Table of Content

How to Pick Stocks with an AI Stock Picker: A Beginner’s Guide (2025)

By Vincent NguyenUpdated 391 days ago

How to Pick Stocks with an AI Stock Picker

An AI stock picker can transform your investing approach by analyzing massive amounts of market data in real time, helping you make more informed decisions on which stocks to buy, hold, or sell. In today’s fast-paced investment landscape, many beginners feel overwhelmed by the sheer volume of information, financial jargon, and market fluctuations. Fortunately, advancements in artificial intelligence (AI) have made it possible for even novice investors to level the playing field.

In this beginner-friendly guide, we’ll walk you through the fundamentals of how an AI stock picker works, why it can be a powerful addition to your investing toolkit, and the steps you need to follow to get started. By the end, you’ll be equipped with the knowledge to begin making more strategic, data-driven stock picks that align with your personal financial goals.

What Is an AI Stock Picker?

An AI stock picker is a digital tool or software that uses artificial intelligence and machine learning algorithms to analyze market trends, economic indicators, company fundamentals, and even real-time news feeds. The goal is to identify potentially profitable stocks or investment opportunities that match your specified criteria, such as risk tolerance, target industry, or time horizon.

Because the underlying technology relies on data science and pattern recognition, these platforms often process vast amounts of information more quickly and objectively than any single human analyst could. In practical terms, this means you might receive “buy,” “hold,” or “sell” signals based on an AI model’s assessment of a stock’s future performance. Some AI stock picker solutions offer sophisticated dashboards with metrics like predictive accuracy, real-time price movement, and sentiment analysis derived from social media and news articles.

Importantly, different AI stock picker tools can vary in complexity. Some are standalone software solutions, whereas others come integrated with online brokerage accounts. The best part? Many platforms are designed to be beginner-friendly, providing intuitive tutorials and guides to help you understand the recommended trades before you invest real money.

Why Use an AI Stock Picker for Your Investment Strategy?

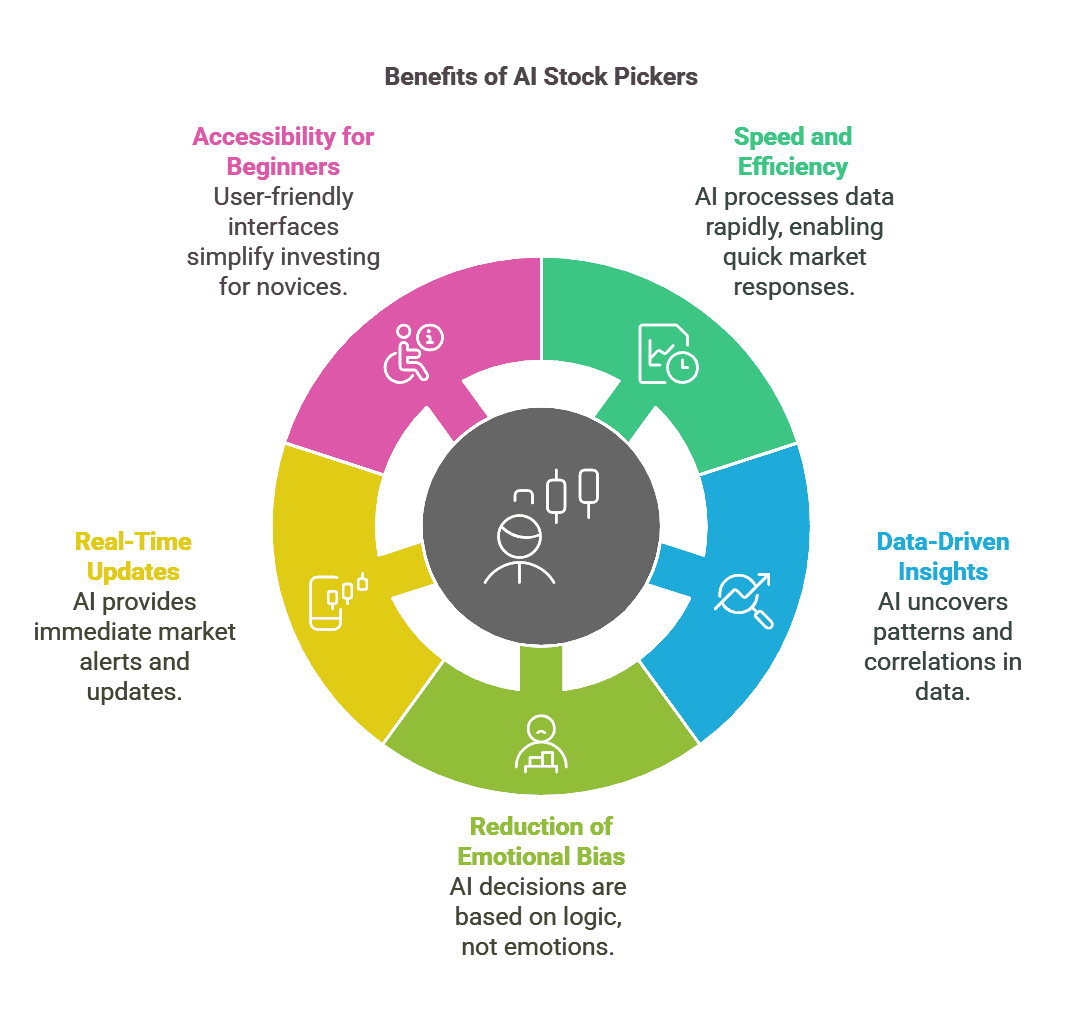

Speed and Efficiency

One of the biggest advantages of using an AI stock picker is the incredible speed at which AI-driven tools can crunch data. Instead of manually scanning dozens of financial news websites, chart patterns, and economic reports, an AI system can process these inputs within seconds. This efficiency allows you to stay on top of market changes and act quickly when profitable opportunities arise.

Data-Driven Insights

By design, AI excels at detecting subtle relationships and patterns in data that human analysts might overlook. Whether it’s a sudden shift in trading volume, a change in market sentiment, or an unexpected correlation between economic indicators, an AI stock picker can surface insights faster and more accurately than manual methods. This can help you make decisions rooted in empirical evidence rather than gut feeling alone.

Reduction of Emotional Bias

Emotions often lead investors astray think panic selling during a market dip or impulsively buying stocks on hype. An AI stock picker operates on logic, scanning quantitative data and historical trends rather than reacting to emotional triggers. By keeping your decisions grounded in objective data, you reduce the risk of making costly emotional trades.

Real-Time Updates

Markets move fast, and so does AI. Many AI stock picker platforms update their recommendations in real time, alerting you to new signals via email, SMS, or push notifications. This immediate feedback loop means you can respond to opportunities before they fade or avoid potential pitfalls before they escalate.

Accessibility for Beginners

Finally, using an AI stock picker doesn’t require a PhD in finance. Modern platforms often feature user-friendly dashboards, tutorials, and community forums. This makes it easier for beginners to start investing with confidence, focusing on learning the ropes rather than wrestling with complex spreadsheets and technical analysis from day one.

Key Features to Look For in an AI Stock Picker

When evaluating an AI stock picker, it’s crucial to know which features matter most. Below are some core functionalities that can help ensure you’re getting a tool suited to your needs.

1. Data Sources and Real-Time Analysis

- Look for a platform that integrates with reputable data providers.

- Real-time market updates can be invaluable for trading decisions.

- Check for coverage across multiple stock exchanges if you’re interested in global investments.

2. Backtesting Capabilities

- Backtesting lets you apply the AI model’s strategy to historical data.

- This feature shows how the system might have performed in past market conditions.

- Good backtesting tools allow you to tweak parameters like risk tolerance and investment horizon.

3. User-Friendly Interface

- Beginners benefit from intuitive dashboards that simplify complex data.

- Look for visual aids like color-coded charts, clear signals (e.g., “Buy,” “Hold,” “Sell”), and tutorials.

- A learning center or built-in educational resources can significantly shorten your learning curve.

4. Customizable Risk Tolerance Settings

- Everyone has a different comfort level for market volatility.

- Seek platforms that let you adjust risk parameters so you can focus on safer or more aggressive picks.

- Automated alerts tailored to your personal thresholds can prevent you from missing critical updates.

5. Transparent Accuracy Metrics

- Check if the AI stock picker provides performance metrics, like historical win rate or average return.

- Look for ongoing model updates that reflect the platform’s commitment to improving accuracy over time.

6. Security and Compliance

- Ensure the platform follows industry regulations for data and privacy.

- Look for encryption and reputable security measures to protect your financial and personal information.

Traditional Stock Picking vs. Automated Solutions: What’s the Difference?

It’s important to understand how AI stock picker tools differ from old-school, manual stock analysis methods. Below is a side-by-side comparison to highlight the main differences.

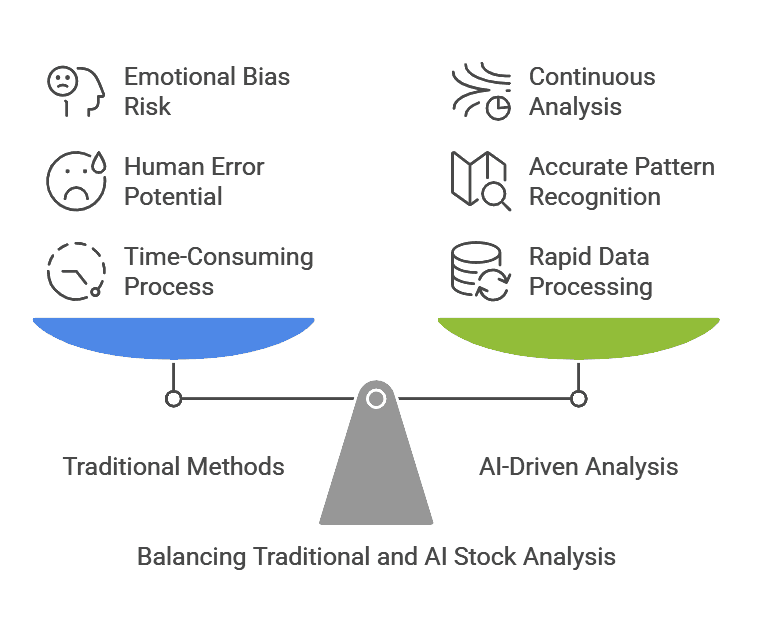

Fundamental Research by Humans

Traditionally, investors pour through annual reports, analyze financial statements (like income and balance sheets), and track metrics such as the P/E (price-to-earnings) ratio. They also consider macroeconomic events, company-specific news, and industry trends. While this approach can be thorough, it’s time-consuming and prone to human errors especially emotional biases.

Automated AI-Driven Analysis

In contrast, an AI-driven tool can handle thousands of data points simultaneously, identifying complex correlations and patterns that might not be immediately obvious. For instance, an algorithm might detect that a company’s stock typically rises or falls in response to specific patterns in commodity prices or interest rates. Moreover, an AI can run these analyses continuously, updating its recommendations as new market data streams in.

Potential Drawbacks of Automation

While an AI stock picker can drastically reduce workload, it’s not immune to pitfalls. Overreliance on past data can lead to inaccurate predictions if market conditions change dramatically (e.g., unexpected global events). Additionally, AI-driven solutions can sometimes be a “black box,” making it hard for users to understand how the algorithm arrived at its conclusions.

Combining the Two Approaches

The most prudent strategy for many investors is a blend of both methods: trusting the AI for speed and data depth but verifying its recommendations with at least some human oversight. This hybrid approach aims to harness the best of both worlds objectivity from AI and nuanced judgment from human reasoning.

Step-by-Step Guide to Using an AI Stock Picker

Below is a clear roadmap for beginners to get started with an AI stock picker. While the specific steps may vary depending on the platform you choose, the process generally follows a similar flow.

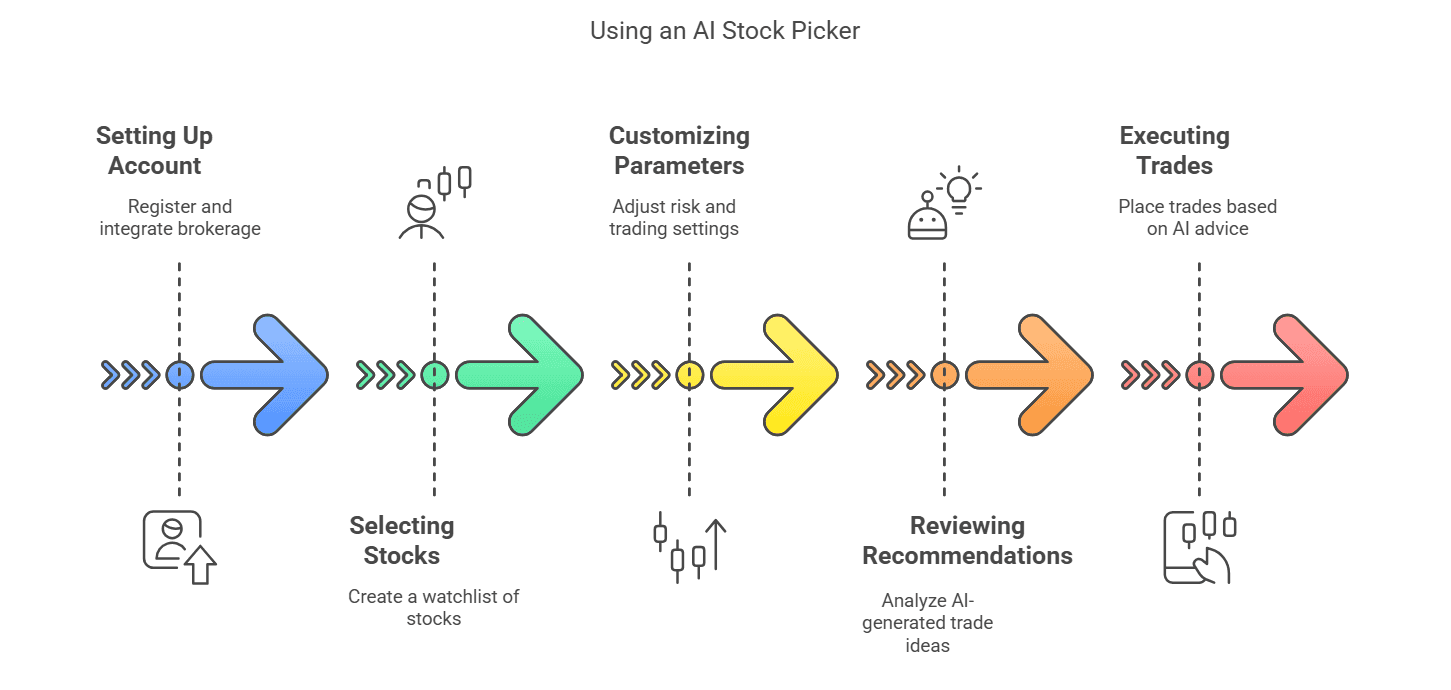

Step 1 – Setting Up Your Account

First, select a reputable AI stock picker platform. Many offer free trials or tiered subscriptions, allowing you to test the waters with minimal financial commitment. Once you’ve chosen a platform:

- Registration: Provide basic details such as your name, email address, and password.

- Brokerage Integration: Some AI tools require you to link an existing brokerage account so you can execute trades directly. Others might offer their own brokerage services.

- Identity Verification: Depending on regulations, you may need to submit documents or complete a KYC (Know Your Customer) process.

- Set Up Payment: If using a paid version, enter your payment details or choose a subscription plan that fits your budget and needs.

Keep an eye out for any educational resources the platform provides. Before diving in, it’s often wise to take advantage of tutorials or demo accounts to practice using the system without risking real money.

Step 2 – Selecting Stocks to Analyze

Once your account is ready, you’ll typically set up a watchlist. This watchlist is a curated group of stocks you want the AI to monitor more closely. To choose which stocks to include:

- Industries of Interest: Focus on sectors you understand or are curious about, such as technology, healthcare, or finance.

- Market Capitalization: Decide if you want to concentrate on large-cap, mid-cap, or small-cap stocks. Each carries different levels of volatility and growth potential.

- Geographical Focus: Some platforms allow you to pick stocks from multiple international markets.

- Volatility Preferences: If you’re risk-averse, stick to more stable stocks with lower price fluctuation. If you can handle more risk, you might include high-growth or more volatile options.

Building a watchlist that aligns with your interests and risk profile helps the AI produce more relevant recommendations. You can always revise this list as you gain more experience.

Step 3 – Customizing AI Stock Picker Parameters

Most advanced platforms let you personalize how the AI stock picker operates. This often includes:

- Risk Tolerance: Adjust risk levels to match your comfort with volatility.

- Time Horizon: Specify whether you’re day trading, swing trading, or investing for the long term.

- Trading Frequency: Set how often you want the AI to scan for opportunities hourly, daily, or weekly.

- Model Preferences: Some platforms let you choose among different AI models (e.g., conservative vs. aggressive).

- Notification Settings: Decide how and when you want to receive alerts (push notifications, emails, or text messages).

These customizations ensure the AI stock picker aligns with your personal investing style. If you’re just starting, it’s wise to begin with conservative settings and gradually adjust as you learn more about how the market behaves.

Step 4 – Reviewing AI Stock Picker Recommendations

After configuring your preferences, the AI stock picker will start generating trade ideas:

- Ranking System: Many platforms use star ratings or numerical scores to indicate how strong a recommendation is.

- Buy/Hold/Sell Signals: You might see clear indicators for whether a stock is expected to rise, remain stable, or drop in value.

- Confidence Level: Some AIs provide a percentage that expresses how certain the model is about its prediction.

- Analytical Breakdown: Look for features like charts showing historical price movement, fundamental ratios, or even news articles relevant to that stock.

Make it a habit to review these recommendations regularly. Beginners should also cross-reference AI suggestions with basic fundamental research like checking the company’s latest earnings report or news releases about leadership changes.

Step 5 – Executing Trades with an AI Stock Picker

If you decide to act on a recommendation, you can typically place a trade directly through the platform or via an integrated brokerage account. Here’s how it usually works:

- Enter Order Details: Choose whether to buy or sell, how many shares, and at what price (market order vs. limit order).

- Review Estimated Costs: Brokerage fees or commissions can eat into profits. Always check fees before finalizing the trade.

- Confirm Execution: Once you confirm, the order goes to the exchange. You’ll receive a notification when the trade is filled.

- Monitor Performance: Keep track of how your positions perform over time, leveraging your AI stock picker to reassess and adjust your holdings.

Remember that no AI system is infallible. Always use proper risk management, like position sizing and stop-loss orders, to protect against unexpected market swings.

How to Interpret Machine-Based Insights

AI algorithms often use a variety of data visualization tools and performance metrics to present their findings. Interpreting these correctly can help you make informed decisions.

- Graphs and Heatmaps: These can highlight price trajectories or market “hot spots.”

- Sentiment Analysis: Some AI stock picker platforms factor in social media, news headlines, and analyst reports. Positive sentiment can correlate with upward price movement, but it’s not guaranteed.

- Fundamental Indicators: You may see metrics like earnings per share (EPS), return on equity (ROE), and debt-to-equity ratio, alongside AI-driven sentiment or pattern recognition.

- Confidence Scores: A higher confidence score typically means the model sees a strong signal, but it’s essential to remember that even high-confidence predictions can be wrong in volatile markets.

For best results, combine AI-driven metrics with a basic understanding of finance. Even a brief look at a company’s leadership team, competitive advantages, and industry outlook can offer valuable context for the AI’s recommendation.

Common Pitfalls and How to Avoid Them with an AI Stock Picker

While an AI stock picker can significantly improve your stock selection process, investors still make mistakes. Below are some common pitfalls and how an AI-driven approach can help mitigate them.

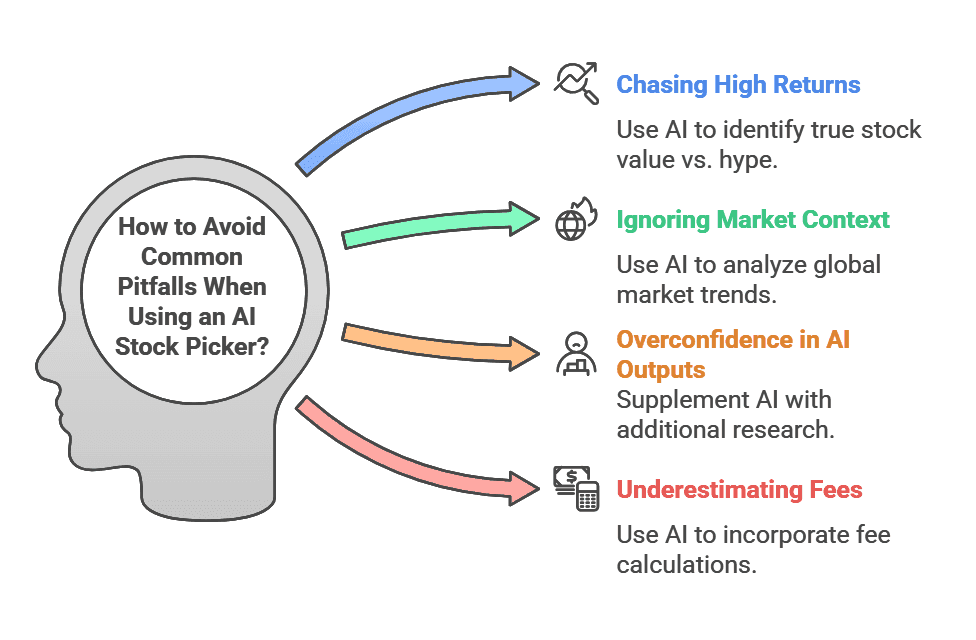

1. Chasing High Returns Blindly

- The Pitfall: Some newcomers focus on “hot” stocks that have recently skyrocketed, hoping for continued gains.

- AI Solution: The tool provides data-driven insights, often identifying whether a stock is truly undervalued or just riding a hype wave.

2. Ignoring Market Context

- The Pitfall: Failing to consider macroeconomic factors like interest rates, economic cycles, or geopolitical events.

- AI Solution: Many platforms analyze global market trends, integrating them into stock recommendations.

3. Overconfidence in AI Outputs

- The Pitfall: Putting all your trust in the AI’s recommendations without doing any additional research.

- AI Solution: AI is best used as a supplement. Always validate signals with fundamental analysis or at least a secondary source.

4. Underestimating Fees and Commissions

- The Pitfall: Over-trading or failing to account for brokerage fees that erode profits.

- AI Solution: Some AI tools incorporate fee calculations, showing net returns. Additionally, you can set thresholds to avoid small, frequent trades.

5. Failure to Adapt

- The Pitfall: Sticking with the same parameters or stocks for too long, missing out on new opportunities.

- AI Solution: Because AI is adaptive, it can flag emerging trends. Review your settings periodically and update your watchlist to capture shifts in the market.

Combining Human Expertise with an AI Stock Picker

A balanced approach that unites human understanding with the speed and complexity-handling of an AI stock picker often yields the best results.

- Stay Informed: Even the best AI can’t replace a well-informed investor. Keep up with the latest news, earnings calls, and sector developments relevant to your holdings.

- Use AI as a Second Opinion: Treat your AI stock picker as a knowledgeable assistant rather than the ultimate authority. If the AI suggests a certain stock, do a quick review to confirm the logic aligns with your investing principles.

- Diversify Your Portfolio: Rely on both AI-driven picks and your own research to spread investments across various sectors and asset classes.

- Refine Over Time: As you gain experience, you’ll learn how to tweak AI parameters to better reflect your personal goals, whether that’s capital growth, dividend income, or long-term stability.

Many experienced investors see AI-driven insights as a layer of analysis that can highlight overlooked opportunities or risks. By marrying data science with your own intuition and understanding, you can craft a more robust investment strategy.

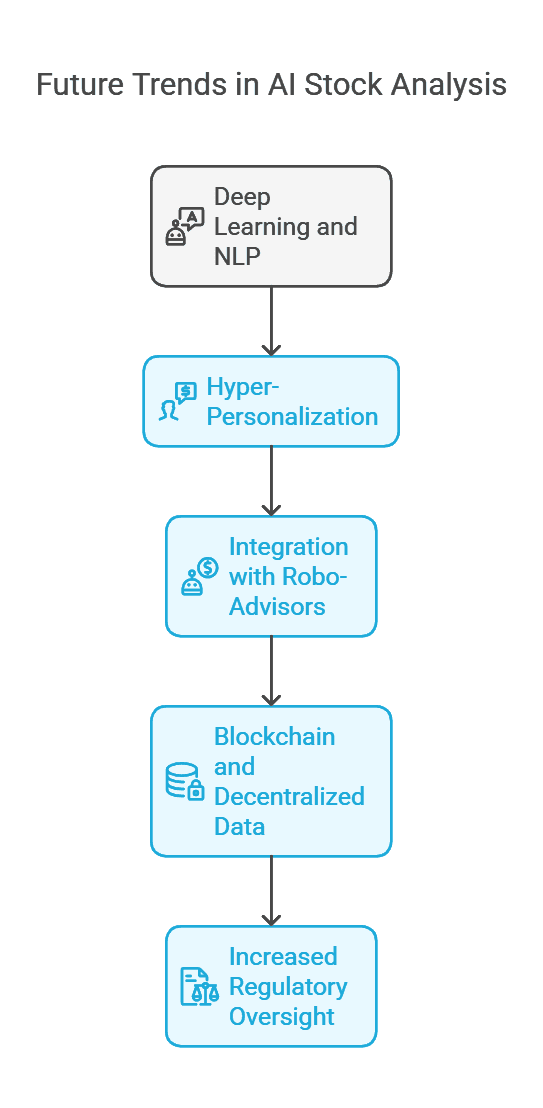

Future Trends in AI Stock Analysis

The world of finance is evolving rapidly, and AI stock picker tools are expected to become even more sophisticated. Here are some areas where innovation is likely to continue:

1. Deep Learning and NLP

- Advanced algorithms will refine their ability to understand human language, scanning earnings calls or CEO interviews for nuanced sentiment clues.

- Deep learning models could better predict market shifts by considering unstructured data like social media posts, videos, and more.

2. Hyper-Personalization

- Expect to see AI platforms that tailor recommendations to each investor’s financial history, goals, and behavioral patterns.

- Customized alerts and portfolio rebalancing suggestions could become more precise, adjusting in real time based on your unique performance metrics.

3. Integration with Robo-Advisors

- Hybrid services might merge AI stock picker functionalities with robo-advisor solutions, automating everything from portfolio allocation to tax-loss harvesting.

- This could make sophisticated wealth management strategies accessible to the average investor.

4. Blockchain and Decentralized Data

- As blockchain technology becomes more mainstream, AI tools may use decentralized ledgers for accurate, tamper-proof data.

- This could further improve trust in the analytics and reduce the risk of data manipulation.

5. Increased Regulatory Oversight

- As AI plays a bigger role in finance, expect more regulatory frameworks ensuring fairness, transparency, and accountability.

- Future AI stock picker tools may be required to meet certain explainability standards, helping users understand how the AI arrives at its predictions.

Staying aware of these trends can help you adapt your investing strategy over time, ensuring you remain at the cutting edge of stock market analysis.

Conclusion: Maximizing Results with an AI Stock Picker

Using an AI stock picker effectively can be a game-changer for both novice and experienced investors. By leveraging AI-driven insights alongside your own research, you can develop a well-rounded strategy that capitalizes on real-time market data, advanced analytics, and objective decision-making.

From setting up your account and customizing parameters to interpreting recommendations and executing trades, each step is easier when you lean on the strengths of AI. Remember, though, that no technology no matter how powerful can guarantee profits in the stock market. Maintaining a disciplined approach, conducting periodic reviews of your investment strategy, and staying informed about broader economic trends will all contribute to long-term success.

As you grow more confident in your abilities, consider gradually increasing your investment size and diversifying your portfolio. The world of finance is dynamic, and tools like an AI stock picker will only continue to evolve. Harness this technology wisely, stay curious, and let data-driven insights guide you toward achieving your financial goals. Good luck with your investing journey!

Looking for a smarter way to pick winning stocks? 🚀

Let TradeSearcher.ai help you harness the power of AI-driven insights for better investment decisions. Start exploring AI-powered trading strategies today at TradeSearcher.ai!