls and puts, making it a reliable day trading candidate.

While this is hardly an exhaustive list, these good option trading stocks represent a reliable starting point for beginners eager to explore day trading. Market dynamics may shift, so always keep an eye on broader economic indicators, company-specific news, and any emerging competitors that could provide equally enticing day trading opportunities.

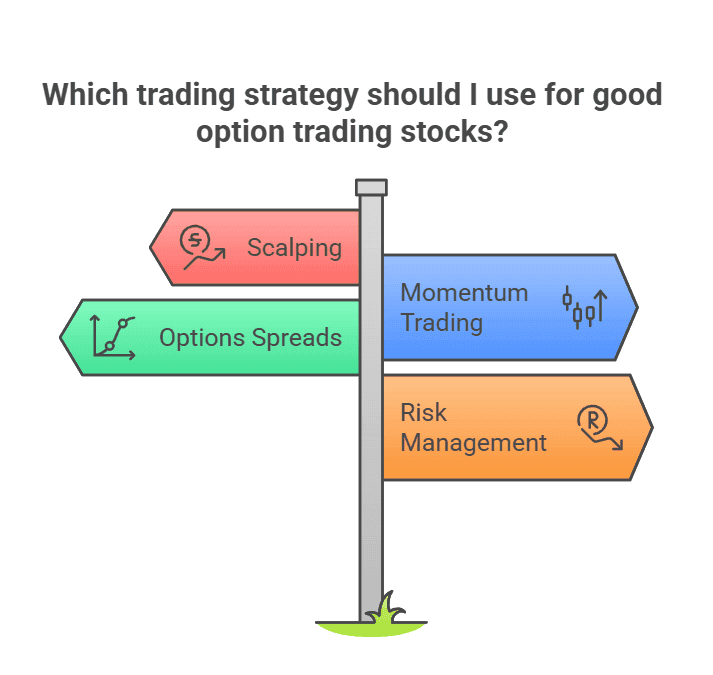

Strategies for Trading Good Option Trading Stocks

Understanding which stocks to trade is just one piece of the puzzle. Equally crucial is knowing how to approach each position. Below are some popular day trading strategies tailored for good option trading stocks.

1. Scalping

Concept: Scalping targets tiny price increments, aiming to capitalize on rapid fluctuations. Scalpers may hold positions for mere seconds to minutes. Why It Works for Good Option Trading Stocks: High volume and tight spreads make it easier to enter and exit quickly without losing too much profit to slippage. Execution Tips: Use ultra-short time frames (1-min or 5-min charts). Rely on Level II quotes and real-time order flow to catch micro changes. Implement strict stop-loss levels to shield against sudden reversals.

2. Momentum Trading

Core Principle: Identify a strong directional move and ride the wave until it loses steam. Often executed around significant breakouts or breakdowns.

Best Conditions: Market sentiment, driven by news or technical indicators (e.g., crossing a major moving average), can fuel sharp intraday rallies or drops.

Entry and Exit:

- Enter call options if the stock breaks above a well-established resistance level with high volume.

- Enter put options if it breaks below a major support level.

- Watch for momentum indicators like the Relative Strength Index (RSI) or the Moving Average Convergence Divergence (MACD).

3. Options Spreads

Why Spreads?: Spreads can reduce overall cost and risk by pairing a long option position with a short option at a different strike or expiration.

Examples:

- Vertical Spread: Buy a call and simultaneously sell another call at a higher strike (or buy a put and sell another put at a lower strike).

- Iron Condor: A more advanced strategy suitable for range-bound markets, selling both a call spread and a put spread.

Advantages:

- Lower upfront cost compared to outright calls or puts.

- Defined risk profile, as losses are capped if the stock moves drastically.

4. Risk Management for Day Traders

- Position Sizing: Allocating 1% to 2% of your capital per trade is a common guideline. Overextending can lead to heavy losses if a trade turns against you.

- Stop-Loss Techniques: Consider using a time-based stop if a trade goes nowhere within a certain period. Additionally, set a maximum daily loss limit to preserve capital.

- Trade Journaling: Document each trade, including rationale, entry/exit points, and outcomes. Regularly review these entries to identify strengths and weaknesses in your strategy.

By combining these tactical approaches with the liquidity, volatility, and robust options chains found in good option trading stocks, you give yourself a higher probability of achieving consistent, repeatable intraday profits.

Three Backtest Examples for Day Trading

Before risking live capital, traders often backtest their strategies on historical data. This process allows you to see how a particular approach might have performed and can help identify pitfalls. Below are three hypothetical backtests focusing on good option trading stocks, illustrating different day trading methods and their potential outcomes.

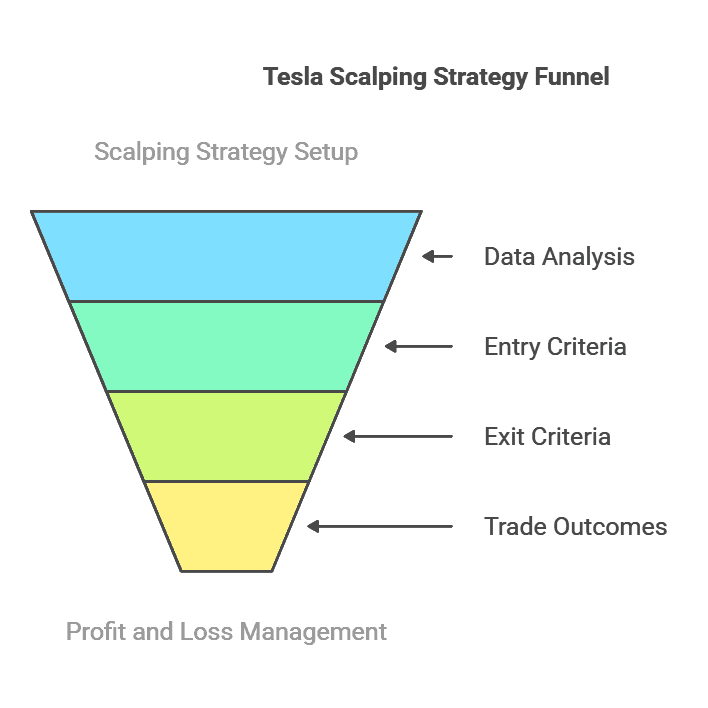

Backtest #1: Scalping Good Option Trading Stocks

Ticker Example: Tesla (TSLA)

- Reasoning: Tesla’s high intraday volatility makes it an ideal subject for scalping experiments, especially on 1-minute or 5-minute charts.

Methodology

- Data Range: Examined a 30-day period to capture various market conditions.

- Entry Criteria: Entered call or put options when the stock price moved 0.5% above or below its opening range on a spike in trading volume.

- Exit Criteria: Targeted a 0.2% to 0.5% price move, setting stop-loss orders at a 0.2% retracement against the position.

Key Metrics

- Win Rate: Out of 100 trades, let’s say 62 ended profitably.

- Average Gain per Trade: Approx. $50 per winning trade, reflecting small but frequent gains.

- Maximum Drawdown: Reached $1,000 during a series of losing trades amid unpredictable price swings.

Results Analysis

- Pros: Scalping capitalized on Tesla’s minute-by-minute price changes, generating consistent small wins.

- Cons: Profits could be quickly erased by a few losing trades in a row, emphasizing the need for disciplined stops.

Backtest #2: Momentum on Good Option Trading Stocks

Ticker Example: Apple (AAPL)

Reasoning: Apple’s stable liquidity and moderate volatility make it a strong candidate for momentum strategies, especially around earnings announcements or product launches.

Methodology

- Data Range: A 60-day window, focusing on days with significant price movements.

- Entry Criteria: Identified a breakout above a 20-day high on strong volume or an RSI reading crossing above 70 for a bullish play.

- Exit Criteria: Closed positions by the end of the day or if momentum indicators showed a reversal (e.g., RSI dropping below 50 intraday).

Key Metrics

- Risk-to-Reward Ratio: Aimed for a 1:2 ratio, risking $100 to gain $200 on each trade.

- Profit Factor: Calculated as total gains divided by total losses; in this scenario, let’s say it was around 1.8, indicating profitable trading.

- Total PnL: Over the 60 days, net gains could amount to $2,800 after accounting for commissions.

Results Analysis

- Pros: Caught substantial moves when Apple rallied on product rumors or positive earnings guidance.

- Cons: False breakouts triggered losses on days when volume spikes were misleading or news didn’t translate into sustained price movement.

Backtest #3: Swing Trading Strategy Example

Ticker Example: Microsoft (MSFT)

Reasoning: Known for somewhat lower volatility compared to Tesla but still an active options market. Microsoft is a prime candidate for short-term, multi-day holds—though we’ll adapt it to illustrate an “intraday plus hold” scenario.

Methodology

- Data Range: Chosen a 45-day window, incorporating an earnings release period to test the influence of corporate announcements.

- Entry Criteria: Initiated trades at the market open when the previous day’s closing price broke above a 10-day moving average. Calls were purchased if that bullish momentum persisted.

- Exit Criteria: Exited positions by the third day at the latest if the uptrend remained intact, or sooner if the stock dipped below key support.

Key Metrics

- Historical Returns: Over the 45-day window, the strategy yielded a modest 5% overall gain on capital allocated.

- Volatility Measures: Standard deviation remained moderate, indicating fewer wild swings.

- Best Time Frames: Notable gains clustered around earnings week, when volume and price action intensified.

Results Analysis

- Pros: The strategy capitalized on short bursts of momentum and alleviated the stress of micromanaging trades minute-by-minute.

- Cons: Holding positions overnight introduces “gap risk,” a day trading consideration if the stock moves sharply when the market is closed.

Collectively, these backtests underscore how different tactics can succeed under varying market conditions. Each approach—scalping, momentum, or brief swing trading—demonstrates a unique risk-reward profile. Tailor your methodology to your personality, risk tolerance, and the nature of the good option trading stocks you choose to trade.

Conclusion: The Value of Good Option Trading Stocks

Good option trading stocks remain pivotal for both new and experienced day traders looking for optimal liquidity, volatility, and news-driven momentum. By focusing on reputable tickers like Apple, Tesla, and AMD, you can better manage your risk and position yourself for consistent gains.

Above all, remember that a disciplined approach, thorough backtesting, and ongoing education are essential to long-term trading success in today’s dynamic markets.

Are you looking to enhance your day trading strategies with reliable data?

TradeSearcher offers access to over 100,000 TradingView strategies and backtests, helping you make informed decisions. Join more than 3,200 traders who trust TradeSearcher to find the best trading strategies for any symbol.