Table of Content

What is Tether (USDT)? Everything You Need to Know About USDT Stablecoin

By Vincent NguyenUpdated 391 days ago

1. Understanding Stablecoins and Tether (USDT)

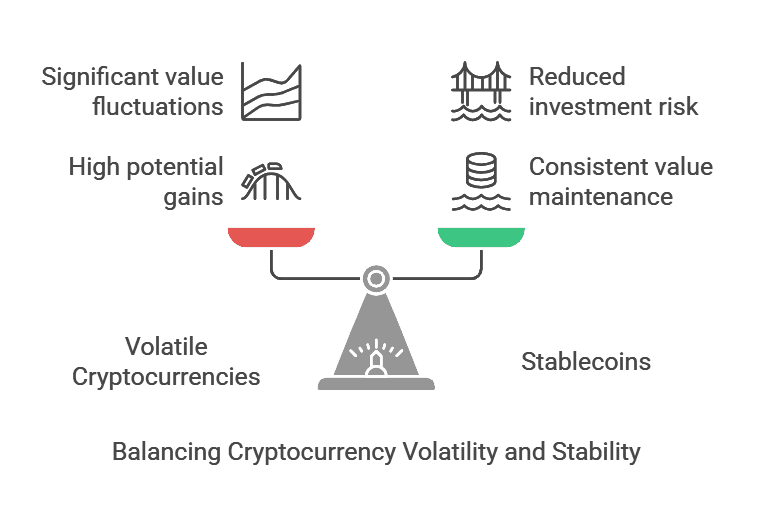

Before diving into Tether (USDT) specifically, it’s important to grasp the concept of stablecoins in general. In the cryptocurrency world, high volatility is part of the game. A coin’s price can rocket 20% in one day, then plummet by the same amount the next. For some traders, that volatility is thrilling it’s an opportunity to make (or lose) a lot of money quickly. For others, though, it’s impractical to hold a cryptocurrency that can lose a significant chunk of its value overnight.

That’s where stablecoins come in. Stablecoins are cryptocurrencies designed to maintain a consistent price. Their value is usually pegged to a traditional currency, like the US dollar or the euro. Ideally, each stablecoin is backed by an equivalent reserve of the underlying asset, whether that’s actual fiat currency in a bank account, collateral in other cryptocurrencies, or even algorithmic mechanisms that maintain the peg.

Tether (USDT) in a Nutshell

Tether is widely regarded as the first successful stablecoin project, having launched under the name “Realcoin” back in 2014. It was rebranded to Tether soon after. USDT, the most common form of Tether, is pegged to the US dollar, with a stated 1:1 ratio so 1 USDT is meant to equal 1 USD. Tether’s creators claim that each USDT token is fully backed by real-world fiat reserves (in this case, primarily US dollars).

In practice, USDT is often used as a bridge between cryptocurrency markets and traditional finance. When you see people trading on major crypto exchanges, flipping in and out of Bitcoin or Ethereum positions, there’s a high chance they’re moving funds into USDT when they want to “park” their money in a stable coin. It’s effectively a way to sit in a cryptocurrency that isn’t supposed to fluctuate wildly with the rest of the market.

2. A Quick History of Tether

Early Days

Tether’s story starts in 2014 with a project called Realcoin, founded by Brock Pierce, Reeve Collins, and Craig Sellars. Realcoin set out with a fairly straightforward proposition: put the US dollar onto the blockchain, enabling the best of both worlds blockchain-based transactions (fast, transparent) and the stability of the US dollar. Not long after the project’s public launch, Realcoin rebranded to Tether in late 2014.

The underlying technology was originally built on the Omni Layer (formerly Mastercoin) on the Bitcoin blockchain. This layer allows for tokens to be minted and transferred on top of Bitcoin’s network. Over time, Tether has expanded its operation to multiple blockchains, including Ethereum, TRON, EOS, and more, to improve transaction speed and reduce fees.

Key Milestones

- 2014: Realcoin is founded; rebrands to Tether.

- 2015: Tether tokens start circulating, offered on various exchanges.

- 2017: Tether’s popularity surges during the crypto bull run, volume skyrockets.

- 2019: Tether transitions heavily to Ethereum’s ERC-20 standard (though still operates on other chains).

- 2020 and beyond: Tether becomes a top cryptocurrency by market capitalization. It also faces scrutiny and legal challenges which shape its public image.

Relationship with Bitfinex

It’s almost impossible to talk about Tether’s history without mentioning Bitfinex, one of the largest cryptocurrency exchanges in the world. Tether and Bitfinex share key personnel and corporate structures; both entities have overlapping owners and executives. This relationship has drawn attention from regulators and skeptics alike. Many controversies revolve around whether Tether’s reserves are properly managed and how funds move between Tether and Bitfinex.

3. The Technology Behind Tether: How It Works

Blockchain Agnostic

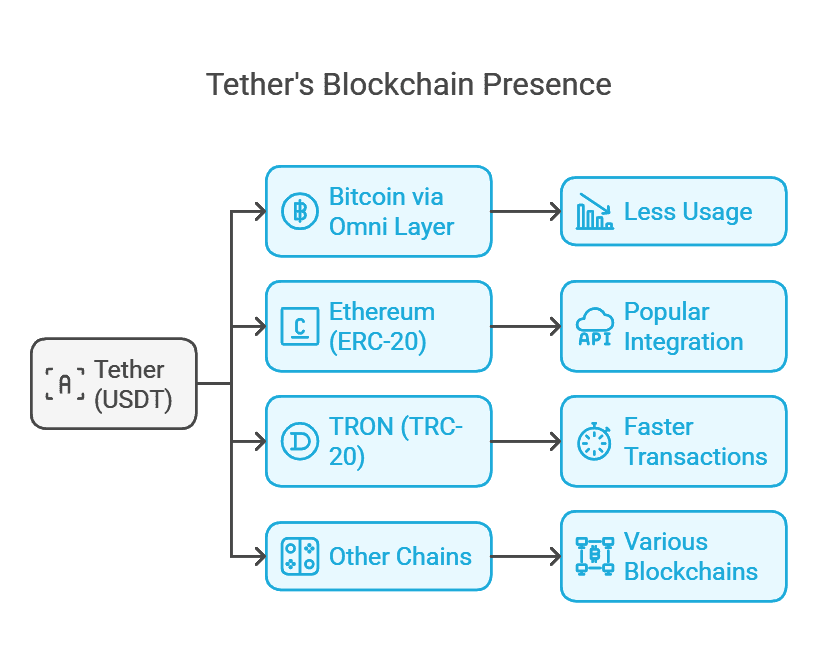

One unique aspect of Tether is that it’s blockchain agnostic, meaning it exists on multiple blockchains:

- Bitcoin via Omni Layer: The “original” Tether issuance, though now it sees less usage.

- Ethereum (ERC-20): The most commonly used version, given Ethereum’s popularity and the ease of integration with decentralized exchanges, wallets, and dApps.

- TRON (TRC-20): Offers faster transactions and lower fees than Ethereum, which is why TRON-based Tether is popular in certain regions.

- Other Chains: Tether also exists on EOS, Liquid Network, Solana, Algorand, and more.

Despite these different versions, the concept remains the same: each Tether token is intended to be backed 1:1 by US dollars (plus a mix of other assets, including cash equivalents, commercial paper, etc.). This pegging process is mostly managed off-chain by Tether Limited, which claims to hold the reserves.

Minting and Redemption

The process of issuing Tether tokens (often called minting) starts when a user or an institutional partner wires USD to Tether Limited. In theory, Tether Limited then creates new Tether tokens and sends them to the user’s crypto wallet. In reverse, if a user wants their real dollars back, they can redeem their USDT, which removes those tokens from circulation.

For retail users, though, this direct redemption process can sometimes be cumbersome. Many choose to convert their USDT into fiat currency via an exchange, rather than going directly to Tether. Fees, verification requirements, and minimum redemption amounts can apply when dealing with Tether Limited directly.

Peg Maintenance

Maintaining a 1:1 peg in an unregulated global market is no small feat. Tether’s peg generally holds because:

- Arbitrage: If USDT dips below $1 on an exchange, traders buy up USDT, expecting to redeem it for $1 worth of fiat or use it to buy other crypto assets at a discount. This buying pressure pushes USDT’s price back toward $1.

- Confidence: Tether relies heavily on the market’s belief that Tether Limited has enough reserves. As long as traders trust that USDT can be converted back into real dollars, they’re willing to accept it at a near-1:1 exchange rate with USD.

However, it’s not purely automated like an algorithmic stablecoin (e.g., older TerraUSD concepts), nor is it managed with total transparency (more on that in the controversies section). Regardless, the system has held together for years, making Tether the largest stablecoin by market cap.

4. Why Use Tether? Key Use Cases

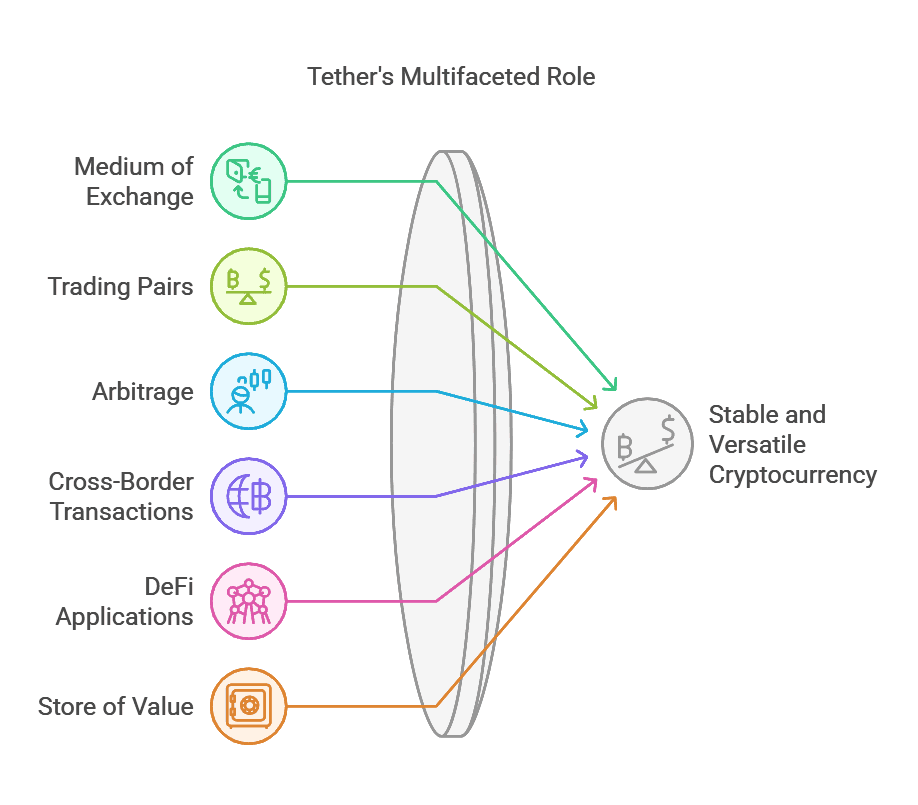

- Stable Medium of Exchange: USDT offers a way to transact in a crypto-like environment without exposing oneself to the wild price swings of something like Bitcoin or Ethereum.

- Crypto Trading Pairs: Many cryptocurrency exchanges offer USDT trading pairs. Instead of trading BTC/ETH or BTC/fiat, you’ll often see BTC/USDT or ETH/USDT. Traders can quickly move into USDT to “take profits” or “stop losses” without withdrawing to a bank.

- Arbitrage: Tether’s near-immediate settlement on blockchains makes it a handy tool for arbitrage traders who exploit price discrepancies on different exchanges.

- Cross-Border Transactions: If you need to transfer money internationally, USDT can serve as a near-instant solution, bypassing the delays of traditional bank wires and (often) lower fees compared to some remittance methods.

- DeFi Applications: The DeFi ecosystem on networks like Ethereum or Tron often welcomes USDT liquidity, letting users lend out their stablecoins for interest or use them as collateral in various protocols.

- Store of Value in Volatile Markets: While not exactly an “investment” in the sense that it’s pegged, Tether can serve as a relatively stable place to park crypto holdings when a trader expects a market downturn.

5. Tether vs. Other Stablecoins

Competitors

Although Tether holds the largest market cap and name recognition among stablecoins, it’s far from alone. Other major stablecoins include:

- USD Coin (USDC): Issued by Circle and Coinbase, known for its greater transparency and regular audits.

- Binance USD (BUSD): Issued by Paxos in partnership with Binance. Also claims 1:1 fiat backing and is heavily used on Binance’s platform.

- Dai (DAI): A decentralized stablecoin managed by the MakerDAO protocol, backed by crypto collateral rather than fiat reserves.

- TrueUSD (TUSD): Another fiat-backed stablecoin that publishes regular attestations of its fiat reserves.

How Tether Compares

Transparency: Tether has faced repeated criticism for not having fully transparent audits (though it publishes attestations by some third-party firms). USDC, on the other hand, is known for releasing regular audit reports. Regulatory Scrutiny: Tether has faced intense scrutiny in various jurisdictions, partly due to its relationship with Bitfinex and questions around its reserves. USDC and BUSD are seen as somewhat more “compliant,” especially in the U.S. Liquidity and Adoption: Despite the controversies, Tether is still the most widely used stablecoin. Its liquidity is nearly unmatched, making it extremely popular for trading pairs on many exchanges worldwide. Multiple Blockchains: Tether is available on more blockchains than most of its competitors, which can be an advantage for those wanting to move stablecoins around different networks.

6. How to Acquire and Store Tether (USDT)

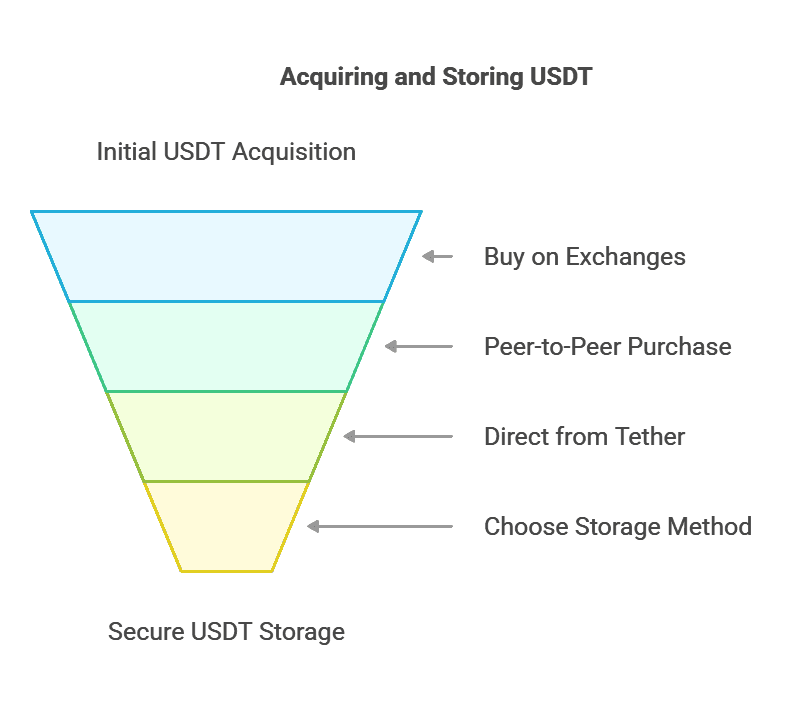

Buying USDT

- Crypto Exchanges: The most straightforward way to acquire USDT is by buying it on a centralized or decentralized exchange. Major exchanges like Binance, Kraken, Coinbase (depending on region), KuCoin, and many others offer USDT trading pairs.

- Peer-to-Peer (P2P): Some P2P marketplaces let users buy USDT directly from another individual, using various payment methods. This can be handy in regions without robust banking access, or if you prefer more privacy.

- Direct from Tether: As mentioned, you can (in theory) send USD to Tether Limited and have them deposit newly minted USDT to your wallet. However, this typically requires a significant amount of capital and a rigorous KYC (Know Your Customer) process.

Storing USDT

Because Tether is available on multiple blockchains, it’s essential to store it on a compatible wallet that supports the specific version of Tether you have (ERC-20, TRC-20, etc.). Here are some options:

- Hardware Wallets: If your hardware wallet (e.g., Ledger or Trezor) supports the chain Tether is on, you can store it offline. This is the most secure method.

- Software Wallets: Wallets like MetaMask (for ERC-20 tokens on Ethereum) or TronLink (for TRC-20 tokens on Tron) are popular. They’re easier to use than hardware wallets but come with additional security risks.

- Exchange Wallets: You can keep your USDT on an exchange, which is convenient for frequent trading. However, leaving funds on an exchange means you’re trusting a third party with custody of your tokens.

Important: Always confirm that you’re sending or receiving USDT via the correct blockchain. Sending USDT (ERC-20) to a TRC-20 wallet address would result in a loss of funds. Double-check addresses and network types before pressing “Send.”

7. Controversies, Criticisms, and Legal Issues

One can’t talk about Tether without addressing the elephant in the room: controversy. Over the years, Tether has found itself in the headlines for a range of issues. Here’s a breakdown:

Reserve Transparency

For a long time, Tether’s critics complained there was no proof Tether was actually holding an equivalent amount of USD in reserves to back every USDT in circulation. Tether posted periodic self-attestations, but they didn’t satisfy skeptical observers who wanted a full third-party audit. The worry was that Tether might be printing tokens out of thin air, injecting them into crypto markets, and artificially inflating Bitcoin’s price.

While Tether has published documents showing it holds sufficient assets, those haven’t always been the comprehensive audits people expected. Instead, they’re often attestations from third-party accounting firms. Critics say this still lacks the rigor of a formal audit. Proponents argue that Tether’s expansions and redemptions work as expected, so there’s no reason to doubt them.

Bitfinex Loan and NYAG Settlement

In 2019, the New York Attorney General (NYAG) alleged that Bitfinex borrowed hundreds of millions of dollars from Tether to cover losses of customer funds. This was apparently not disclosed to Tether holders, who believed their USDT was fully backed. Tether’s stance was that the funds were eventually repaid. However, the scandal increased concerns about transparency and whether Tether’s reserves were ever temporarily under-collateralized.

Ultimately, Tether and Bitfinex reached an $18.5 million settlement with the NYAG in 2021, in which they did not admit wrongdoing but agreed to stop serving customers in the state of New York and committed to providing regular updates on their reserves.

Allegations of Market Manipulation

Another major criticism is the belief among some crypto analysts that Tether is used to prop up the price of Bitcoin and other cryptocurrencies. Critics point to studies suggesting that large issuances of USDT correlate with upward moves in Bitcoin prices. Tether has consistently denied any wrongdoing, stating that these issuances are purely a response to market demand from customers who want to buy large amounts of USDT.

8. Regulatory Environment for Tether

Global Scrutiny

As crypto becomes more mainstream, regulators across the globe are stepping up their scrutiny of stablecoins. Tether, being the largest stablecoin, often finds itself at the center of these discussions. Governments are concerned about:

- Money Laundering and Terrorist Financing: Because USDT can move quickly and be traded on many platforms, regulators worry it could be used illegally.

- Systemic Risk: If stablecoins become large enough, a sudden loss of confidence could cause market chaos.

- Lack of Consumer Protections: Crypto is still largely unregulated, and stablecoin holders might not have legal recourse if something goes wrong.

Stablecoin-Specific Legislation

Some jurisdictions, especially in the U.S., have begun considering stablecoin-specific regulations. A key question is whether Tether (and other stablecoins) will be regulated as money market funds, bank-like products, or something else entirely. The outcome of these legislative efforts could significantly impact Tether’s operation and adoption.

Ongoing Developments

Tether has taken steps to improve transparency and work with regulators. However, the regulatory environment is fast-evolving. It’s worth keeping an eye on news headlines and official announcements from Tether if you’re actively using or holding large amounts of USDT. Changes in regulations could impact the availability, redemption, or use cases of stablecoins.

9. Tether’s Role in the Crypto Ecosystem

Trading Volume and Liquidity

Even with its controversies, Tether remains the most traded cryptocurrency by volume on many days often surpassing even Bitcoin in 24-hour volume. This points to just how crucial USDT is for liquidity in the crypto markets. Exchanges around the world list USDT pairs, and it’s used for all sorts of on-chain and off-chain transactions.

Gateway to DeFi

Decentralized Finance (DeFi) has exploded in recent years, offering decentralized exchanges (DEXs), lending/borrowing protocols, yield farming, and more. Tether, primarily in its ERC-20 form on Ethereum, is widely used in DeFi. It allows participants to deposit stable assets to earn interest, provide liquidity, or transact seamlessly in dApps that require a stable unit of account.

Settlement and Payments

In some contexts, Tether has become a go-to option for near-instant cross-border settlement. Crypto remittance services, payment platforms, and freelancers increasingly rely on Tether because it’s more widely accepted on exchanges and among peer networks than other stablecoins. The liquidity factor is huge here wherever you go in the crypto world, you’re almost guaranteed that people will accept USDT.

10. Practical Tips for Trading and Using USDT

If you’re considering diving into the Tether ecosystem, here are some practical pointers:

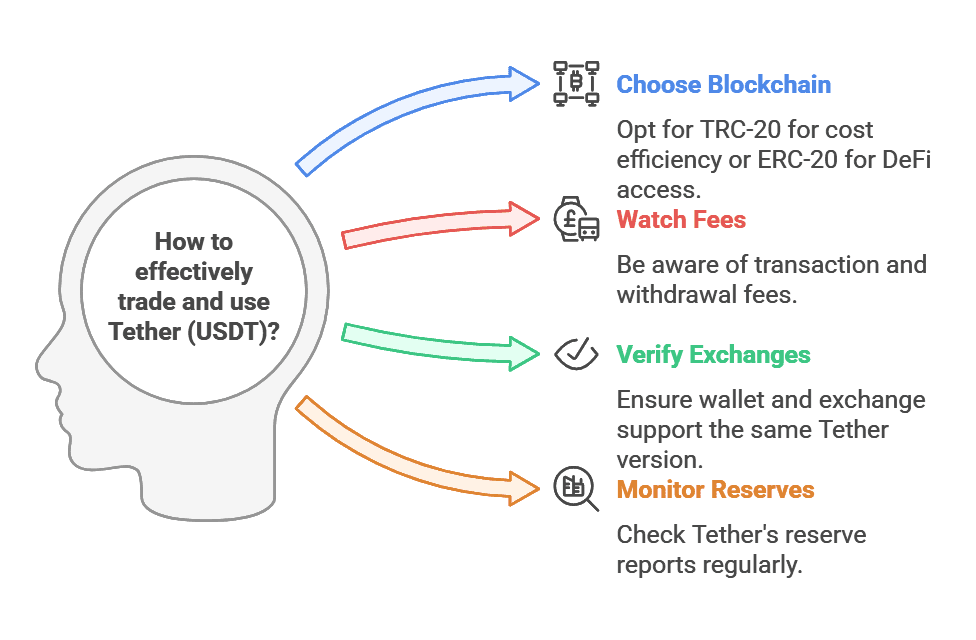

- Choose the Right Blockchain: If you want cheaper, faster transactions, you might opt for TRC-20 Tether on TRON. If you prefer a more extensive DeFi environment, ERC-20 Tether on Ethereum is the standard even though gas fees can be high.

- Watch Out for Fees: Different chains have different transaction fees. Exchanges may also charge withdrawal fees that vary based on the blockchain.

- Verify Exchange Options: Not all exchanges support every version of Tether. Ensure your wallet and the exchange both support the same protocol.

- Keep an Eye on Reserve Reports: Tether provides updates about its reserves. If you’re holding a lot of USDT, it’s worth periodically checking the Tether website or following reputable news sources.

- Leverage Arbitrage Opportunities: If you’re an experienced trader, you can leverage minor price discrepancies in USDT across different platforms but be sure to account for fees and network speed.

- Security: Follow standard crypto security practices (strong passwords, two-factor authentication, secure wallet management) to protect your USDT holdings.

11. Potential Future Developments and Updates

Full-Scale Audit?

Many in the crypto community still anticipate a comprehensive, professional audit of Tether’s reserves by a major accounting firm. If Tether manages to secure such an audit, it could quell many of the lingering doubts about its solvency and backing. On the other hand, if controversies continue or if an audit fails to materialize, those doubts may persist.

Regulatory Clarity

Regulators around the world are moving toward creating guidelines or laws that specifically address stablecoins. This can go several ways for Tether:

- Positive Outcome: Regulatory clarity could lead to increased trust and adoption, especially among institutional investors who have been wary of Tether.

- Negative Outcome: If new laws are too restrictive, Tether might face hurdles in major markets (such as the U.S.). It could potentially lose ground to stablecoins with stronger regulatory backing (like USDC).

Expansion to More Blockchains

Tether has historically expanded whenever a new blockchain shows promise. As Layer 2 solutions on Ethereum gain traction (like Arbitrum or Optimism) or as other blockchains mature, we might see Tether bridging over to those platforms, offering faster, cheaper transactions. This could further entrench Tether as the stablecoin with the broadest presence.

Shifting Reserve Composition

Tether has updated its reserve composition in the past, reducing exposure to commercial paper and focusing more on treasury bills and cash equivalents. Future updates may continue to evolve Tether’s reserve strategy, potentially making USDT’s backing more conservative or more transparent over time. Changes in interest rates or global financial conditions might also influence how Tether holds its reserves.

12. Conclusion: Is Tether Right for You?

Summary

Tether (USDT) is the world’s most popular stablecoin, primarily because it’s well-integrated across exchanges and blockchains, offering a reliable way to store and transfer value without experiencing the volatility of typical cryptocurrencies. Whether you’re a day trader looking for quick stable pairs or a casual user wanting to shield your funds from market swings, Tether can be a powerful tool in your crypto arsenal.

However, Tether is not without its controversies. Critics claim its reserve backing lacks transparency, and it has faced legal action that calls into question some of its practices. That said, for all the talk, Tether has continued to operate and maintain its 1:1 peg (with minor deviations) for many years, cementing its place at the center of the crypto markets.

Potential Pros and Cons

Pros: Near-ubiquitous adoption in the crypto space High liquidity and acceptance on virtually all major exchanges Multiple blockchain integrations for different use cases Ideal for quick trades and hedges against volatility Cons: History of controversies and incomplete audits Regulatory uncertainty, particularly in the U.S. Complex relationship with Bitfinex raises transparency questions Not necessarily the cheapest to transfer on networks like Ethereum

How to Decide

- Check Your Use Case: If your main interest is day trading, Tether might be the most convenient stablecoin thanks to its widespread liquidity. If you’re more concerned about transparency, you might lean toward something like USDC.

- Consider Your Jurisdiction: If you’re in a region with strict crypto regulations, make sure Tether (and the exchange or wallet service you plan to use) is authorized.

- Evaluate Risk Tolerance: While USDT is intended to stay at $1, there’s always a small risk that the peg could break if confidence collapses or if regulators crack down severely.

- Stay Informed: Pay attention to news about Tether’s reserve attestations, regulatory developments, and any major announcements. The stablecoin space evolves quickly.

Ultimately, Tether remains a dominant force in the crypto world. For everyday traders and crypto enthusiasts, it’s often the easiest on-ramp to the stablecoin concept. Yet, being aware of Tether’s background and ongoing controversies is key to using it wisely. As always, do your own research, consider multiple viewpoints, and choose the stablecoin that best meets your needs, whether that’s USDT, USDC, BUSD, or others.

Ready to boost your crypto trading game?

With TradeSearcher, you can instantly backtest and analyze thousands of strategies for assets like Tether (USDT) and more. Join over 3,200 traders who rely on TradeSearcher to refine their strategies and maximize profits! Discover more here.