Table of Content

How to Use ChatGPT for Trading: Beginner's Guide with Backtest Examples

By Vincent NguyenUpdated 385 days ago

How to Use ChatGPT for Trading

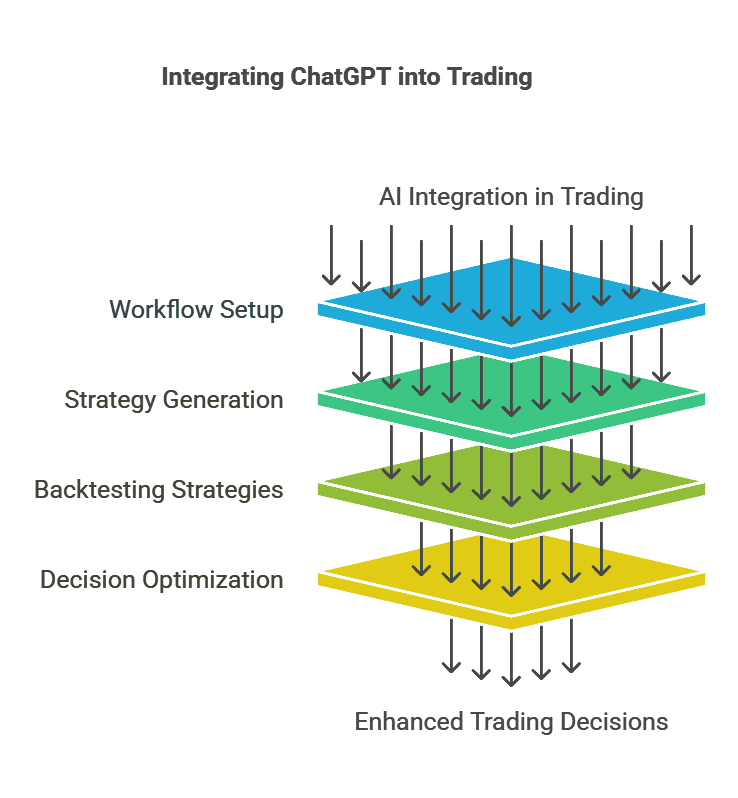

ChatGPT Trading is quickly gaining traction among beginners and veteran traders who want to leverage AI-driven insights in fast-paced financial markets. In this comprehensive guide, we’ll explore how to use ChatGPT for trading, from setting up your workflow to running backtests on the strategies that ChatGPT generates.

This article is designed to offer a step-by-step approach for those new to AI-powered tools, ensuring you can seamlessly integrate ChatGPT into your trading routines while optimizing your decision-making process.

What is ChatGPT Trading

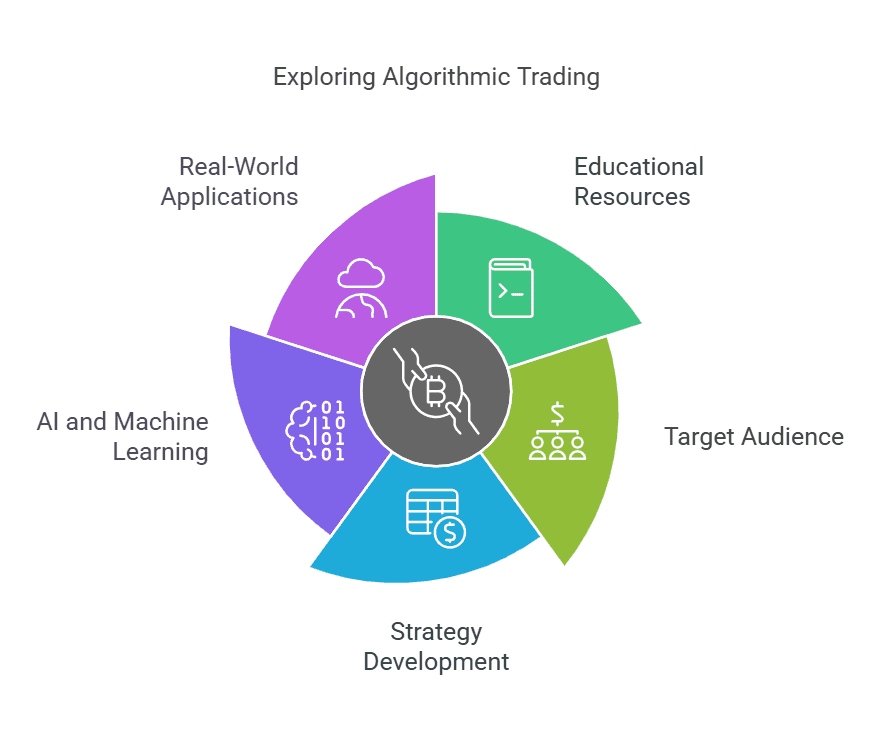

ChatGPT Trading involves using ChatGPT an AI language model developed by OpenAI to analyze market data, interpret financial news, and help craft trading strategies. Traditional trading methods often rely on human intuition and analysis, but ChatGPT Trading harnesses the power of natural language processing (NLP) to distill vast amounts of financial information into concise and actionable insights.

In simple terms, ChatGPT can read and understand text-based market data such as news articles, earnings reports, and social media posts and then make educated guesses about what might happen next in the markets. While it cannot guarantee profits, it can save time by filtering out irrelevant data, summarizing complicated information, and even generating fresh ideas for potential trades.

One of the strongest benefits of ChatGPT Trading is accessibility. Whether you are day trading stocks or swing trading cryptocurrency, ChatGPT can be integrated into various trading platforms or Python scripts, making it versatile enough for both novices and pros. Moreover, ChatGPT’s user-friendly interface is often just a text box where you input queries, meaning you don’t need to be a seasoned coder to get started.

That said, it’s important to remember that ChatGPT is a tool, not a crystal ball. It doesn’t “feel” market sentiment the way human traders do, nor does it possess real-time data out of the box. This is why you must combine ChatGPT’s output with your own market knowledge, robust risk management, and, if possible, additional AI or algorithmic tools. By doing so, you’ll ensure that AI complements, rather than replaces, your decision-making process.

The Growing Popularity of ChatGPT Trading

The rise of ChatGPT Trading can be attributed to a broader shift toward AI-powered solutions in virtually every sector. In finance, AI already plays a key role in algorithmic trading, quantitative analysis, and automated risk management. ChatGPT takes this a step further by bridging the gap between raw data and human-readable insights.

Why the Surge in Adoption?

Automation: ChatGPT can quickly sift through thousands of articles, posts, and financial statements, giving traders distilled information. Scalability: It can handle multiple queries simultaneously, enabling traders to test multiple ideas in seconds rather than hours. Accessibility: No specialized degree or advanced coding skills are required to start leveraging ChatGPT. Cost Efficiency: AI-powered assistants can reduce the need for large research teams, offering budget-friendly solutions for sole traders.

Impact on Retail vs. Institutional Traders

- Retail Traders: Individuals benefit from ChatGPT’s easy-to-use interface, which can help close the information gap that often exists between retail and professional traders.

- Institutional Traders: Hedge funds and banks can integrate ChatGPT into proprietary systems to expedite due diligence, manage large portfolios more efficiently, and customize complex quant models.

Overall, the popularity of ChatGPT Trading signals a new phase in market participation. Traders now recognize the potential of AI to streamline processes that used to be overwhelmingly manual. Yet, in this rush to adopt AI, it remains vital to strike a balance between automated inputs and human judgment to avoid blindly following AI-generated signals.

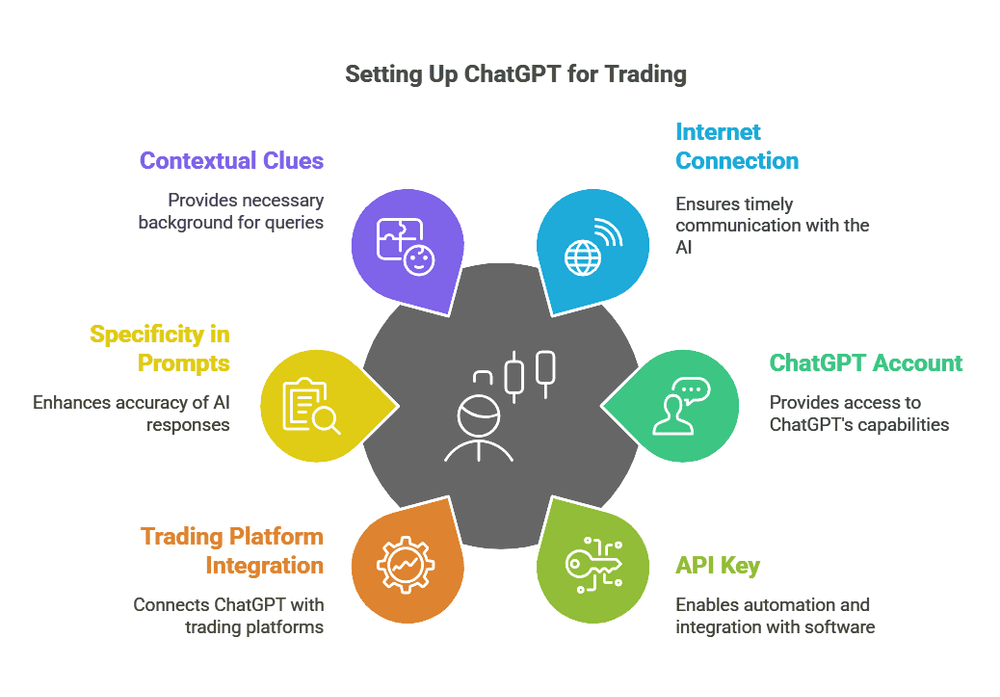

Setting up ChatGPT for Trading

Before delving into complex strategies, it’s essential to properly set up ChatGPT for trading tasks. This involves creating a ChatGPT account, learning how to structure prompts for financial contexts, and integrating ChatGPT with any trading platforms or software you currently use.

Technical Requirements

- Internet Connection: A stable internet connection is crucial for sending queries to the AI and receiving timely responses.

- ChatGPT Account: You’ll need access to ChatGPT (free or paid tiers, depending on your data and volume requirements).

- Possible API Key: If you plan to automate tasks, an API key allows you to incorporate ChatGPT into custom software or third-party applications.

- Trading Platform Integration: Platforms like TradeSearcher, MetaTrader, or TradingView can be connected with ChatGPT via scripts or APIs, enabling real-time data flow.

Prompt Crafting (Prompt Engineering)

Specificity: Clear, concise prompts yield more accurate answers. For instance, asking “What is the short-term outlook for Bitcoin given current market sentiment?” is far better than simply typing “Bitcoin?” Contextual Clues: Provide ChatGPT with context such as your risk tolerance, your preferred markets (e.g., stocks, crypto, or forex), or any historical data you want it to consider. Iteration: You may need to refine your prompts multiple times to get the level of detail or insight you’re seeking.

Basic Troubleshooting

- Response Limitations: ChatGPT might truncate or shorten responses if the prompt is too lengthy or vague. Break your queries into smaller parts if needed.

- Data Timeliness: ChatGPT’s default knowledge cutoff may limit real-time analysis. Consider referencing external data feeds or using plugins (when available) to get up-to-date quotes.

- Verification: Always cross-check ChatGPT outputs with other reliable sources to confirm accuracy.

Fundamentals of ChatGPT Trading Analysis

ChatGPT Trading hinges on the AI model’s ability to parse text-based data and convert it into actionable information. This section explains how ChatGPT interprets your requests, the types of data you can provide, and how to best interpret the AI-generated analyses.

Understanding ChatGPT Trading Inputs

When you feed ChatGPT headlines, earnings transcripts, or social media snippets, the AI identifies relevant keywords, tone, and patterns. For trading, you might input:

- News Headlines: “Company X missed quarterly earnings by 10%. Should I consider a short position?”

- Market Statistics: “Dow Jones is up 2% week over week. What does this suggest for momentum trading?”

- Indicator Data: “RSI for Ticker Y is at 70. Is it overbought?”

- Fundamental Data: “Company Z has a P/E ratio of 15, historically around 12. How might this influence share price sentiment?”

These inputs guide ChatGPT toward a specific domain of knowledge, enabling it to produce more focused and relevant outputs. Keep your prompts structured and detailed to get the most accurate results.

Interpreting ChatGPT Output

ChatGPT’s responses can include a summary of market sentiment, potential trading strategies, or a breakdown of technical indicators. However, it’s crucial to validate these insights:

- Compare with Real Data: Use a reliable data feed or trading platform to confirm that ChatGPT’s analysis aligns with the latest market figures.

- Assess Feasibility: If ChatGPT suggests a strategy with unrealistic profit targets or risk management rules, adjust accordingly or prompt ChatGPT for a more “conservative” approach.

- Factor in Macroeconomics: AI models trained on text data may not always factor in macroeconomic shifts adequately, so layer ChatGPT’s insights with known economic events.

By mastering both the input and output phases, you can consistently extract valuable information from ChatGPT that aligns with your trading objectives.

ChatGPT Trading for Market Research & Trend Analysis

One of the most exciting aspects of ChatGPT Trading is its ability to aggregate and interpret multiple sources of data for market research. Beyond just scanning headlines, ChatGPT can point out emerging themes, analyze large sets of financial statements, and even gauge social media sentiment around specific tickers.

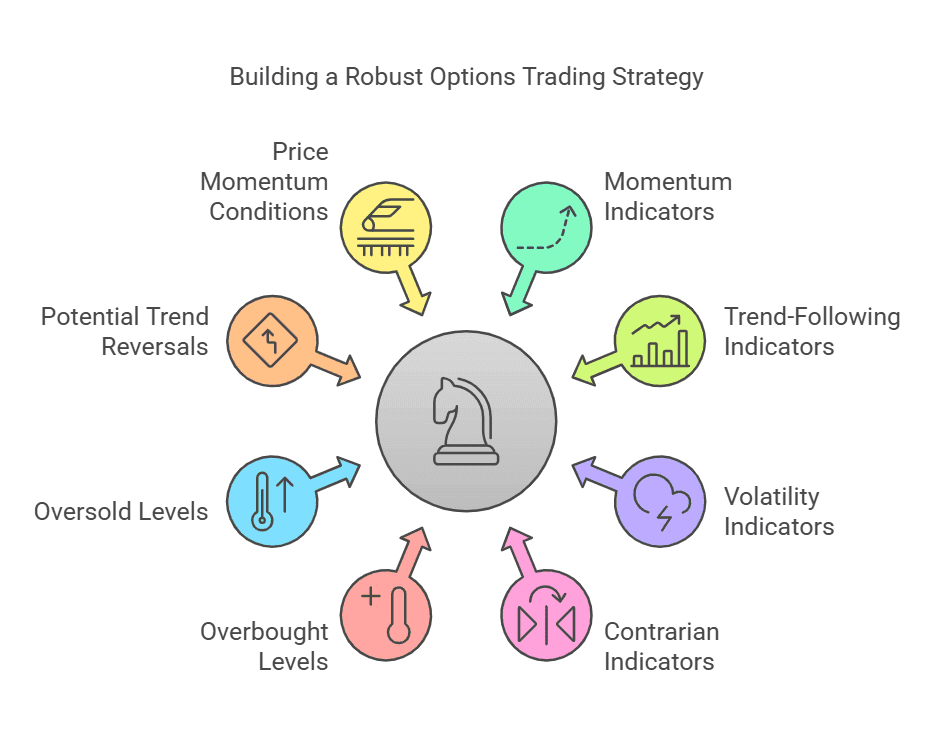

Identifying Key Market Indicators

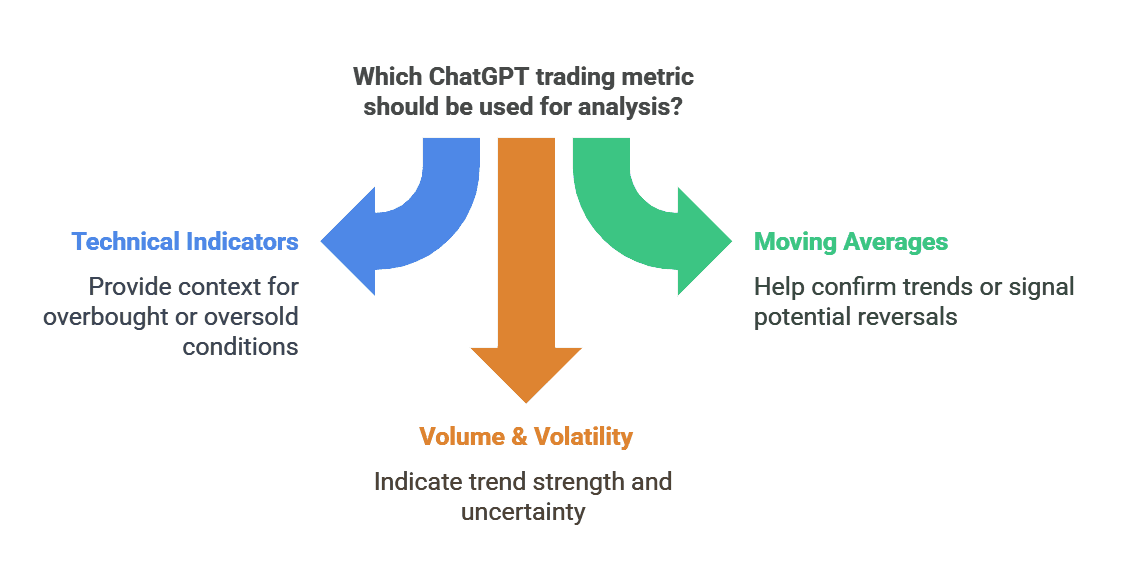

ChatGPT can help you understand and monitor a variety of popular metrics:

- Technical Indicators: RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), and Stochastic Oscillator. ChatGPT can provide context on when these indicators suggest overbought or oversold conditions.

- Moving Averages: Simple Moving Average (SMA) or Exponential Moving Average (EMA). ChatGPT can outline how these indicators help confirm trends or signal potential reversals.

- Volume & Volatility: High trading volume may confirm trend strength, while increased volatility often indicates uncertainty. ChatGPT can help pinpoint periods when these factors warrant a change in strategy.

You can prompt ChatGPT with queries like, “Explain how RSI and MACD complement each other for short-term BTC trading,” and receive a concise breakdown of how to combine indicators for a more robust analysis.

Integrating ChatGPT Trading with Economic Calendars

Economic events such as GDP releases, interest rate announcements, and employment reports can significantly influence market movements. ChatGPT can help by:

- Summarizing Data: Provide the AI with a snippet of upcoming economic announcements, and ask for insights on which events are historically most impactful for your chosen asset.

- Scenario Analysis: Prompt ChatGPT with “If the interest rate is hiked by 0.5%, how might it affect tech stocks?” This can produce a rough scenario analysis guiding your trading decisions.

- Alert Generation: Some traders create scripts that automatically query ChatGPT when an event is imminent, receiving an at-a-glance summary of potential market implications.

By blending these macro-level insights with technical analysis, you get a more holistic view of your trades, reducing the likelihood of being caught off-guard by sudden fundamental shifts.

Step-by-Step ChatGPT Trading Strategies

While ChatGPT can provide theoretical insights, it becomes truly powerful when applied to the practical realm of strategy formulation. Below, we’ll examine how to use ChatGPT Trading to craft both short-term and long-term approaches, focusing on risk management and clear entry/exit signals.

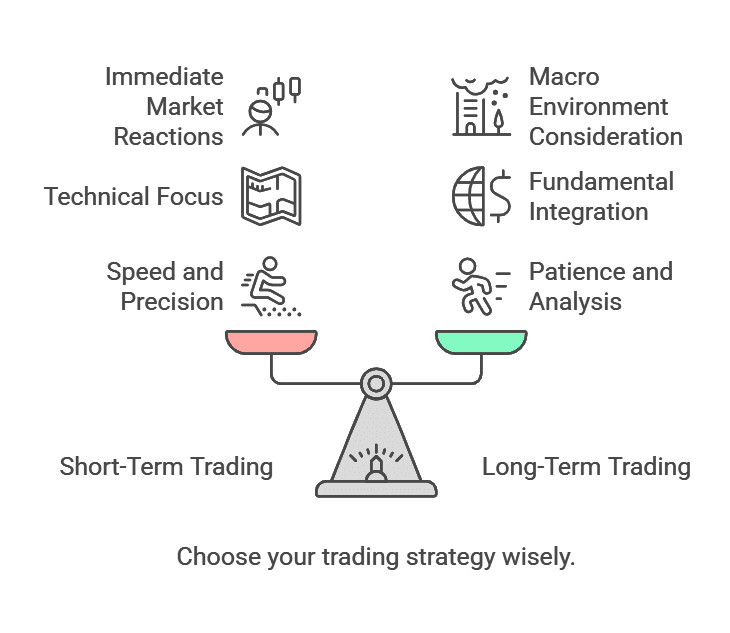

Short-Term ChatGPT Trading Setup

Identify Volatile Assets: For day traders or scalpers, prompts can ask ChatGPT to scan for assets with high intraday volume or frequent price swings.

Set Time Frames: Specify if you’re looking at 5-minute, 15-minute, or 1-hour charts. ChatGPT can tailor indicator suggestions accordingly.

Generate Entry/Exit Rules:

- Sample Prompt: “Provide a scalping strategy for EUR/USD using 15-minute candles and MACD crossovers.”

- Sample Output: ChatGPT might suggest you enter a trade when the MACD line crosses above the signal line, accompanied by an uptick in volume, and exit as soon as a reverse crossover occurs or price hits a trailing stop.

Integrate Stop-Losses: Always ask ChatGPT to include stop-loss recommendations. For instance, you might place stop-losses slightly below recent support levels to protect against sudden market reversals.

Short-term ChatGPT Trading focuses on speed, precision, and vigilant risk management, making it ideal for traders who can dedicate time to monitoring positions throughout the day.

Long-Term ChatGPT Trading Approaches

For swing traders or position traders with extended time horizons:

- Broader Trends: Prompt ChatGPT with queries about multi-month or multi-year price patterns. For example, “Analyze Tesla’s weekly chart for the past two years and identify major support and resistance zones.”

- Fundamental Integration: Over longer periods, fundamentals play a more significant role. ChatGPT can highlight key financial ratios, earnings cycles, and industry trends that might influence a stock’s long-term performance.

- Risk/Reward Ratio: ChatGPT can help you calculate a favorable ratio by suggesting appropriate entry points, likely target levels, and a safety net for stop-losses.

- Scenario Planning: Ask ChatGPT how shifts in the macro environment, such as changes in interest rates or geopolitical tensions, could affect your positions over weeks or months.

Long-term ChatGPT Trading is less frenetic than short-term setups and aims to capture more substantial price moves by allowing trades to develop over time, relying heavily on a blend of technical and fundamental data.

Examples of ChatGPT Trading Backtests

Backtesting is essential for gauging whether an AI-suggested strategy holds water in real-market conditions. With ChatGPT Trading, the workflow typically involves generating a strategy through ChatGPT, coding it into a backtesting platform, and then analyzing the results.

Backtesting a Momentum Strategy

Strategy Generation:

- Prompt Example: “Create a basic momentum strategy for AAPL based on a 50-day moving average crossover and RSI for bullish confirmation.”

- ChatGPT Output: You might receive step-by-step instructions: enter when the 50-day SMA crosses above the 100-day SMA, and only when RSI is above 50. Exit if the 50-day SMA falls below the 100-day SMA or RSI drops under 45.

Implementation in a Backtesting Tool: Tools like TradeSearcher or Python-based libraries (e.g., pandas, backtrader) allow you to code these rules.

Run Historical Simulations: Check how the strategy would have performed over a specific time frame say, the past five years.

Review Metrics: Look at win/loss ratios, average profit per trade, max drawdown, and the strategy’s Sharpe ratio.

If the results are subpar, revisit ChatGPT and refine your prompts, ask for alternative indicators, or adjust your risk-management rules. This iterative process can lead to a more resilient strategy over time.

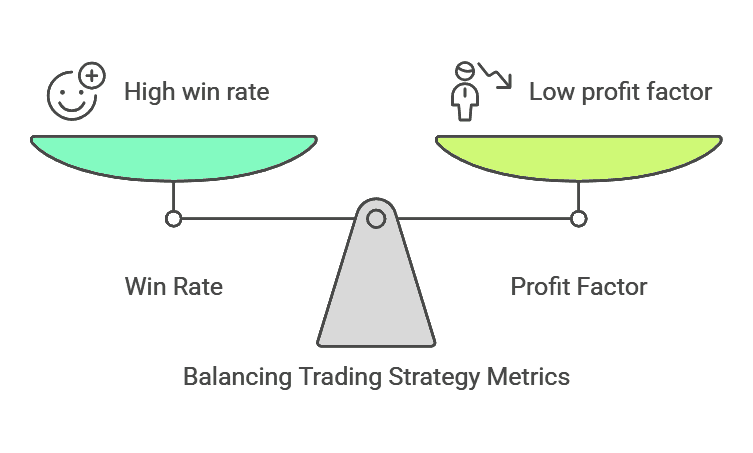

Interpreting ChatGPT Trading Results

- Win Rate vs. Profit Factor: A high win rate with a low profit factor may indicate many small winners but significant losses. ChatGPT can help you tweak your exit criteria to combat this.

- Drawdowns: If you spot large equity drawdowns, ask ChatGPT how to incorporate tighter stop-losses or add diversification by trading multiple correlated or uncorrelated assets.

- Overfitting Alerts: Overly complex rules often perform well in backtests but fail in live markets. Check with ChatGPT for simplified approaches or fewer conditions to avoid over-optimization.

Backtesting confirms whether ChatGPT-driven ideas merit further attention. While no simulation can guarantee future performance, backtests offer data-driven insight, helping traders make more informed decisions.

Best Practices for AI-Driven Trading

Using ChatGPT Trading effectively requires more than just generating ideas. It involves a disciplined approach to risk management, data verification, and continuous learning.

1. Combine Multiple Data Sources:

ChatGPT’s analysis is text-based and might not always reflect real-time price movements or specialized indicators. Use real-time data feeds, sentiment analysis tools, and analytics platforms to form a well-rounded view.

2. Risk Management Is Key

Never enter a position without predefined stop-losses or a clear exit plan. Even AI-driven strategies can’t escape the unpredictability of markets.

3. Stay Updated on Model Enhancements

OpenAI periodically updates and improves ChatGPT, which can affect how it interprets prompts. Keep track of new features to refine your AI-driven trading strategies.

4. Maintain Realistic Expectations

While AI can increase efficiency, it’s not a silver bullet. Continual testing and adjustment remain crucial.

5. Ethical & Data Privacy Considerations

Ensure your methods of collecting, storing, and using market data comply with relevant regulations. Be mindful of potential biases in the data fed to ChatGPT.

Common Pitfalls & How to Avoid Them

In the pursuit of seamless ChatGPT Trading, many traders make specific mistakes that reduce the effectiveness of their AI-driven strategies. Here are some potential pitfalls and tips to steer clear of them:

1. Over Reliance on AI Outputs

It’s easy to assume ChatGPT “knows everything,” but in reality, it relies on historical data and statistical patterns. Always verify its suggestions with fresh market data and independent research.

2. Poor Prompt Quality:

Vague or generic prompts yield equally vague results. If ChatGPT is providing superficial analysis, refine your question to include more context or specific metrics.

3. Ignoring Execution Slippage:

ChatGPT can propose perfect entry and exit points on a chart, but actual execution might deviate due to liquidity or latency. Incorporate a buffer to account for real-world conditions.

4. Failure to Adapt to Market Changes:

Markets evolve, and strategies that worked last year may fail this year. Regularly prompt ChatGPT for updated insights, especially during major economic or geopolitical shifts.

5. Neglecting Macroeconomic Variables

Even the best technical strategy can falter if you ignore interest rates, inflation data, or major political events. Ask ChatGPT for scenario analyses to anticipate potential disruptions.

By recognizing these pitfalls, you’ll be better equipped to refine your approach, ensuring your ChatGPT Trading journey remains both profitable and sustainable.

Conclusion: The Future of ChatGPT Trading

ChatGPT Trading is poised to become an integral part of modern investing as AI models continue to evolve and more data sources become readily available. From quick market sentiment analysis to sophisticated backtest generation, the benefits of incorporating ChatGPT into your trading routine are substantial.

The key is to remember that while ChatGPT Trading provides you with powerful, data-driven suggestions, it should always be complemented by your own market research, risk management protocols, and ongoing learning. By balancing AI insights with your personal expertise, you’ll be well-positioned to navigate the financial markets and potentially uncover new trading opportunities that you might have otherwise overlooked.

Ready to take your trading to the next level?

Use TradeSearcher to instantly backtest strategies and uncover the most profitable setups for your favorite tickers.